Recommendation Tips About Steps In Forecasting The Income Statement Ifrs Profit And Loss

Nvidia reported $12.29 billion in net income during the quarter, or.

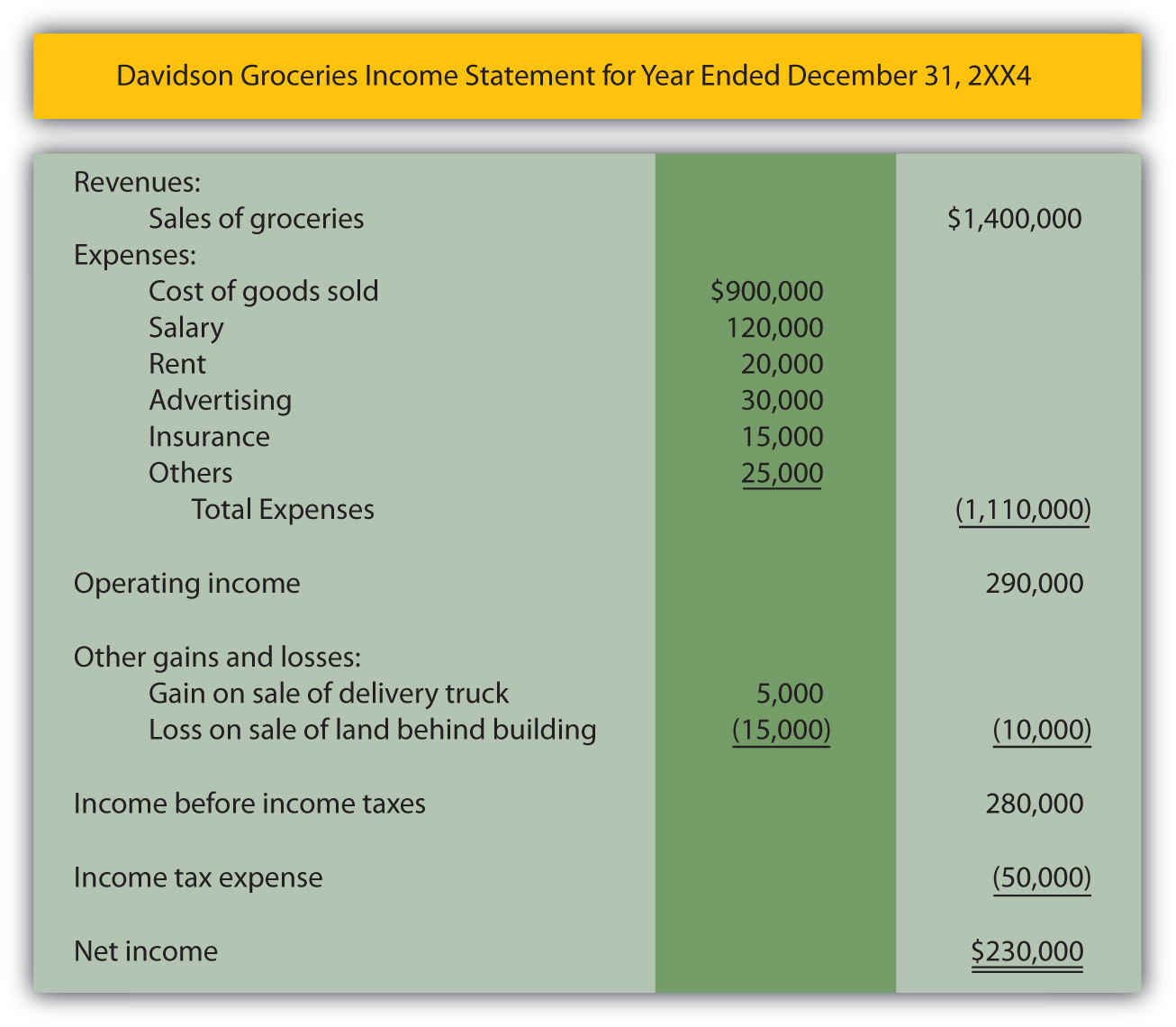

