Ace Tips About Direct Method Income Statement Us Gaap Financial Statements Format

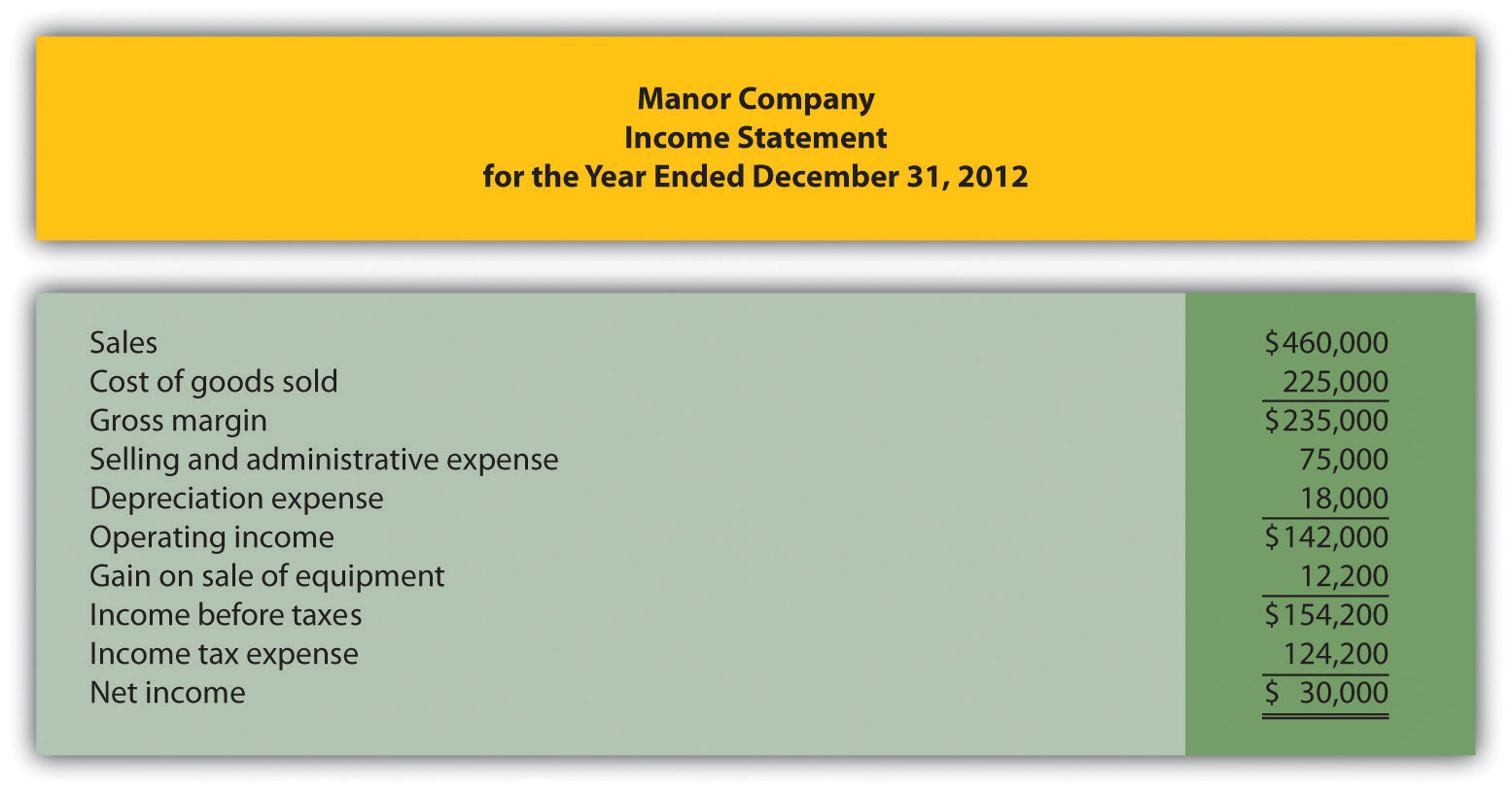

For instance, assume that sales are stated at $100,000 on an accrual basis.

