Marvelous Tips About Income Tax Paid In Cash Flow Statement Subsidiary Financial Statements

The income statement is a useful way to see how a company makes money and how it spends it.

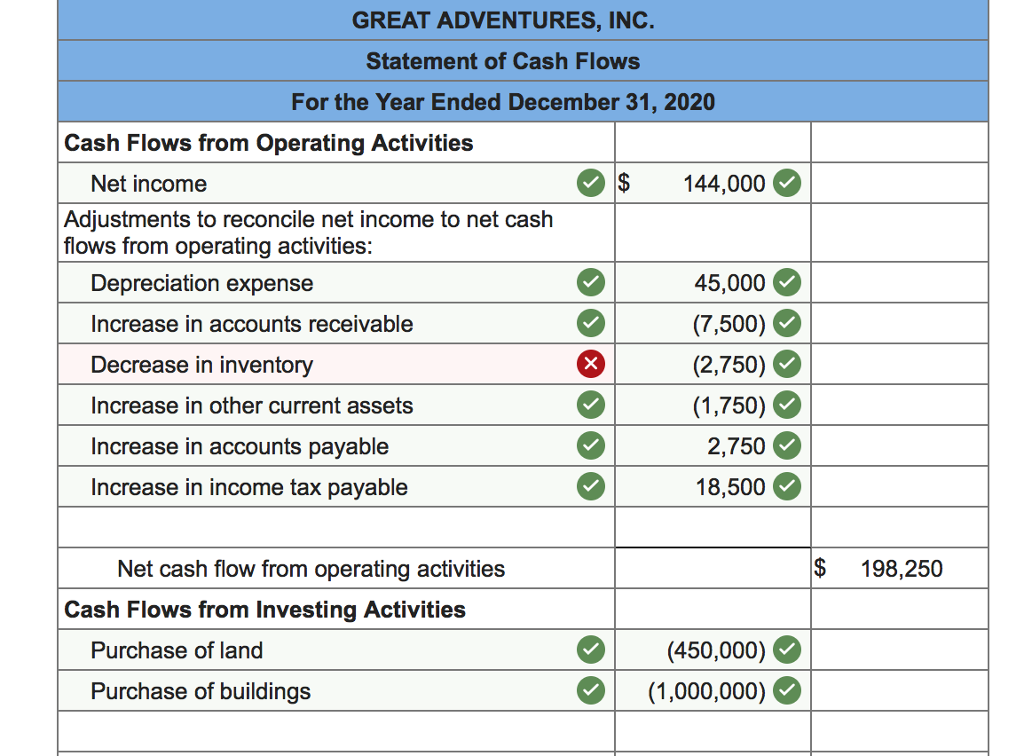

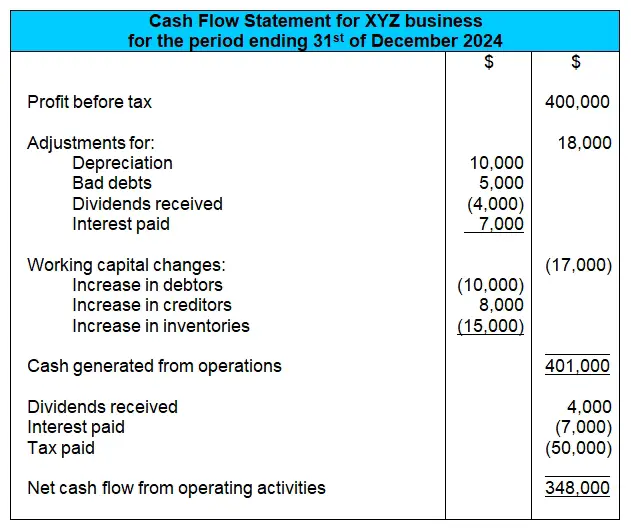

Income tax paid in cash flow statement. An income statement is another name for a profit and loss statement (p&l). The amount of interest and income taxes paid are often overlooked when using the indirect method of reporting the statement of cash flows. The income statement and the cash flow from operations portion of the statement of cash flows of the xyz company follow:

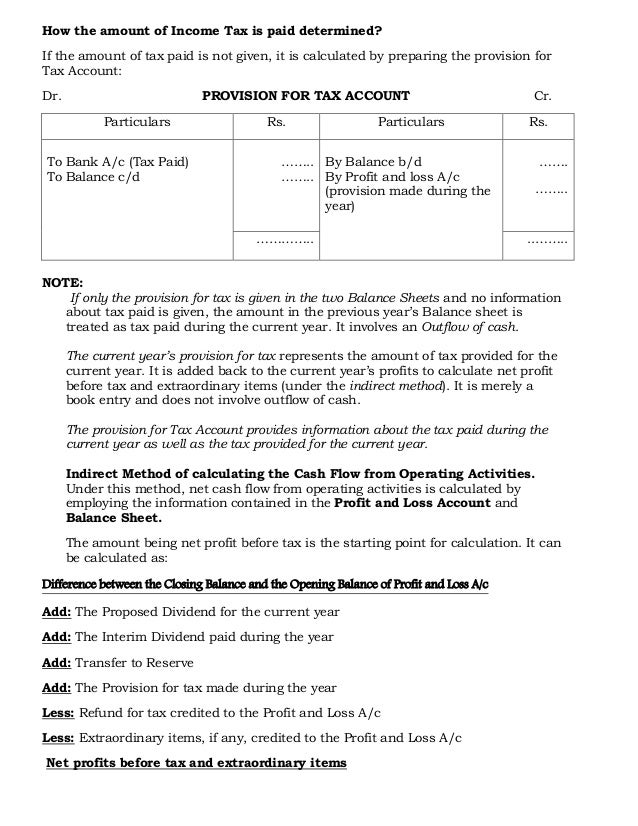

Proceeds from sale of fixed assets: Like other unpaid debts, accounting treats income tax payable as a liability. Record adjusted ebitda margin fourth.

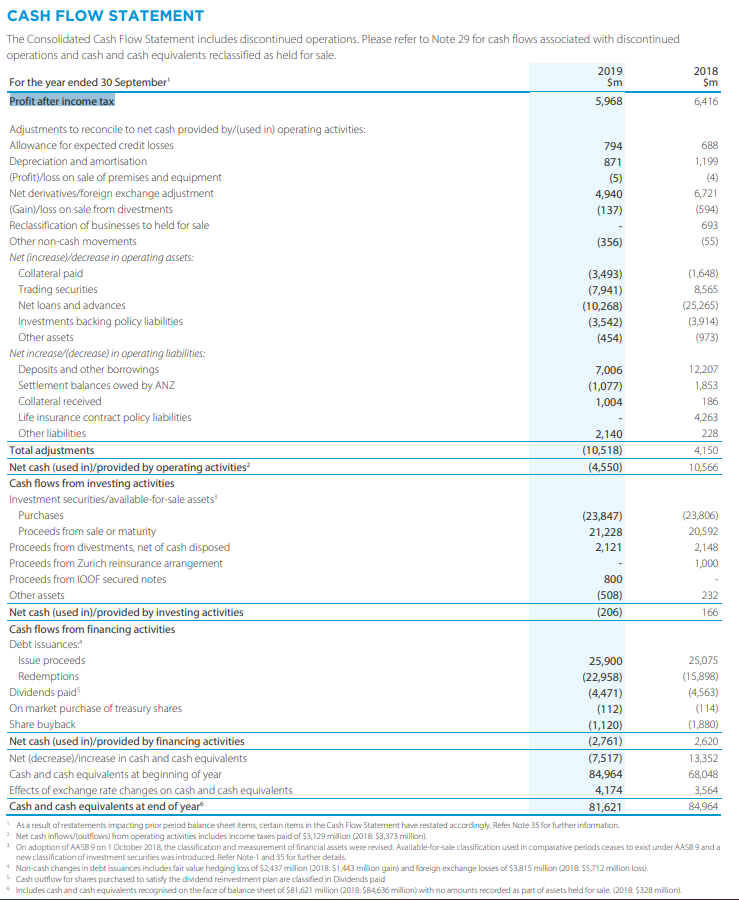

The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. Trump claimed under oath last year that he was sitting on more than $400 million in cash, but between justice engoron’s $355 million punishment, the interest mr. This video shows how to calculate the cash paid for income taxes for the operating section of the statement of cash flows when it is prepared using the direct method.