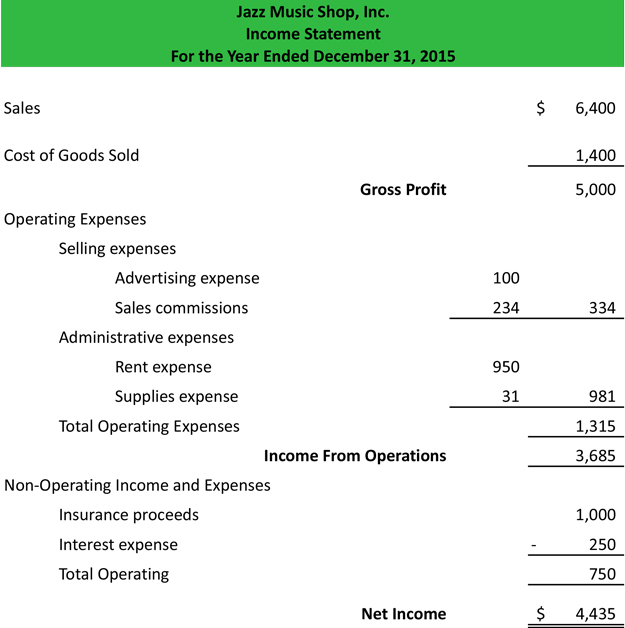

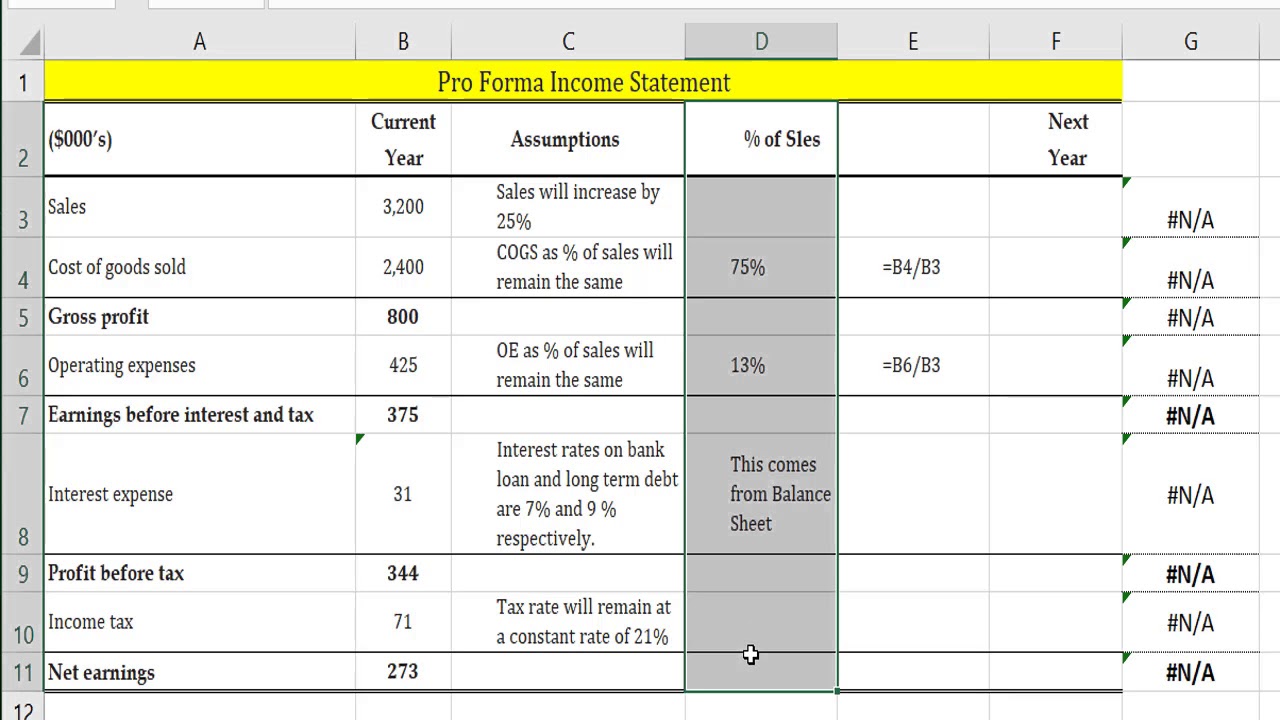

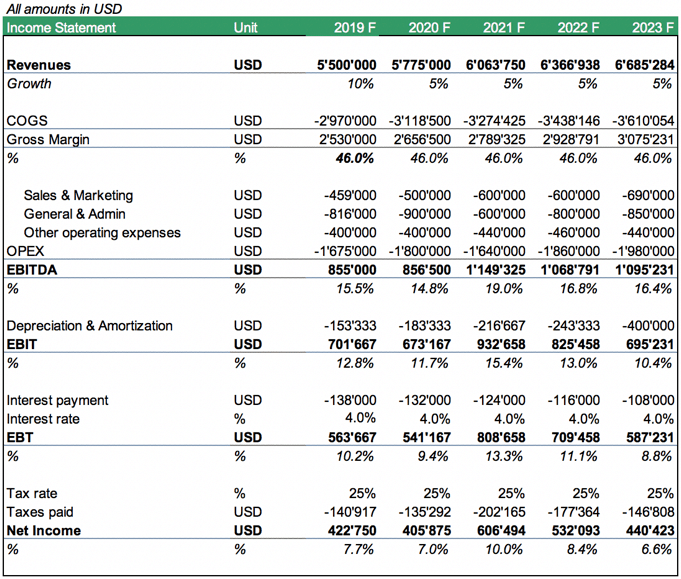

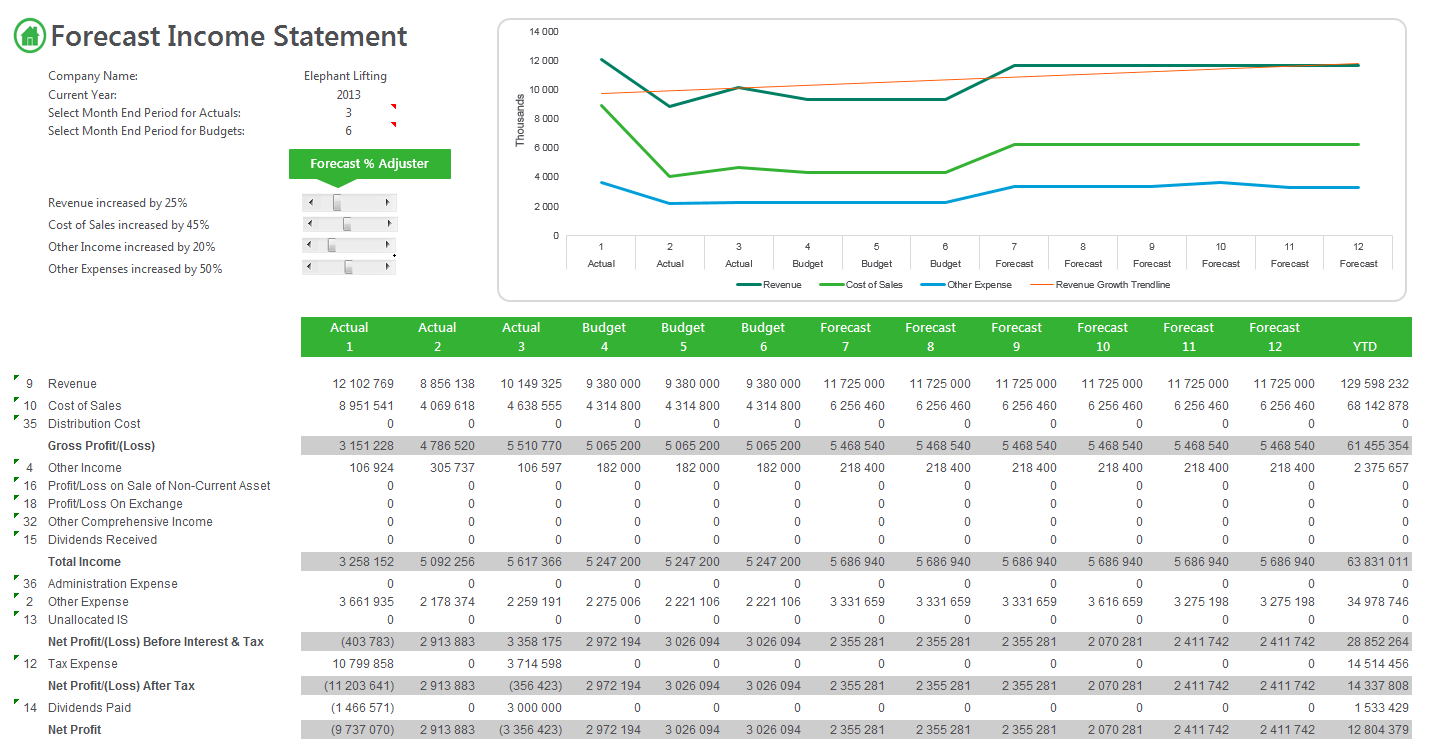

Steps in forecasting the income statement. What is “forecasting income statement line items”? Pro forma income statement our forecast starts with what we call a pro forma income statement. Creating a pro forma income statement is one of the most important tasks in the financial modeling process.