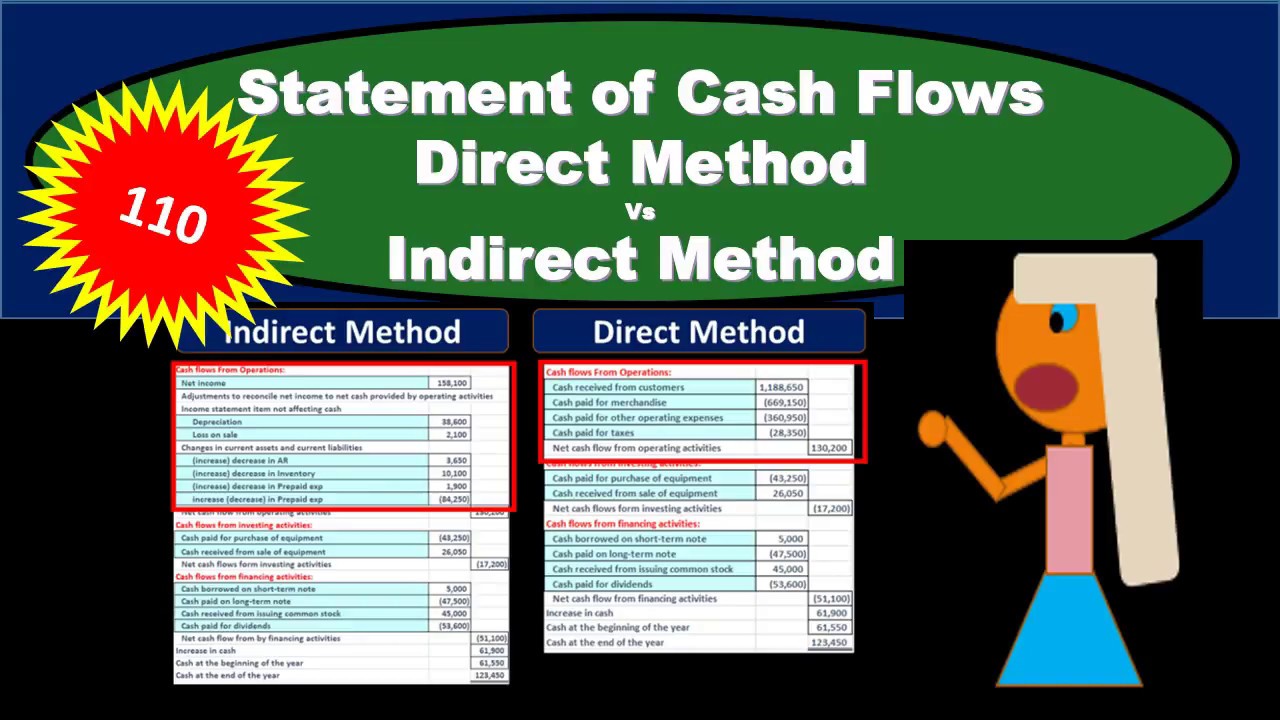

Direct method income statement. So the direct method, starts with the income statement and rebuilds it on the cash basis. Advice for employersnationwide coverage40,000 happy clientsexpert support The direct method requires the use of the actual cash inflows and outflows of the organization, i.e., the actual cash inflows and outflows that took place within the company when the incomes and payments are actually received and not when they are accrued.

