Fabulous Tips About Adjusting Entry For Accrued Interest On Notes Payable Statement Of Changes In Equity Partnership Example Pdf

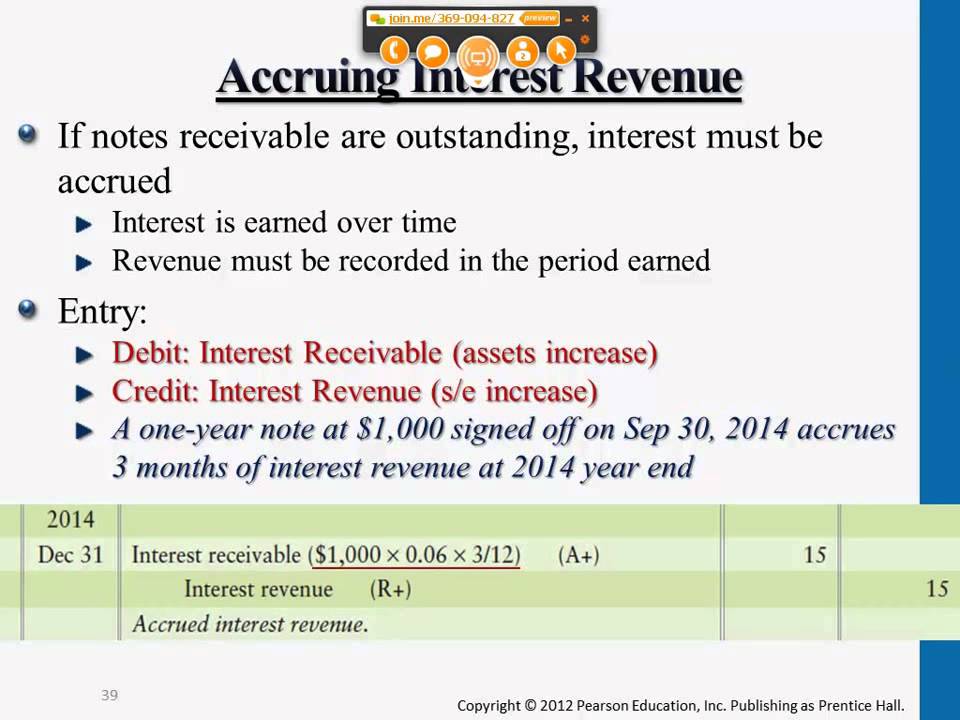

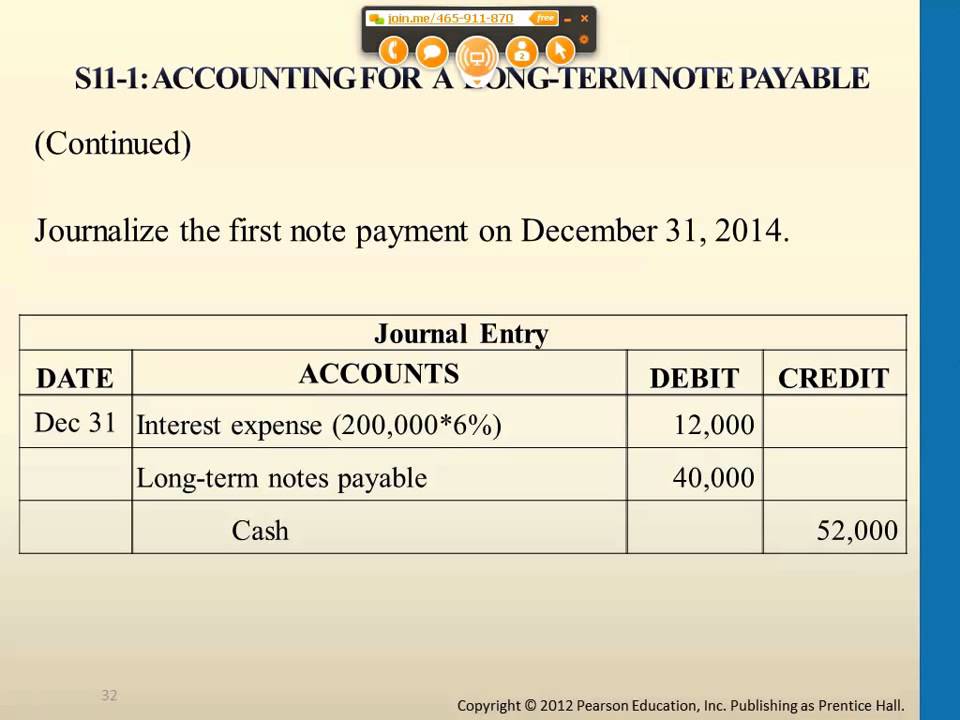

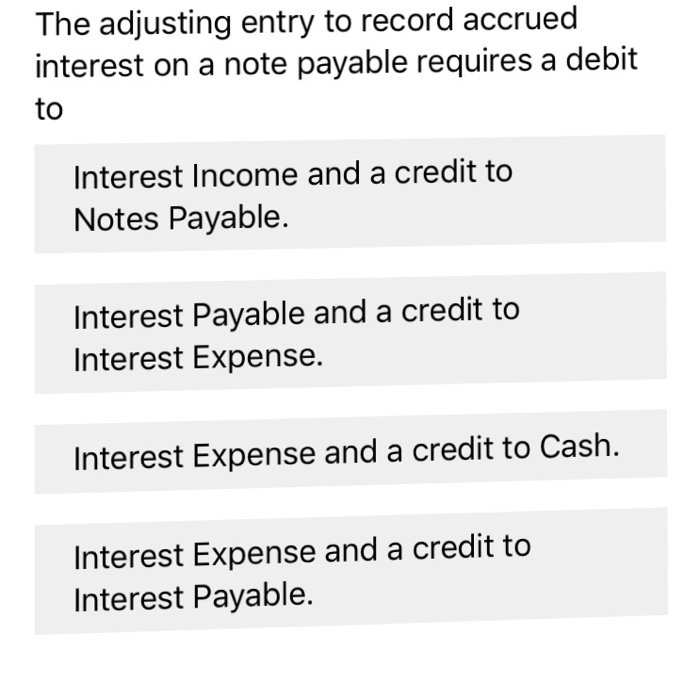

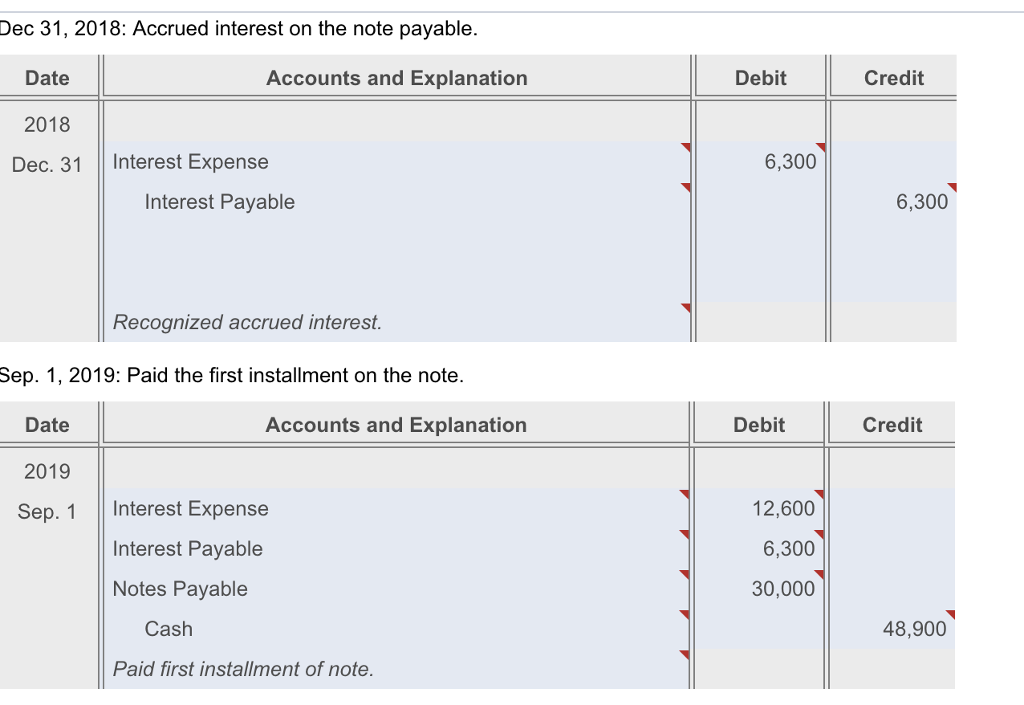

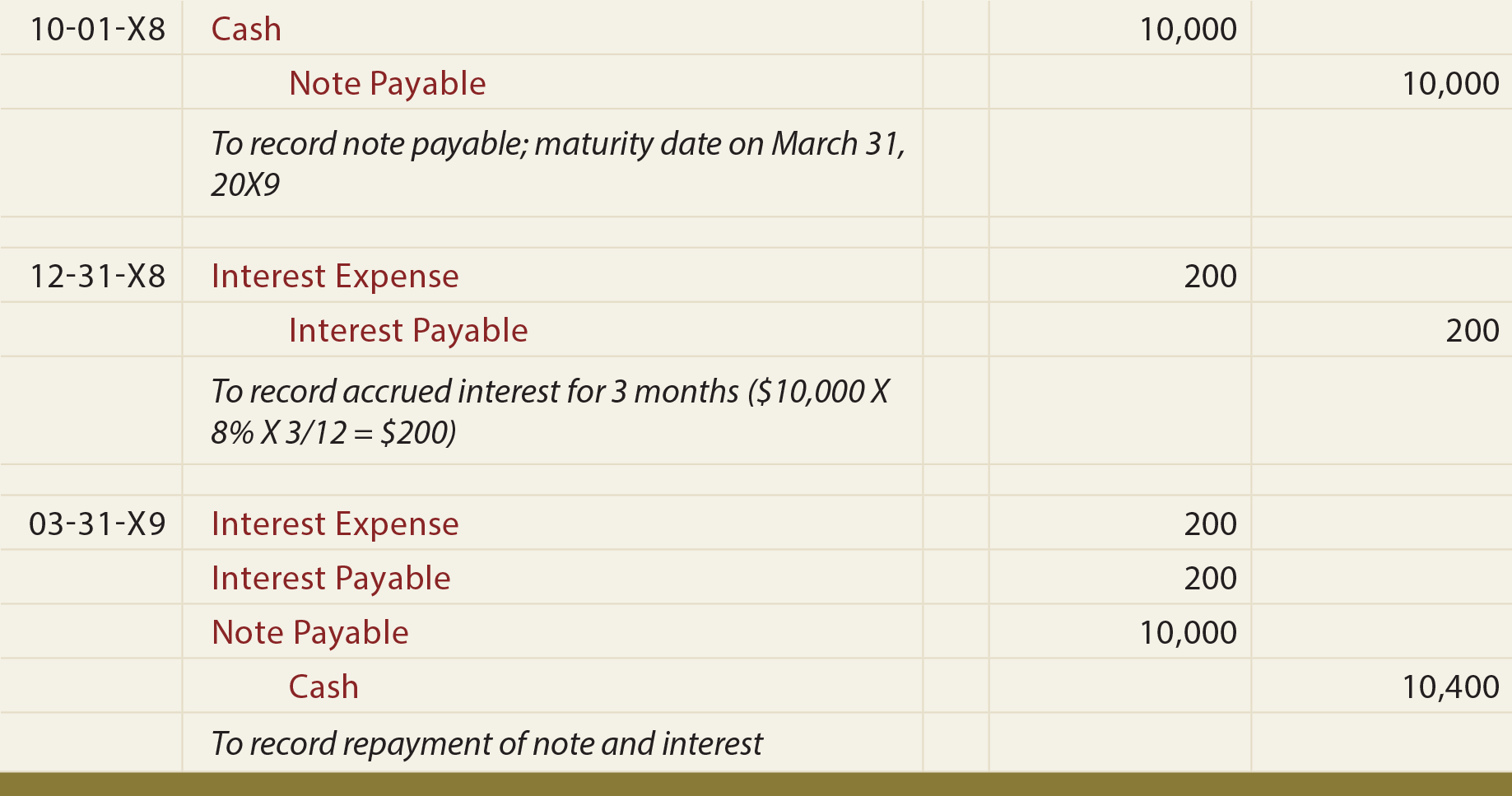

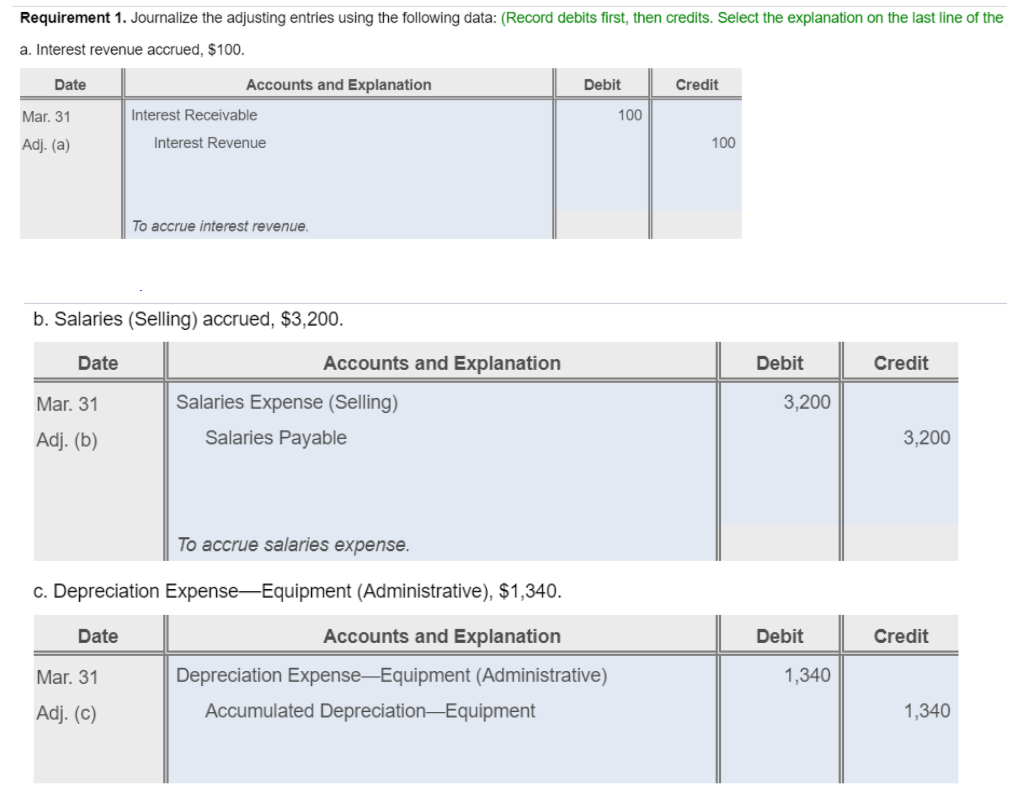

These accrued expenses include accrued interest on notes payable, in which the company needs to make journal entry by debiting interest expense account and crediting interest.

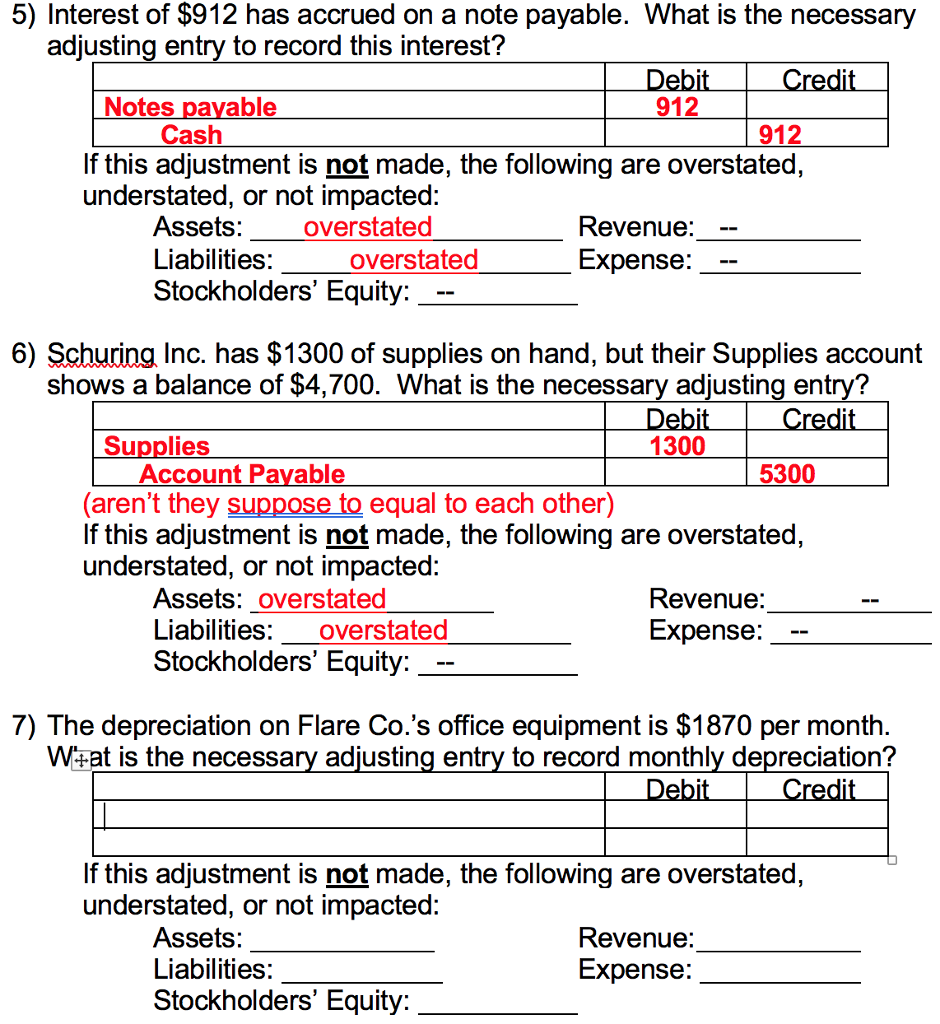

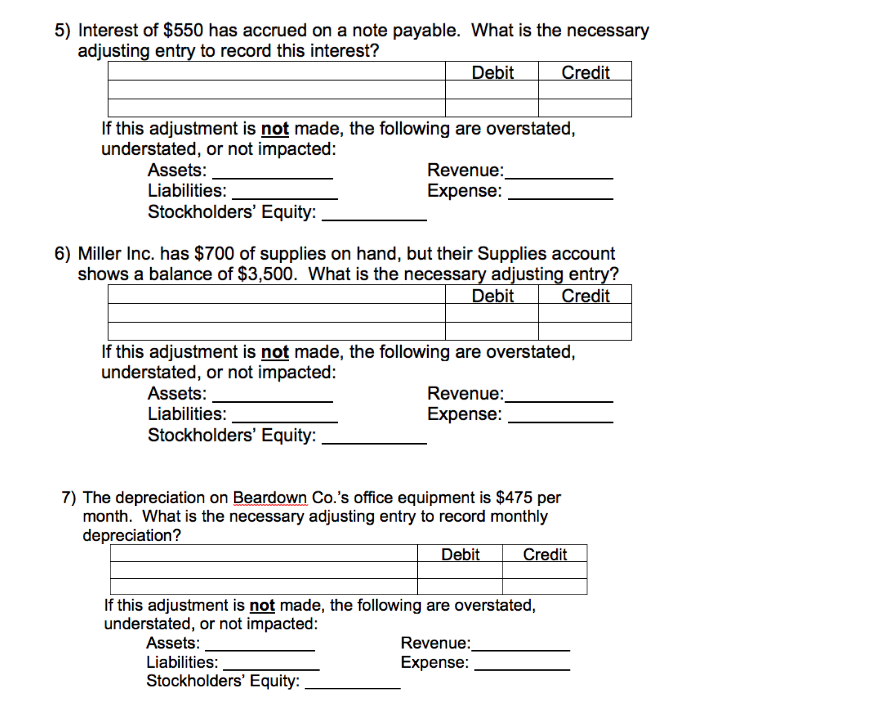

Adjusting entry for accrued interest on notes payable. Since a note payable will require the issuer/borrower to pay interest, the issuing company will have interest expense. In this case, we can make the. Adjusting entries update accounting records at the end of a period for any transactions that have not yet been recorded.

The adjusting entry for an accrued expense updates the taxes expense and taxes payable balances so they are accurate at the end of the month. Each month that a company has a notes payable, an adjusting entry is required to record accrued interest expenses. To record accrued interest expense, an adjusting entry debits notes payable for the amount of accrued interest, while a credit to accrued interest revenue.

The adjusting entry for accrued interest consists of an interest income and a receivable account from the lender’s side, or an interest expense and a payable account from the. The interest accrued on notes payable adjusting entry should look like: One important accounting principle to remember is that just.

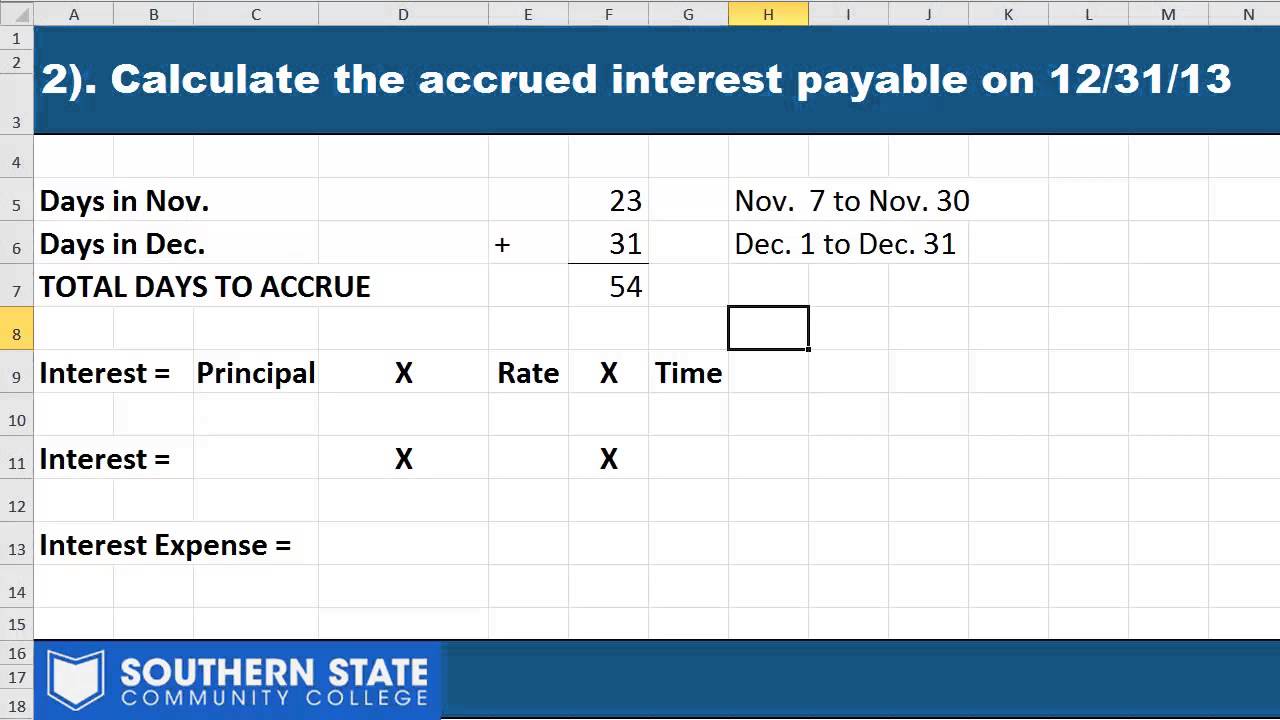

You can have accrued expenses or accrued revenues:. Now that you know the daily interest amount, count up the total number of days the notes. As mentioned, we may need to record the accrued interest on the note payable at the period end adjusting entry before the payment is made.

Divide the annual interest expense by 12 to calculate the amount of interest to record in a monthly adjusting entry. To do this, divide the total interest amount by 365 ($500/365 = $1.369). Debit interest expense 200 credit interest payable 200 record the semiannual.

This type of adjusting entry will add to two accounts. The amount you will be adding was not already on the books. Under the accrual method of accounting, the company will.

Interest payable is a liability account, shown on a company’s balance sheet, which represents the amount of interest expense that has accrued to date but has not been. Understand the details of the note. If accountants find themselves in a situation where the cash account must be adjusted, the necessary adjustment to cash will be a correcting entry and not an adjusting entry.