Can’t-Miss Takeaways Of Tips About Types Of Cost Audit Report Income And Profit

Auditing for the trade association.

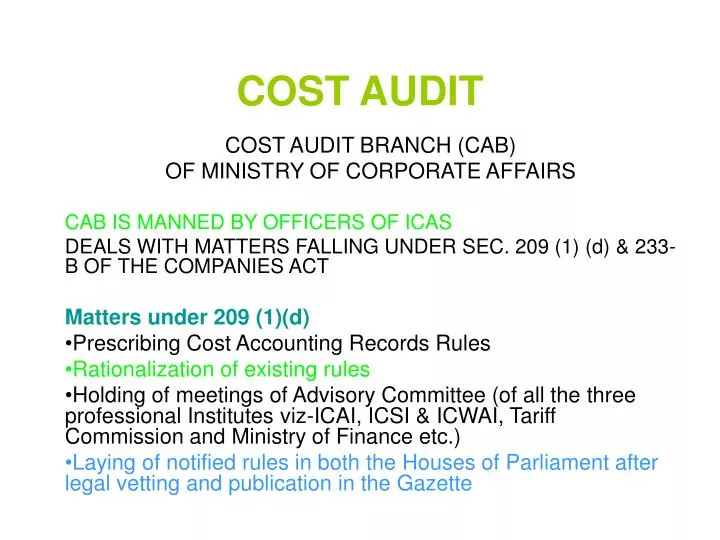

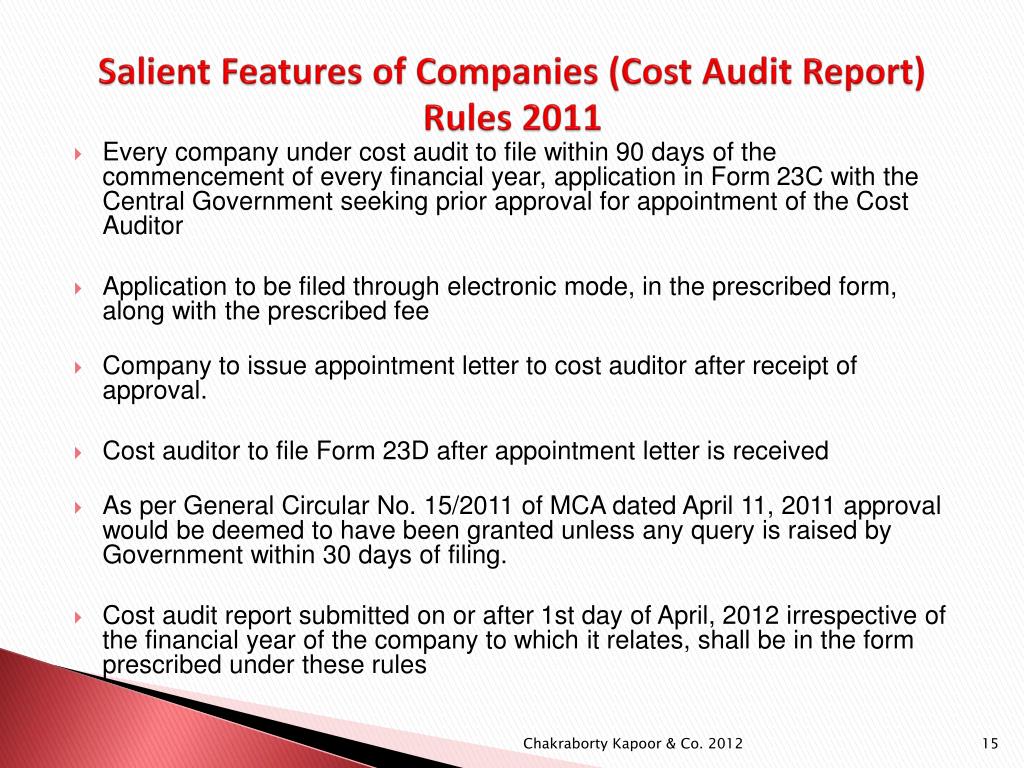

Types of cost audit report. Cost audit on behalf of tribunals. Cost variation from one unit to another unit within the same industry. Cost audit is not always conducted at the instance of management or at the initiative of government.

A cost audit actually helps the statutory auditor with his job as well. According to icwai : 16, 2024 updated 9:59 a.m.

Audited costing data helps him determine the value of stocks, managerial remuneration, and other such aspects. Cost audit is mainly a preventive measure, a guide for management policy and decision, in addition to being a barometer of performance. The 2011 review identified a further 13 systematic reviews containing 313 discrete primary studies.

