What Everybody Ought To Know About Market Value On Balance Sheet Predecessor Successor Financial Statements

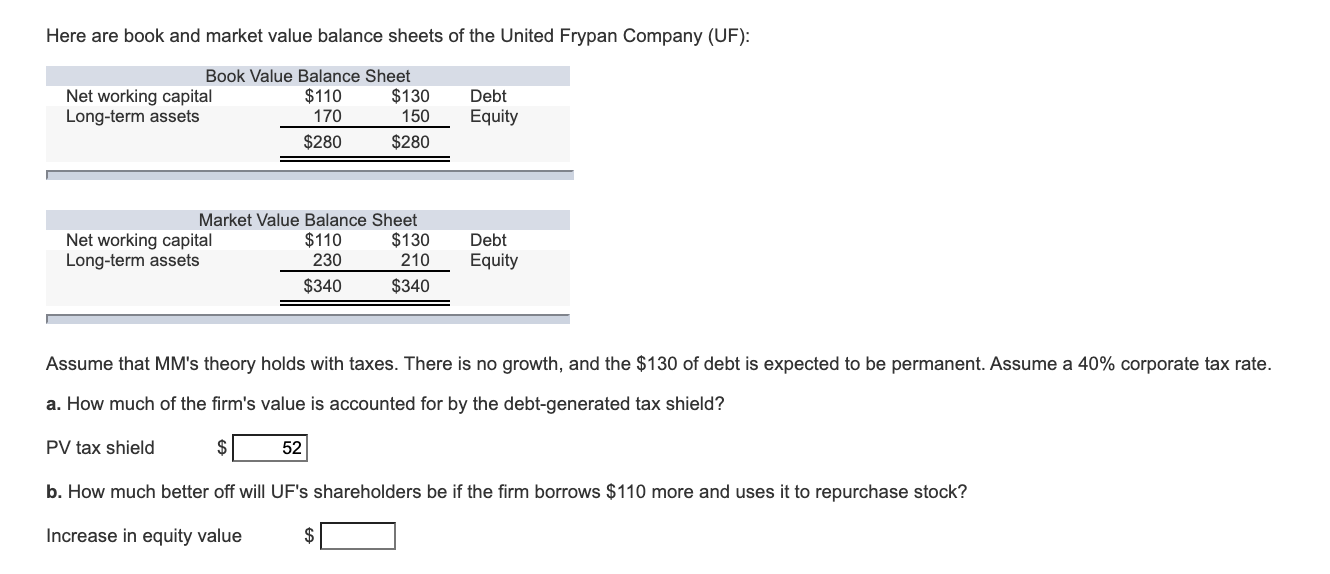

Revaluation of a fixed asset is the accounting process of increasing or decreasing the carrying value of a company's fixed asset or group of fixed assets to.

