Divine Tips About Outstanding Expenses In Balance Sheet Statement Of Corrected Net Profit

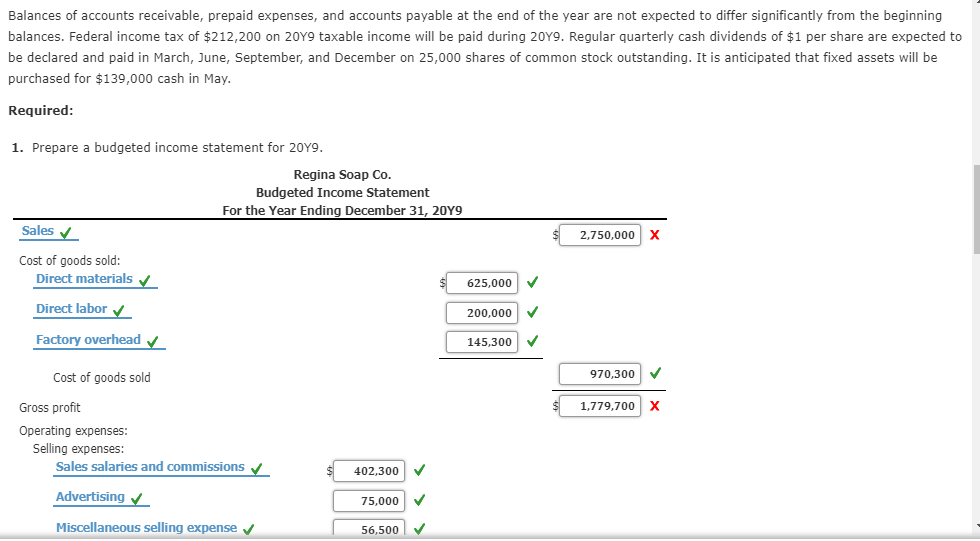

![[Solved] Help please?! On December 31, Year 1, Hilton Company](https://www.thevistaacademy.com/wp-content/uploads/2020/03/What-is-Outstanding-Expense-in-Accounting.jpg)

The most common types of prepaid expenses are prepaid rent and prepaid insurance.

