One Of The Best Info About The Financial Statements Of A Business Enterprise Include Understanding Income Statement

In this free guide, we will break down the most important types and techniques of financial statement analysis.

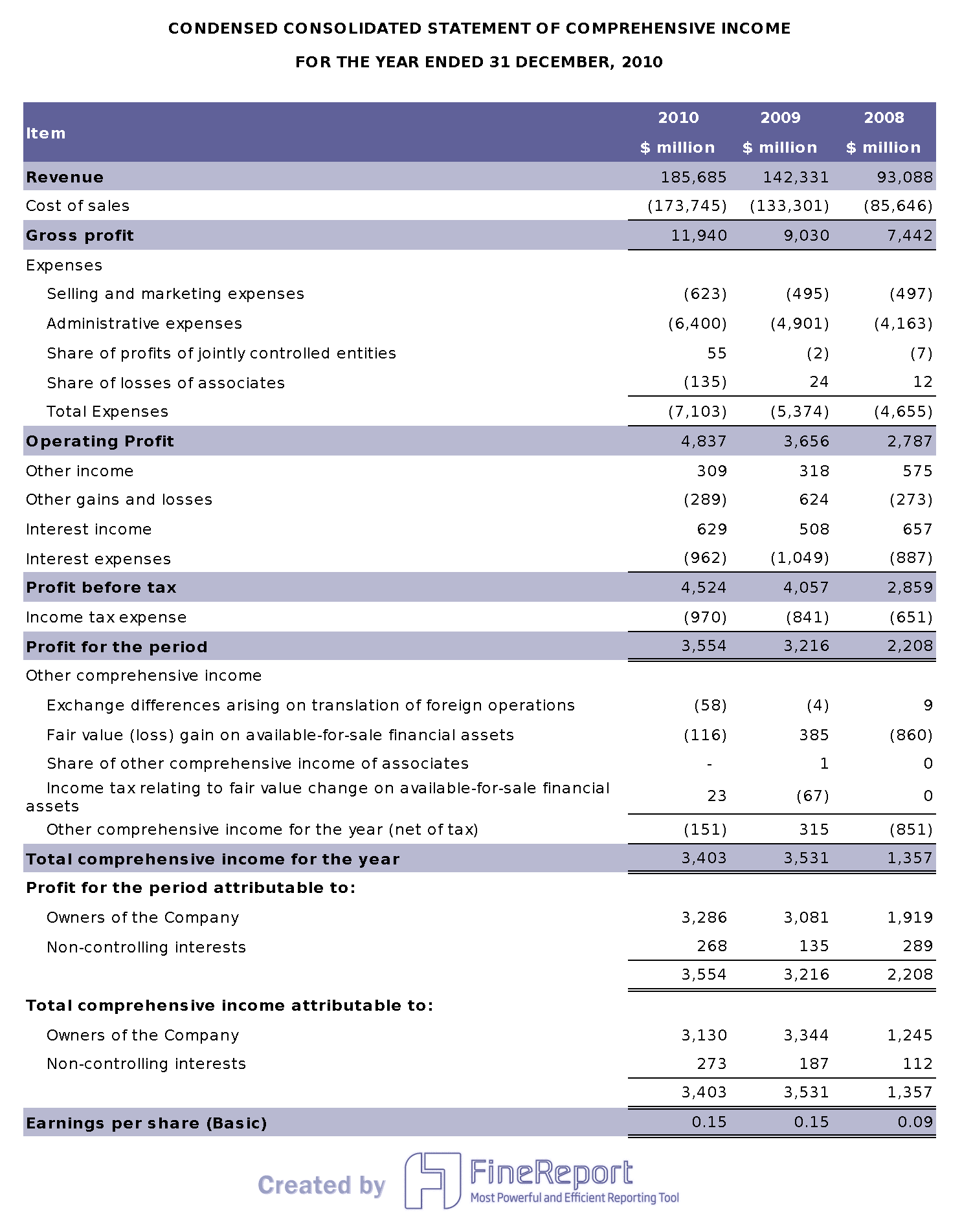

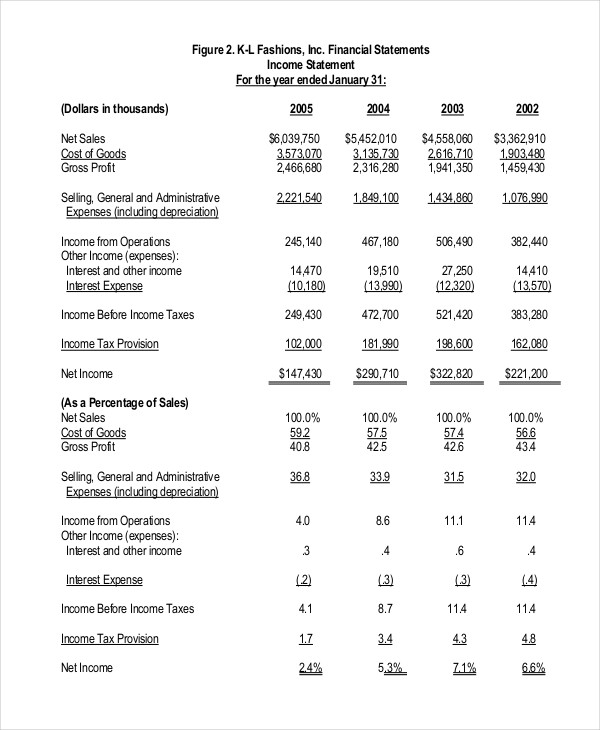

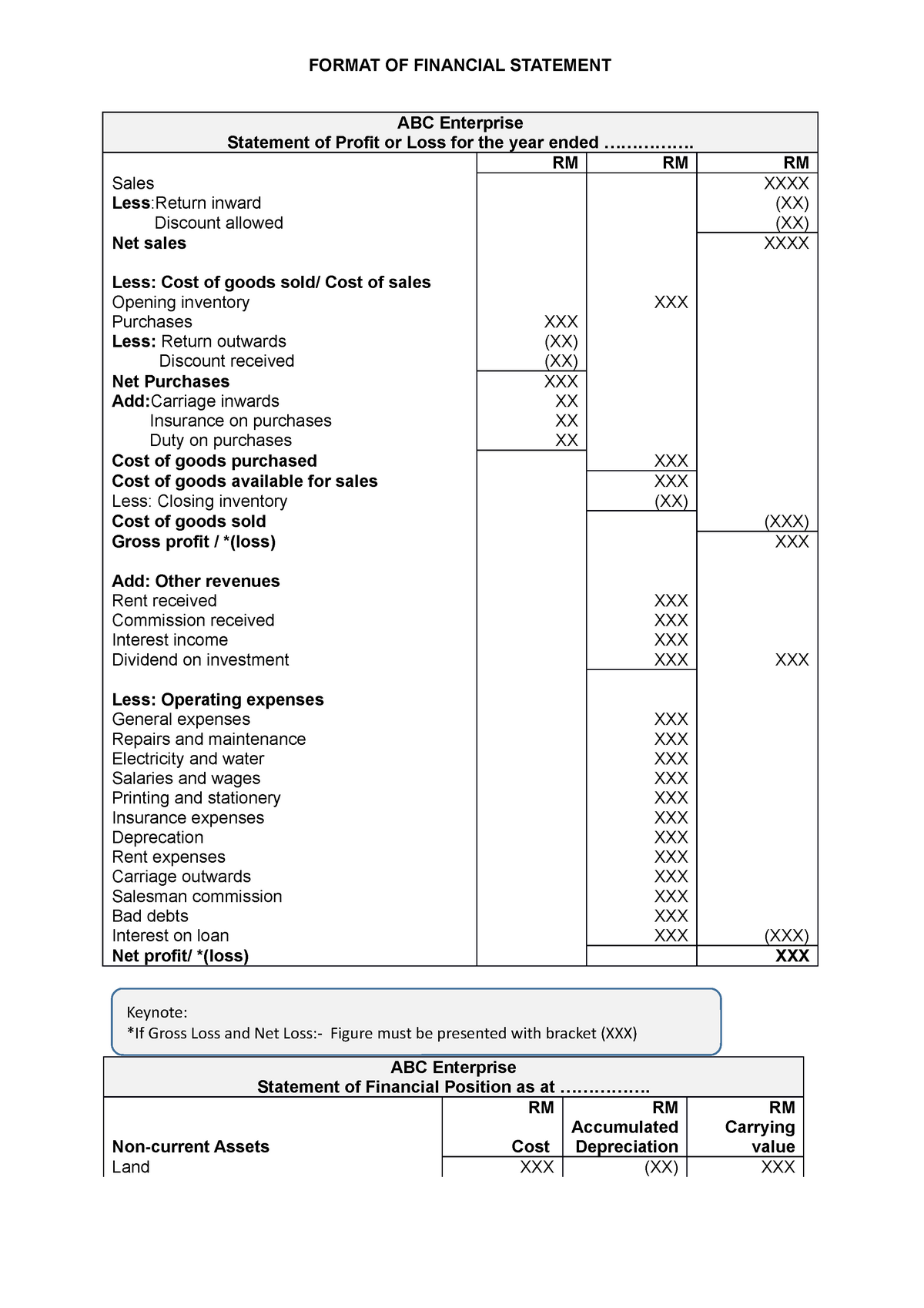

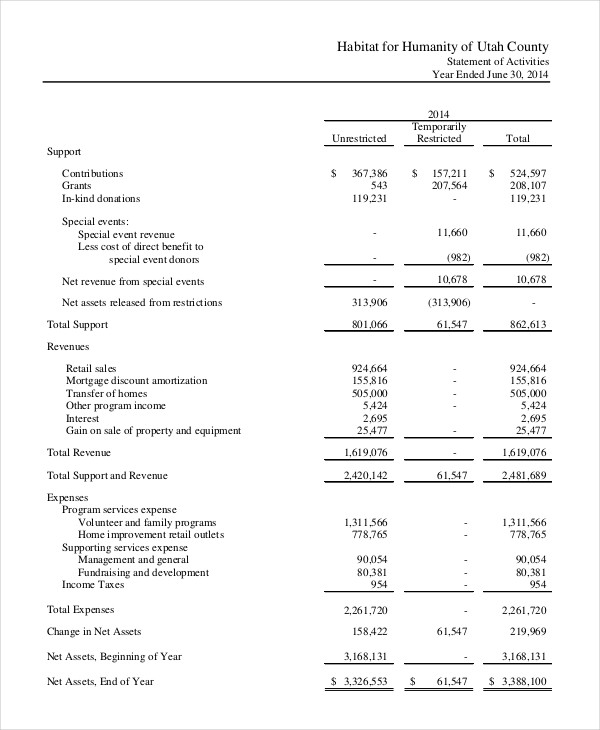

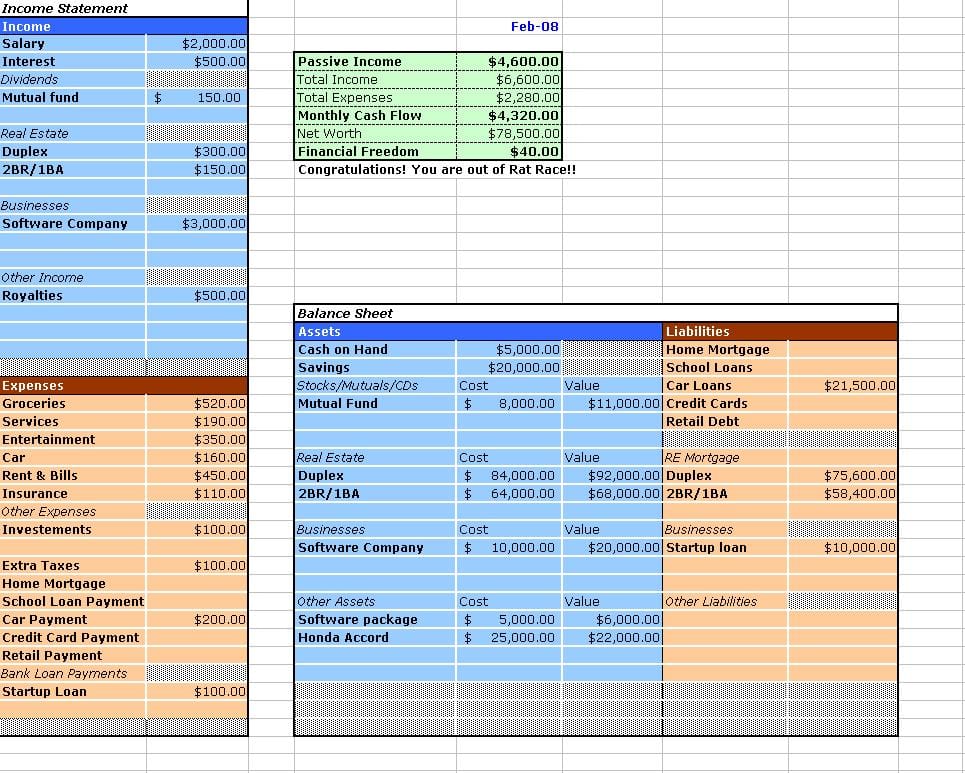

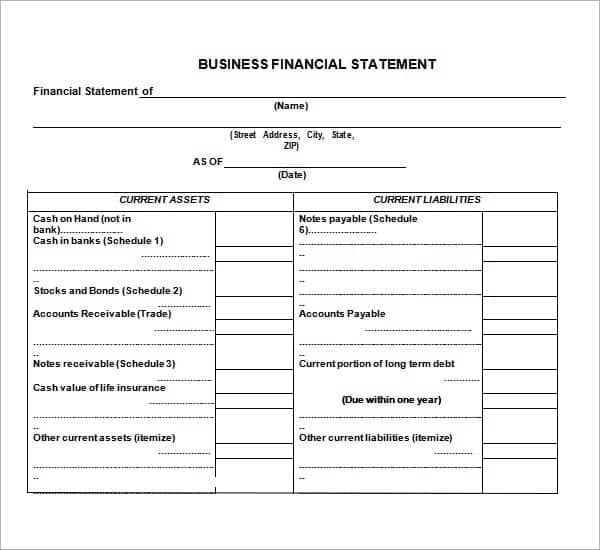

The financial statements of a business enterprise include. The balance sheet, income statement, and cash flow statement. Corporate finance financial statements financial statements financial statements are essentially the report cards for businesses. Financial statements include the income statements and positional statements that ensure to represent the actual financial position of the business to management and external stakeholders.