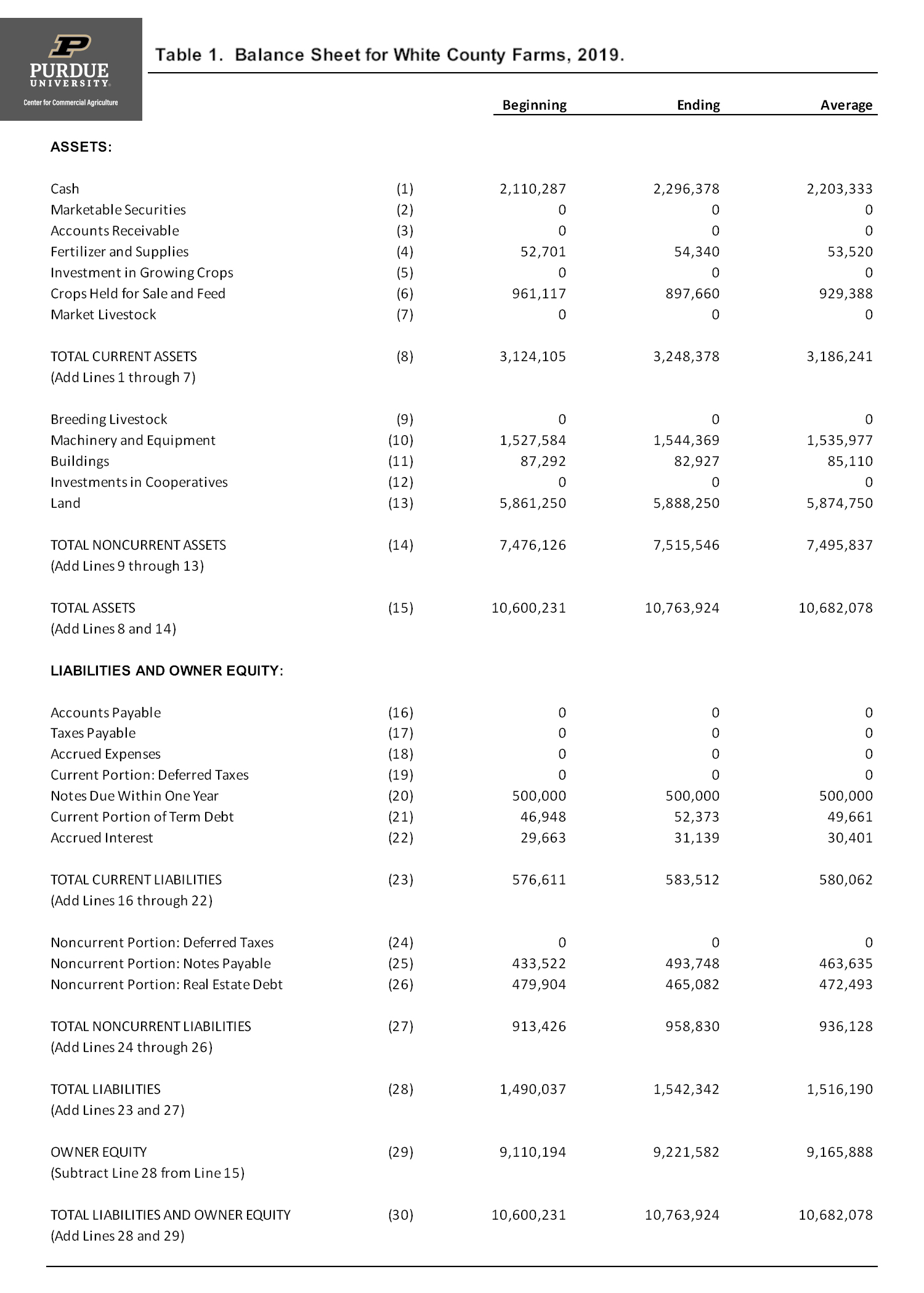

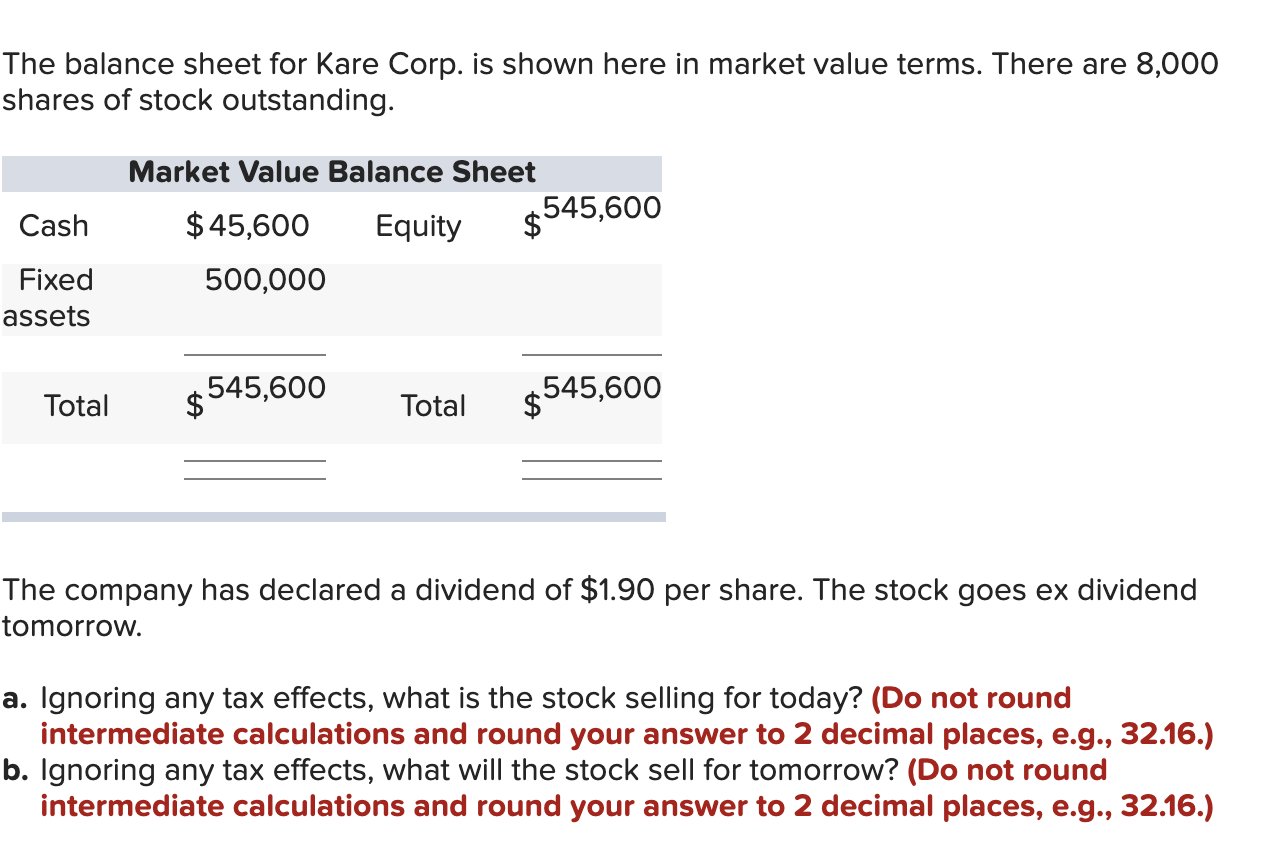

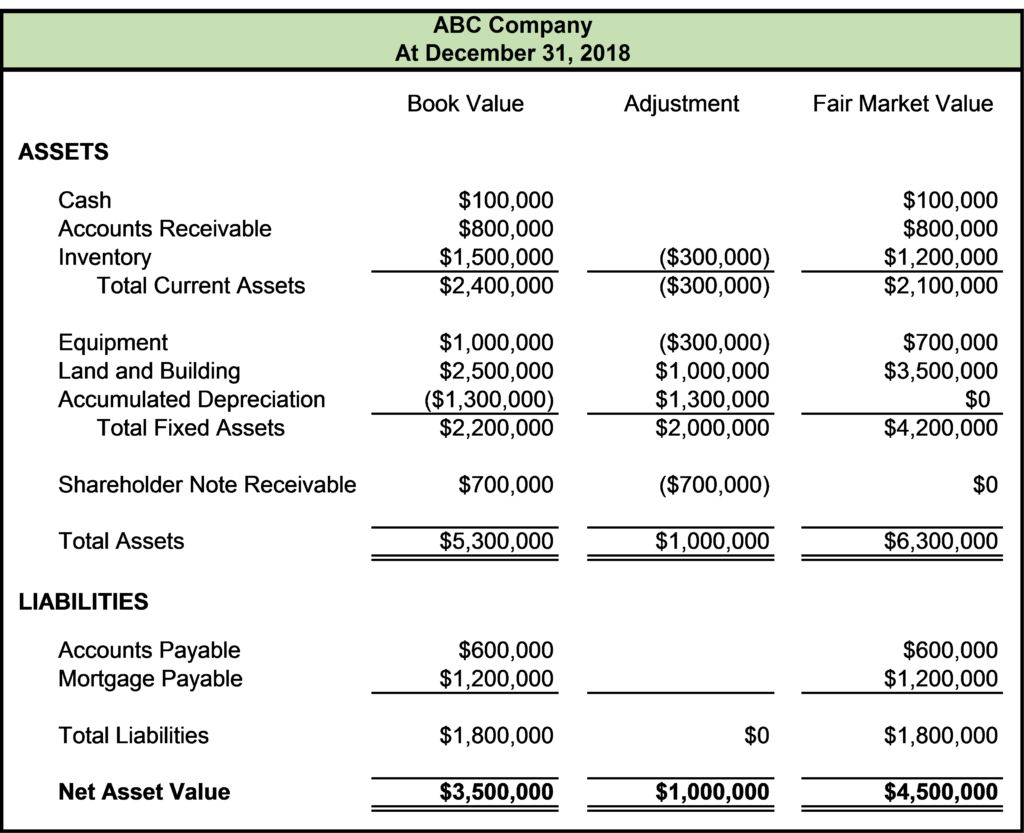

Market value on balance sheet. Ways of measuring the value of assets on the balance sheet include: If the asset is valued on the balance at market value, then its book value is equal to the market value. One person thinks the land is worth $1 million while another thinks.