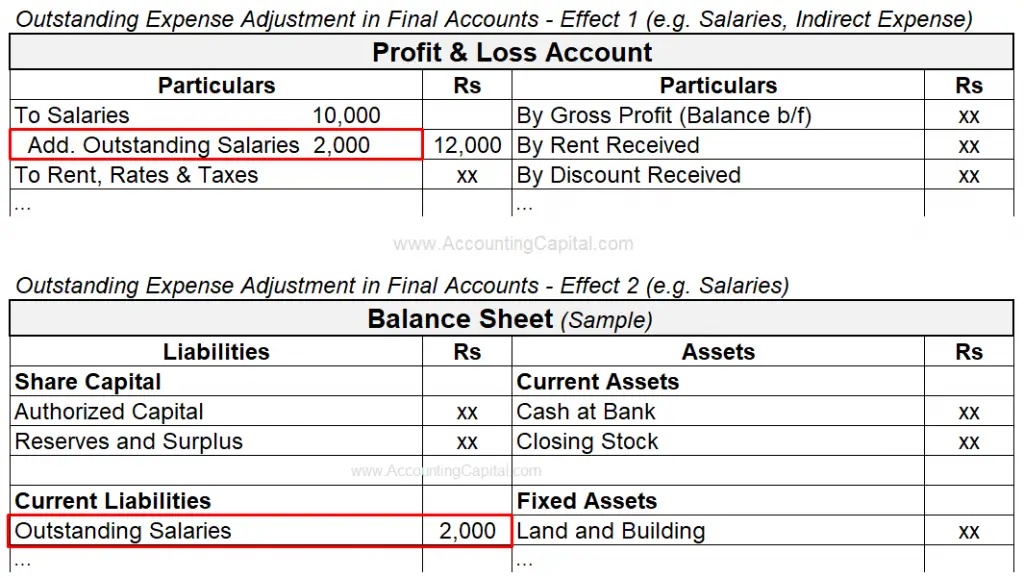

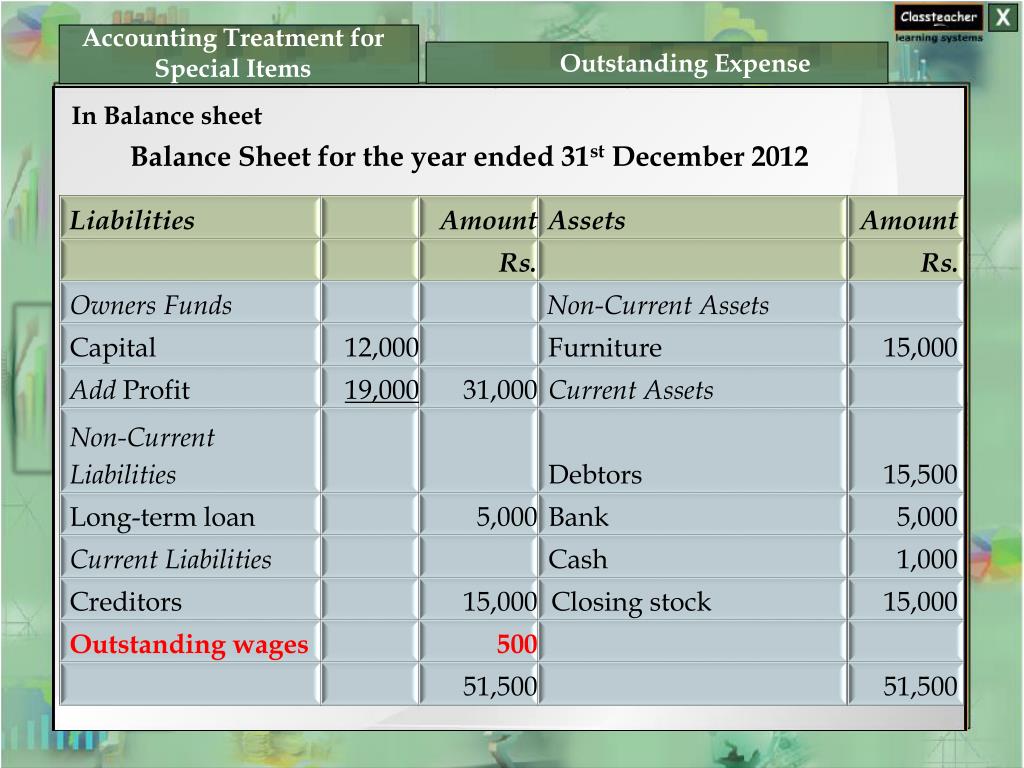

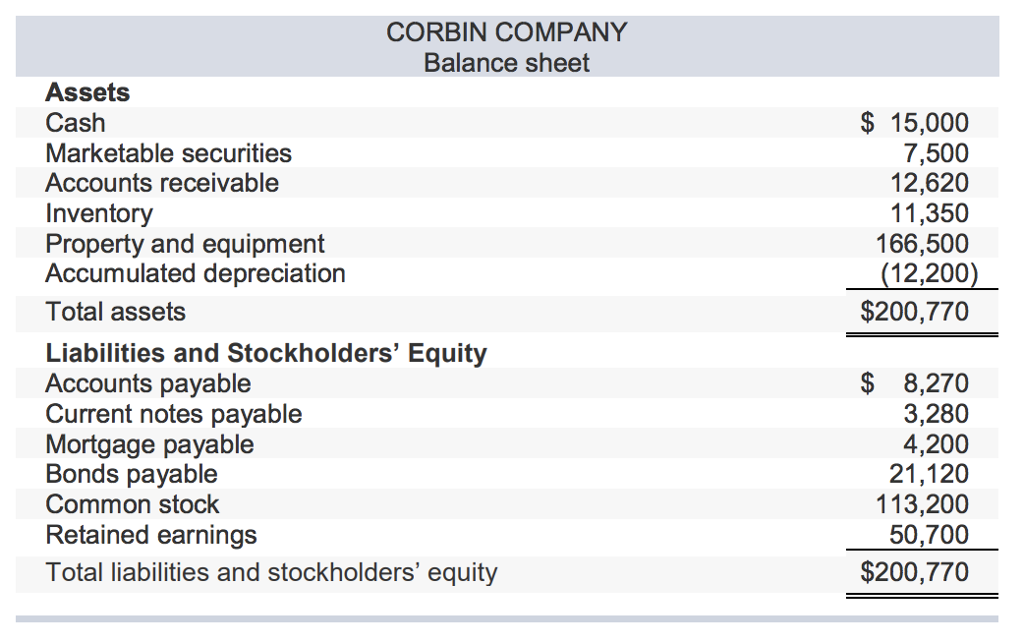

Outstanding expenses in balance sheet. The outstanding expense is represented on the liability side of the balance sheet of a business. These expenses are considered liabilities on the balance sheet because they represent amounts owed to creditors or service providers. Outstanding expenses in balance sheet are viewed as a liability and shown on the balance sheet under the head “current liabilities”.

