First Class Tips About Prepaid Expenses In Trial Balance Vertical Analysis Income Statement Formula

![[Solved] balance sheet accounts, even those with zero balances](https://4.bp.blogspot.com/-qi5itEJp9C8/XMSU5e6IcTI/AAAAAAAAF9s/VNmzGpktPdoAHKFM43fKLTKPUIhLXdJXgCK4BGAYYCw/s1600/IMG_6512.jpeg)

This statement comprises two columns:.

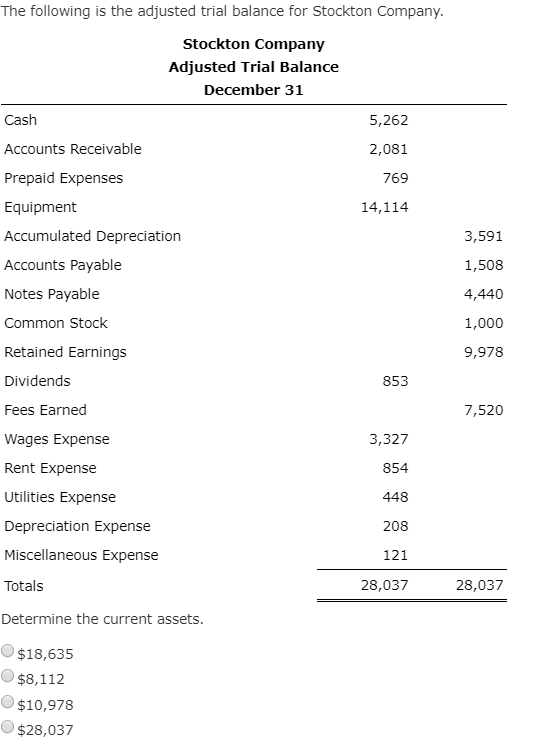

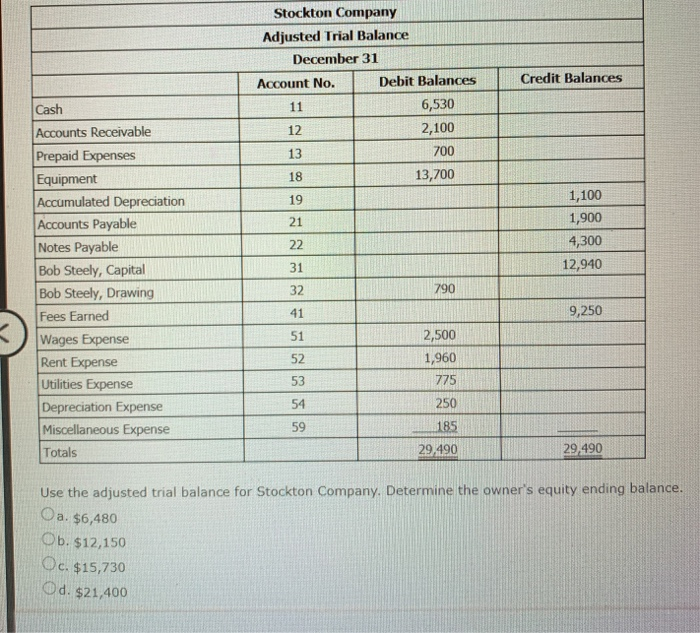

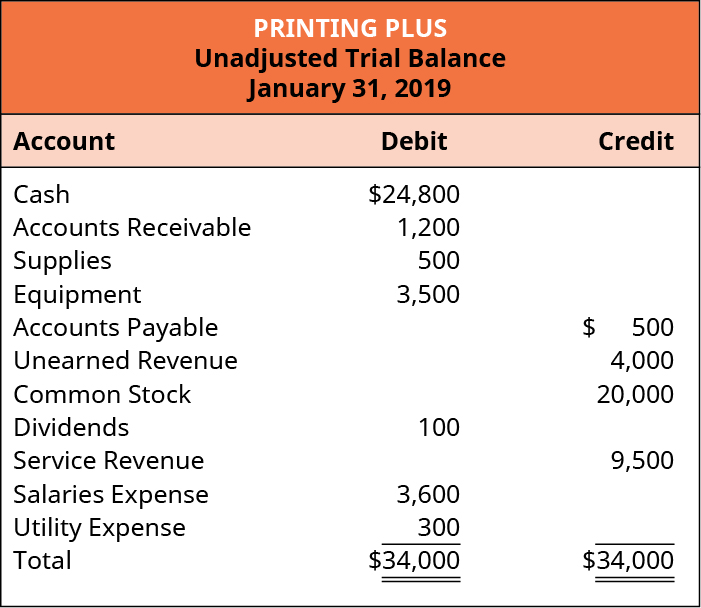

Prepaid expenses in trial balance. Presentation of prepaid expenses. Prepayments) represent payments made for expenses which have not yet been incurred or used. A trial balance is a report that lists the balances of all general ledger accounts of a company at a certain point in time.

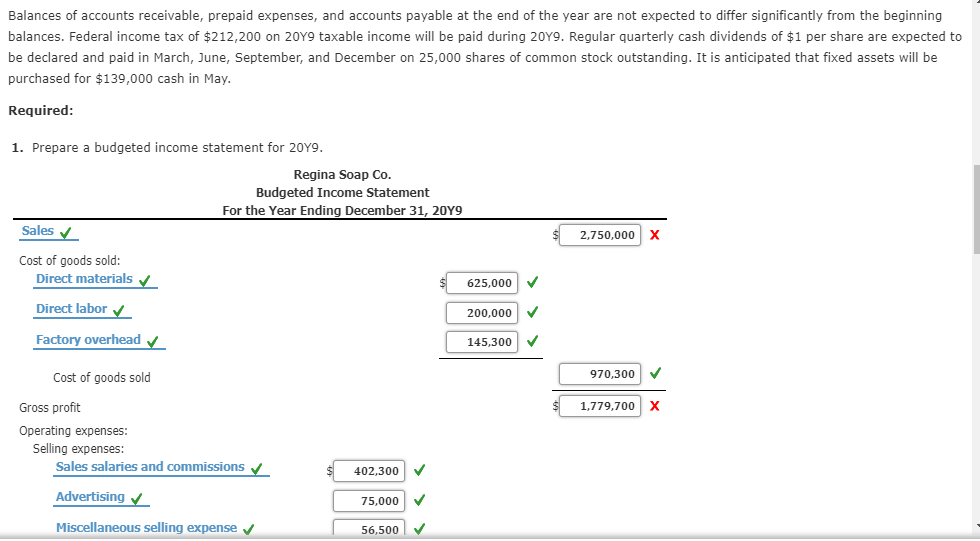

Most companies use at least one or two prepaid expenses, given how goods and services are sold. Prepaid expenses = prepaid expenses % of opex × operating expenses however, if the connection between upfront payments and operating expenses (sg&a). A trial balance is a list of all accounts in the general ledger that have nonzero balances.

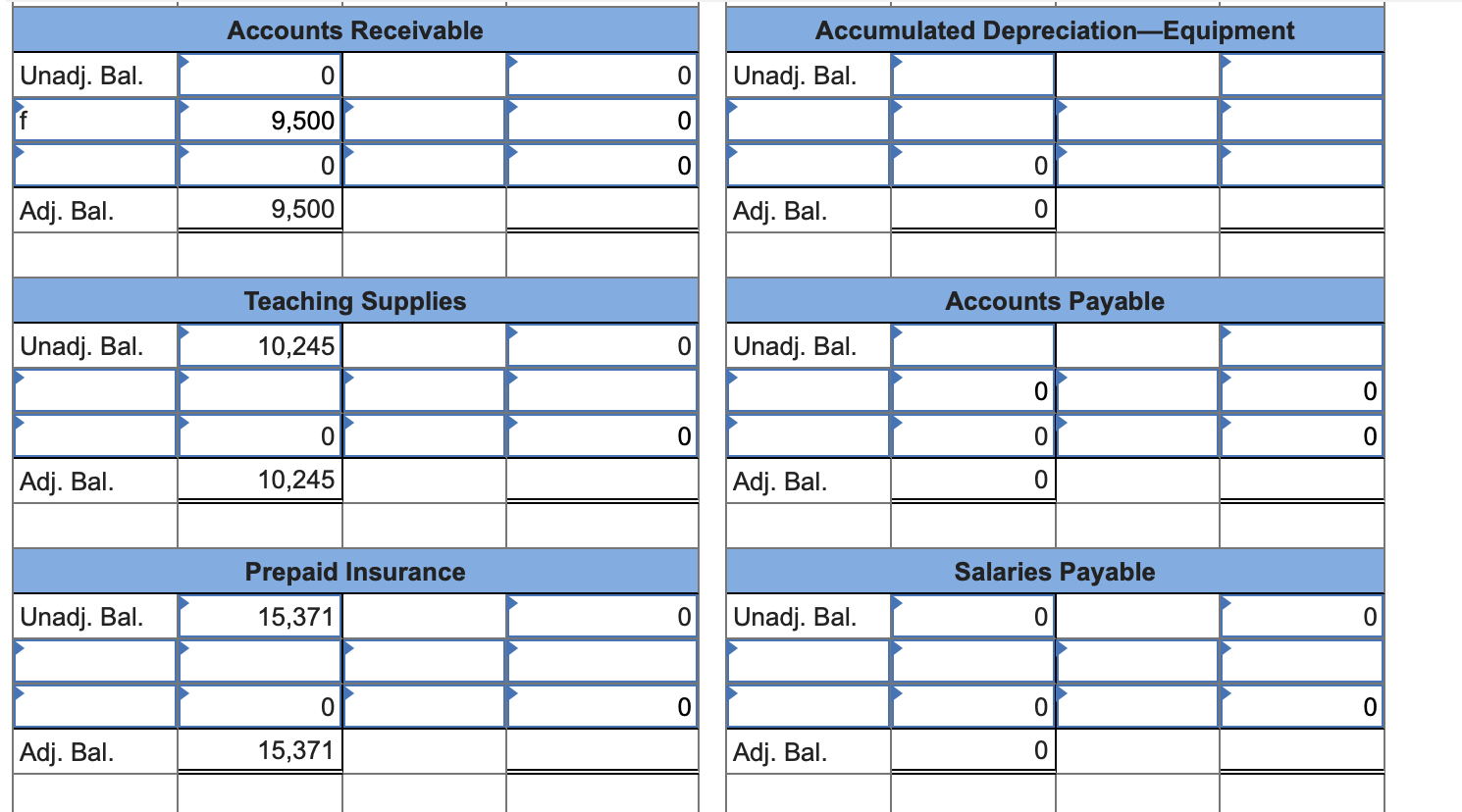

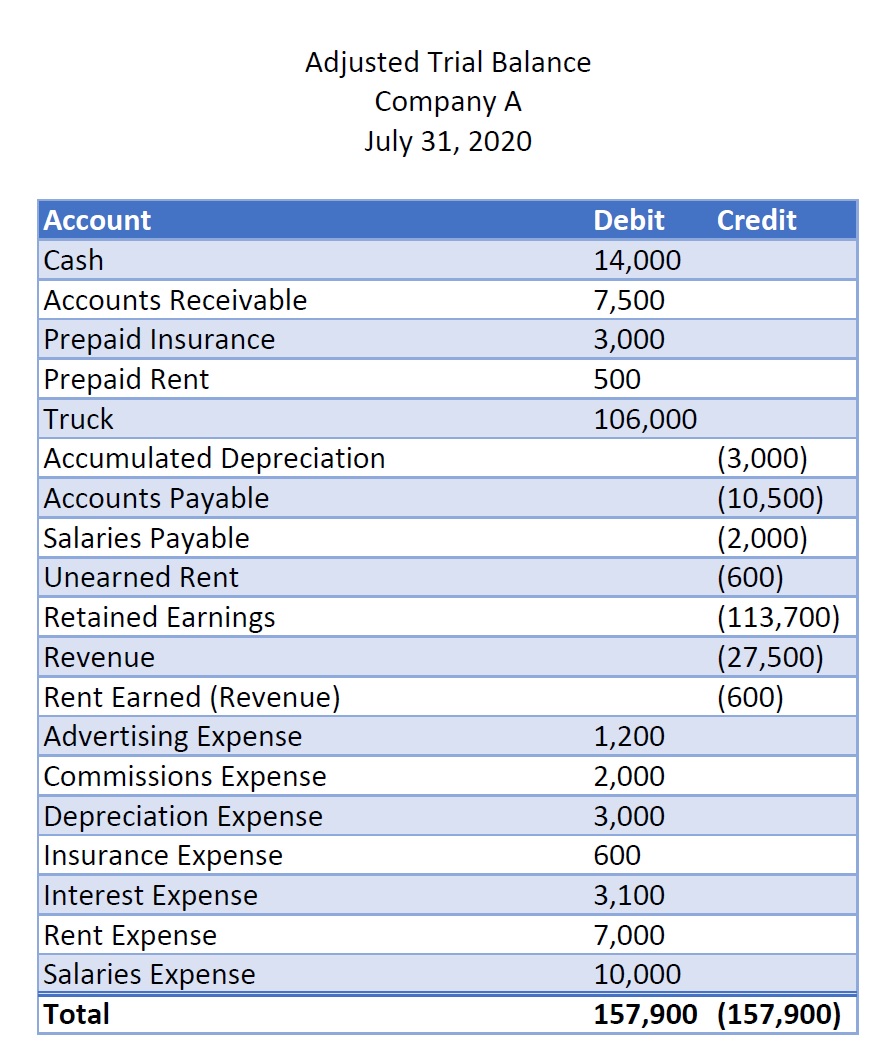

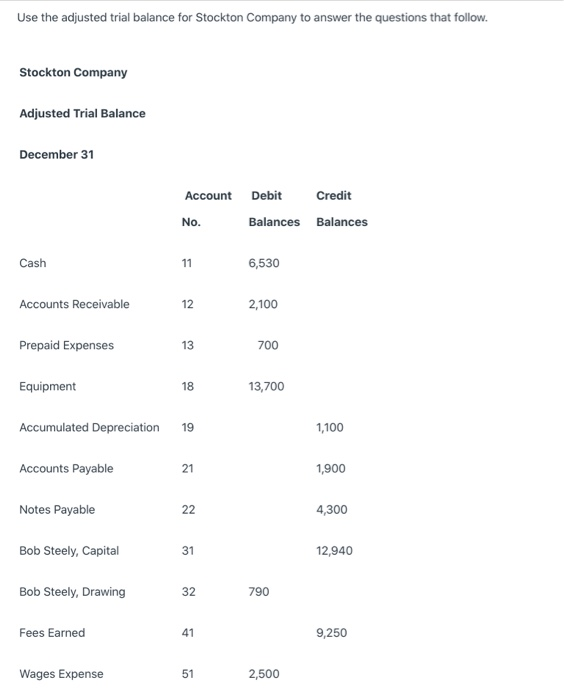

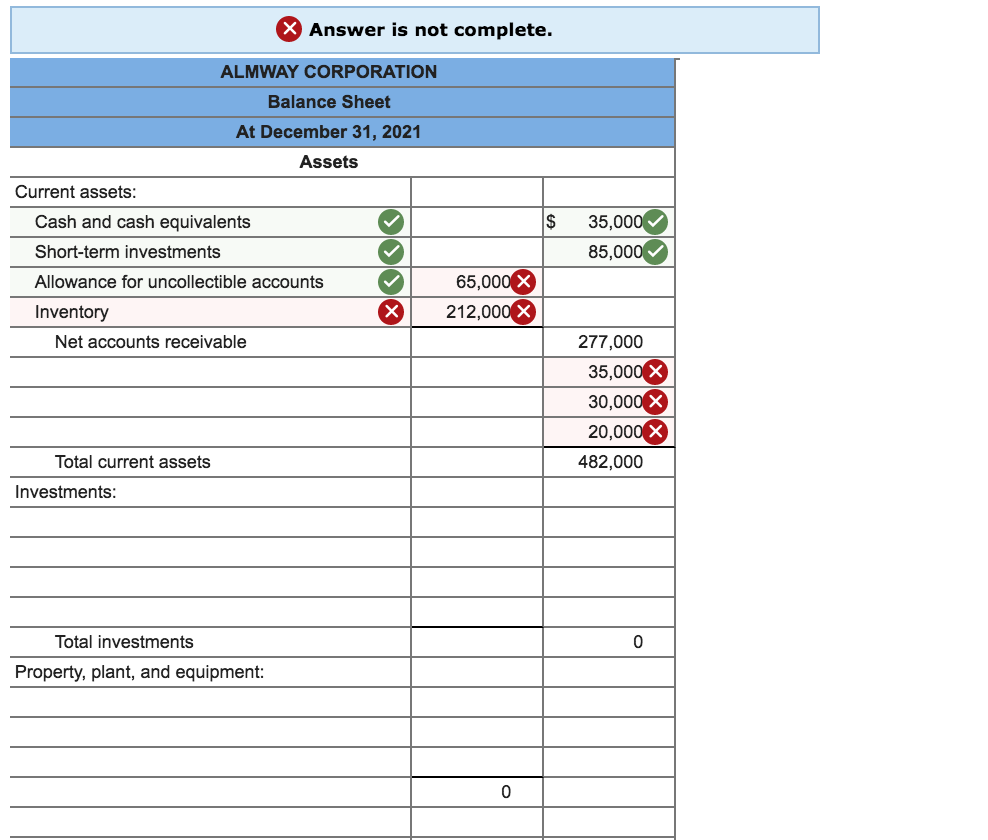

In the final accounts prepaid expenses are: Adjusted trial balance is a listing of all the account balances after adjusting entries that may include accrued and prepaid expenses. Balance sheet accounts include cash accounts, marketable securities, accounts receivable, inventory, fixed assets, prepaid expenses, and intangible assets.

A trial balance is an important step in the accounting process, because it helps identify. Prepaid expense a/c and expense a/c. Shown as a current asset in the year.

The journal entry for prepaid expenses involves two accounts: Service revenue will now be $9,850 from the. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned.

Learn how to account for them and create a prepaid expenses journal. It shall be shown in the balance sheet of the company under current assets. The accounts reflected on a trial balance are related.

However, if prepaid expenses are not shown in the trial balance,. John's trial balance does not disclose it, there is a. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet.

In other words, these are advanced payments by a. The gaap matching principle prevents expenses from being recorded. The balance of accounts receivable is increased to $3,700, i.e.

Insurance is about buying the proactive insurance you need to. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. In the trial balance, revenue accounts (which have credit balances) are expected to have corresponding expense accounts (which have debit balances).

Deducted from the expense amount of the trial balance before listing it in the income statement;