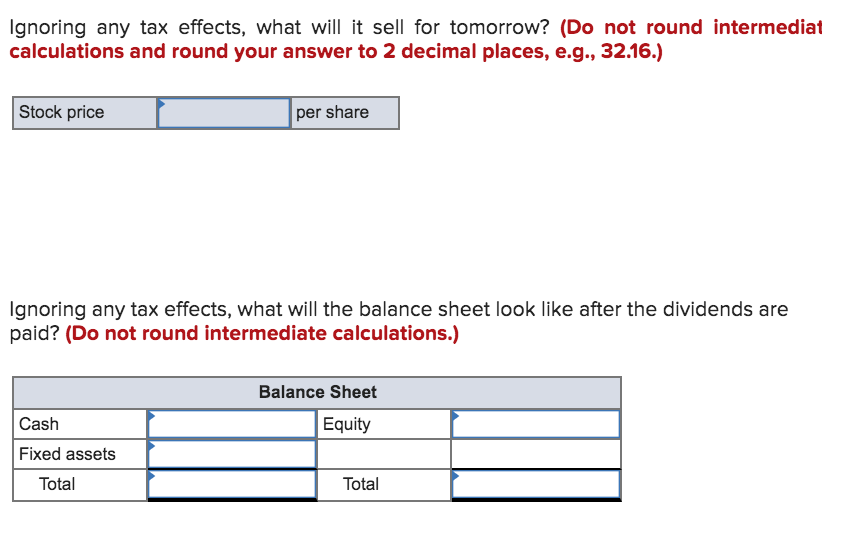

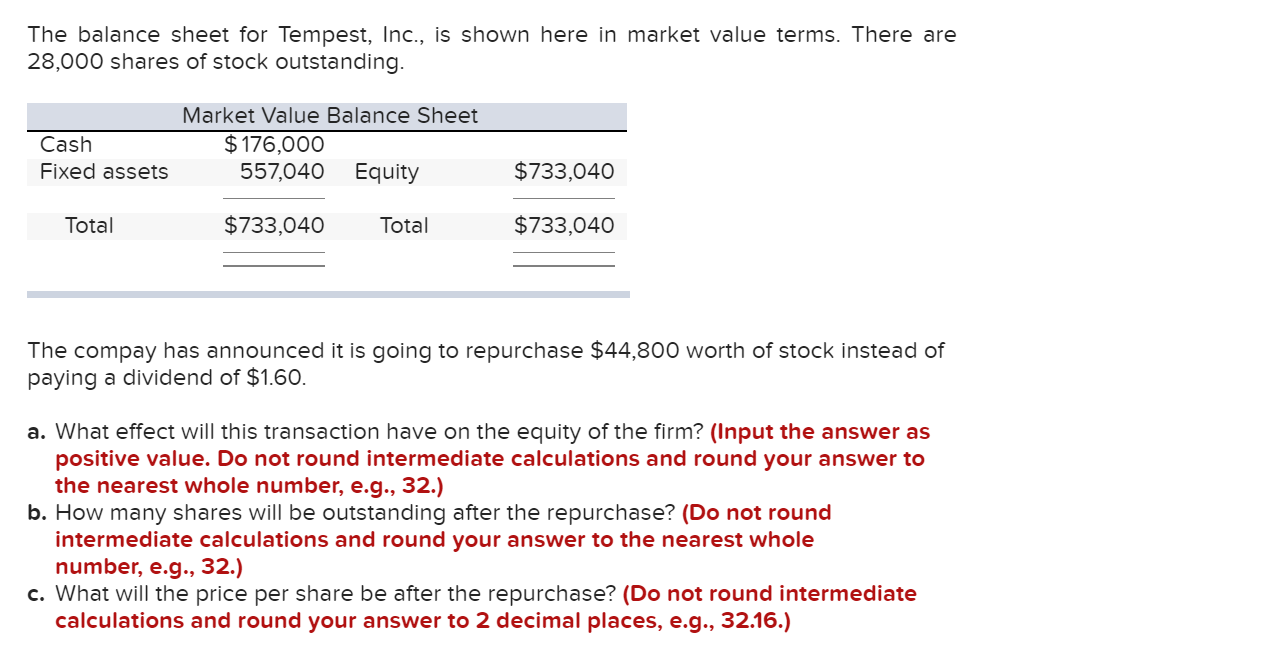

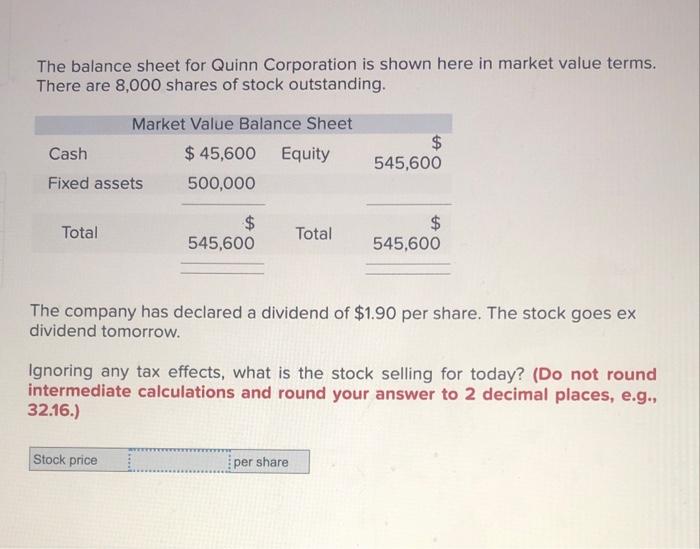

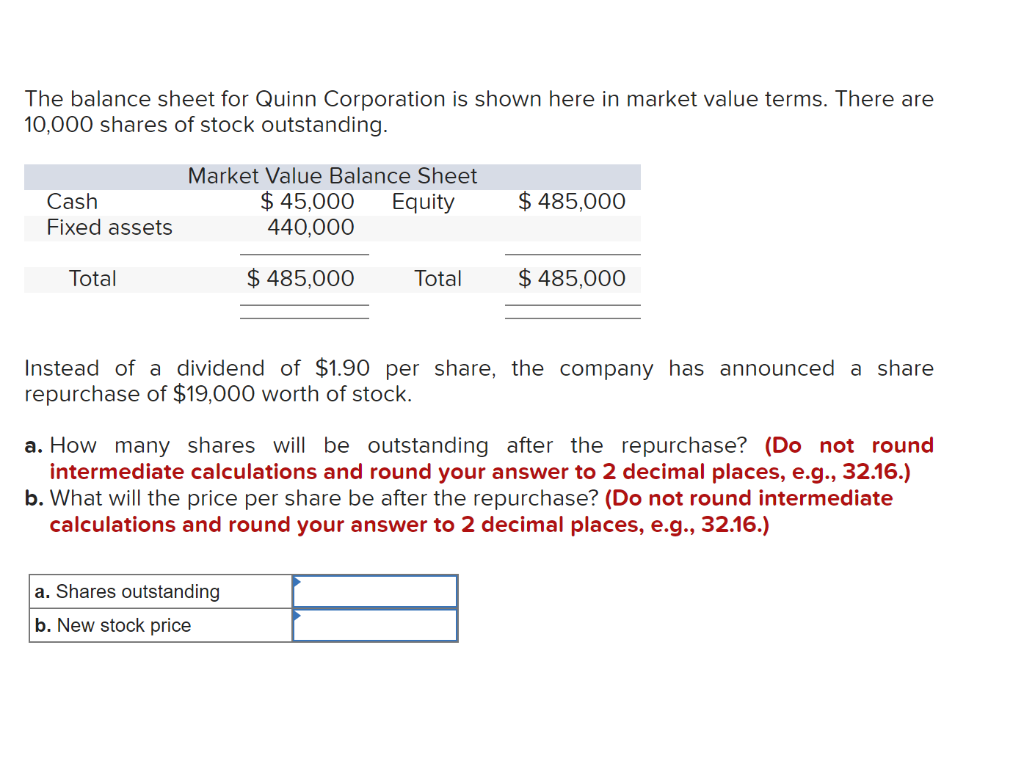

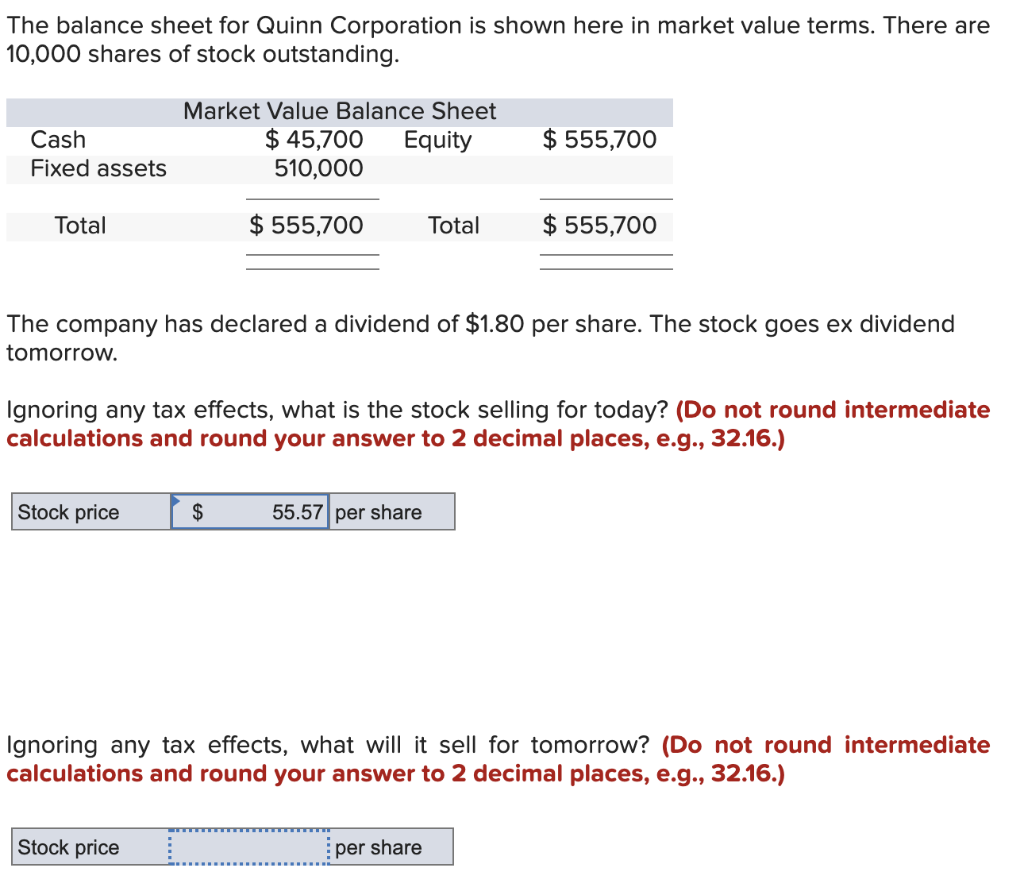

Imposed on trump on february 16 for overinflating the value of his. To calculate this market value, multiply the current market priceof a company's stockby the total number of sharesoutstanding. A fair market value balance sheet adds capital gains to retained earnings to show changes in owner equity, so it can be more difficult to see what retained earnings.

You will see an option for a balance sheet listed under market value. The basic balance sheet in order to produce and sell its products or services, a company needs assets. The assets should be in 'balance' and equal the total.

