Amazing Info About Forecast Financial Statements Example Finance Cost In Profit And Loss Account

Besides past records, there’s other data you can draw on to make your projections more accurate.

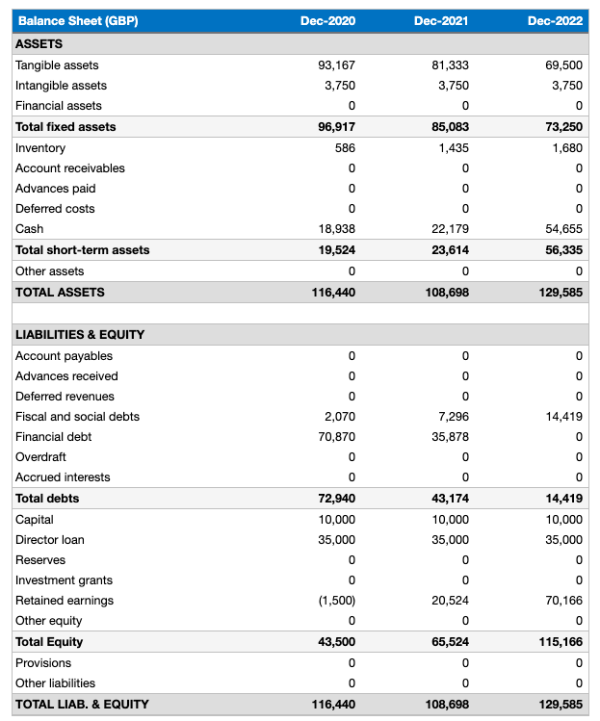

Forecast financial statements example. Forecasting is the use of historic data to determine the direction of future trends. We begin by forecasting cash flows from operating activities before moving on to forecasting cash flows from investing and financing activities. You’ll need to look at your past finances in order to project your income, cash flow, and balance.