These three statements together show the assets and liabilities of a. Examples are accounts receivable, inventory, and fixed assets. The financial statement that reflects a company’s profitability is the income statement.

A new york judge ordered trump and his companies friday to pay $355 million in fines, plus interest, after ruling that he had manipulated his net worth in financial statements. Trump revocable trust while his. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

Companies release financial statements at least once a year for their accounting period. (1) the income statement, (2) the balance sheet, (3) the cash flow statement, and (4) rates of return. Relevant financial information is presented in a structured manner and in a form which is easy to understand.

And (4) statements of shareholders’ equity. The balance sheet used is the classified balance sheet. A merchandising company uses the same 4 financial statements we learned before:

The financial statements are: They are required for audits and are often used for tax, financing or investing purposes. The stiff penalty comes just weeks after trump was ordered to pay $83.3.

Financial statements result from simplifying, condensing, and aggregating masses of data obtained primarily from the financial system. As such, they can be evaluated on the basis of past, current, and projected. Income statement, statement of retained earnings, balance sheet, and statement of cash flows.

Financial statements help you analyze a company’s financial position & performance. The financial statements of a company record important financial data on every aspect of a business’s activities. Testified in court, he disavowed responsibility for his father’s financial statements despite serving as a trustee of the donald j.

Each of the financial statements provides important financial information for both internal and external stakeholders of a company. The three financial statements are: Also known as a profit and loss (p&l) statement, an income statement shows your company’s earnings and expenses over a period—i.e., the bottom line of your company.

There are three key financial statements managers should know how to read and analyze: The statement of owner’s equity —also called the statement of retained earnings. Profits and loss account 2.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)

:max_bytes(150000):strip_icc()/exxonIS09-30-2018-5c5dc83c46e0fb00017dd129.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)