Historical cost is typically the purchase price of. Ways of measuring the value of assets on the balance sheet include:. From the market value balance sheet dropdown, select +new to create a new report.

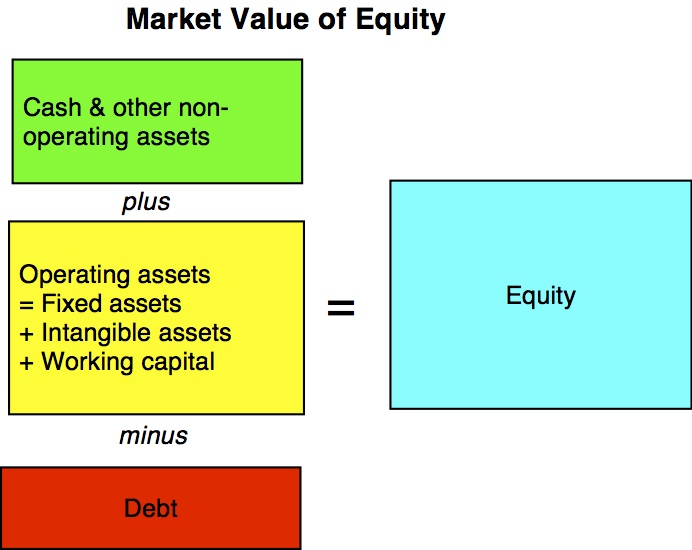

The market value is the value of a company according to the markets based on the current stock price and the number of outstanding shares. Market value of equity is the total dollar value of a company's equity and is also known as market capitalization.

Unlike the more stable book value, which is rarely adjusted, market value is highly dynamic. If we sell a $10,000 spda, we book a $10,000 asset and a $10,000 liability (excluding built in. Market value per share, estimated.

Market value is the current prevailing price for an asset in the marketplace. Historical cost, market value or lower of cost or market. By dividing the $20 billion in equity value by the 1 billion in total diluted shares, the implied share price is $20.00 per share.

This measure of a company's value is calculated. The market value of debt refers to the market price investors would be willing to buy a company’s debt for, which differs from the book value on the balance sheet. A balance sheet is a type of financial statement that lists a company's assets, liabilities, and shareholders' equity.

Gaap, some marketable securities must be adjusted at each balance sheet date so that the value shown on the balance sheet is the market value. In contrast, the market value is subjective:

:max_bytes(150000):strip_icc()/ScreenShot2022-03-08at4.53.06PM-eda6eb2099b245129240ed8ef9d984ed.png)