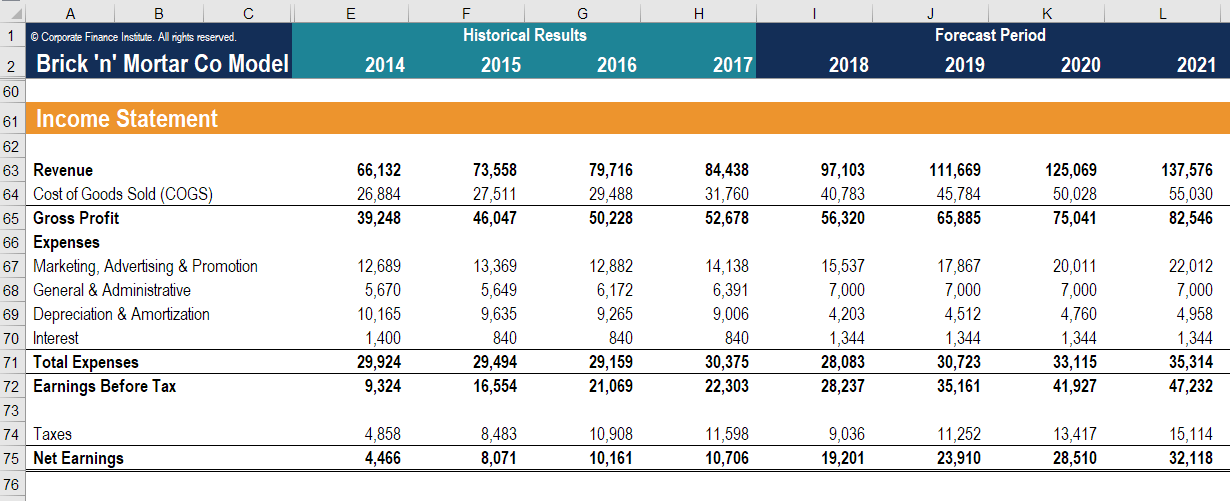

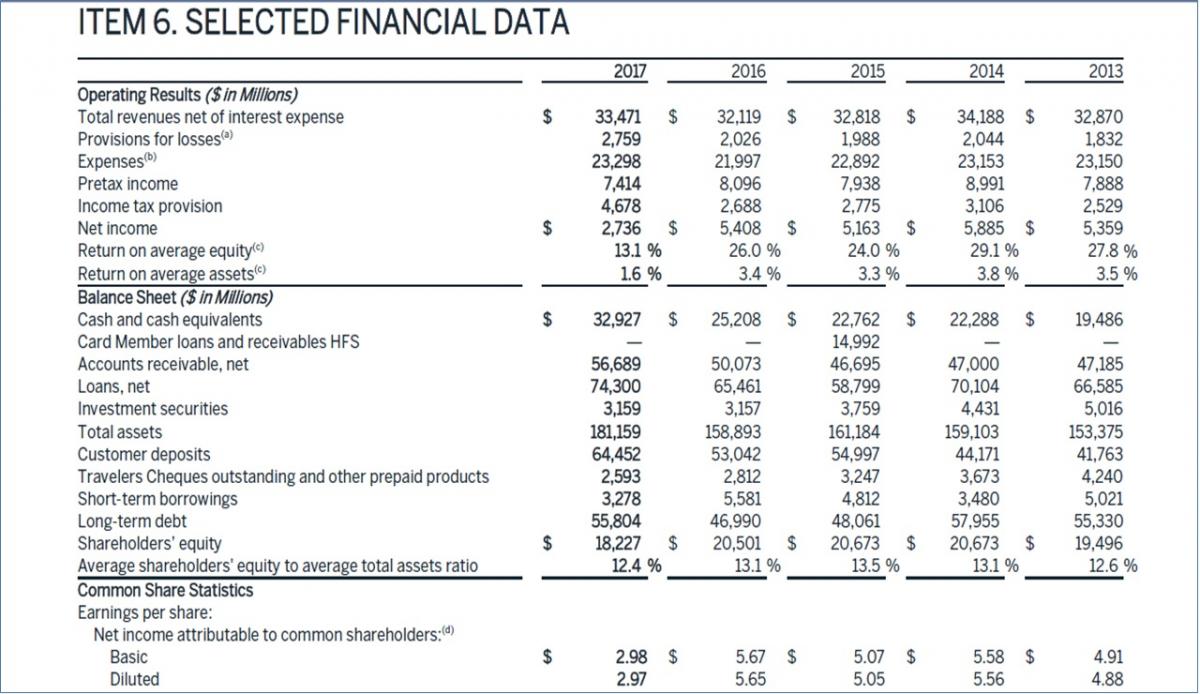

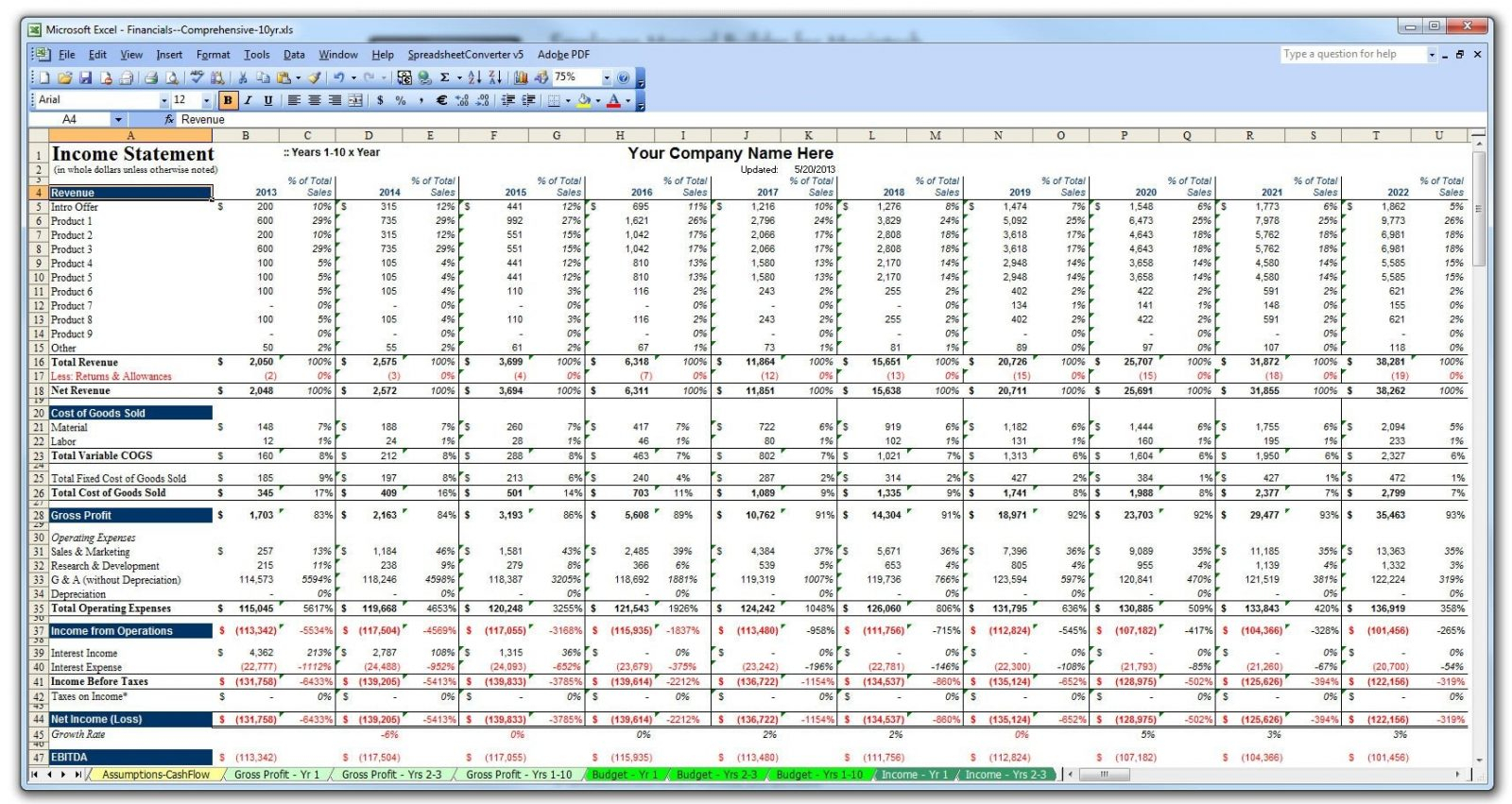

Gather your past financial statements. Financial forecasting example let’s go through an example of financial forecasting together and build the income statement forecast model in excel. A return on tangible equity (rote) of 10.4%, with total capital distributions equivalent.

