Impressive Info About Increase In Accounts Receivable Cash Flow Statement Nadec Financial Statements

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during the year.

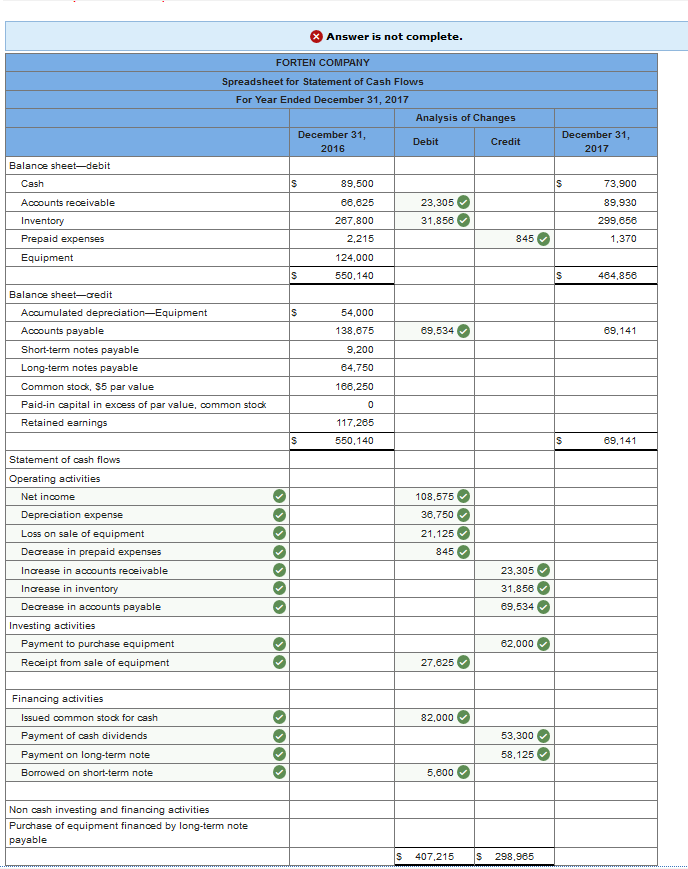

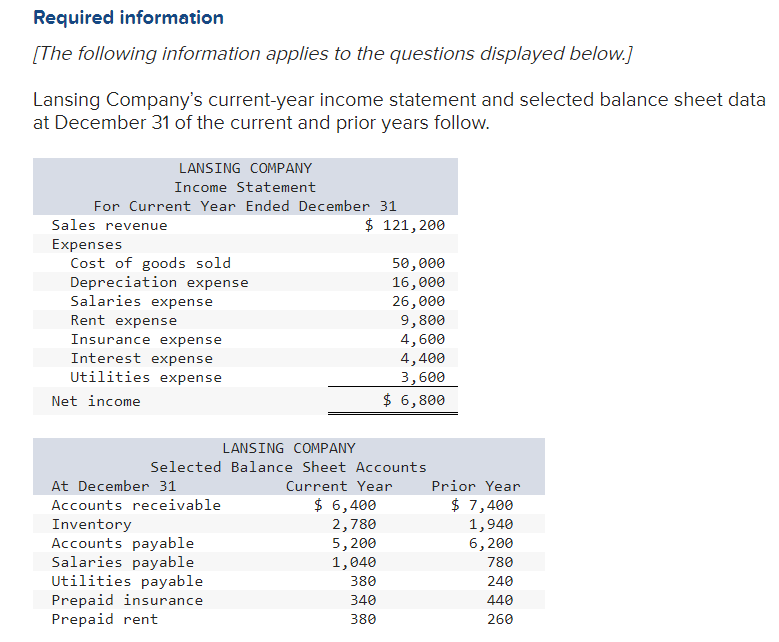

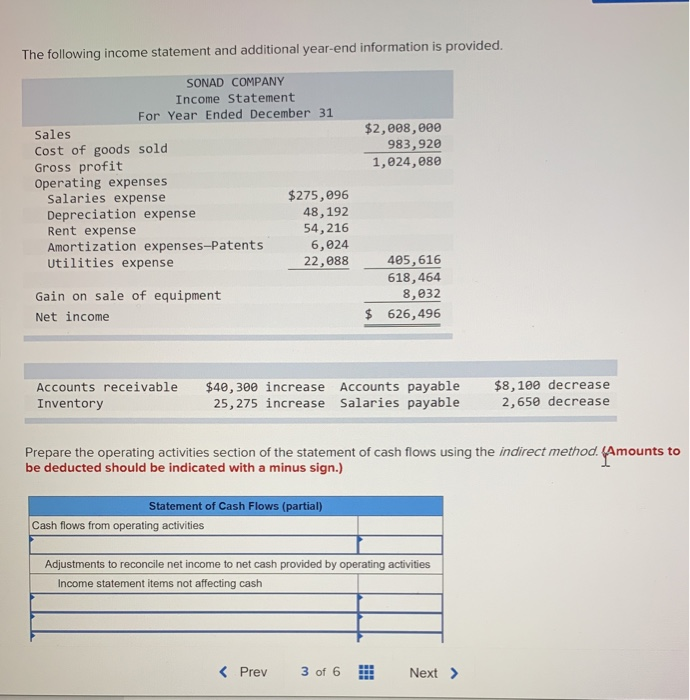

Increase in accounts receivable cash flow statement. While it represents potential future income, it does not immediately translate into liquid assets. Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows: Increase in accounts receivable => deduct the increased amount from net income.

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year). So, we can summarize the adjustments for the increase or decrease in accounts receivable on cash flow statement as below: For example, clear lake’s accounts receivable increased from the prior period to the current period.

The increase in accounts receivables is deducted from net profit and the decrease in accounts receivables is added to net profit. There are two methods for cash flow statement preparation: Conversely, a negative number indicates a cash flow increase of the same amount.

Begin with net income from the income statement. This article delves into the relationship between accounts receivable and cash flow statements. Days sales outstanding (dso) the standard modeling convention is to tie ar to revenue to forecast accounts receivable, given how they are closely associated.

Therefore, we subtract the increase in accounts receivable from the company's net income. Cash from operating activities, cash from investing activities and cash from financing activities. Prepare the cash flow statement for norwich manufacturing, inc.

In example corporation the net increase in cash during the year is $92,000 which is the sum of $262,000 + $ (260,000) + $90,000. Ready to break the shackles of risky net terms while improving your cash flow and accounts receivables? Luke tubinis , growth content, ramp understanding accounts receivable cash flow financial statement implications benefits of converting accounts receivable to cash downsides to converting accounts receivable to cash negative accounts receivable the bottom line

If you're carrying balances that charge you monthly interest, paying them off is an opportunity for better to reduce your expenses long term. The direct method determines changes in cash receipts and payments. It is popularly called trade receivables and it is a current asset.

This is how cash flow problems usually start. December 1, 2023 how does an increase in accounts receivable affect cash flow? With that said, an increase in accounts receivable represents a reduction in cash on the cash flow statement, whereas a decrease reflects an increase in cash.

A cash flow statement consists of three sections: This situation can create a gap in available funds, making it challenging to cover operational costs. The cash flow statement (cfs), is a financial statement that summarizes the movement of cash and cash equivalents (cce) that come in and go out of a company.

The amount due from the customer is called accounts receivables. A positive difference shows an accounts receivable increase, signifying cash usage and indicating a cash flow decline by the same amount. Often used interchangeably with the term, “statement of cash flows,” the cash flow statement tracks the real inflows and outflows of cash from operating, investing and financing activities.

/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)