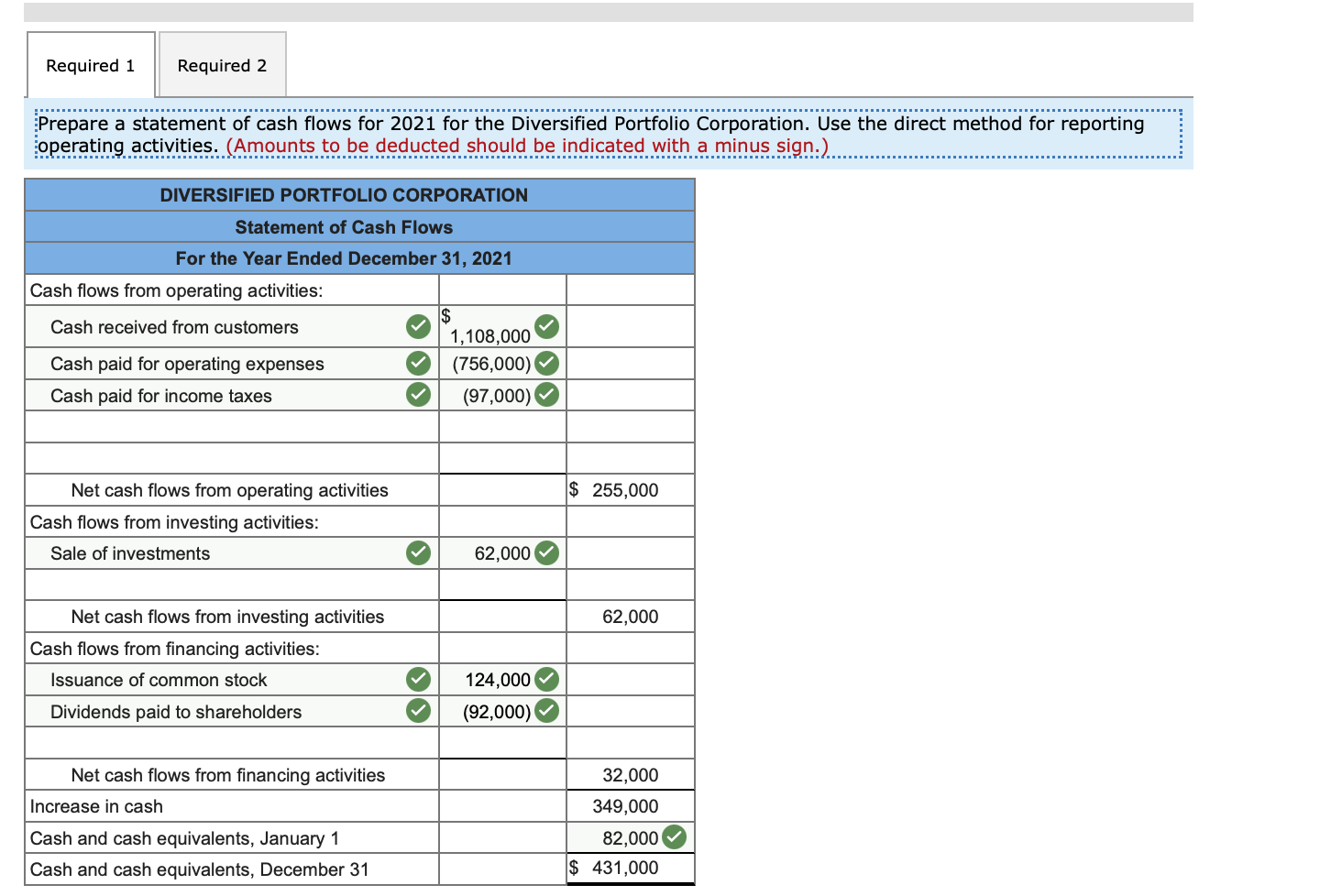

The direct method makes adjustments directly to each income statement revenue and expense line item, thereby converting each line item to a cash basis. The direct method of presenting the statement of cash flows presents the specific cash flows associated with items that affect cash flow. The direct method details where cash comes from and where it goes.

The direct method deducts from cash sales only those operating expenses that consumed cash. It builds the operating section of the cash flow statement directly using each of the cash. The statement effectively converts each line of.