Cost audit by trade association; Trump’s civil fraud trial as soon as friday, the former president could face hundreds of millions. Adverse audit report or adverse opinion.

This aspect of a cost audit is concerned with the actions and plans of management that affect the finance and expenditure of the business concern. Clean report or unqualified opinion. Due to the canada border services agency’s improper financial record keeping and.

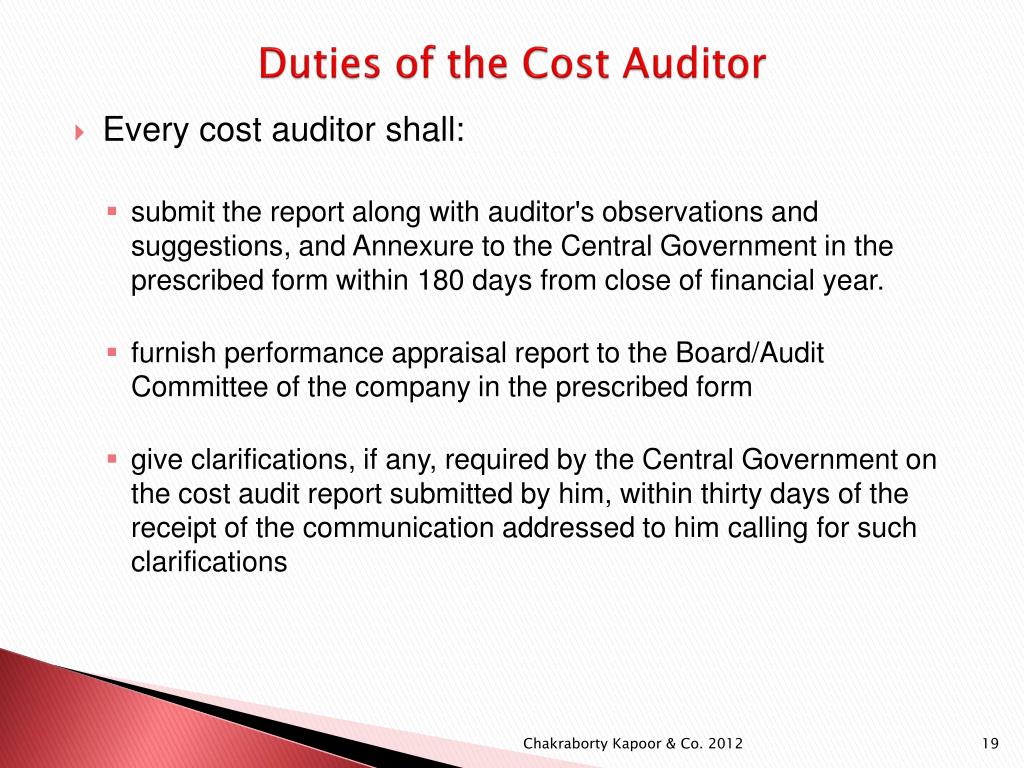

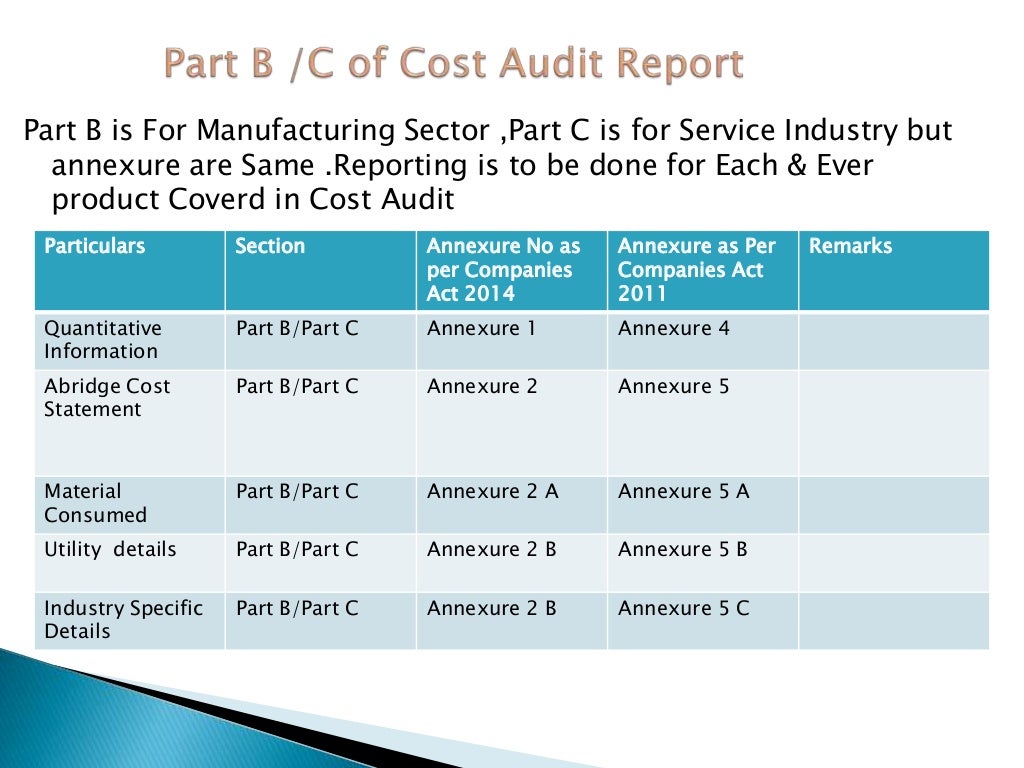

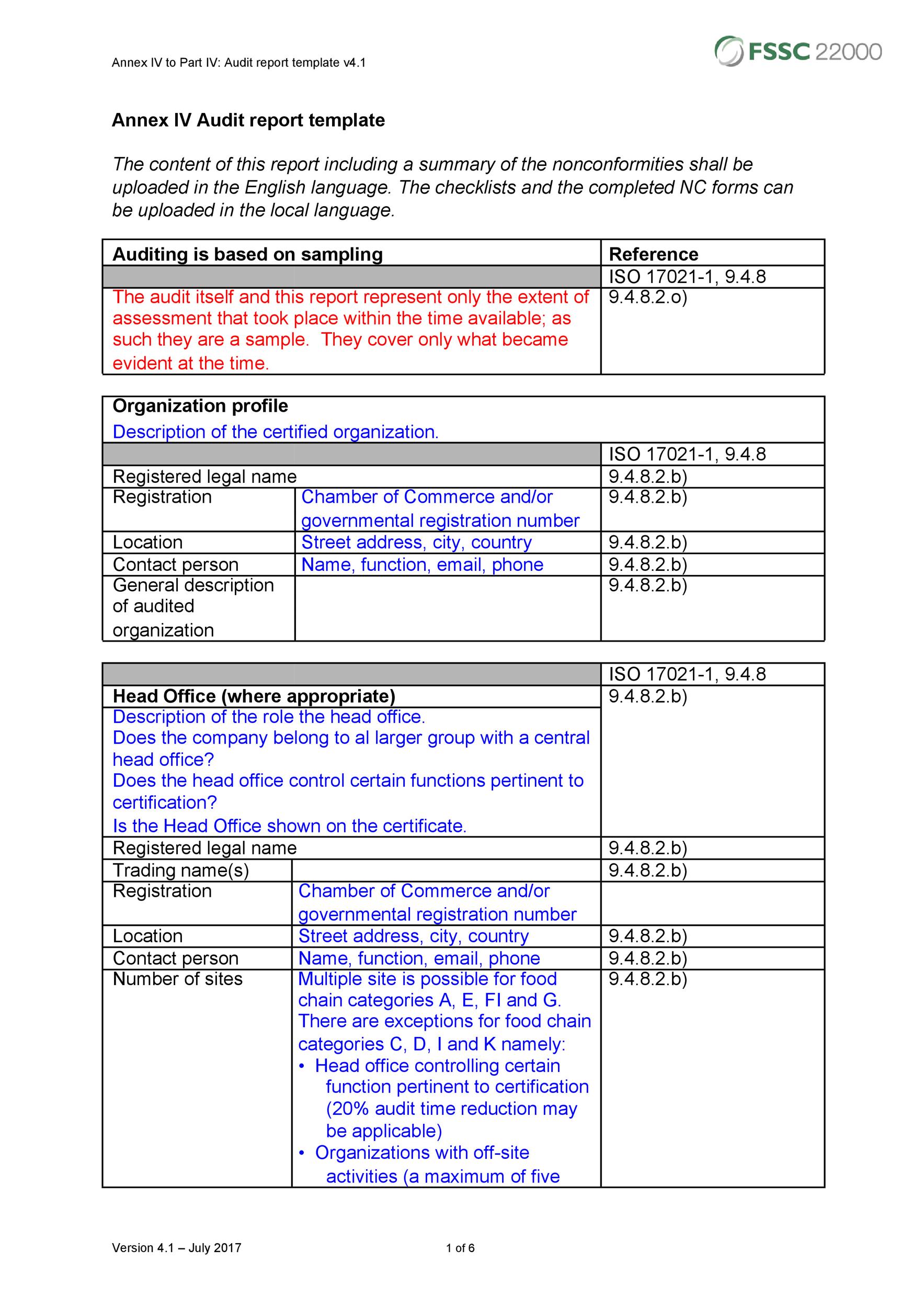

A brief explanation of each of these five types is given below: Review verification reporting review • the cost auditor should familiarise himself with the memorandum and articles of association, past audit reports on the financial accounts, annual reports issued by the board, the chairman’s speech, etc. This article throws light upon the six main classifications of contents in the cost audit report.