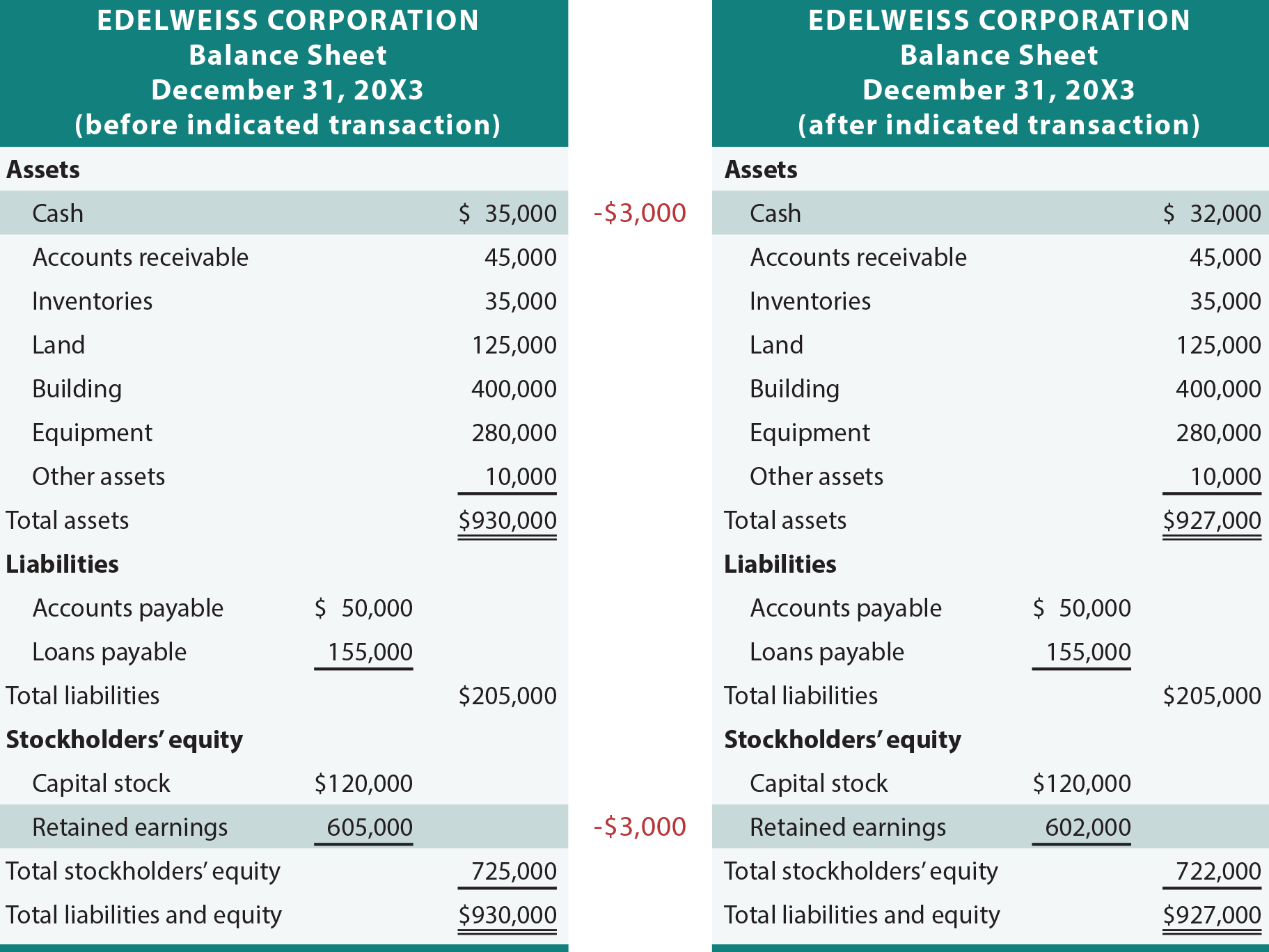

November 18, 2023 when an expense is recorded, it most obviously appears within a line item in the income statement. A decrease in cash, prepaid expenses, supplies on hand, inventory; Accrued expenses are recognized on the books when they are incurred, not when they are paid.