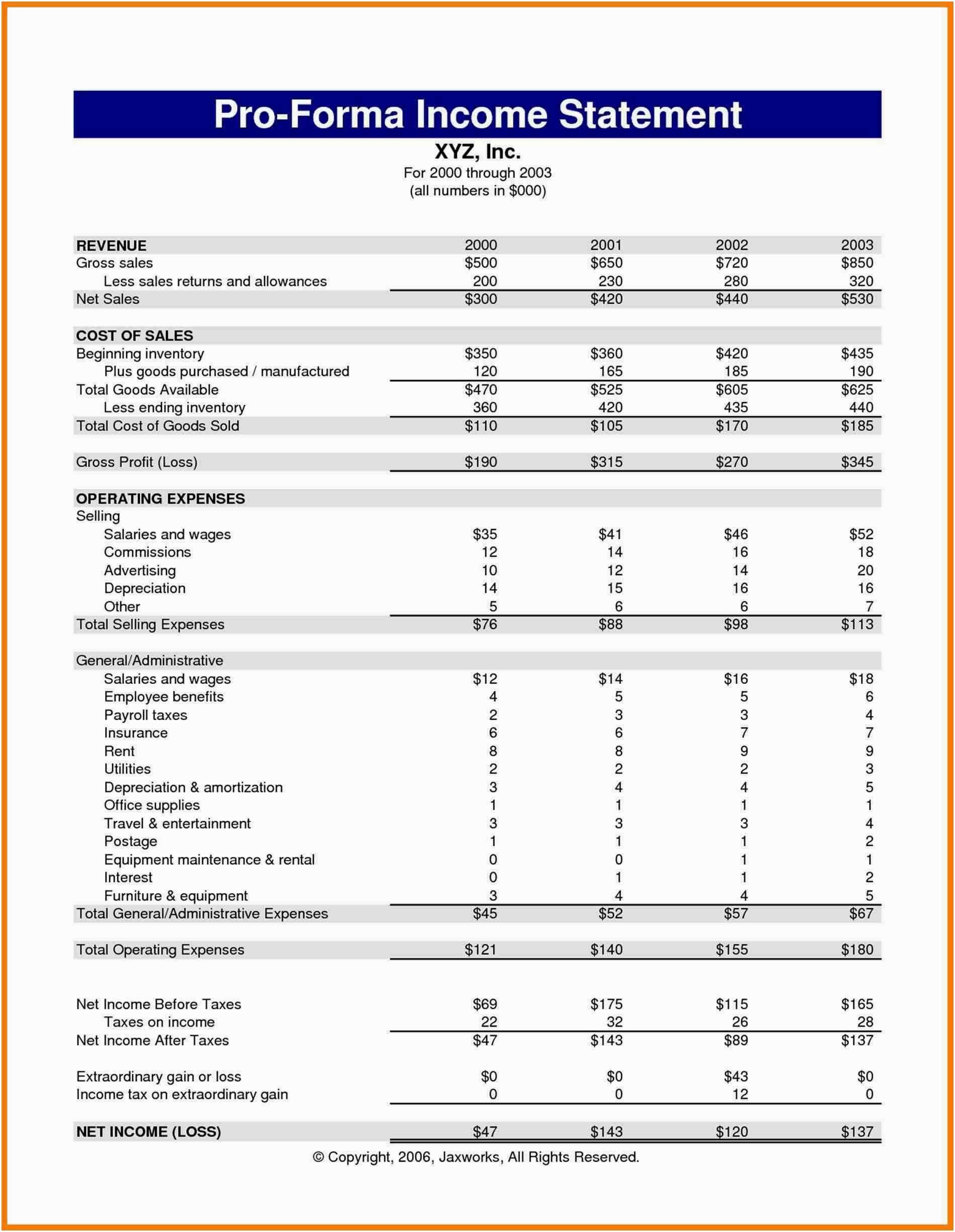

The following financial statement example provides an outline of the most common financial statements. It is impossible to provide a complete set of examples that address every variation in every situation since there are thousands of such companies. It’s a critical tool for businesses of all sizes,.

