Stunning Tips About Amortization Cash Flow Interest Balance Sheet

The cash flow statement is a powerful tool that allows the accountant and top.

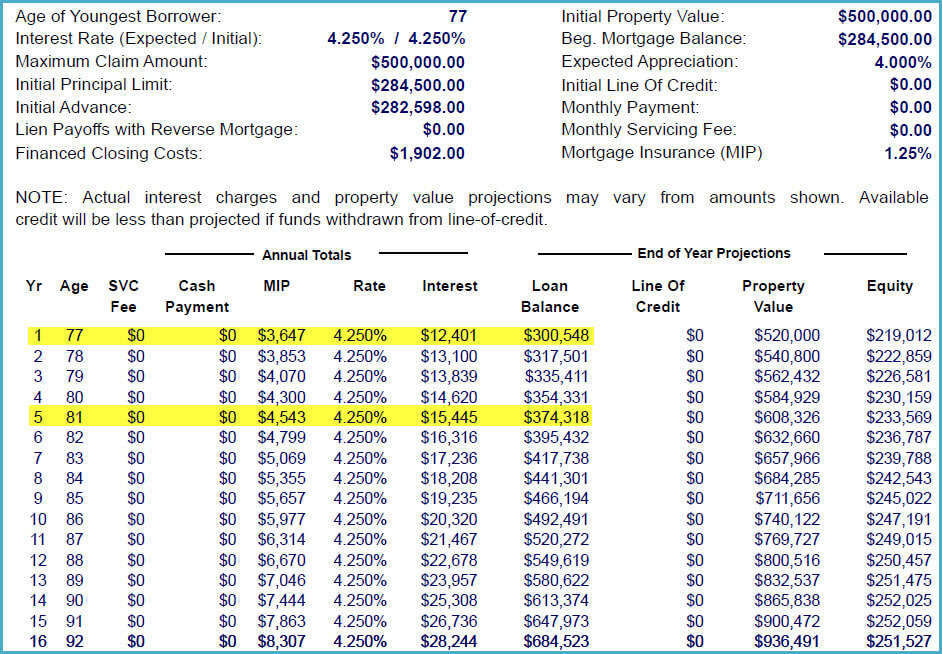

Amortization cash flow. Adjustments to reconcile net income to net cash provided by (used in) operating activities: According to the above accounting schedule, the amortised cost of the bond is $950 as of 1 january 20x4 (the date when entity a revises expected cash flows). As a company uses up resources, it must recognize the exhaustion of these resources as an expense.

Also called depreciation expenses, they appear on a. Santa clara, calif., feb. Cash sweep = 100.0%.

There would be no increase in equity as you have not gained anything. Fcf represents the cash that a company. Amortization helps serve this purpose.