The outstanding expense is a personal account with a credit balance and is treated as a liability for the business. The income statement shows the financial results of a. The balance sheet displays the company’s total assets and how the assets are financed, either through either debt or equity.

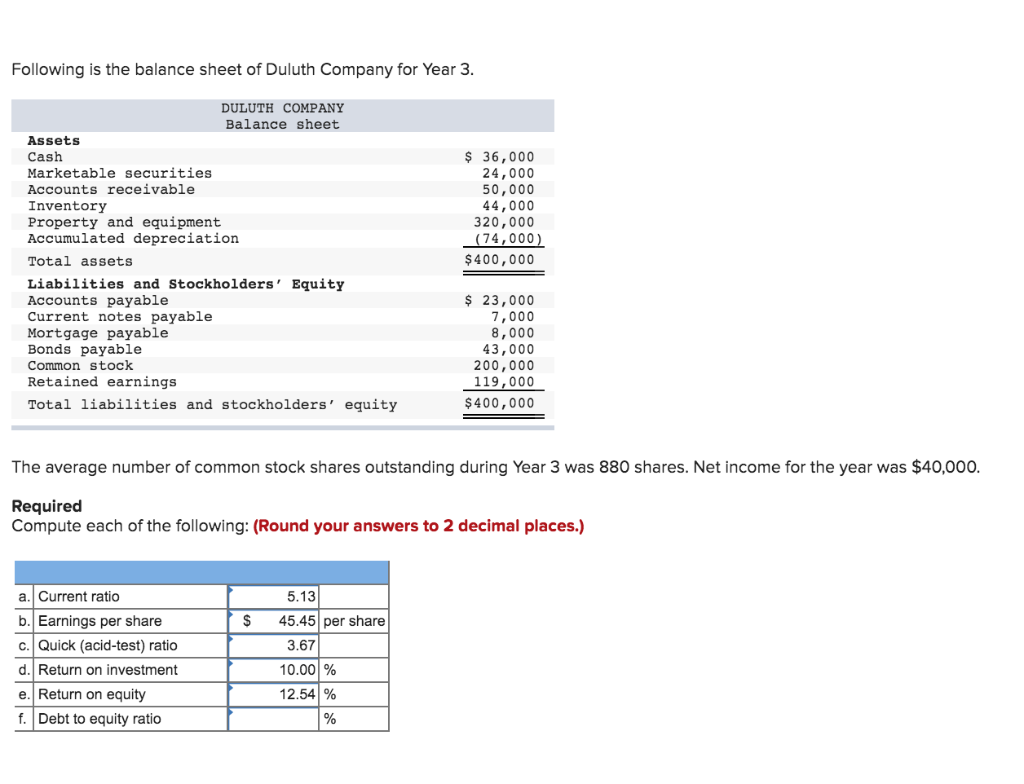

Bills past due but not yet paid. There are expenses that are due but have not been paid as of the end of the current accounting period. For accounting accuracy, these expenses need to.

