Unique Info About Adjustment In Trial Balance Statement Of Sheet Format Common Size Analysis And Interpretation

An organisation prepares a trial balance at the end of the accounting year to ensure all entries in the bookkeeping system are accurate.

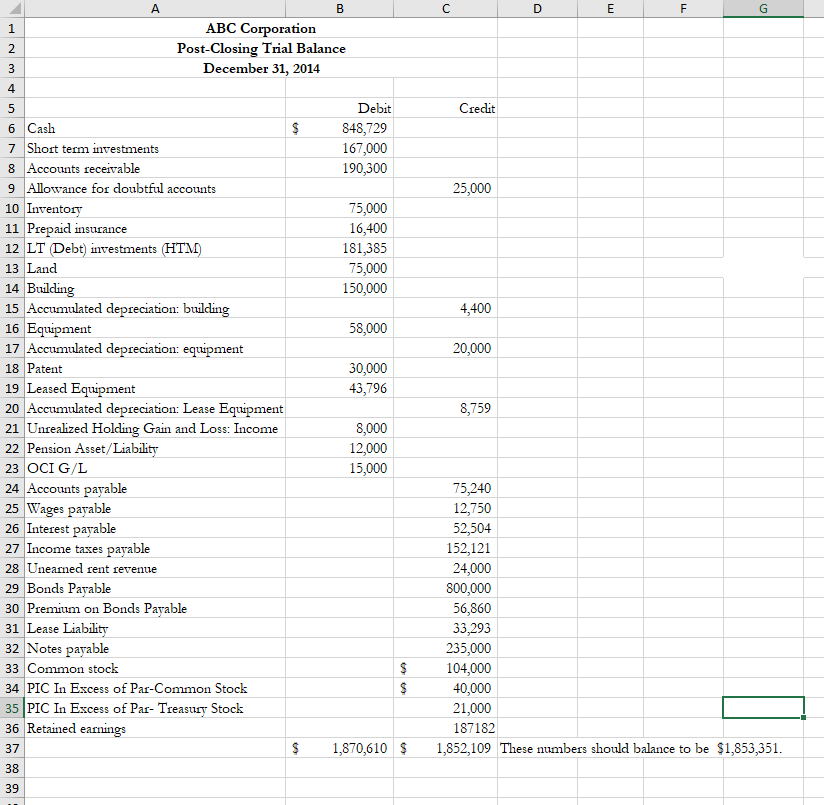

Adjustment in trial balance statement of balance sheet format. The header must contain the name of the company, the label of a trial balance (unadjusted), and the date. Adjusted trial balance. Balance sheet, statement of retained earnings, or income statement.

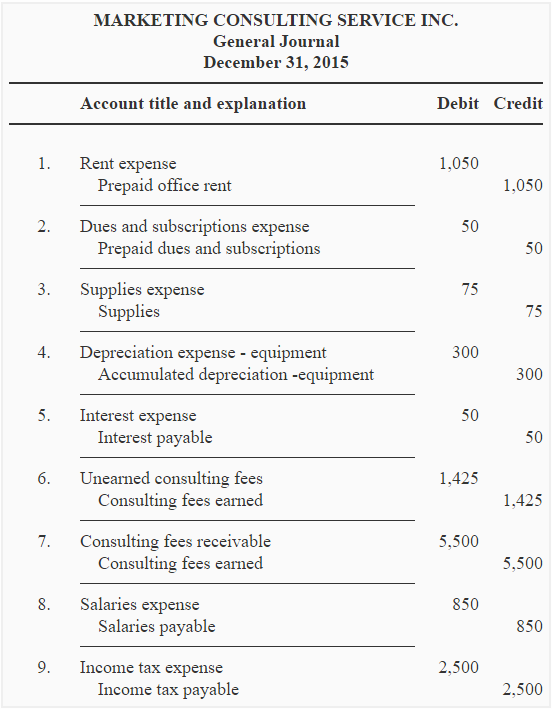

Both ways are useful depending on the site of the company and chart of accounts being used. Will be added to the related income a/c in the cr. Side of profit & loss a/c.

These are the resources owned by an entity, whether tangible or intangible. The accounting equation is a = l + e, or assets equal liabilities plus equity. There are two main ways to prepare an adjusted trial balance.

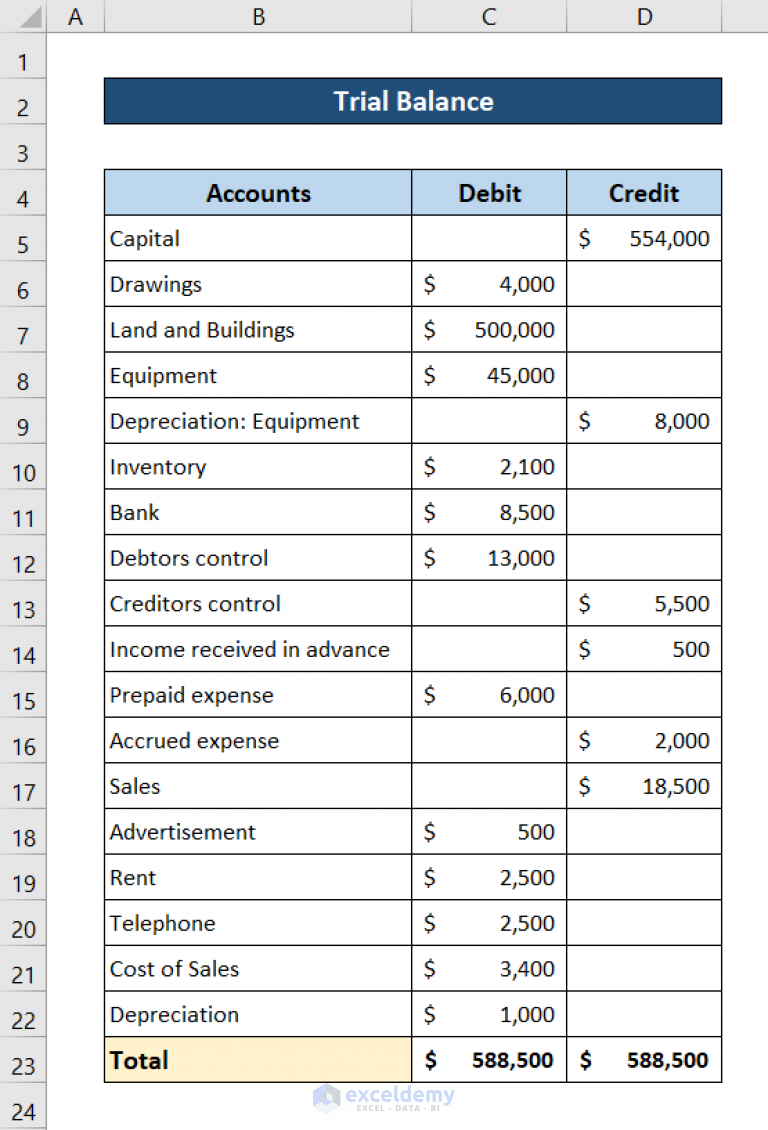

Identify which financial statement each account will go on: Balance sheet, statement of retained earnings, or income statement. The trial balance format contains two columns;

The trial balance isn’t a financial statement itself, but all of the information that you need to create the three major financial statements—the balance sheet, the cash flow statement and the income statement —comes directly from the trial balance. In addition to being a tool for checking the mathematical accuracy of books of accounts, an adjusted trial balance provides enough information for the preparation of a number of mandatory financial statements, such as the income statement , balance sheet, and statement of changes in equity. You could post accounts to the adjusted trial balance using the same method used in creating the unadjusted trial balance.

Will be shown in the assets side of the balance sheet or added to the concerned source in the assets side of the balance sheet. Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company. Definition an adjusted trial balance consists a list of all ledger accounts and finalized after recording the adjusting entries.

Adjusted trial balance contains both the elements of balance sheet and income statement. Or, we can say it is a trial balance that accountants prepare. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable, unearned lawn mowing revenue, and.

Usually, the balance sheet is prepared from a trial balance. The three aspects of a balance sheet are: The trial balance format is easy to read because of its clean layout.

Checked for updates, april 2022. What is the trial balance format? Adjusted trial balance records the account balances of an organization after adjusting the transaction to various expenses, including the depreciation amount, accrued expenses, payroll expenses, etc.

It typically has four columns with the following descriptions: It includes transactions done during the year and the opening and closing balances of ledgers, as every entity needs to evaluate its financial position over a particular period. An adjusted trial balance is a list of all accounts in the general ledger, including adjusting entries, which have nonzero balances.