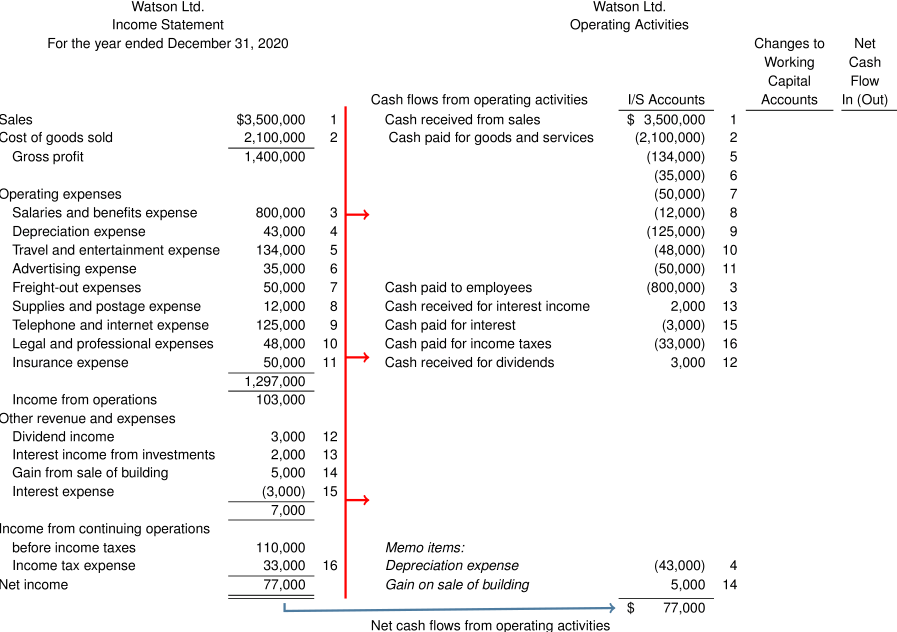

Starting with the top of the income statement, record each income statement line item amount to the most appropriate direct method category in the i/s accounts column. The cash flow statement can be generated using the direct method or the indirect method. The direct method converts each item on the income statement to a cash basis.

