Matchless Info About Types Of Profit And Loss Account Sections Statement Cash Flows

Let’s take a look at the different types of profit & loss accounts.

Types of profit and loss account. The statement is based on the fundamental equation: The p&l is made up of two types of transactions: Less cost of goods sold.

Business income or gross sales are considered to be the top line. This account is for individuals and keeps a record of all their transactions including their income and expenses. One of the most fundamental tools for assessing a company’s financial performance is the profit and loss account, often abbreviated as p&l.

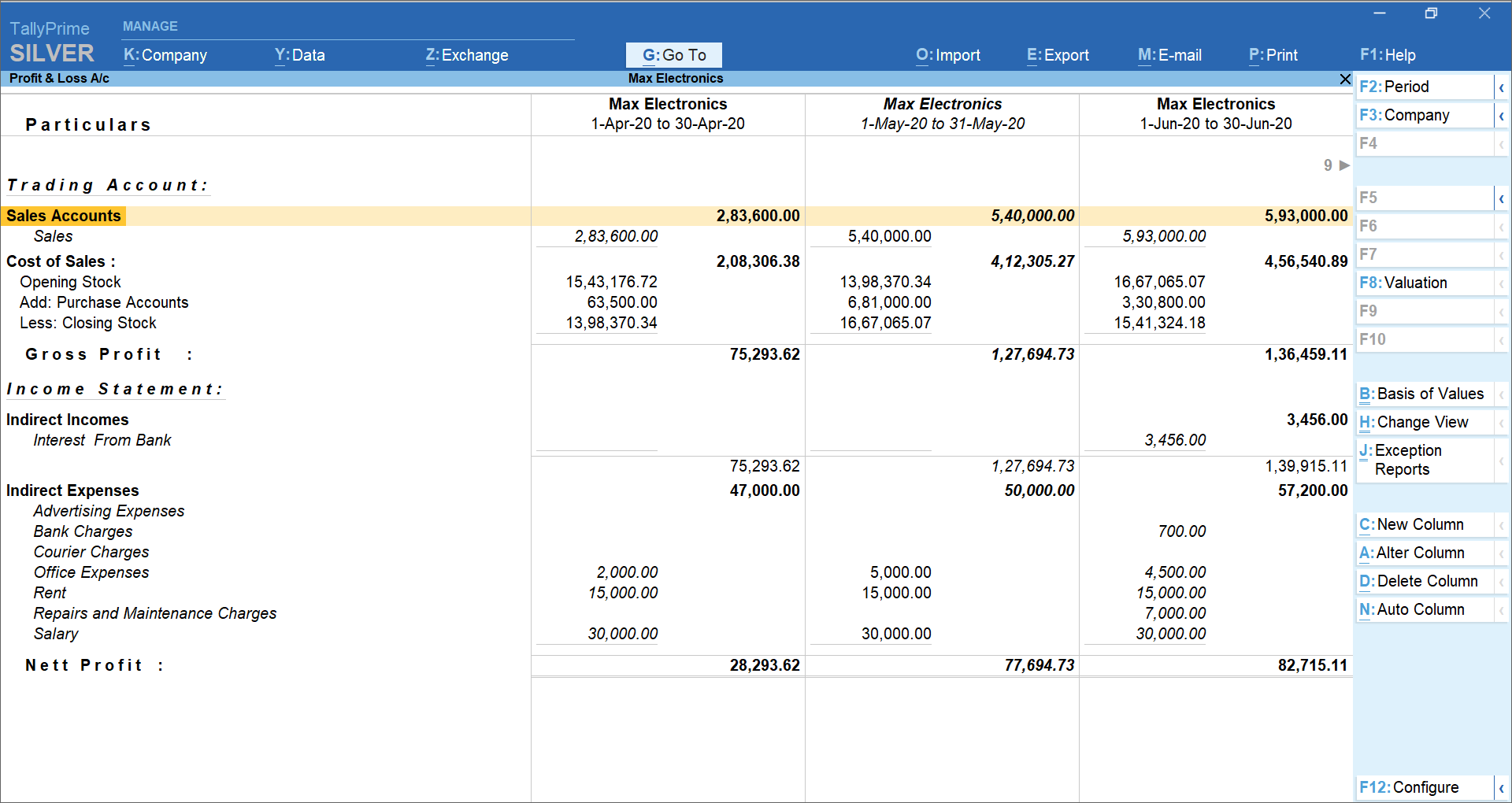

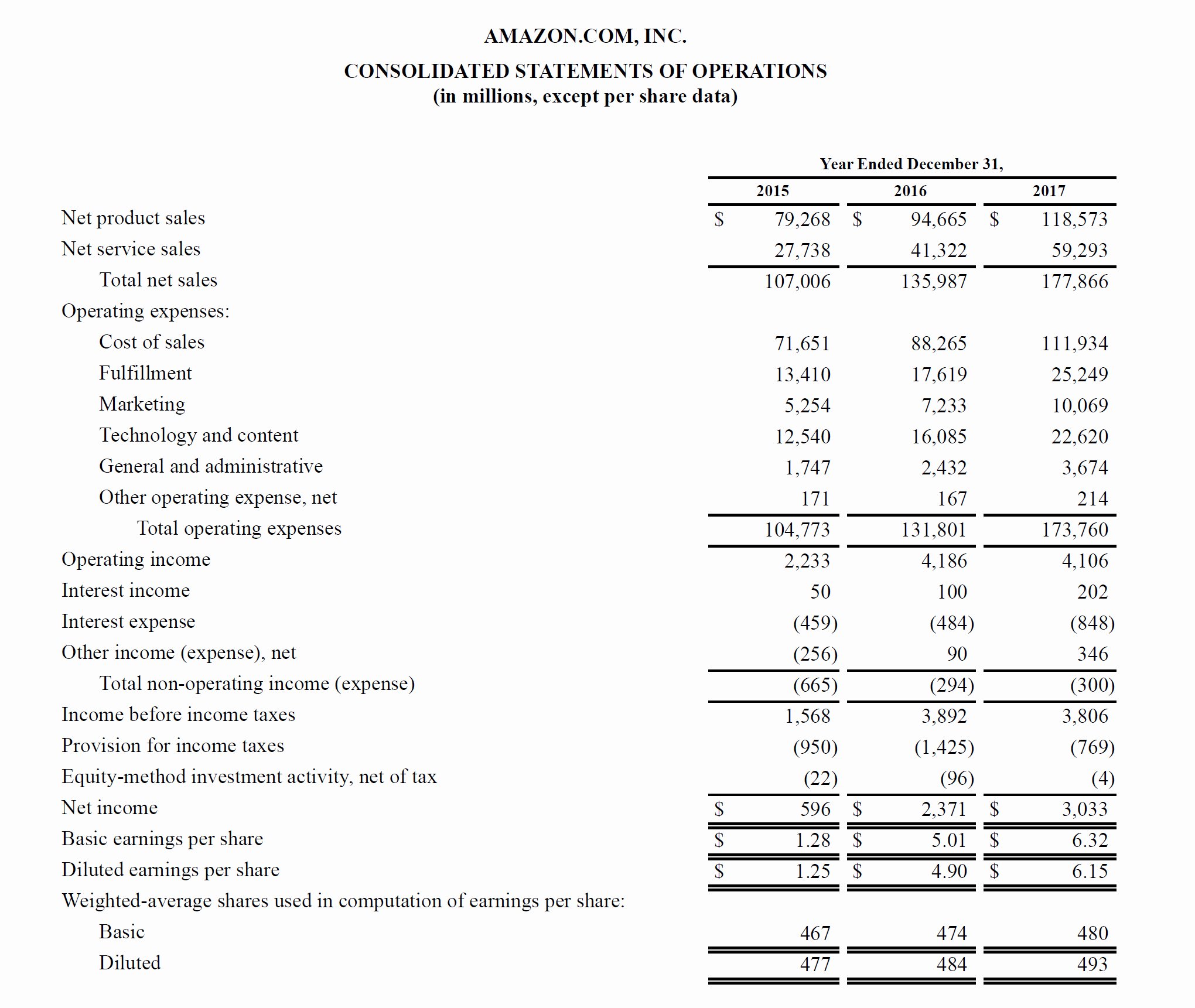

By law, the document has to present the profit (loss) for a financial year, but for own purposes it may be compiled for shorter periods, e.g. The common size analysis p&l statement represents all line items as a % of a chosen metric, typically sales. The p&l statement, also referred to as a statement of profit and loss, statement of operations, expense statement, earnings statement, or income statement, begins by showing how much money your business made from selling goods or services.

What is an income statement? What is profit and loss accounting? A profit and loss (p&l) statement is one of the three types of financial statements prepared by companies.

To ascertain profit or loss made by the business enterprise 2. Types of profit and loss (p&l) statements there are two kinds of p&l statements: Despite doubling its ev deliveries in 2023, rivian.

The three main types of financial statements are the income statement (also known as the profit and loss statement), the balance sheet, and the cash flow statement. You can keep track of your expenses and savings using these accounts. It can be calculated by adding up all of the revenues that the business receives and then subtracting all of the costs that are incurred during that same period.

Classification of profit and loss account ratios | accounting article shared by: For statutory compliance ( for compliance with the companies act, partnership act, or any other governing law) 3. Only indirect expenses are shown in this.

Components of profit and loss account. A profit and loss account is a financial statement showing the income and expenses of a business or other organization for a period, usually one year. Example of a p&l statement.

Types of profit and loss gross profit/ gross loss net profit/ net loss we prepare trading account to ascertain the gross profit/ gross loss. It shows both turnover and profitability for the company over that length of time. It is prepared to determine the net profit or net loss of a trader.

While we prepare profit and loss account to ascertain the net profit/ net loss. It even includes the earnings generated from different business investments. They begin with revenue, also referred to as the ‘top line’.