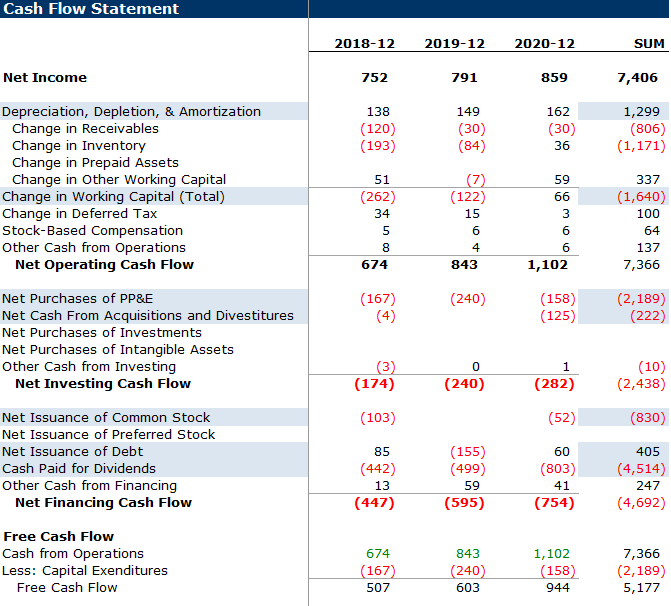

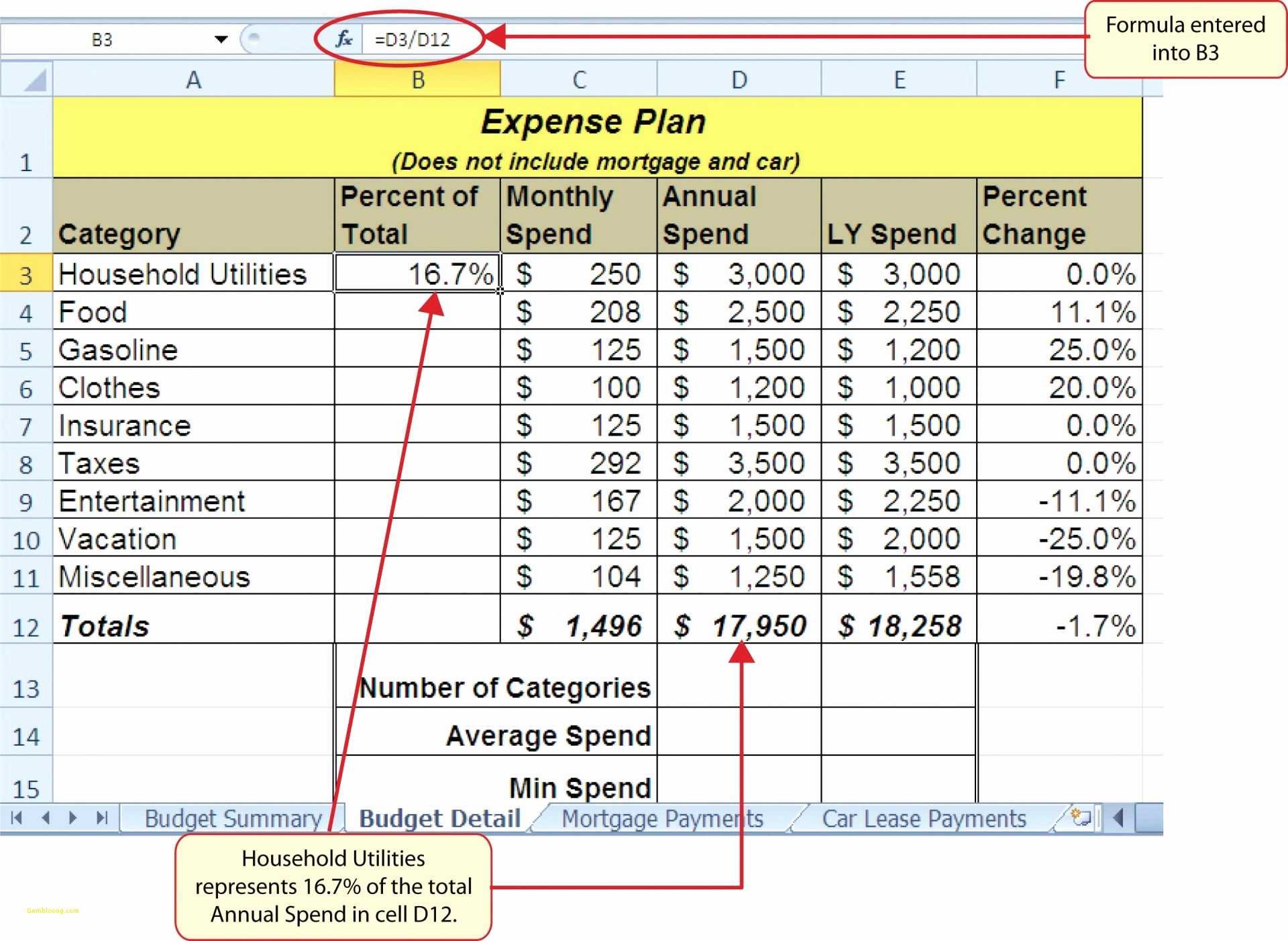

Adjust for changes in working capital. That is why most calculations for cash flows include adding back depreciation and amortization expenses to the net income and then subtracting net ppe and acquisitions to find the free cash flow. Cash flow after taxes (cfat):

Amortization is the practice of spreading an intangible asset's cost over that asset's useful life. For the full year, labcorp’s operating income was operating income was $725.6 million, or 6% of. Entity a now anticipates receiving $1,050 on 31 december 20x4, yielding a present value of $974 ($1,050 discounted at the original eir of 7.8%).

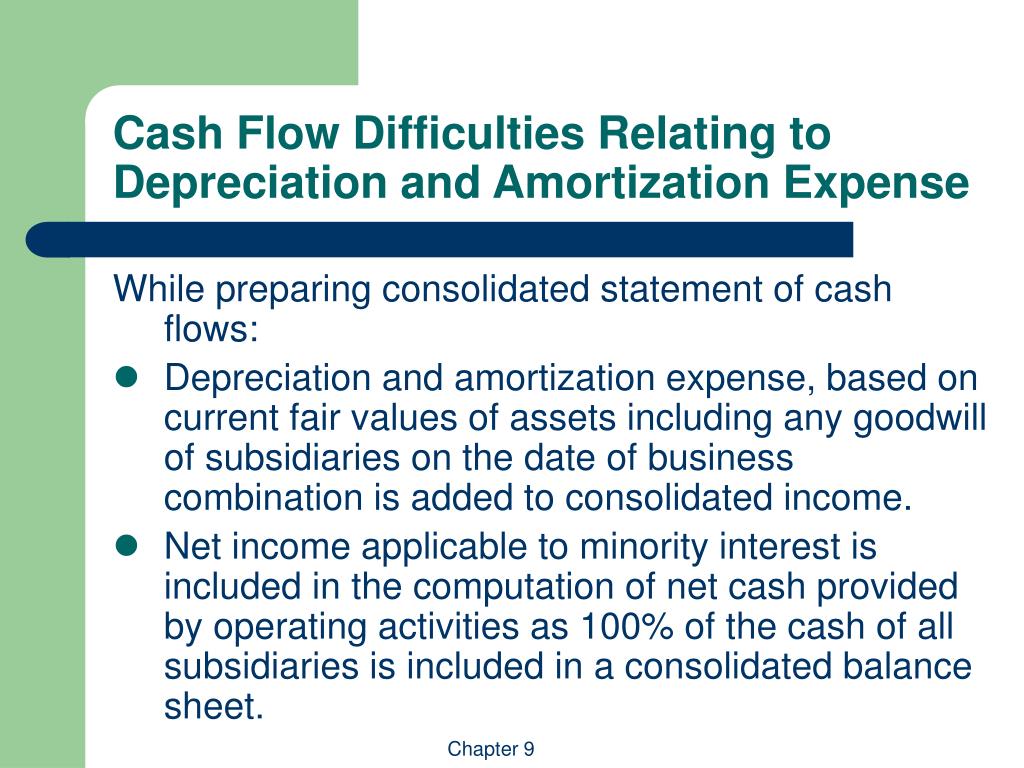

Amortization is the accounting process used to spread the cost of intangible assets over the periods expected to benefit from their use. The term “amortization” refers to two situations. Cash flows from operating activities:

It is an estimated expense that is scheduled rather than an explicit expense. Depreciation is a type of expense that is used to reduce the carrying value of an asset. The cash flow statement (cfs) is a financial statement that reconciles net income based on the actual cash inflows and outflows in a period.

The beginning cash balance, which we get from the year 0 balance sheet, is equal to $25m, and we add the net change in cash in year 1 to calculate the. And allocation procedures open to managers have allowed them to delay or accelerate impairment depending on their own interests. Capex and cash flow.

An investor who examines the cash flow might be discouraged to see that the business made just $2,500 ($10,000 profit minus $7,500 equipment expenses). Next, the amortization expense is added back on the cash flow statement in the cash from operations section, just like depreciation. In this case, depreciation and amortization is the only item.

Another cheater way to calculate free cash flow is to take operating cash flow (cfo) and subtract net ppe. Also, it has proved problematic to disentangle the cash flows attributable to internally generated intangibles from those generated by the purchased goodwill. Under a contractual obligation, the borrower must repay 2.0% (or $4mm) of the original principal back to the lender to avoid.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)