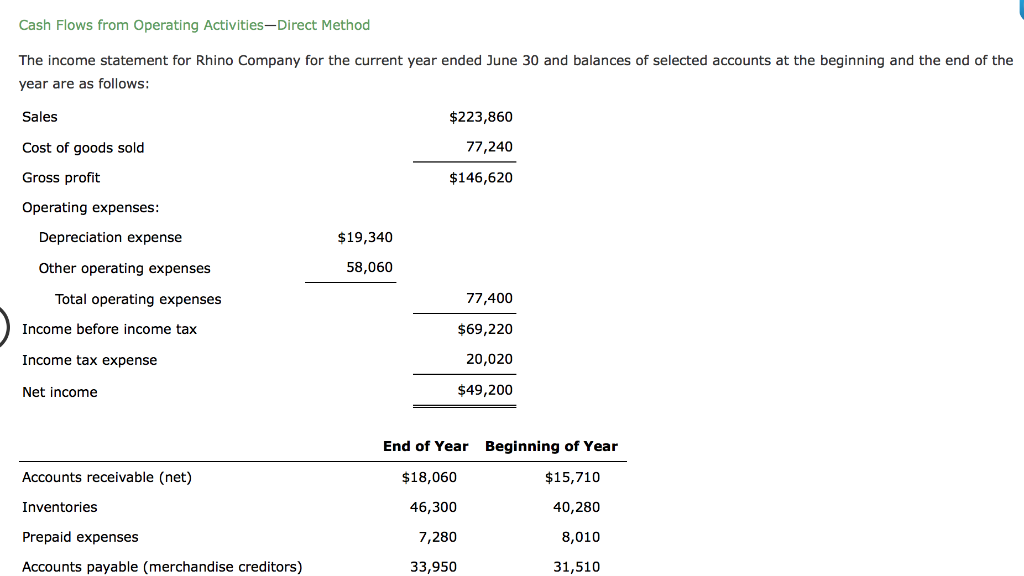

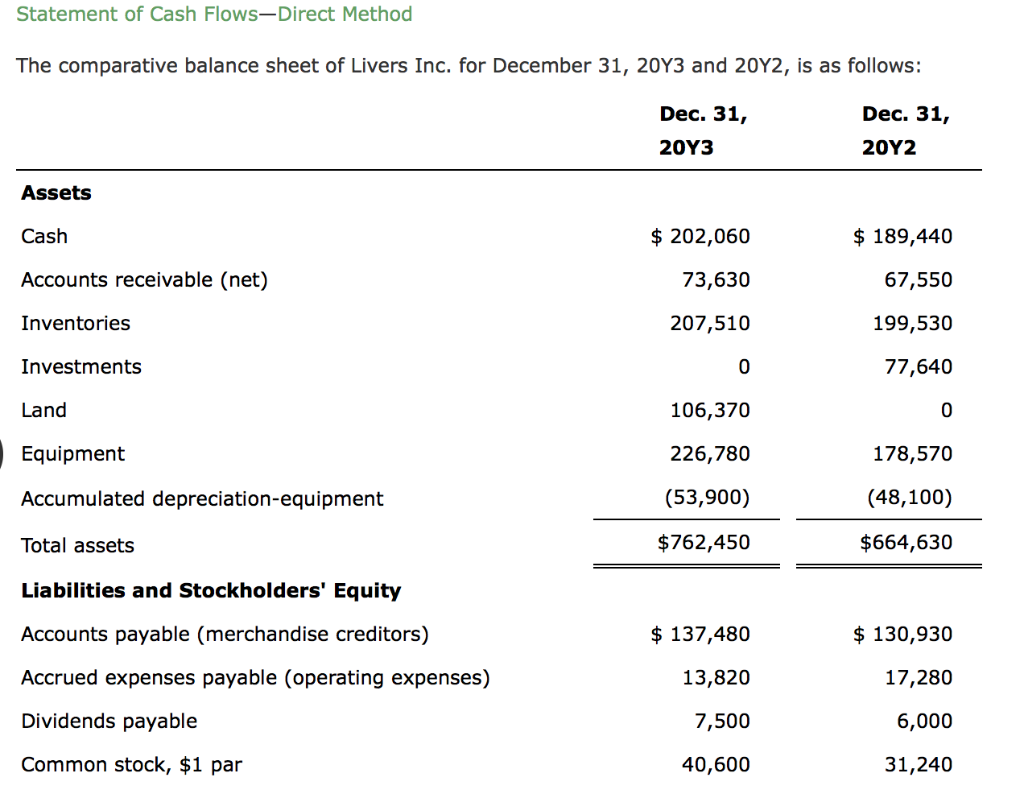

The direct method, the income statement is reformulated on a cash basis, rather than an accrual basis from the top of the statement (the income part) to the bottom (the. The direct method recap and final thoughts. Under the direct method determination of the amount of cash received from customers revenue is adjusted by the net change in accounts receivable during the.

The direct method cash flow statement is one way to show the cash flow from operating activities of a business. Starting with the top of the income statement, record each income statement line item amount to the most appropriate direct method category in the i/s accounts column. Then, each of the separate figures is converted into the amount of cash received or spent in.

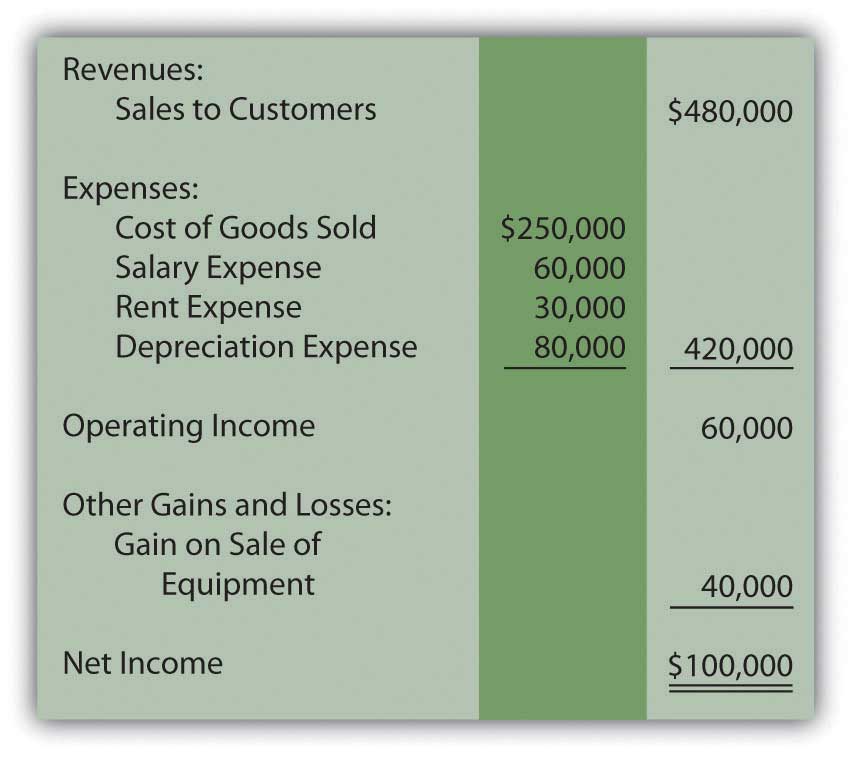

Figure 17.6 liberto company statement of cash flows. For the direct method categories are based on the nature of the cash flows. Although $238,000 of merchandise was acquired, only $229,000 in cash payments were made ($238,000 less $9,000).

The actual inflows received and the. The direct method is sometimes called the income statement method. Most companies operate on the accrual basis, where income is recognized when it is.

The direct method starts with the income statement for the period.