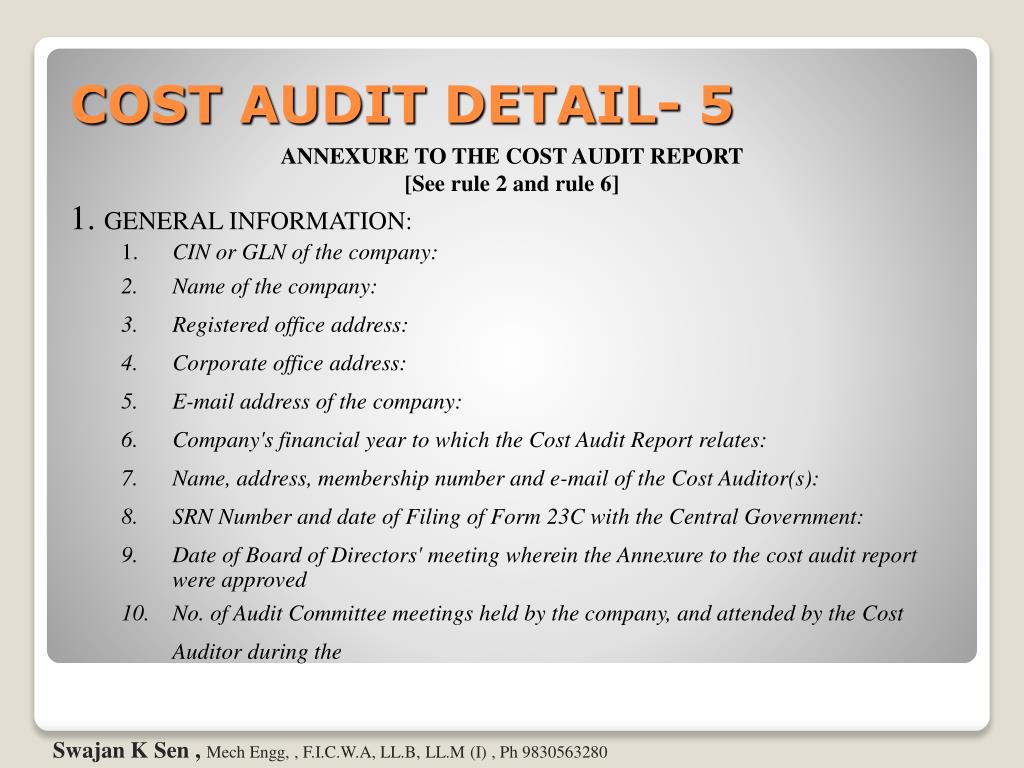

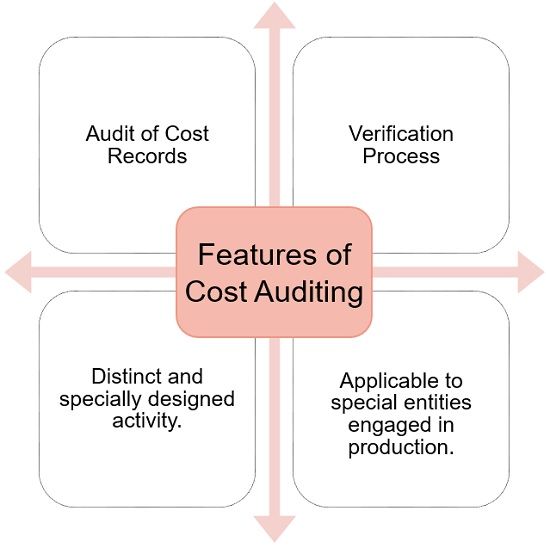

Cost audit means the checking and verification of the cost accountancy books, records, statements, reports and other data related to the cost of a product or service being provided by a business unit. Types of cost audit. Statement of opinion or facts on matters requiring professional competence 6.

