Best Of The Best Info About Interest Payable On Balance Sheet Available For Sale Securities Cash Flow Statement

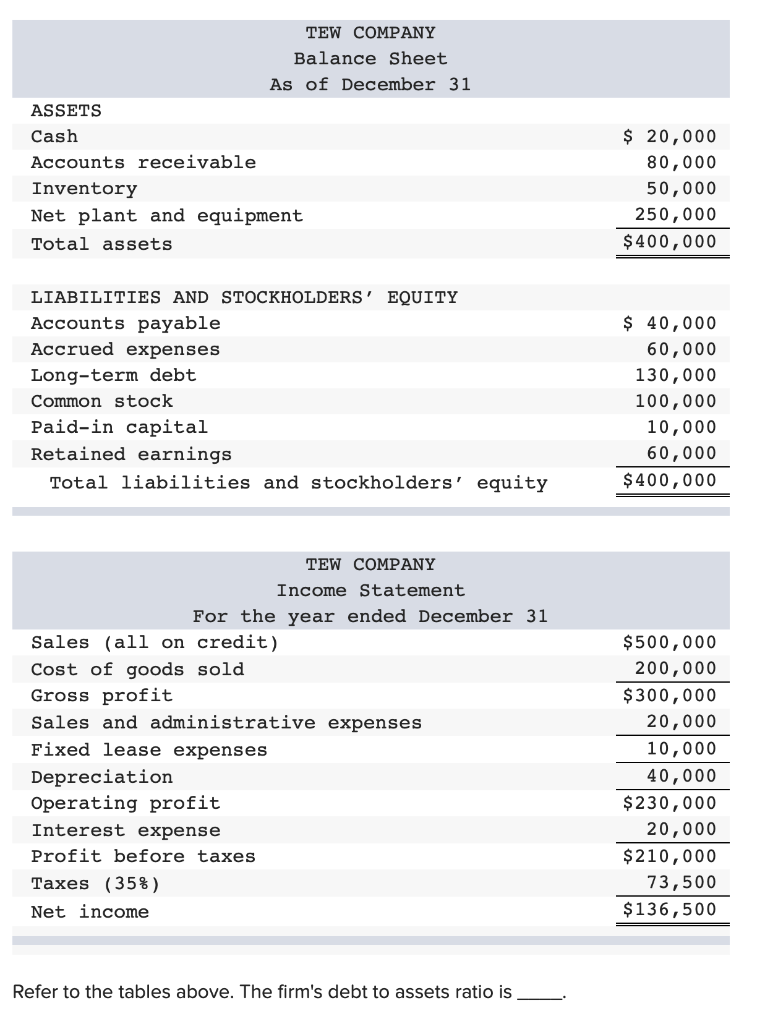

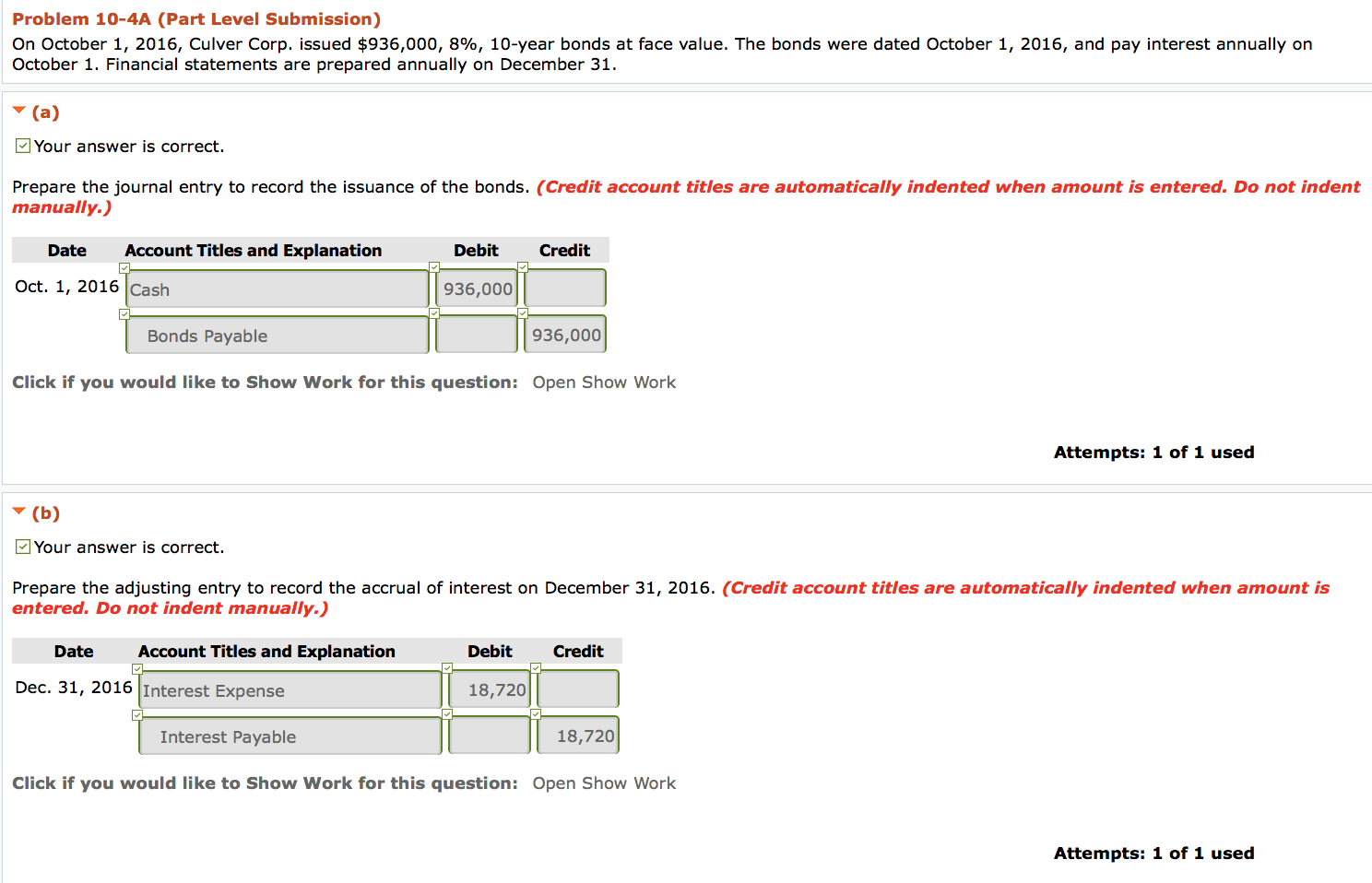

This will be shown in the income statement, made at the end of the six months, as interest expense.

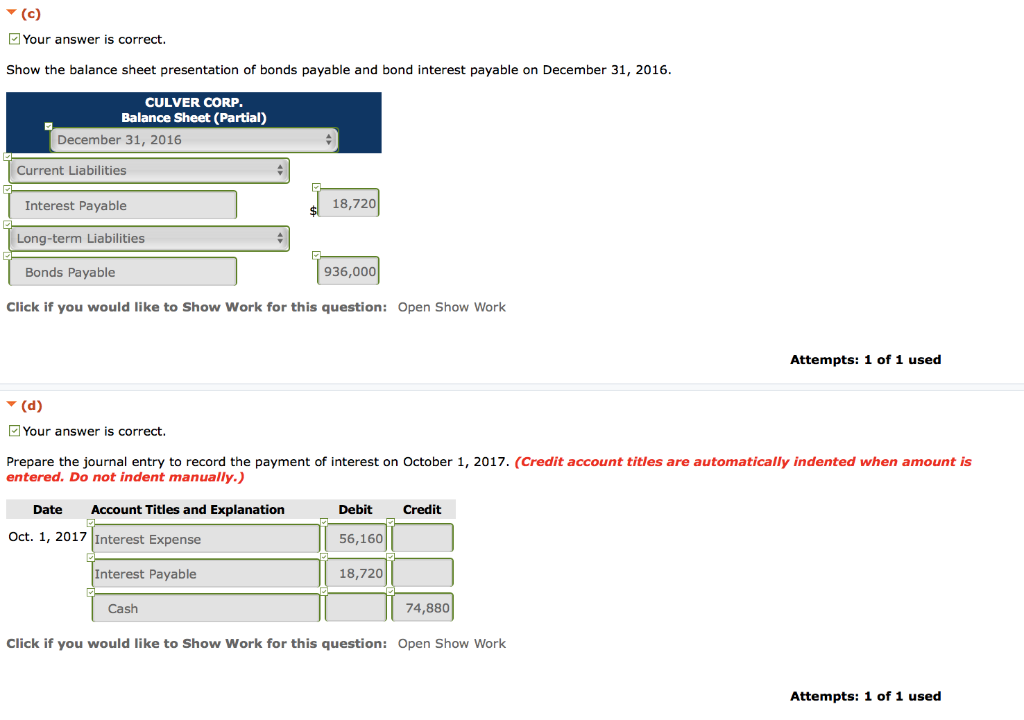

Interest payable on balance sheet. Interest expense is a traditional expense, which was due and paid. Interest payable is a liability, and is usually found within the current liabilities section of the balance sheet. (future interest is not recorded as a liability.)

Accountants realize that if a company has a balance in notes payable, the company should be reporting some amount in interest expense and in interest payable. Interest payable is an outstanding expense, or an amount due but not yet paid as of the date of the balance sheet recording. [interest payable does not include the interest for periods after the date of the balance sheet.] example of interest payable

Suppose the amount is more significant than the average amount. Interest payable is the amount of interest owed to lenders by a corporation as of the balance sheet date. The balance sheet or journal entry for interest payable enables firms to check and track their financial obligations and be prepared to bear them as and when scheduled.

Interest payable definition this current liability account reports the amount of interest the company owes as of the date of the balance sheet. Based on these pieces of information, the financial statements are created. Interest payable is an entity’s debt or lease related interest expense which has not been paid to the lender or lessor as on balance sheet date.

Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been paid as of the date on the balance sheet. Interest payable is a liability account that reports the amount of interest the company owes as of the balance sheet date. The term is applicable to the unpaid interest expense up to the balance sheet date only;

Any amount of interest that relates to the period after balance sheet is not made part of the interest payable. In short, it represents the amount of interest currently owed to lenders. Hence in the balance sheet, made at the end of the six months, this amount will be shown under current liabilities as interest payable.

The associated interest expense that comprises interest payable is stated on the income statement for the amount applicable to the period whose results are being reported. What is interest payable? In that case, it shows that a corporation is defaulting on its debt commitments, and this amount may be a critical aspect of financial statement analysis.