Favorite Info About Unadjusted Balance Sheet What Makes Up An Income Statement

The accounts are generally listed following the balance sheet order, with assets and liabilities before income and expenses.

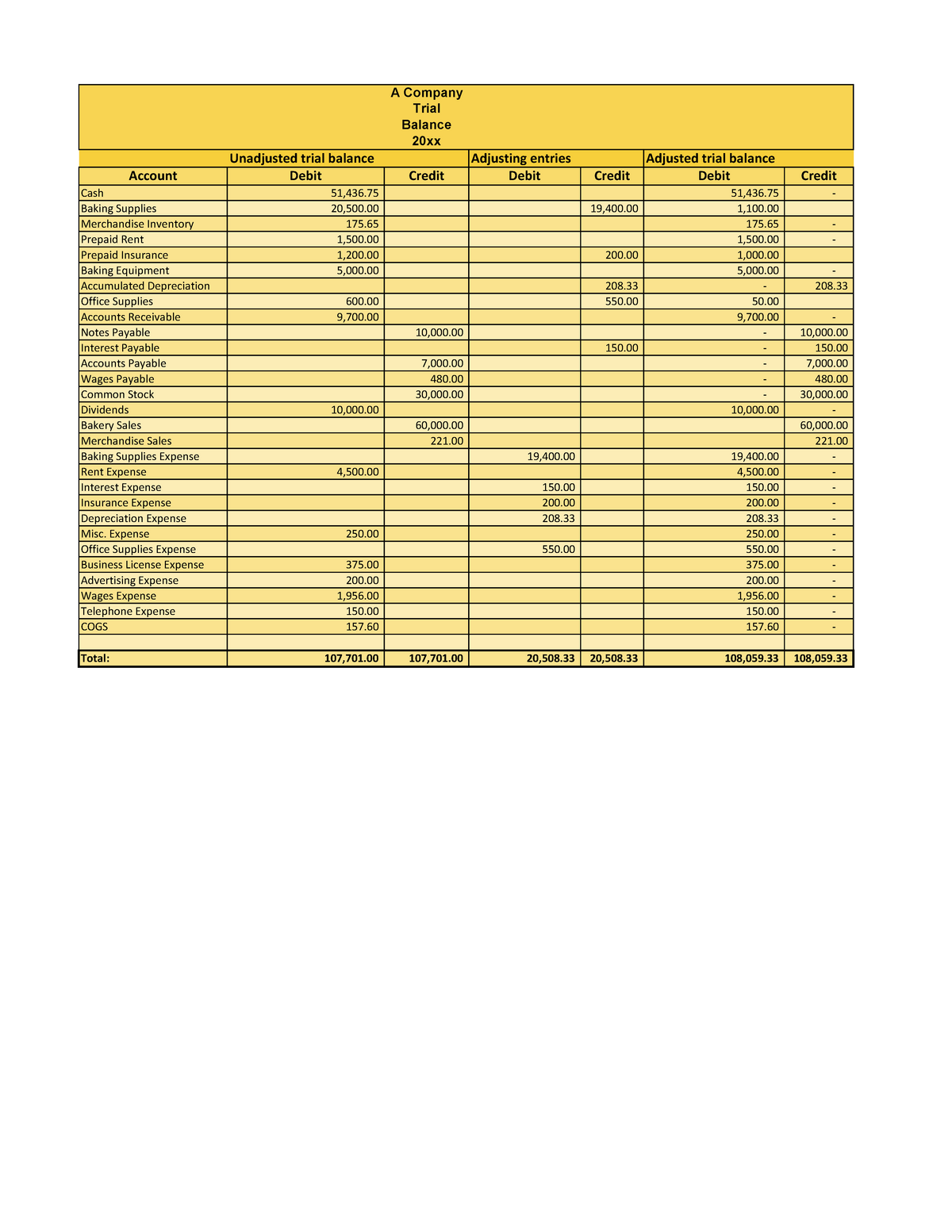

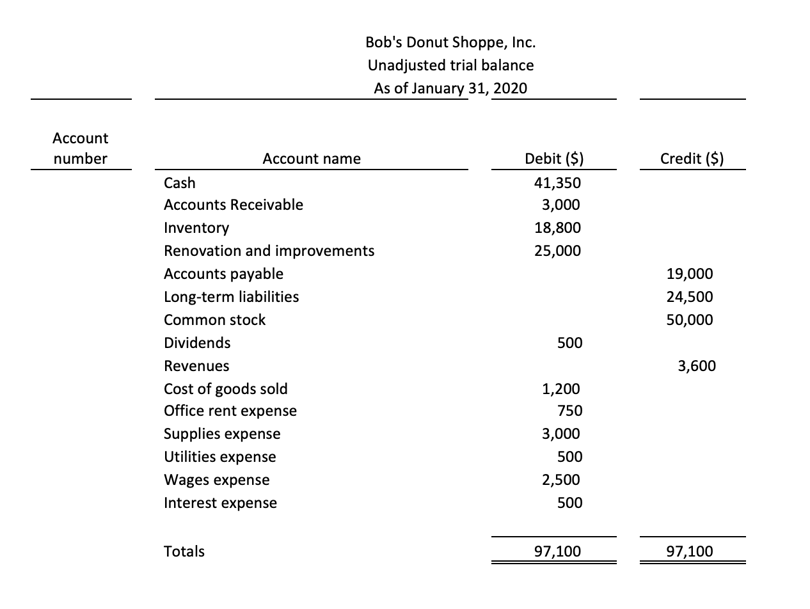

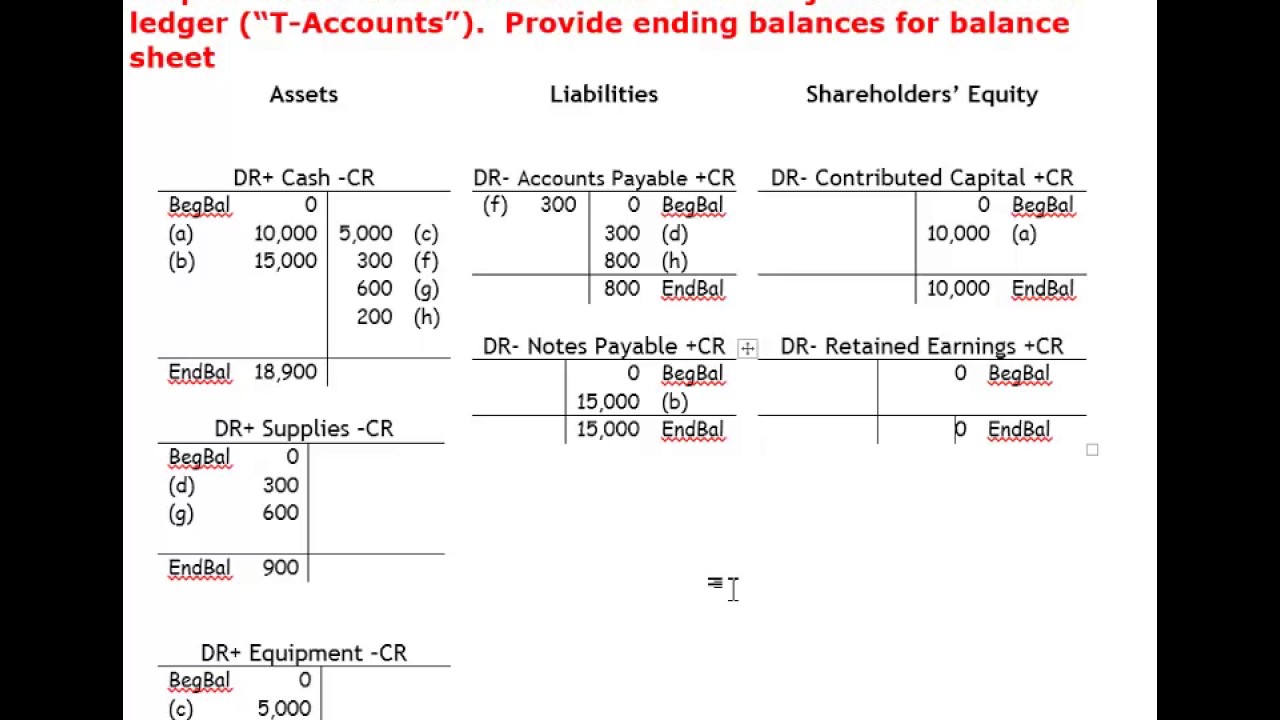

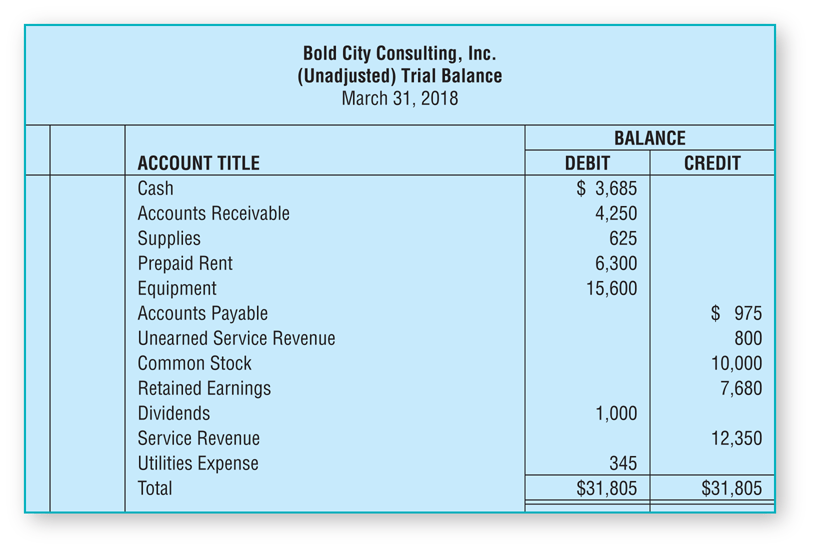

Unadjusted balance sheet. A trial balance is a list of all accounts in the general ledger that have nonzero balances. First, the account balances from the general ledger and subsidiary ledgers are transferred to a trial balance. The unadjusted trial balance (utb) document summarizes all of the accounts in an organization at a single point or period.

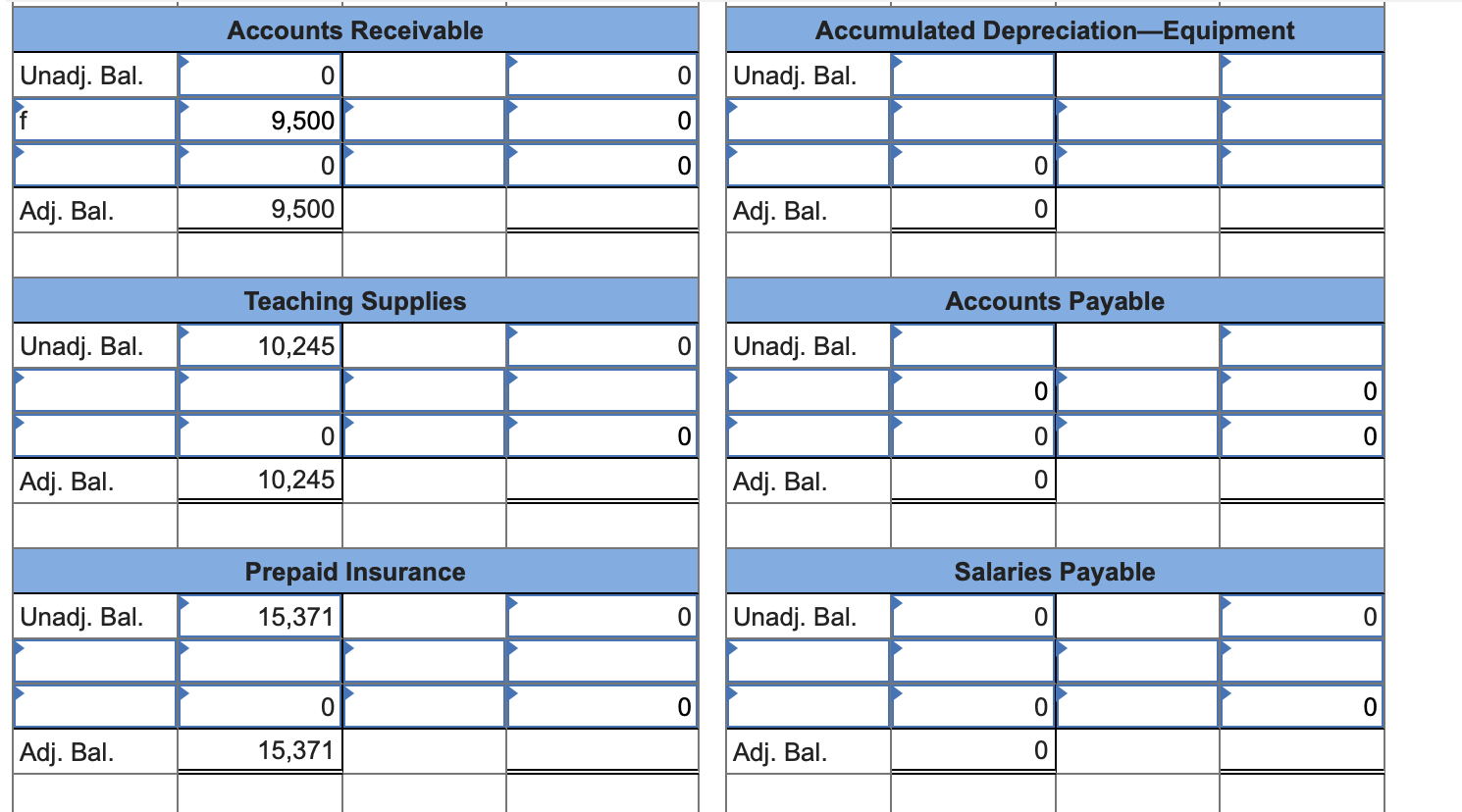

Example of an adjusted trial balance. Unadjusted trial balance is a direct report extracted by a business from its double entry accounting system double entry accounting systemdouble entry accounting system is an accounting approach which states that each & every business transaction is recorded in at least 2 accounts, i.e., a debit & a credit. Adjusted trial balances include adjustments for accruals, deferrals, depreciation, and other necessary corrections.

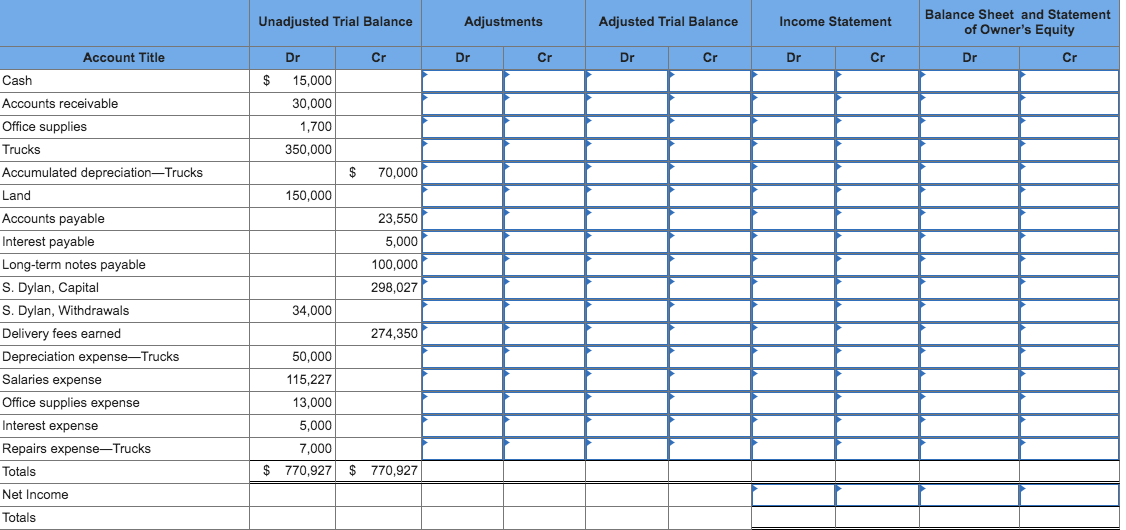

It will include all revenue, expenses, and assets. A column for account names, debits, and credits. The first column includes account names, the second column represents debits, and the third column represents credits.

Next, these balances are listed in balance sheet and income statement order with their debit and credit balances. It helps you detect errors and analyze company accounts. An unadjusted trial balance refers to and means the listing of all the closing balances appeared in ledgers before incorporating adjusting entries therein.

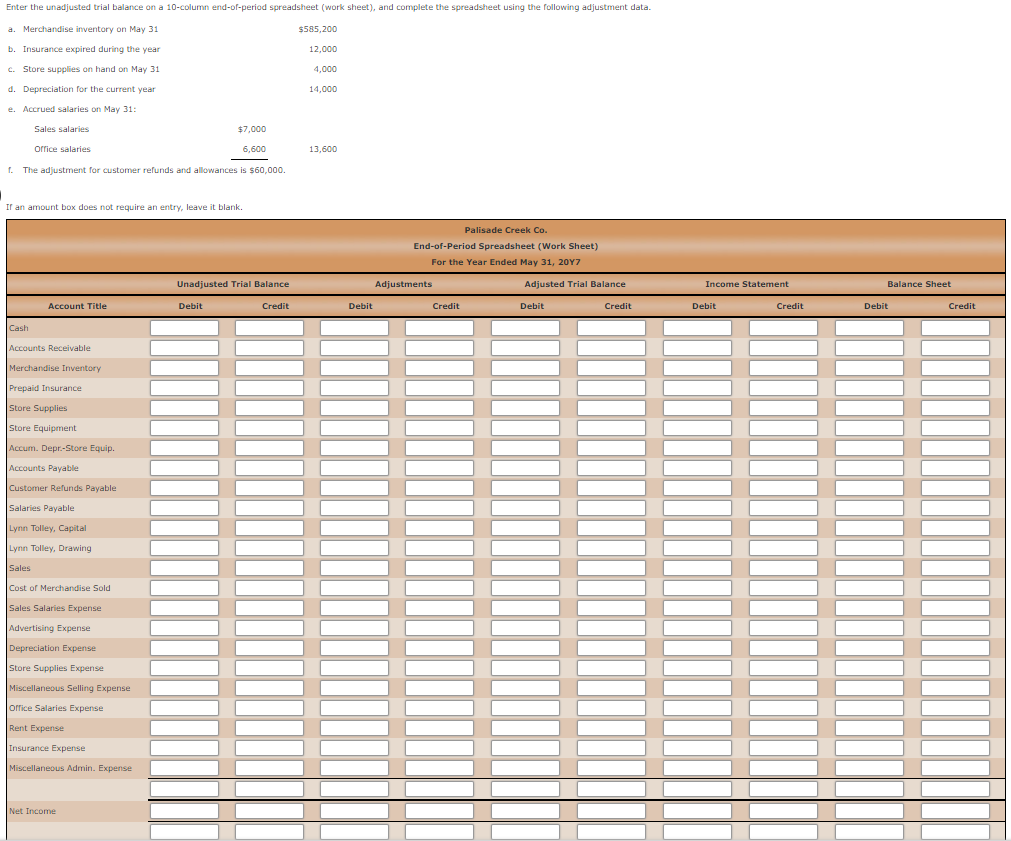

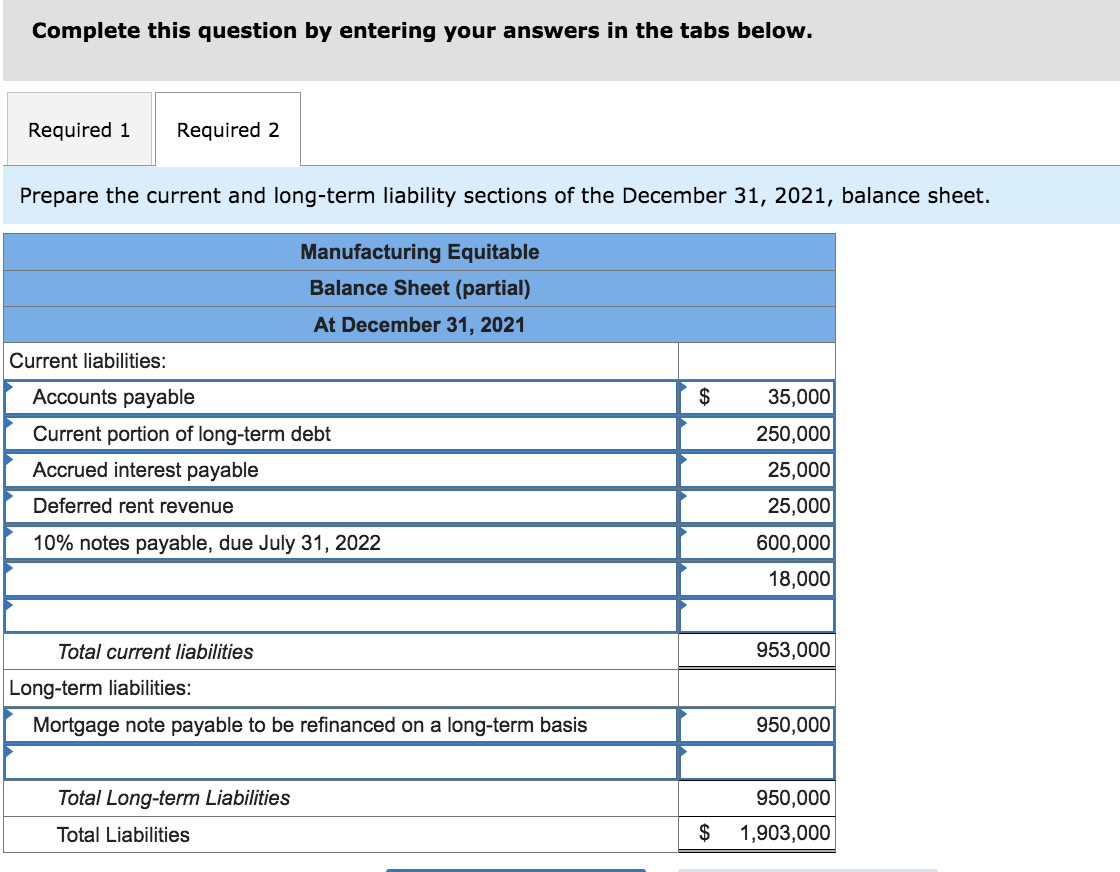

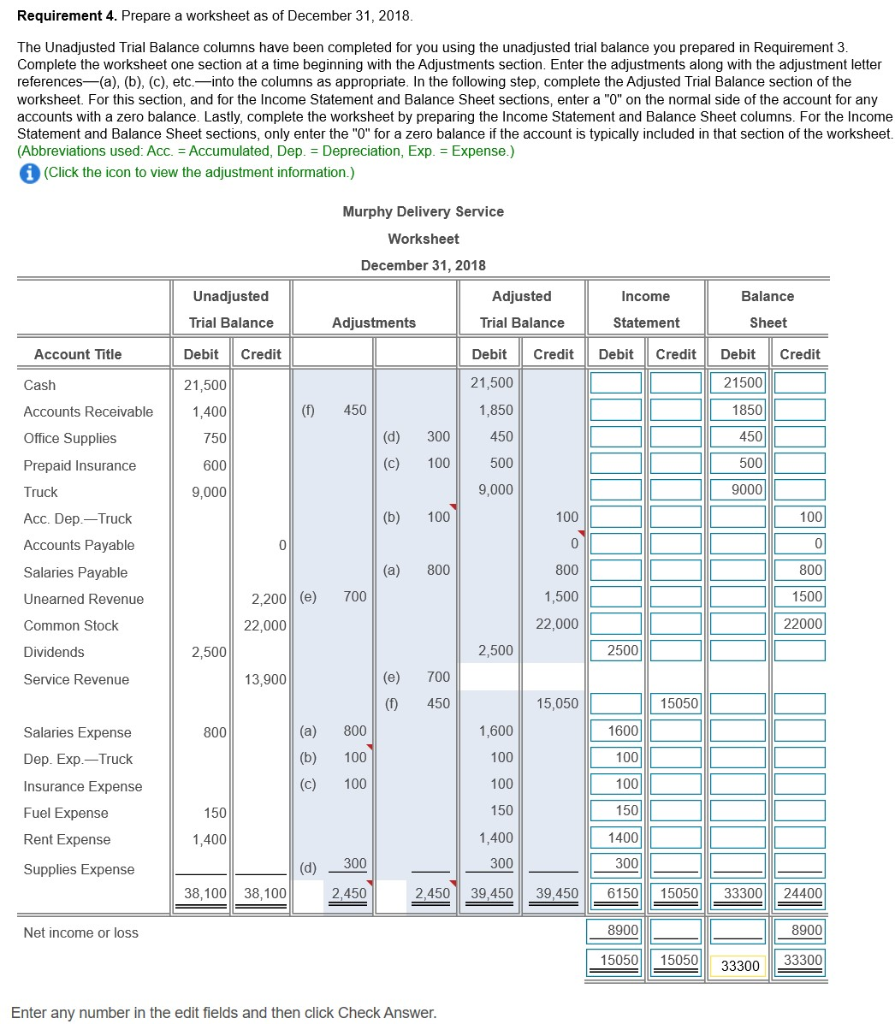

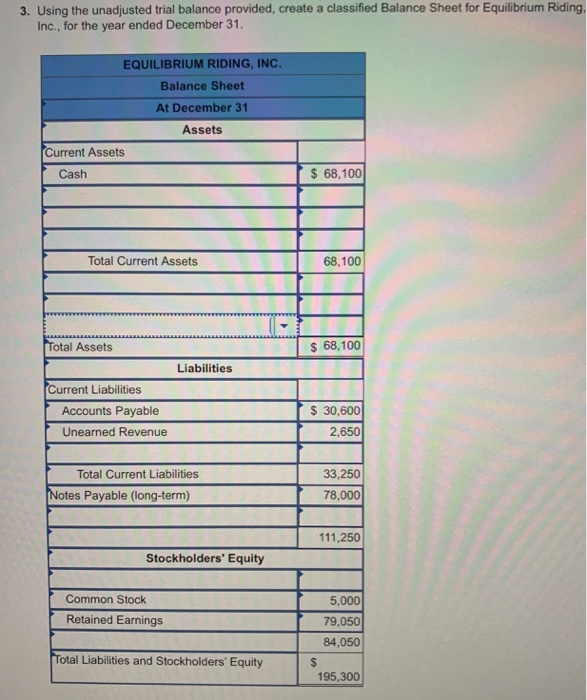

What is an adjusted trial balance? The purpose of an adjusted trial balance sheet is to create a record of the transactions a business makes during one accounting cycle. The five column sets are the trial balance, adjustments, adjusted trial balance, income statement, and the balance sheet.

An unadjusted trial balance is displayed in three columns: How is an unadjusted trial balance prepared? The process of preparing adjustments entails the analysation of unadjusted balances in the balance sheet and income statement accounts.

List the period’s ending date above the table. The purpose is to provide a basis for the preparation of financial statements such as the income statement, balance sheet, and statement of cash flows. Preparation of trial balance starts with a heading.

Accounts are usually listed in order of their account number. For example, cash shows an unadjusted balance of $24,800. The preparation of the unadjusted trial balance depends on information from the general ledger and other accounting records like balance sheets and income statement.

In other words, a trial balance which is prepared at the first instance before making any sort of adjustments in the record is called an unadjusted trial balance. Analysis and income statement presentation 5m. A heading is written at the top of the sheet consisting of three lines mentioning the company’s name, name of the trial balance and date of the reporting period.⁴ (example below) abc company

Unadjusted trial balance is the list of the general ledger accounts balance (balance sheet’s items and income statement’s items) for the specific accounting period before making any adjustment. The only difference between these two statements is that the adjusted trial balance contains shows the. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle.

![Unadjusted Trial Balance [Definition + Examples]](https://crushthecpaexam.com/wp-content/uploads/2019/03/Unadjusted-Trial-Balance..png)