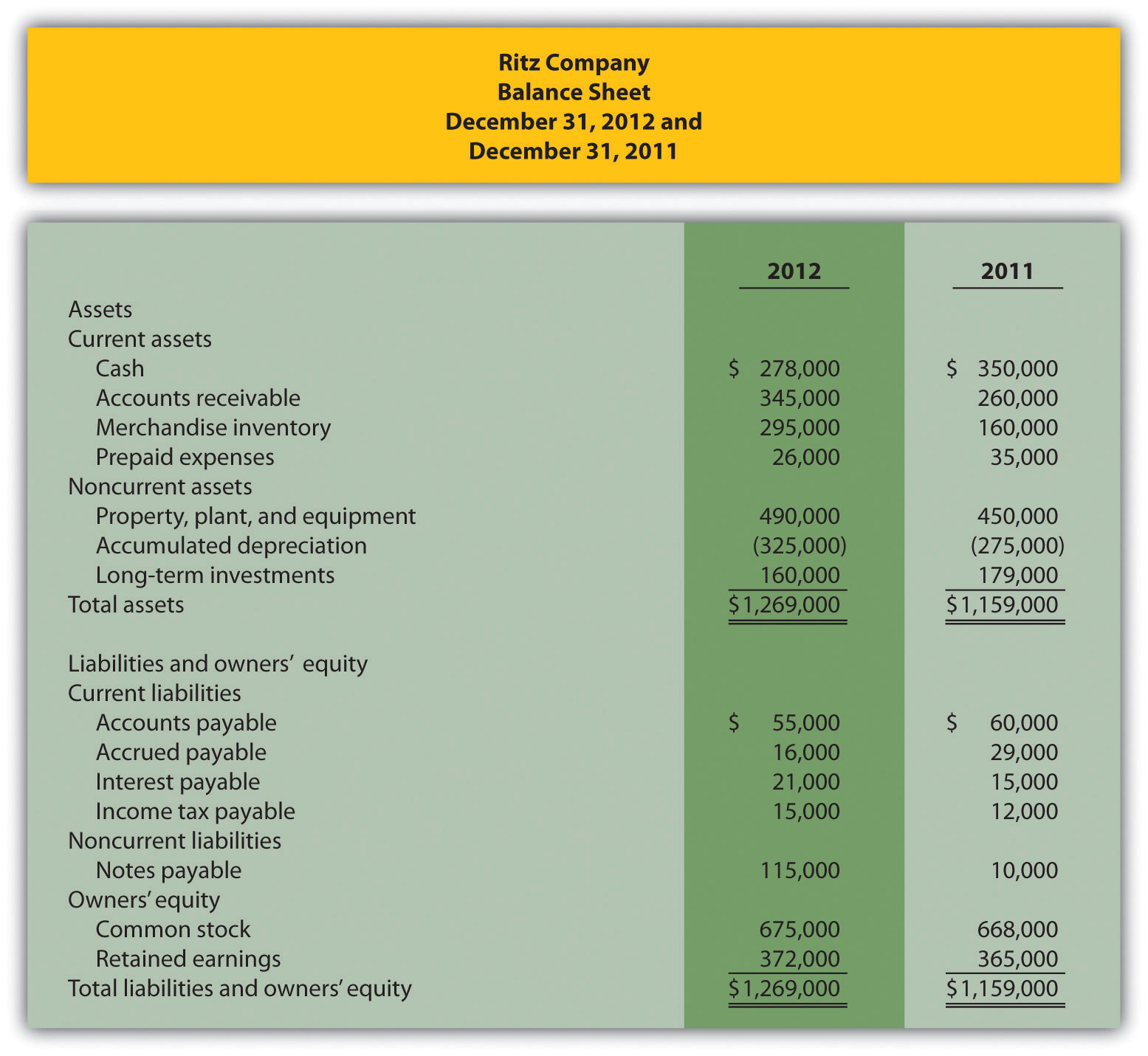

Key highlights since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period. An income statement shows whether a company made a profit, and a cash flow statement shows whether a company generated cash. The time interval (period of time) covered in the scf is shown in its heading.

Proceeds from sale of investments: Deferred component of income tax expense cu (3000) current component of income tax expense cu 27000. The cfs measures how well a.

Cash tax paid is an estimate of the tax amount actually paid in a given period. Dividends received (dividends paid are reported in the financing section) cash paid income taxes; Two examples include year ended december 31, 2022 and three.

Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities; Trump owes and the $83.3. If no payments were made, the ending balance would be cu 41000.

The scf reports the cash inflows and cash outflows that occurred during the same time interval as the income statement. Note, that the profit before tax, the first line item of the cash flow, reflects most of. The cash flow statement is a report that firms use to explain changes in their cash balances over a specific period of time by identifying all of the sources.

Statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements,. This can be quarterly, half yearly or yearly. Sfas 95, statement of cash flows, classifies income tax payments as operating outflows in the cash flow statement, even though some income tax payments relate to gains and losses on investing and financing activities, such as gains and losses on plant asset disposals and early debt extinguishments.

It is common to not only miss these disclosures but also. You obtain the cash paid for. Cash dividends paid to shareholders $ (45.00) blank blank cash flow from financing activities blank (2.25) blank increase.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)