Unique Info About Closing Stock In Trial Balance Ey Financial Statements 2018

Closing stock adjustment entry for adjustment of closing stock is as follows:

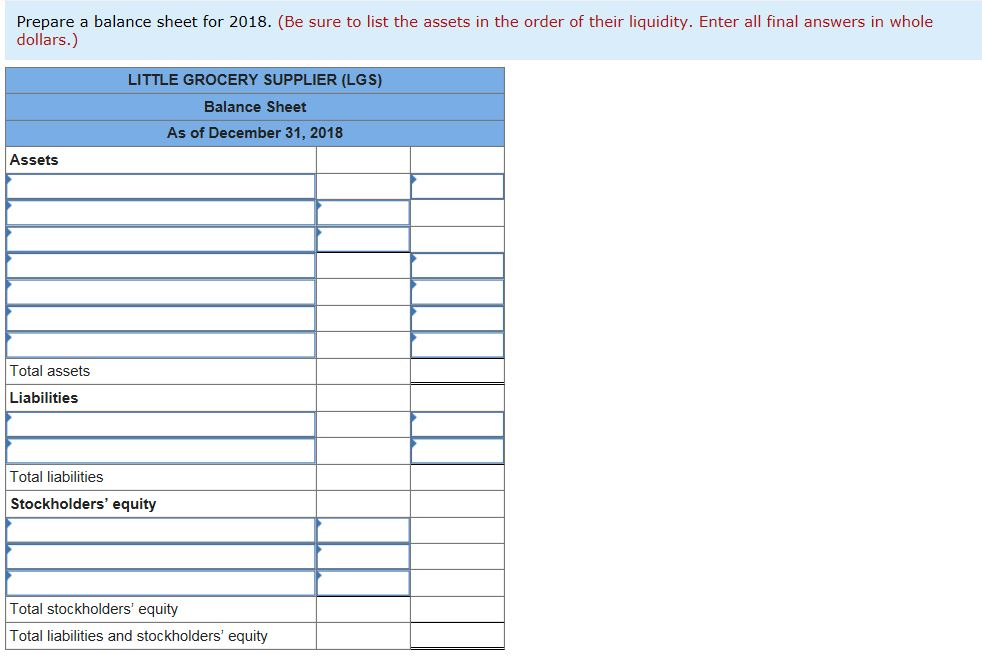

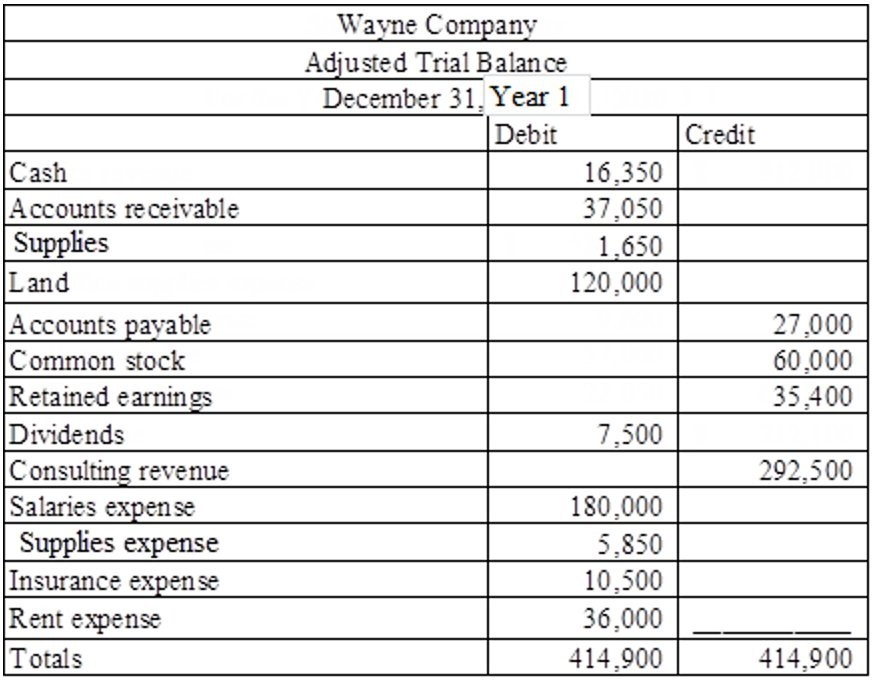

Closing stock in trial balance. Cash, accounts receivable, office supplied, prepaid insurance, equipment, accumulated depreciation (equipment), accounts payable, salaries payable,. Closing stock is the balance of unsold goods that are. Closing stock is represented on the asset side of the balance sheet.

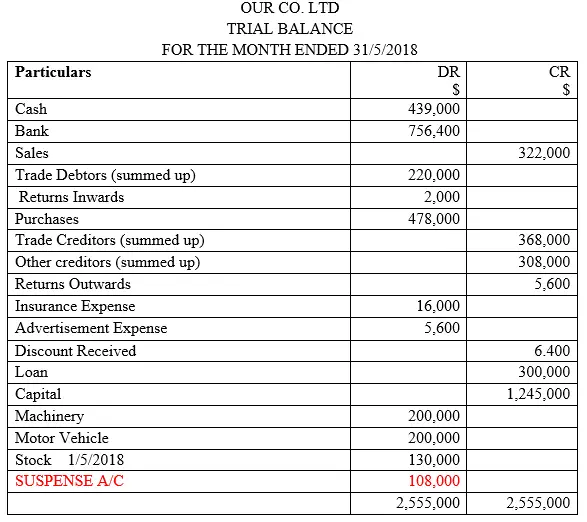

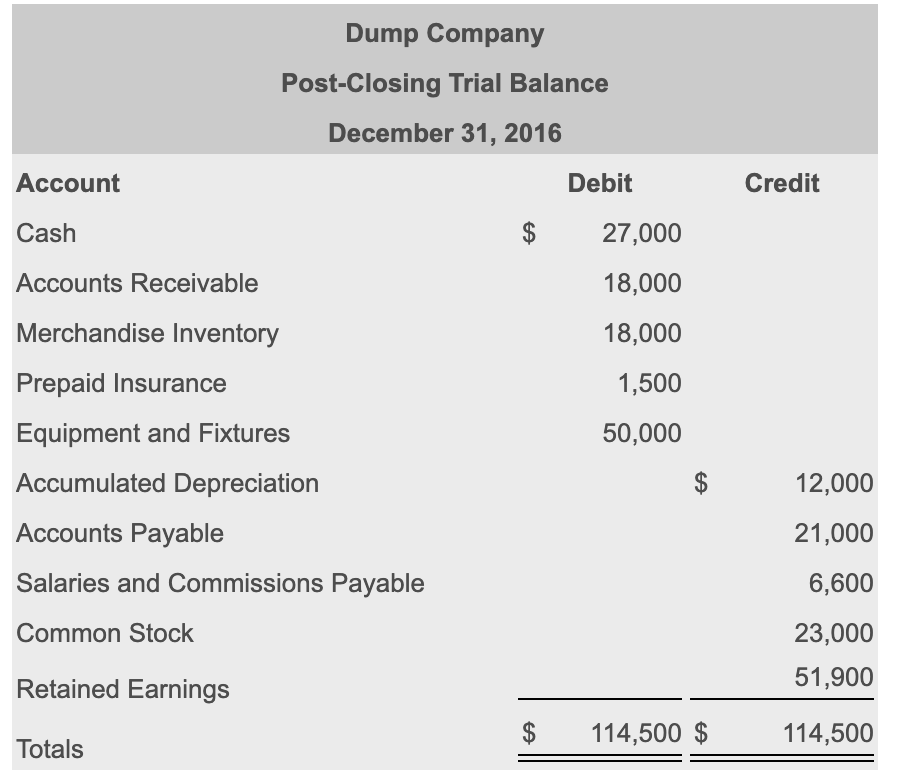

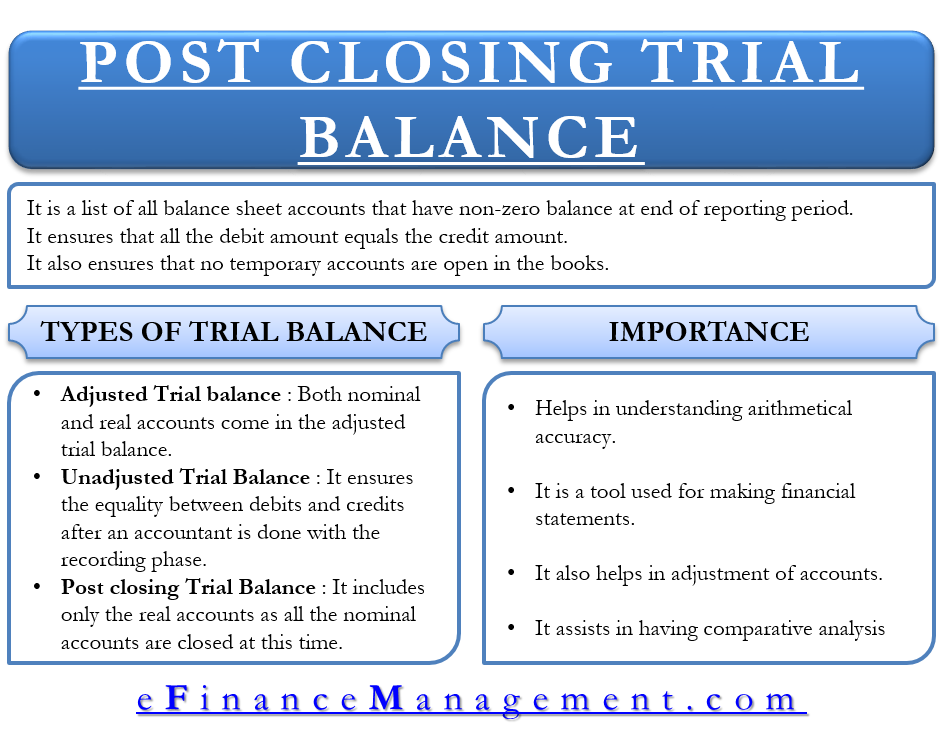

Closing stock in balance sheet. A trial balance is a list of all accounts in the general ledger that have nonzero balances. Closing stock or ending inventory is the stock of inventory which a business has left over at the end of its accounting period, and it includes merchandise that was.

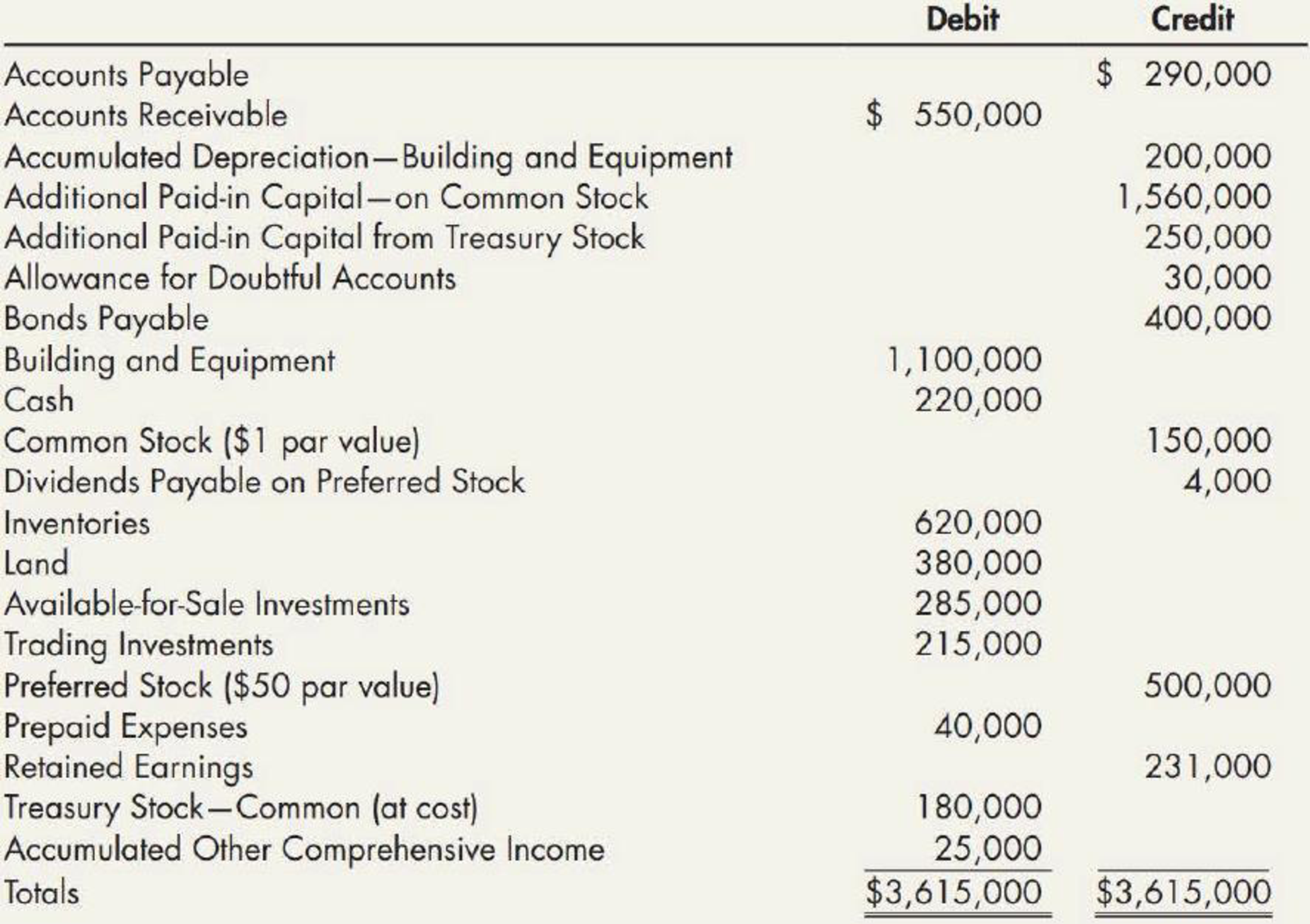

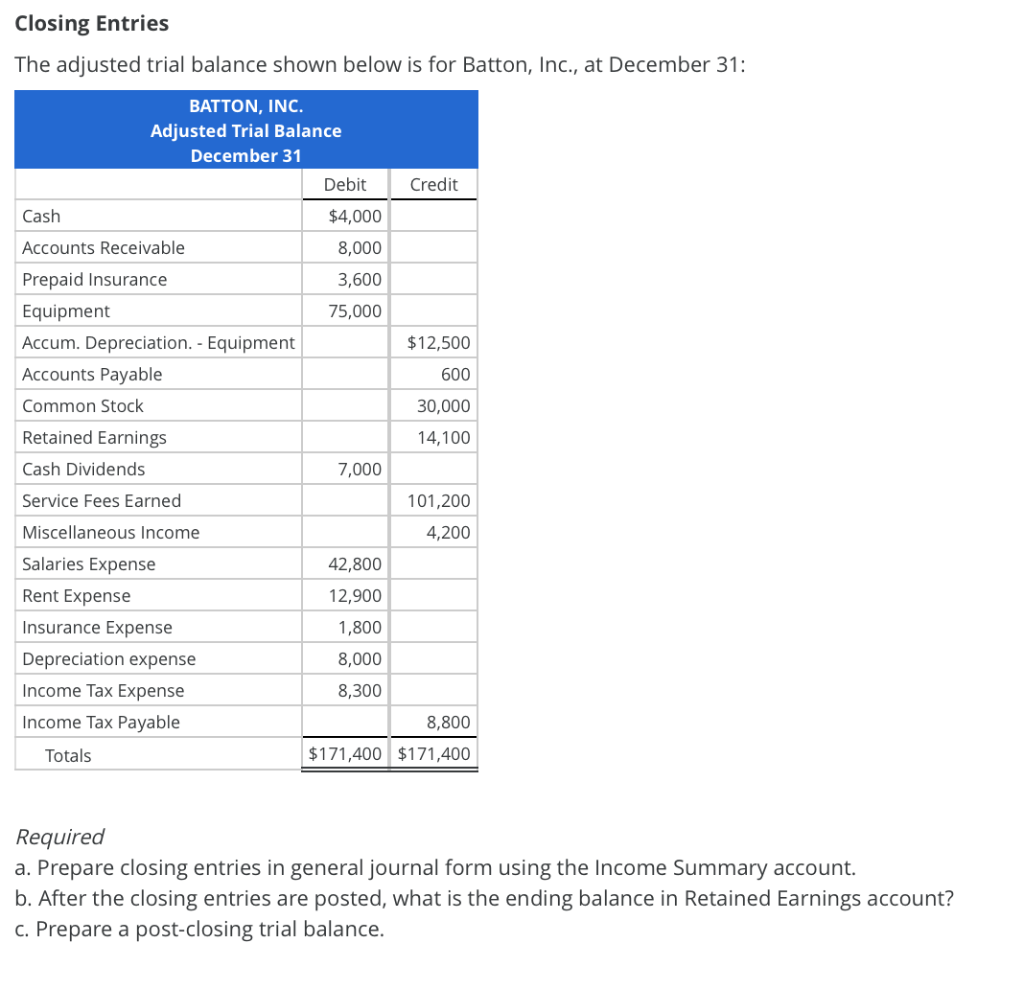

The ledger account behind the adjustment causes problems for some candidates. This scenario is possible only when the closing stock is adjusted against purchases. Example to illustrate, here is a sample adjusted trial.

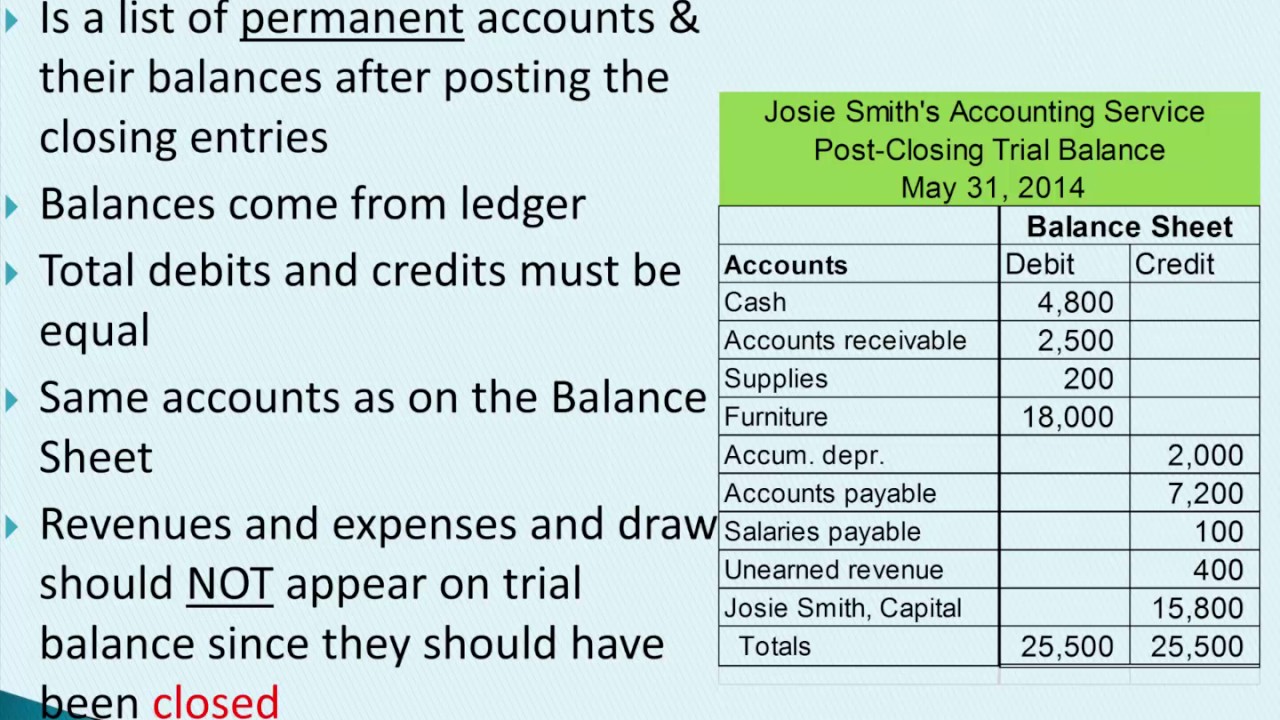

A trial balance is an important step in the accounting process, because it helps identify. Closing stock is shown in the trial balance: Trial balance refers to a part of a financial statement that records the final balances of the ledger accounts of a company.

The only exception is when closing stock is adjusted with purchases using a journal entry. It should not be included in the trial balance, as it will double the effect of total purchases. This statement comprises two columns:.

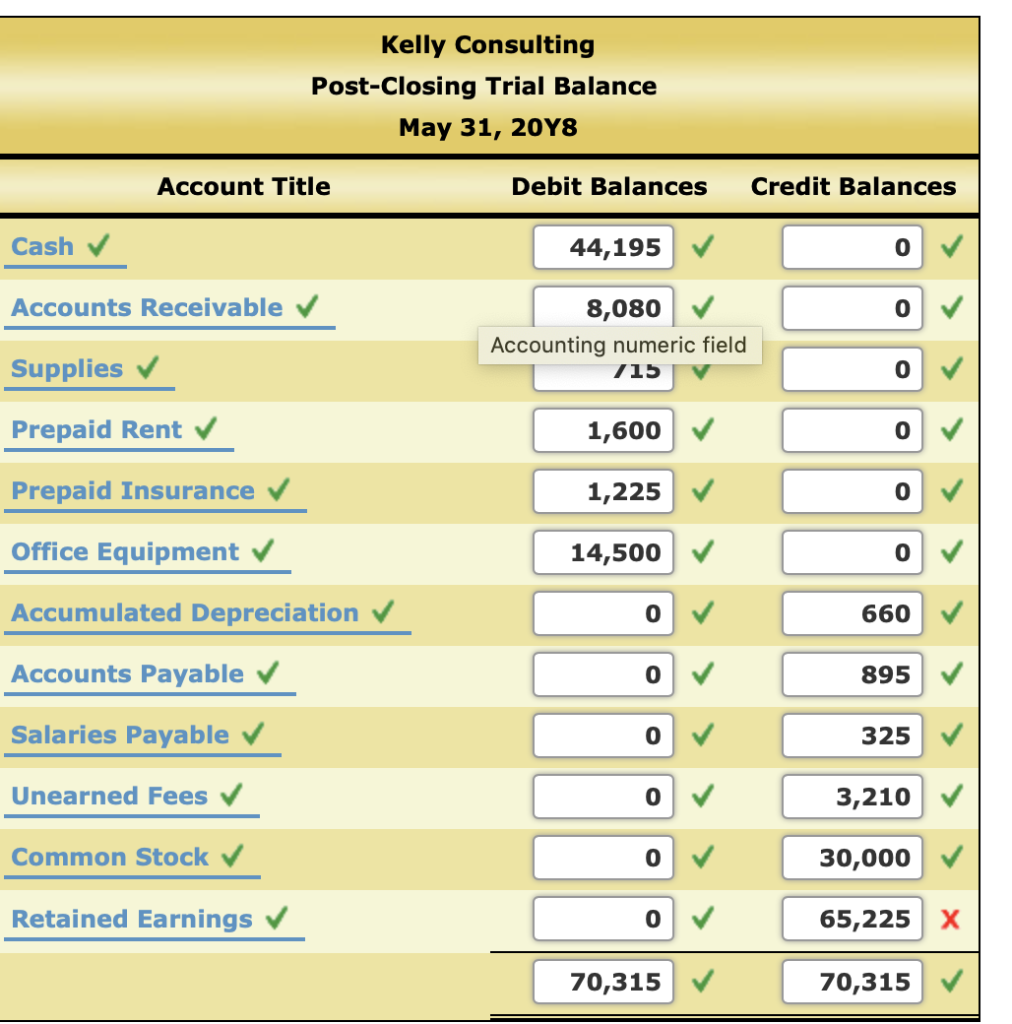

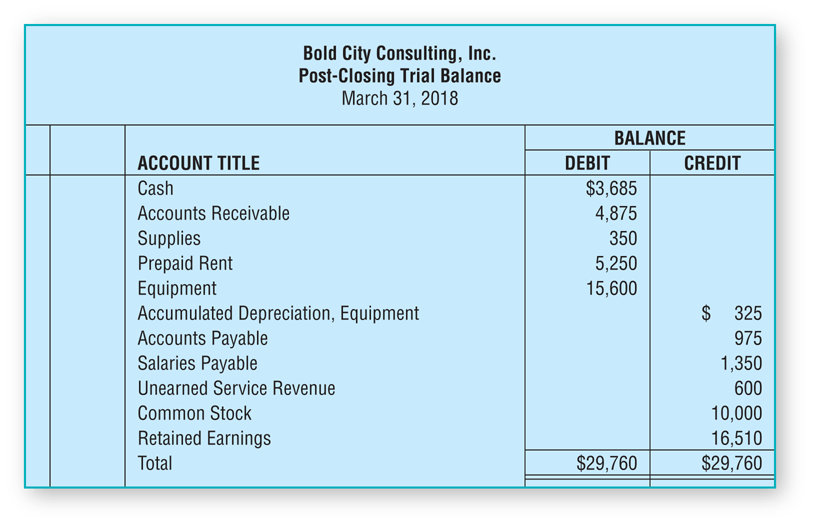

Closing, or clearing the balances, means returning the account to a zero balance. The main change from an adjusted trial balance is revenues, expenses, and. Formula you are free to use this image on your website, templates, etc, please provide us with an attribution link below is the formula for closing stock.

The trial balance shows the ending balances of all asset, liability and equity accounts remaining. A trial balance is a bookkeeping worksheet in which the balances of all ledgers are compiled into debit and credit columns. Closing stock is the leftover balance of goods purchased during an accounting period.

Having a zero balance in these accounts is important so a company can compare performance. This is how the inventory account will look at the time the trial balance is being prepared. By adjusting against purchases, the.

If closing stock is included in the trial balance , the effect will be doubled.