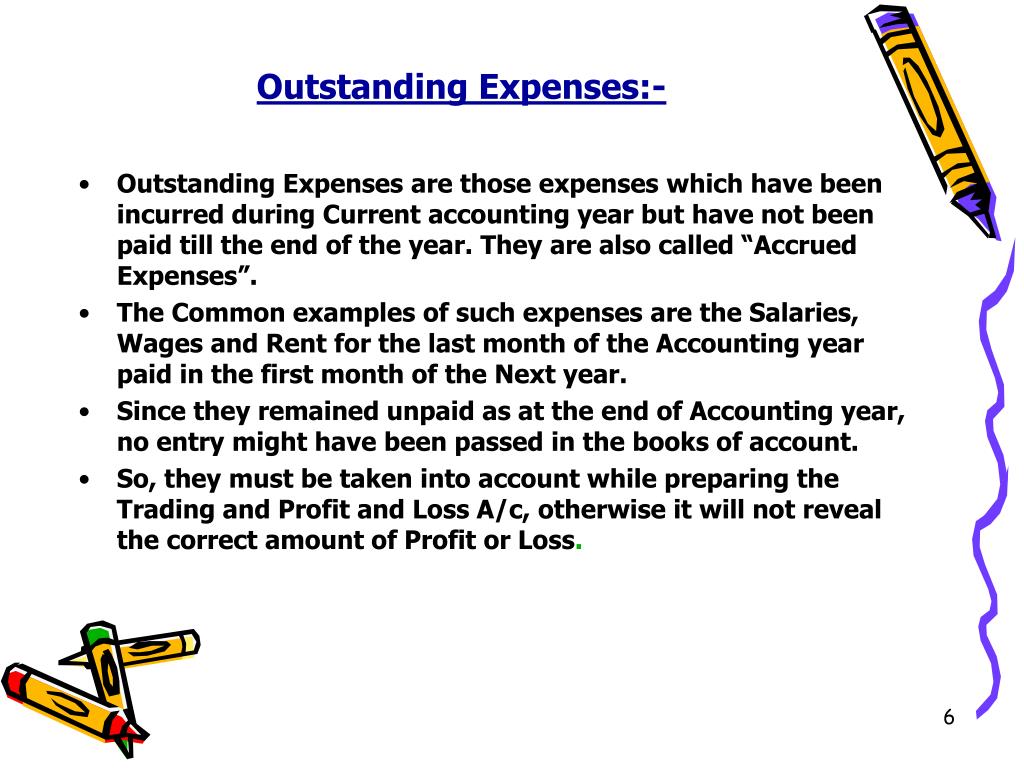

An outstanding expense is an expense which is due but has not been paid. Outstanding expenses are charged as expenses on the p&l statement. We’ll explain how to pass a journal entry for outstanding expenses in this article.

The balance sheet is based on the fundamental equation: Salary expense which not yet paid to employees. It can also be referred to as a statement of net worth or a statement of financial position.

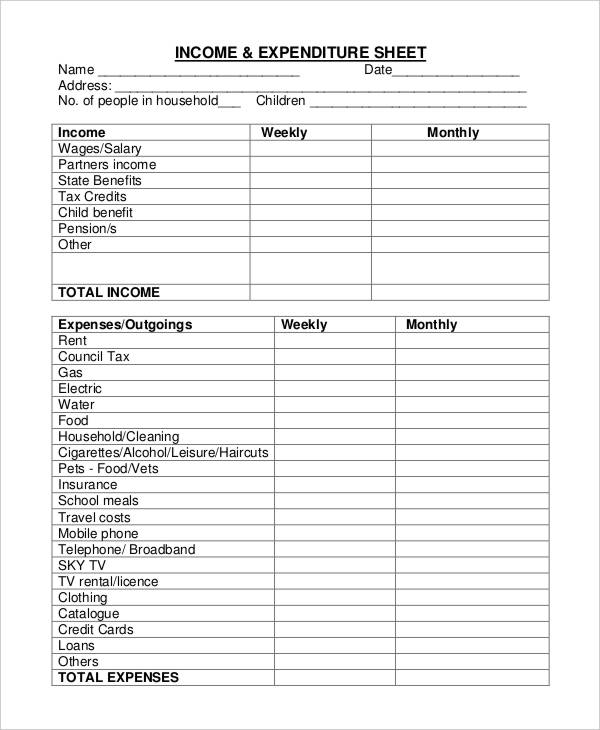

The company’s outstanding expenses include: The balance sheet includes outstanding expenses, accrued income, and the value of the closing stock, whereas the trial balance does not. Thus, outstanding expenses, prepaid expenses, accrued income and income received in advance require adjustment.

Also, show their treatment in the trading and profit and loss a/c and the balance sheet. Outstanding expenses are expenses relating to the current period that have been incurred but not paid at the end of the period. These expenses have those expenses for which we used the services from that expenses but didn’t pay money for that.

Outstanding expenses refer to a type of personal account having a credit balance and it is treated as a liability for a business firm. When a business incurs an expense, this reduces the amount of profit reported on the income statement.however, the incurrence of an expense also impacts the balance sheet, which is where the ending balances of all classes of assets, liabilities, and equity are reported. Does an expense appear on the balance sheet?

The unpaid expenses at the end of the accounting period are the outstanding expenses. Interest on loan expenses ₹150000. Option one is straight to the profit and loss statement, effectively bypassing the balance sheet.