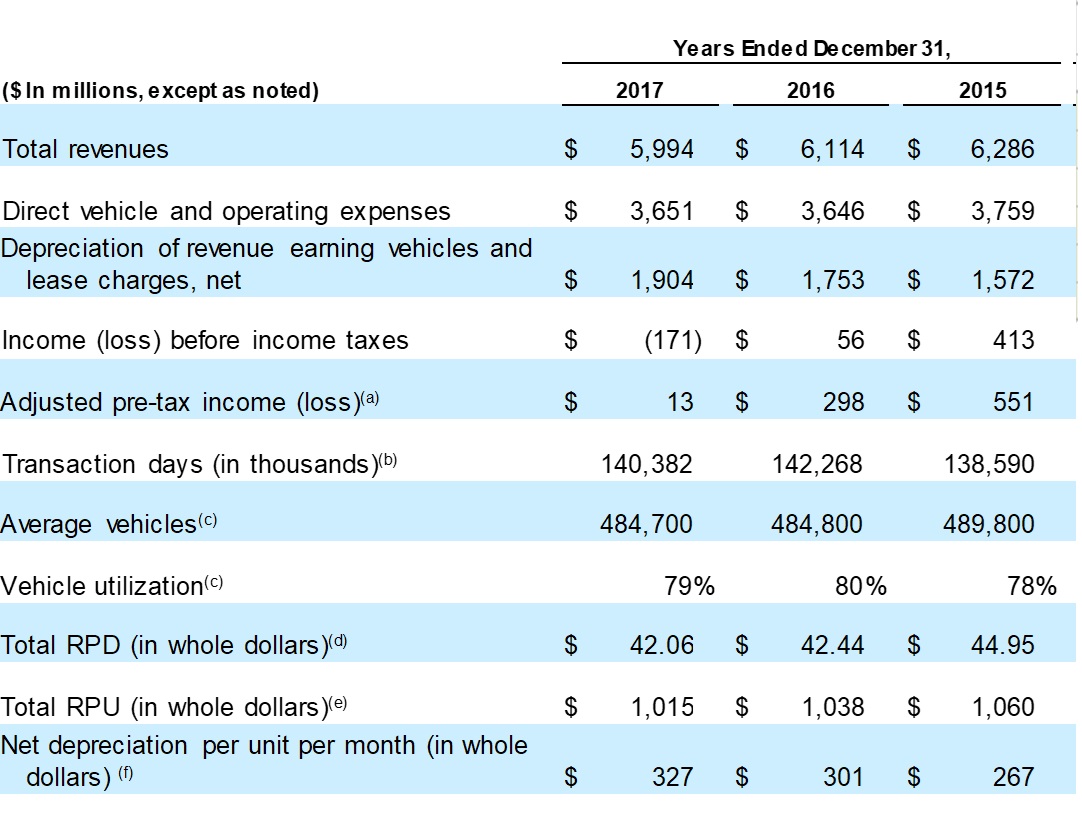

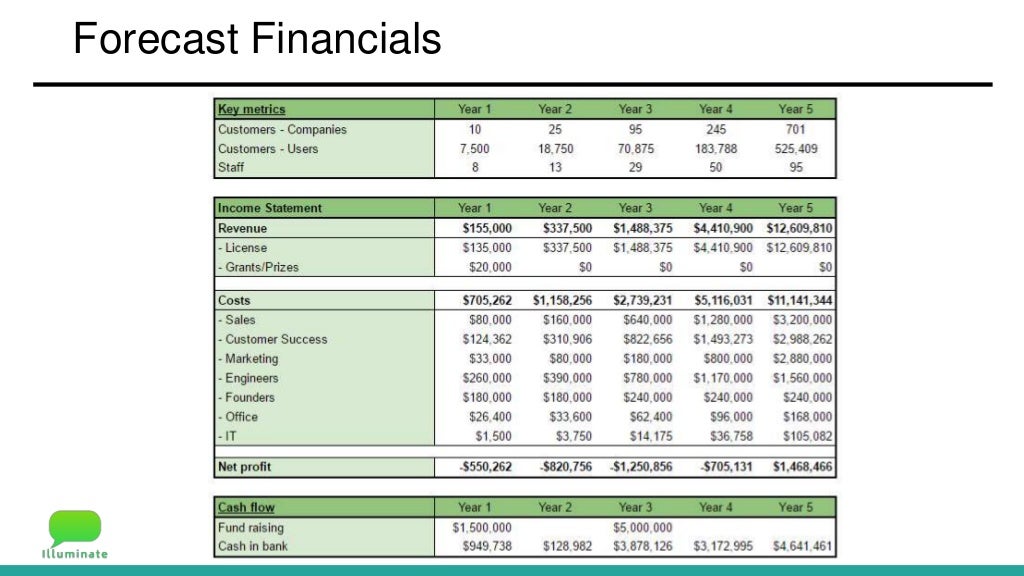

How the business will perform in the future based on historical data by analyzing the income statement, position statement, current conditions, past trends of the financial, future internal and external environment which is usually undertaken. Segment level detail and a price x volume approach A cash flow forecast can be derived from the balance sheet and income statement.

