Cool Tips About Square Profit And Loss Statement Interim Management Accounts

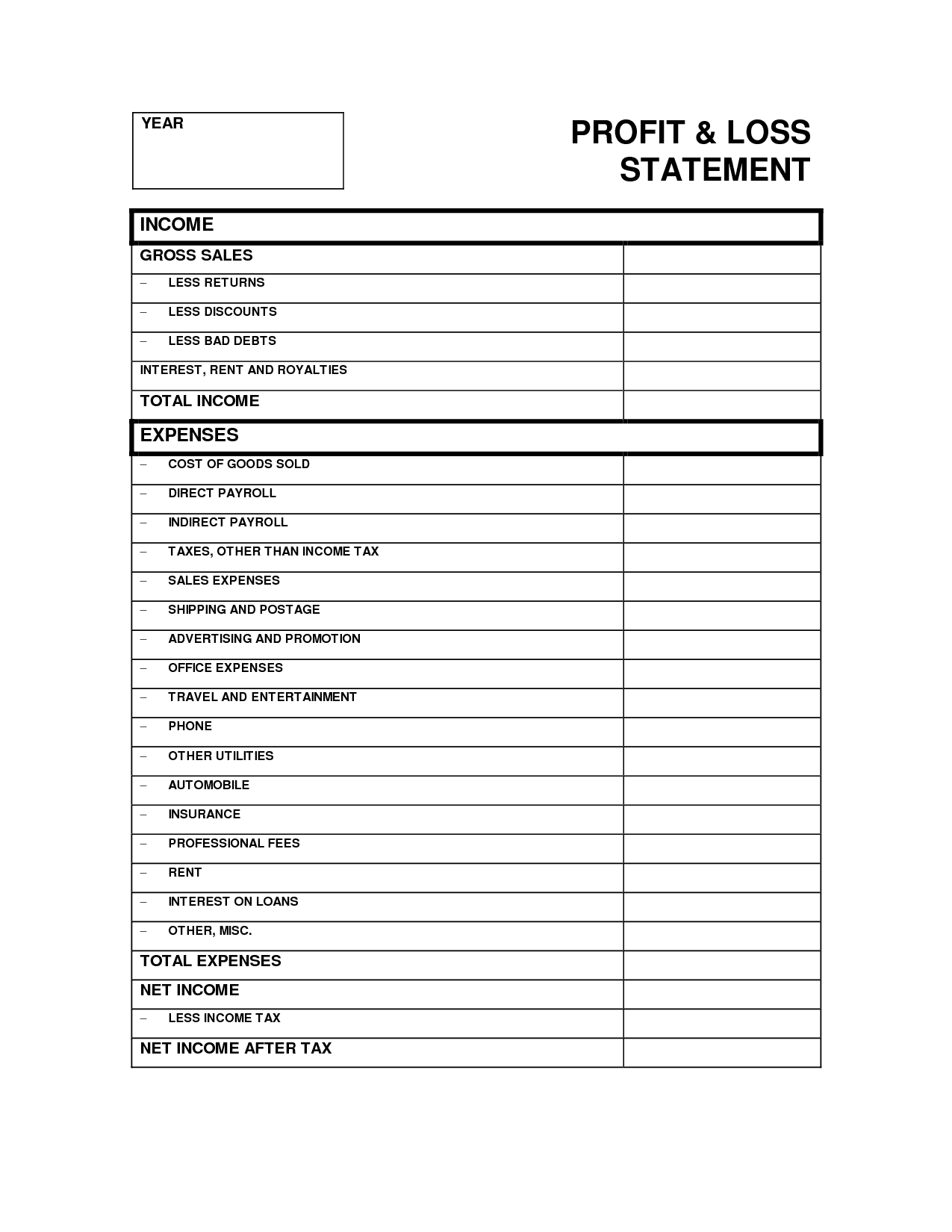

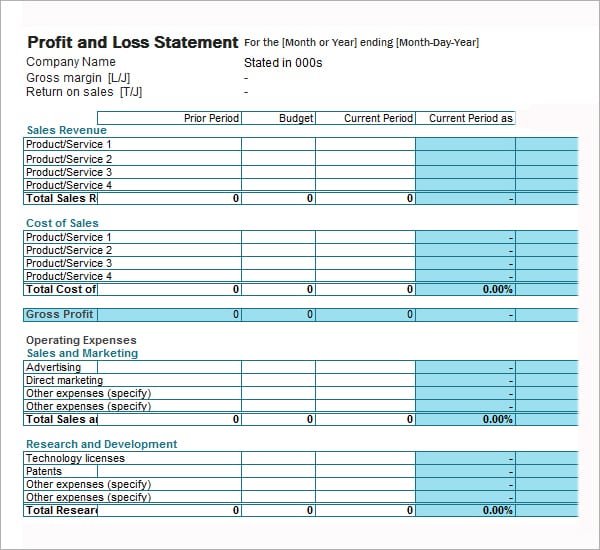

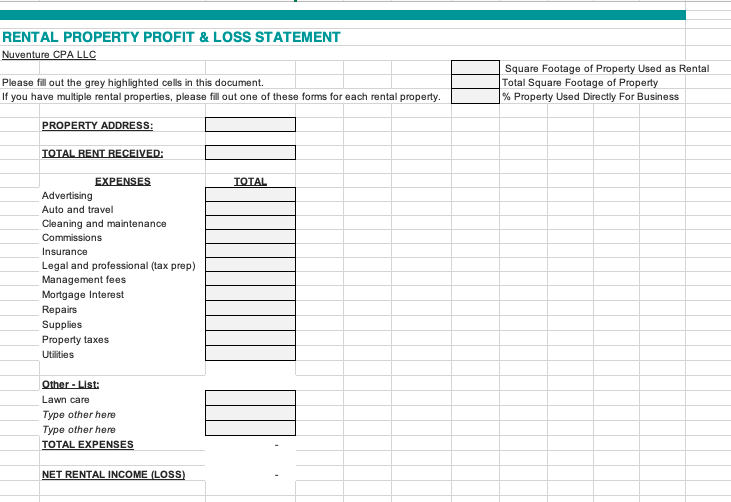

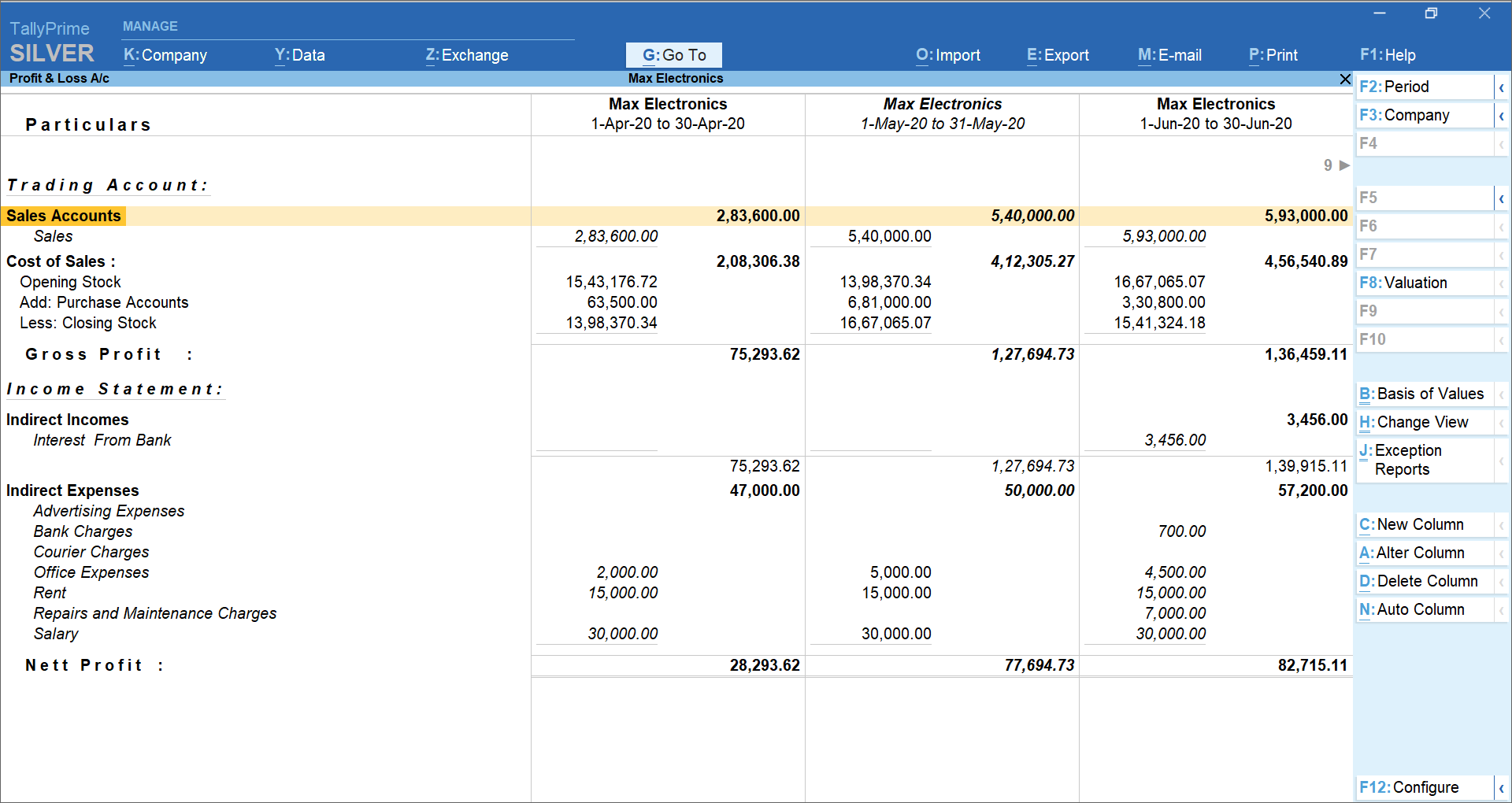

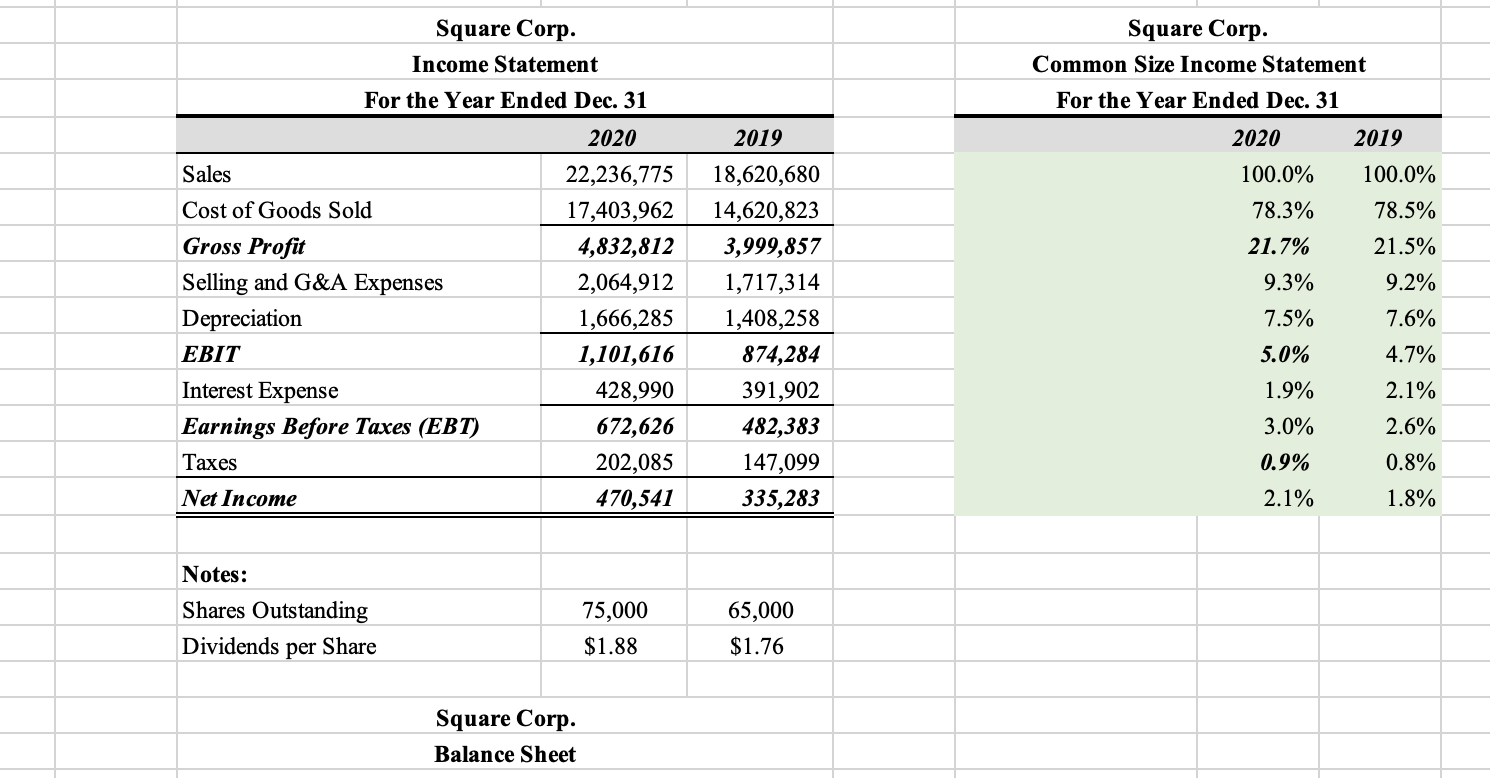

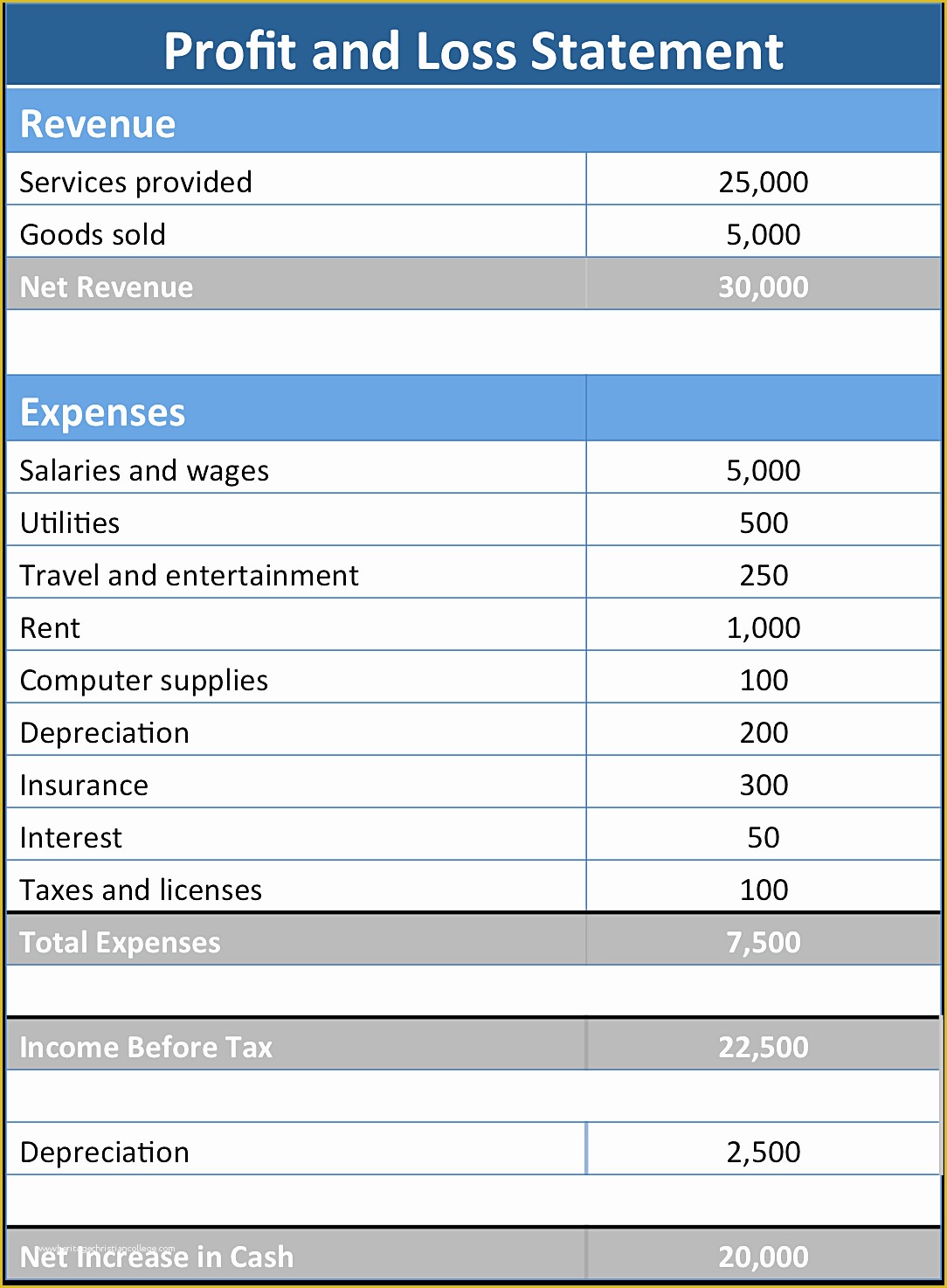

A profit and loss statement includes a business’s total revenue, expenses, gains, and losses, arriving at net income for a specific accounting period.

Square profit and loss statement. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year. The profit and loss statement (p&l) is a financial statement that starts with revenue and deducts costs and expenses to arrive at net income, the profitability of. Or how badly, for that matter.

Square has partnered with workbench accounting to bring she a profit and expenses patterns that you can download, input financials specific to your business, and. Other terms for a p&l statement. A profit and loss statement contains three basic elements:

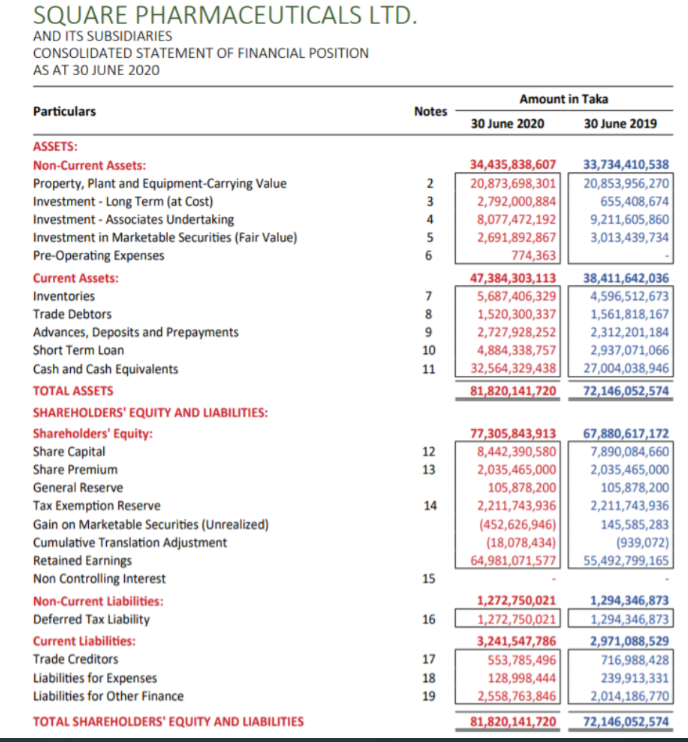

What we’re referring to is the profit and loss statement (p&l), which gives you insight into how well your business is doing. A company’s profit and loss statement details the revenue, capital expenditure and operational expenses incurred during a given period. The balance [bal] function references the balance sheet, allowing you to select balance sheet entities to include in calculations on the profit and loss.

Profit and loss statement. Calculate revenue the first step in creating a profit and loss statement is to calculate all the revenue your business has received. A company’s profit and loss statement details the revenue, capital expenditure and operational expenses incurred during a given period.

In fact, experts consider a. A profit and loss (p&l) statement is a financial document that summarizes your business's revenue, costs, and gross and net income over time. Revenue, expenses, and net income.

It is usually created on a quarterly. It is usually created on a quarterly. Crypto sectors contact us u.s.

More advanced profit and loss statements also include.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)