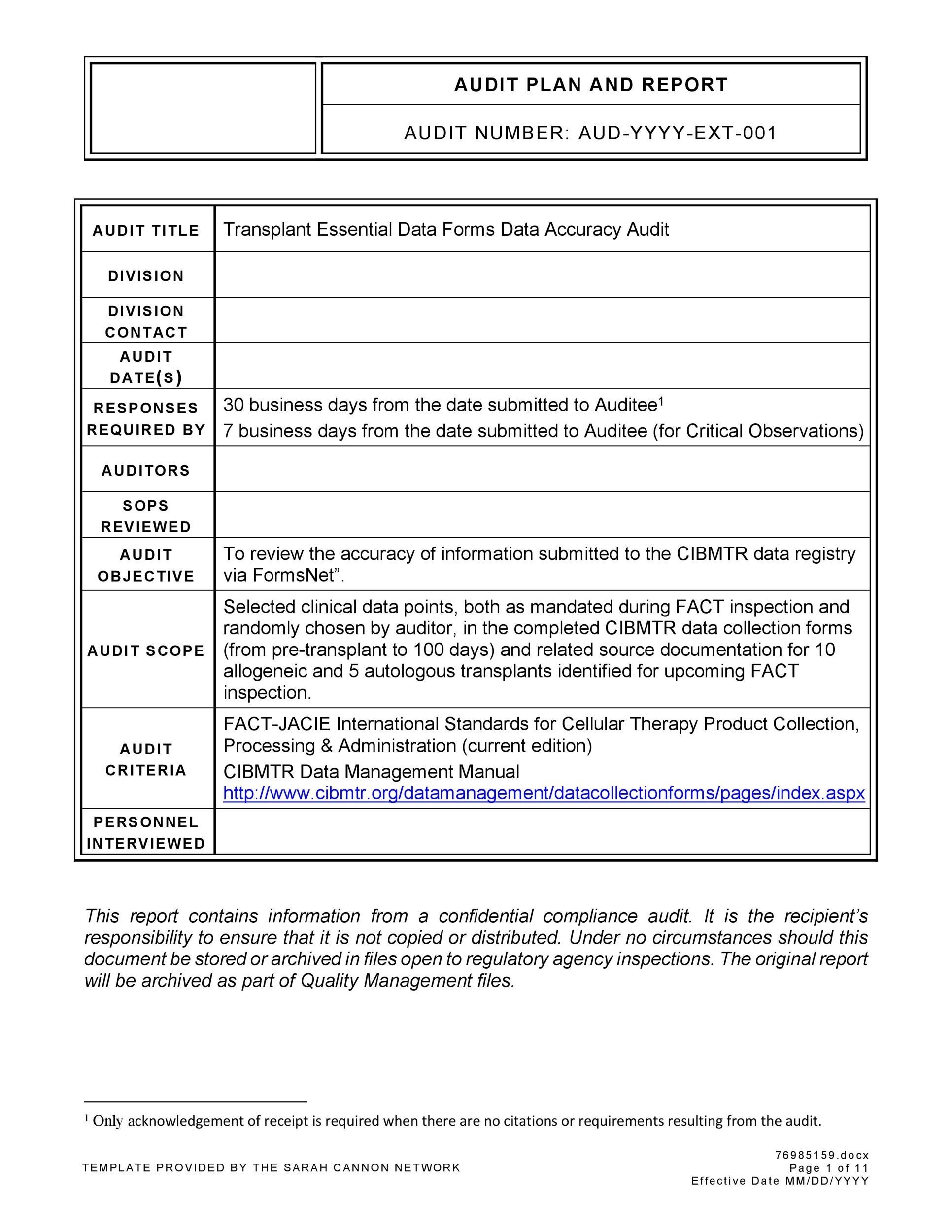

There are three main types of audits: An audit report is a document in which an auditor shares their opinion on an organization’s financial performance and whether they’re compliant with financial reporting regulations. Types of cost audits.

They also highlight how economic uncertainty resulting from wider external. Price fixation to avoid undue profits. The following are the circumstances under, which a cost audit is ordered:

External audits, internal audits, and internal revenue service audits. Cost variation within the industry; The faqs below, created by icaew’s audit and assurance faculty, are designed to help investors and other users of audit reports to better understand the different types of audit report wordings used by auditors, and their significance.