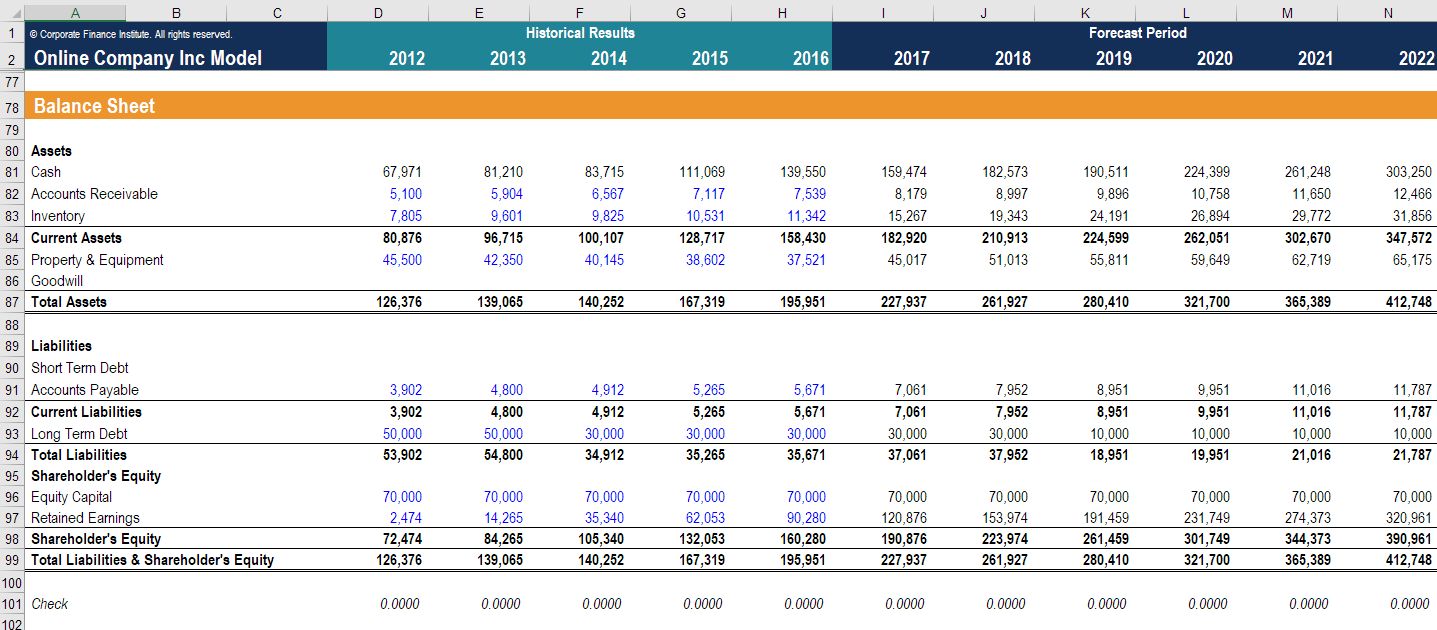

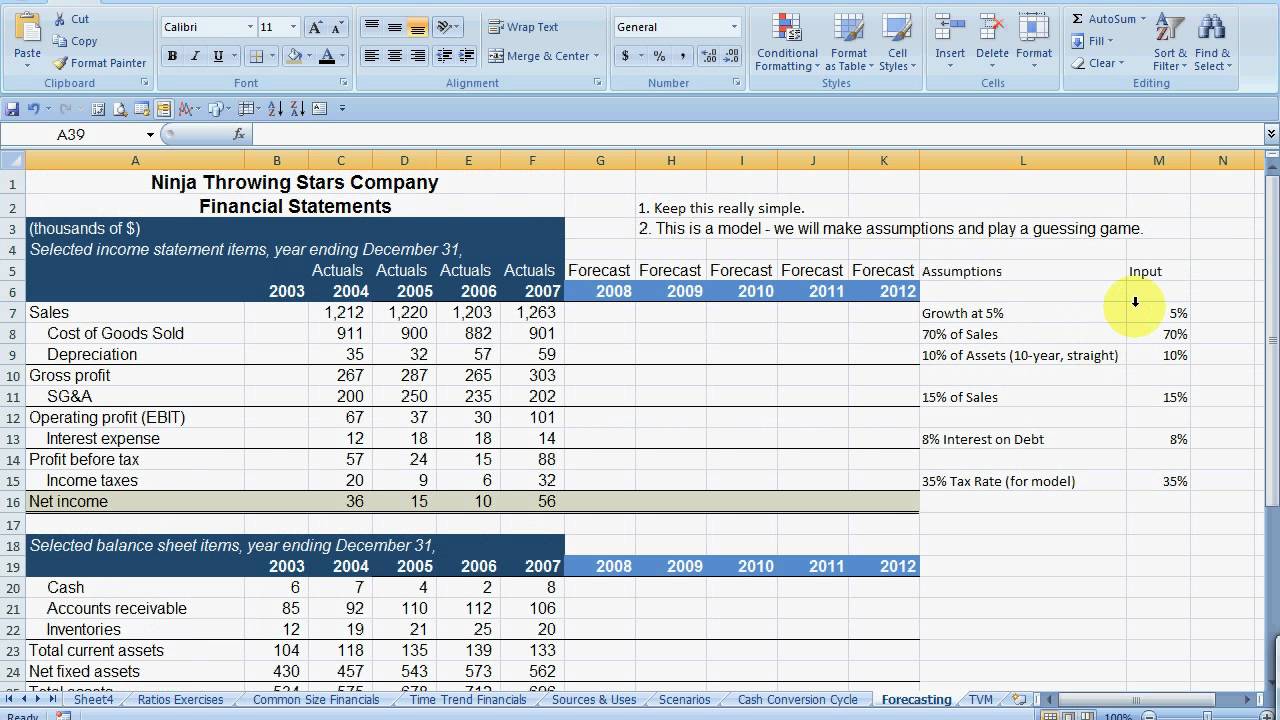

First off, you can see that all the forecast inputs are grouped in the same section, called “assumptions and drivers.” For example, if you forecast that “other long term assets” on the balance sheet grow at the same rate as revenues but forget to include the cash impact of this change on the cash flow statement, your model will not balance. Hub accounting december 19, 2023 small businesses perform financial forecasting by analyzing historical data and using it to predict the company’s future financial performance.