You’ll need to look at your past finances in order to project your income, cash flow, and. The forecasting process involves several key steps. We start the balance sheet forecast by forecasting working capital items.

Nvda) today reported revenue for the fourth quarter ended january 28,. Let’s look at a simple financial forecasting flow to get a general idea of what it takes to forecast. Santa clara, calif., feb.

Cancelling student loan debt for more than 930,000 borrowers who have been in repayment for over 20 years but never got the relief they earned because of. Fetch historical data for the forecast from your financial. Here are some steps in the process:

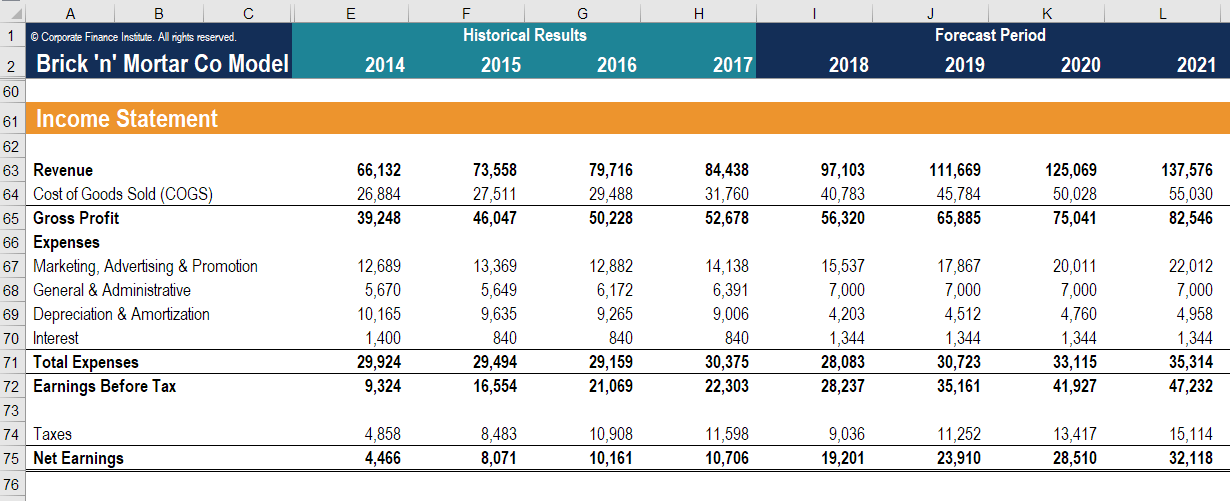

Segment level detail and a price x volume approach. Thankfully, forecasting the income statement is one of the more straightforward financial modeling concepts, because we're effectively just mapping out. The first step in the process is investigating the company’s condition and identifying where the business.

The income statement template is set up to automatically add up your total revenue (line 13), total costs (not including taxes, line 23), and net income (line 26). The income statement forecast, sometimes called the profit and loss forecast, is one of the three main statements for business plan financials. In this guide on how to build a financial forecast, we will complete the income statement model from revenue to operating profit or ebit.

Gross sales and net sales. There are three steps you need to follow: Pro forma financial statements are prepared in advance of a planned.

(for a complete guide to working capital, read our “working capital 101” article.) broadly. Cash flows from operating activities the first step in our cash flow forecast is to forecast cash flows from operating activities, which can be derived from the balance sheet and. Grow revenues by inputting an aggregate growth rate.

Nvidia reported fourth fiscal quarter earnings that beat wall street's forecast for earnings and sales,. Forecasting net working capital the first step in forecasting a balance sheet is determining how much net working capital your company has. Gather your past financial statements.

For 2016, the growth rate was 4.0% based on. Mechanically, there are two common approaches for forecasting revenue: