Fine Beautiful Info About Reading A Profit And Loss Statement Is Balance Sheet Financial

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period.

Reading a profit and loss statement. A profit and loss statement is also called an “income statement,” as it presents the revenue and expenses that ultimately created profitability — or loss — for the period. Just flip to your p&l and look at the bottom. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

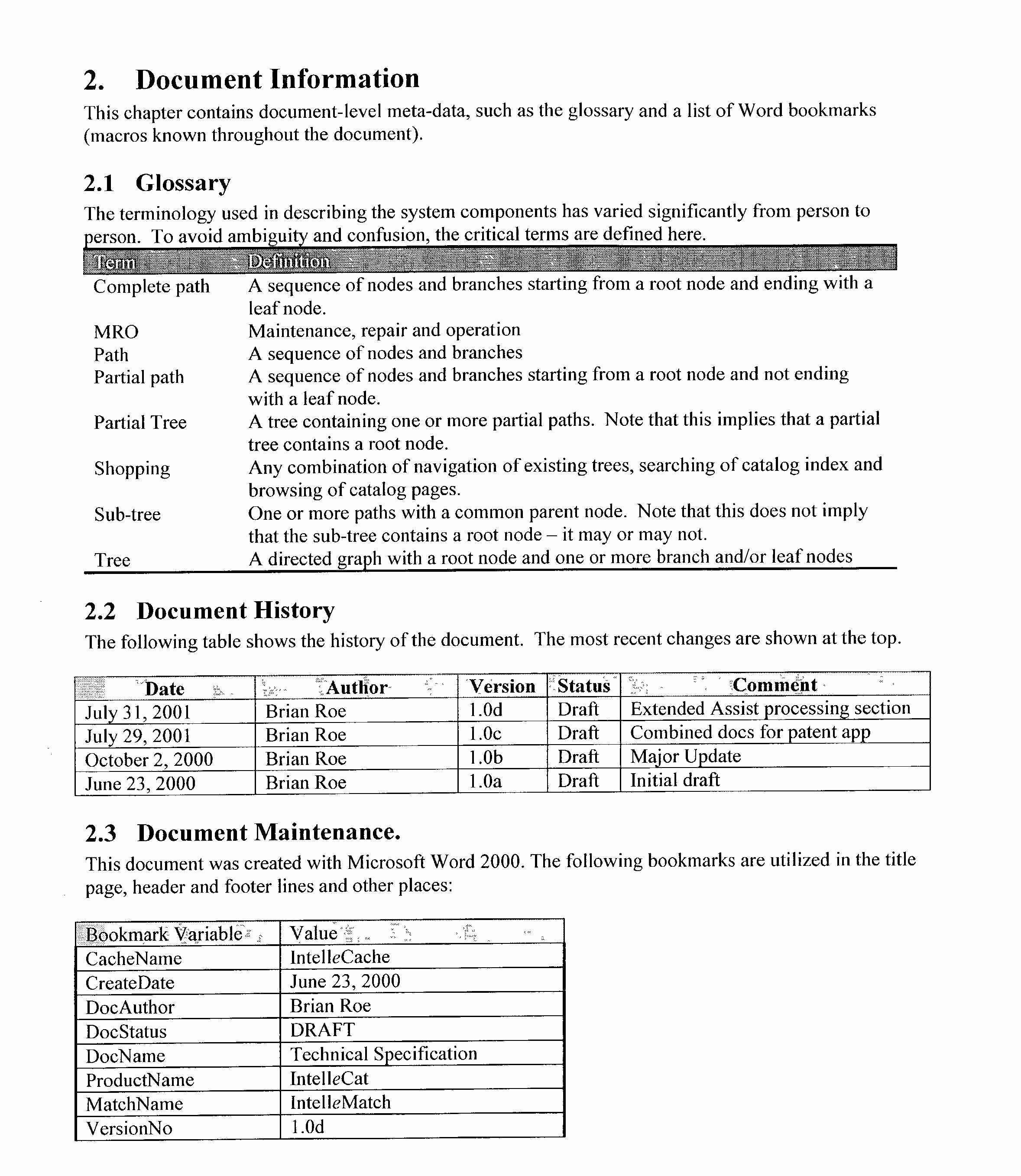

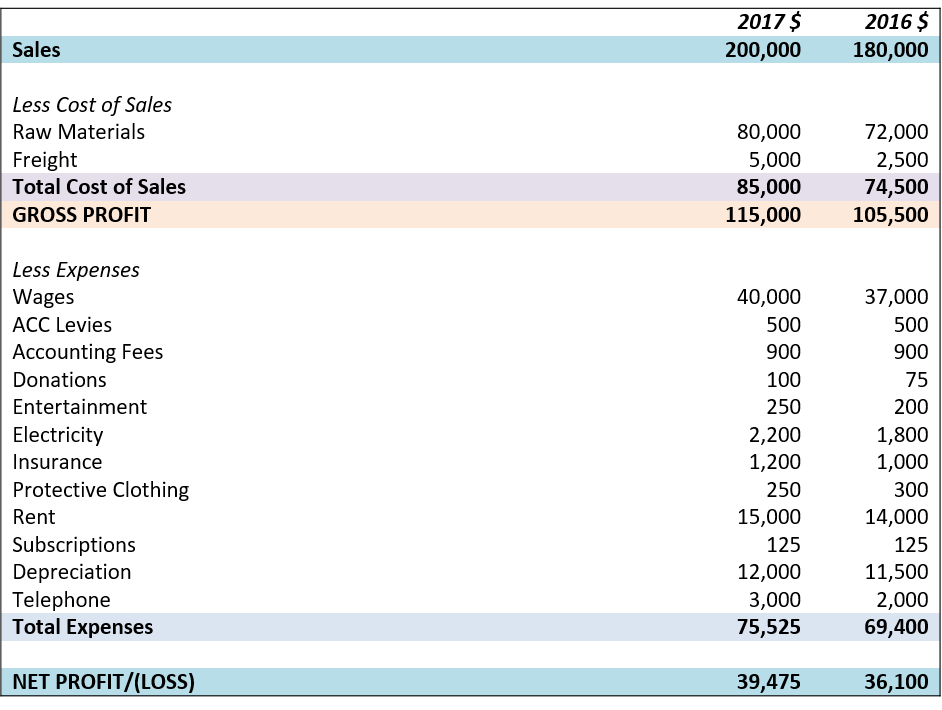

P&l statements tend to follow a standard format: The p&l report lists revenue, expenses and other information to provide insight into the company's performance. A p&l statement is a financial report that summarizes a company’s revenue, expenses and profits or losses over a fiscal year or quarter.

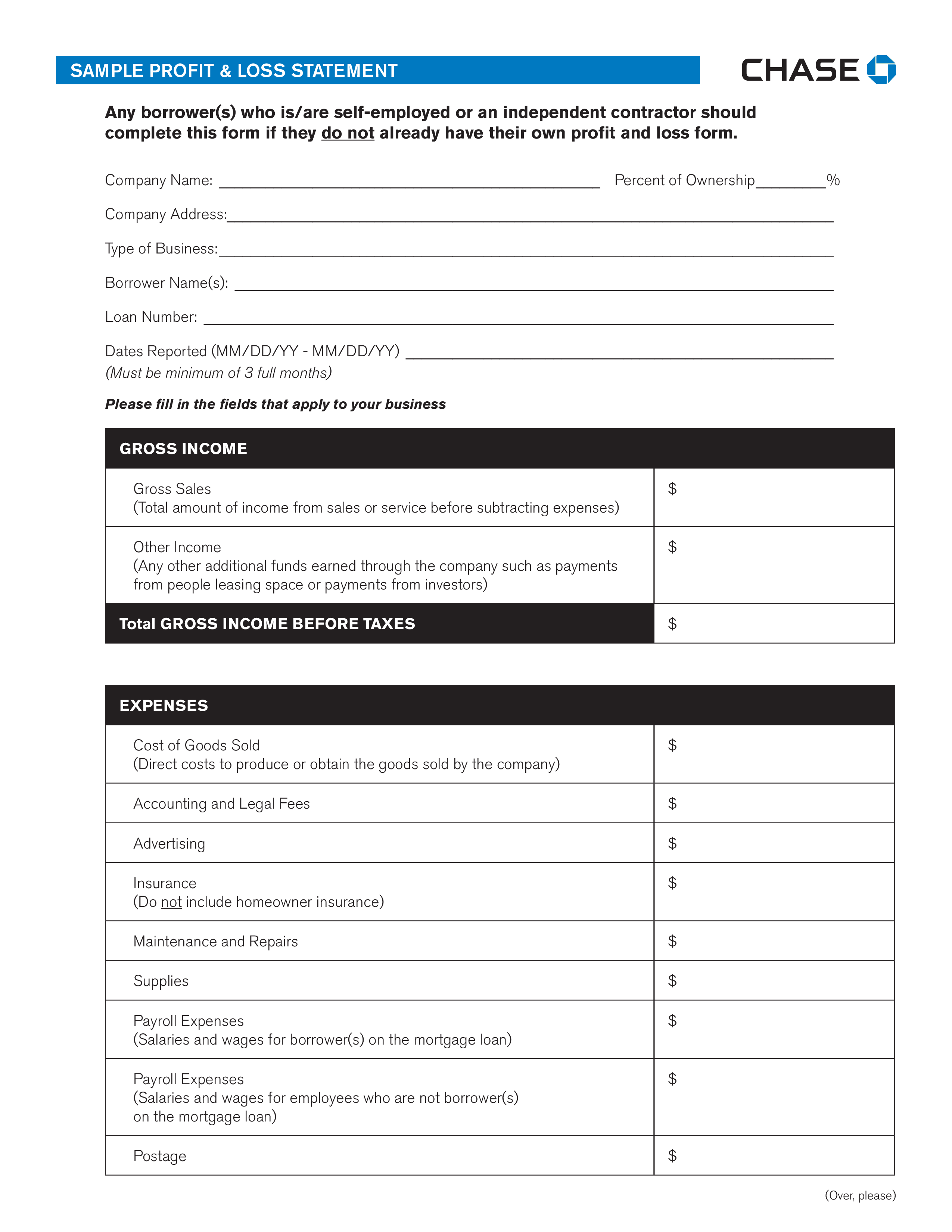

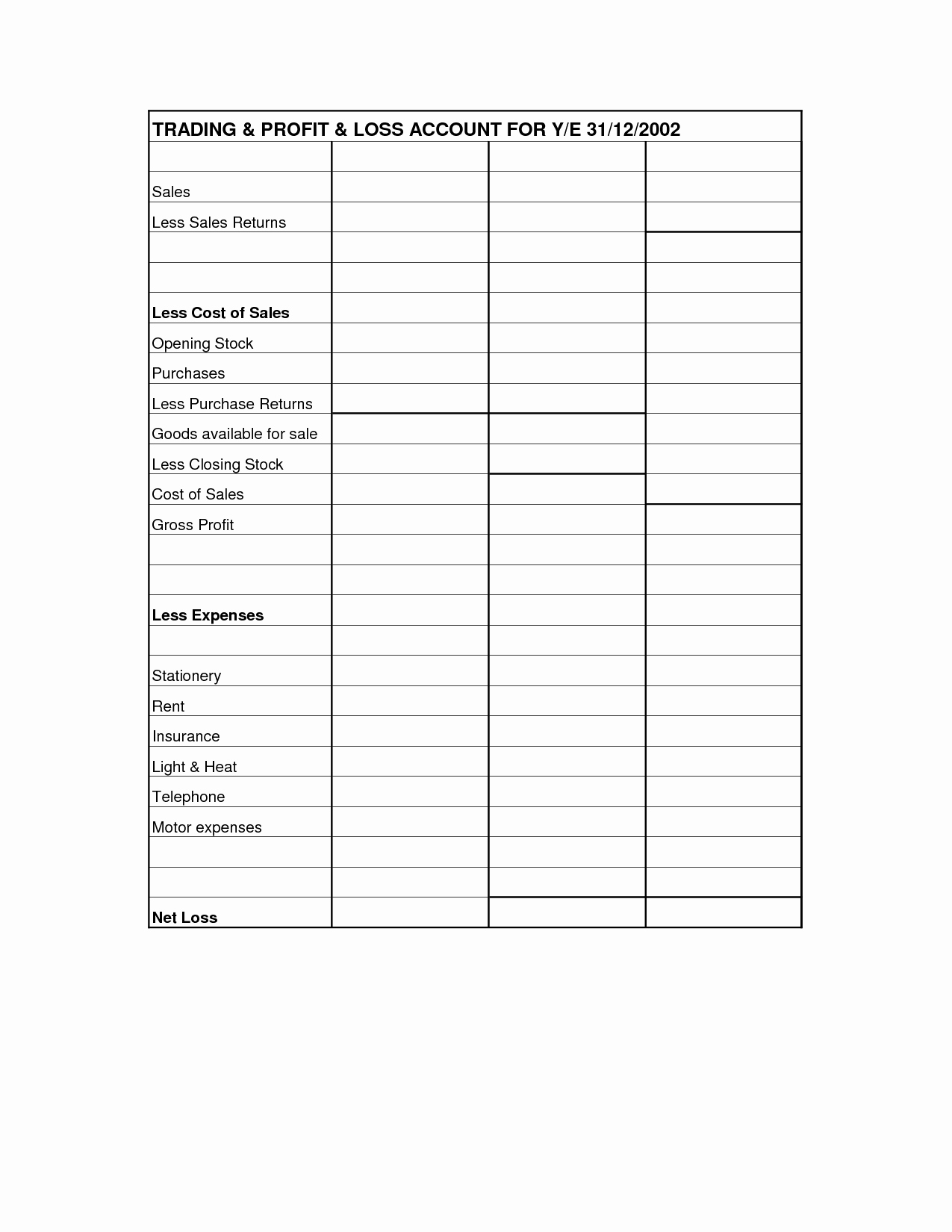

Less cost of goods sold. A p&l statement is an account of a company's income and expenditures (and ultimately its profit) over a period of time. The p&l statement is one of three.

A profit and loss statement (p&l) reveals how much a company earned over a designated period, like a quarter or year. How to read an income statement an income statement , also known as a profit and loss (p&l) statement, summarizes the cumulative impact of revenue, gain, expense, and loss transactions for a given period. You can obtain current account balances from your.

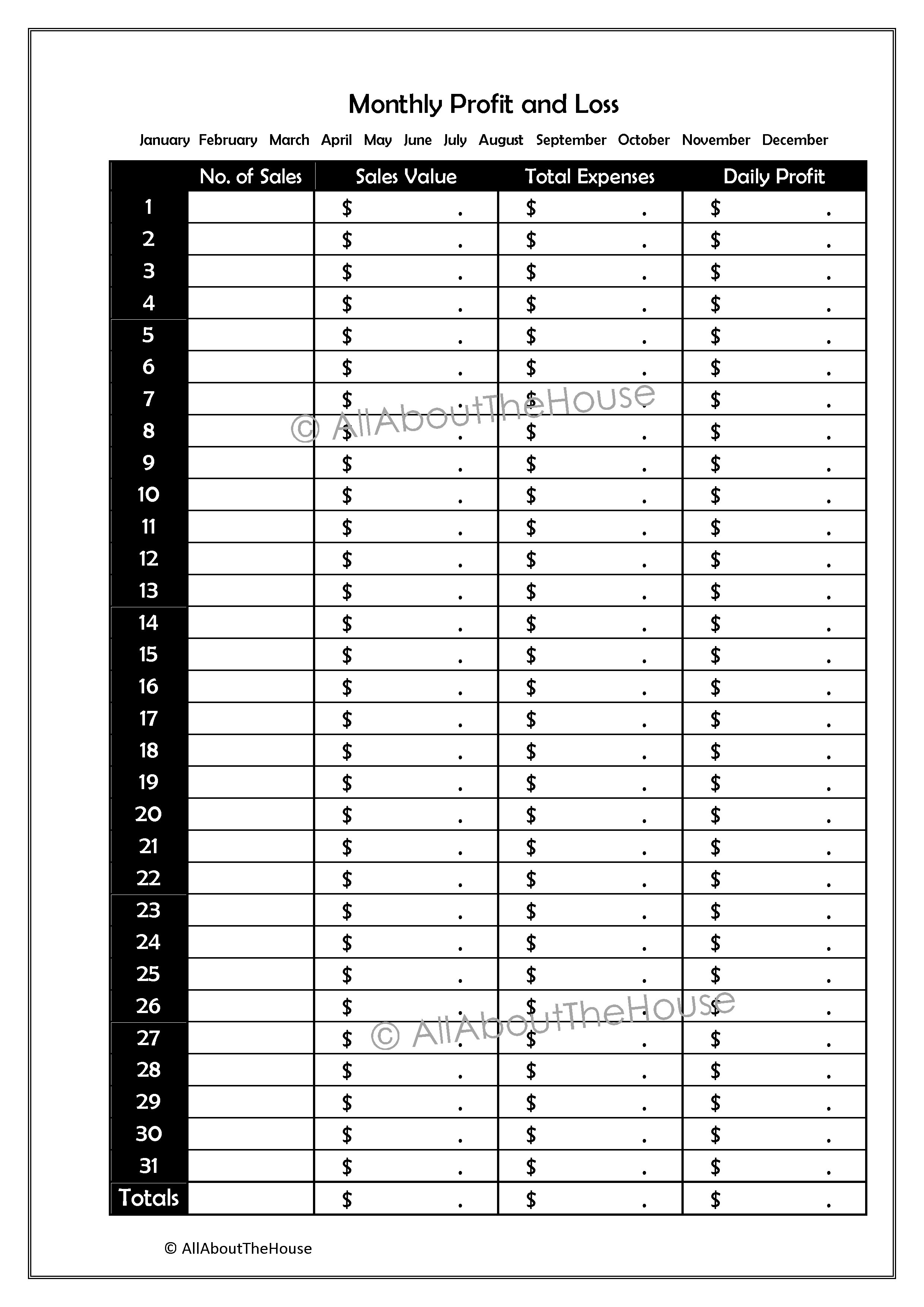

It’s usually assessed quarterly and at the end of a business’s accounting year. The final figure will show the financial performance and show if the business has made a profit or loss. A profit and loss (p&l) report is a critical piece of information for a company that states whether a company is profitable.

Investors might use this information in conjunction with a company's balance. The two main categories outlined in a p&l statement are income and expenses.

When interpreting profit and loss (p&l) statements, it is crucial to grasp critical financial metrics and their implications. Creating one is a standard way to compile historical data for your business to tell its financial story over time. The p&l statement shows a company’s ability to generate sales, manage expenses, and create profits.

The profit and loss statement is an overview of how much revenue the company generated, all the business expenses, other gains or losses, and how much profit (or loss) it made over a. A profit and loss statement—also called an income statement or p&l statement—is a financial statement that shows a business’s revenue, expenses, and net income over a specific period of time. Once you have the necessary details and figures to calculate your net profit or loss, you then need to understand the components of each side of the equation.

Gross profit (or loss) operating profit (or loss) net profit (or loss) 1. The revenue section covers how much money your business brought in for that period, and subtracts the cost of creating your products to show your gross profitability. The first step in creating a profit and loss statement is to calculate all the revenue your business has received.

Create the report either annually, quarterly, monthly or even weekly. Shannon stapleton/getty images. The p&l tells you if your company is profitable or not.

![Reading a Profit & Loss Statement run[Accounting]](https://runaccounting.com/wp-content/uploads/2020/07/20170613222118-GettyImages-601798159-1920x960.jpeg)