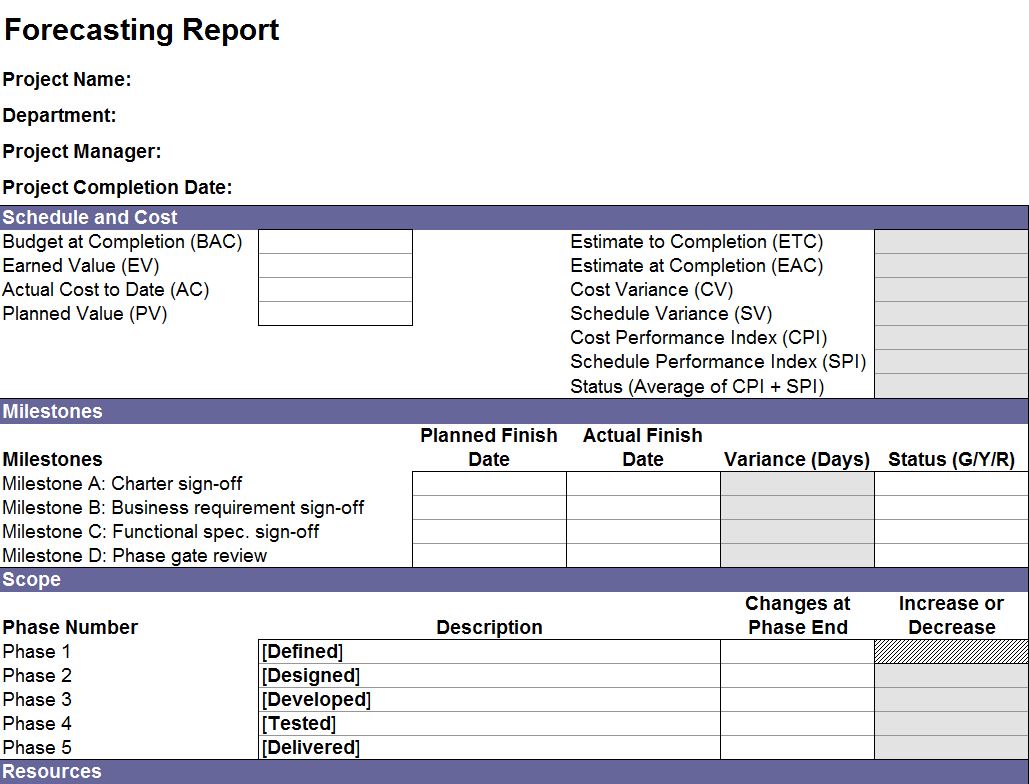

The first step of the forecasting process is determining what you hope to achieve. Businesses utilize forecasting to determine how to allocate their budgets or plan for anticipated expenses for. There are three steps you need to follow:

Financial forecasting is predicting a company’s financial future by examining historical performance data, such as revenue, cash flow, expenses, or sales. Financial forecasting is the process of predicting or estimating future stats of an organization i.e. Actual results could vary materially as a result of numerous factors, including certain.

In this example, changes in receivables and inventory have the effect of. In our example, apple’s revenue growth last year was 9.2%. Set a goal for your forecast.

Building up forecast from payroll schedules, operating expenses schedules and sales forecast to the three financial statements over 1.8 million professionals use cfi to learn accounting, financial analysis, modeling and more. Financial forecasting evaluates a company’s past performance and the market’s current trends to predict its future financial performance. For example, forecasting results will influence investors' decisions, determine how much your company can get in credit, and more.

These templates enable business owners, cfos, accountants, and financial analysts to plan future growth, manage cash flow, attract investors, and make informed decisions. The p&l statement the cash flow statement the balance sheet p&l statement the profit and loss statement enables you to assess: Examples of financial statements to include in your forecast your forecast will need to include 3 financial statements: