Awesome Tips About Different Types Of Financial Ratios The Budgeted Income Statement Is

The formula is net profit, divided by sales.

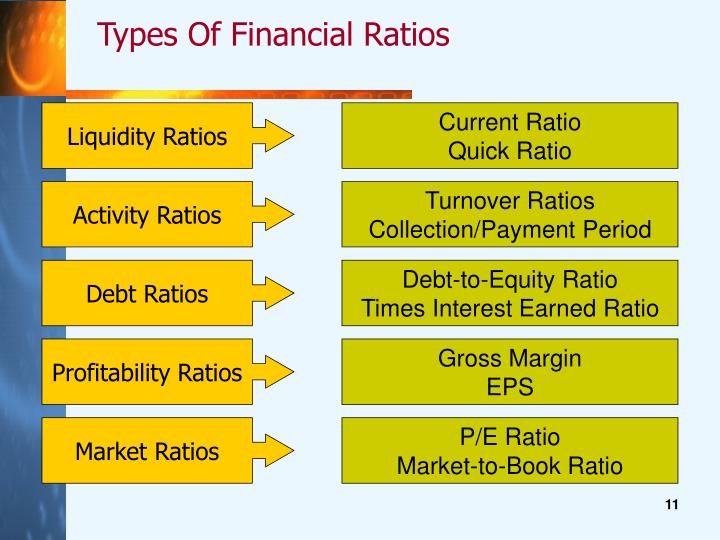

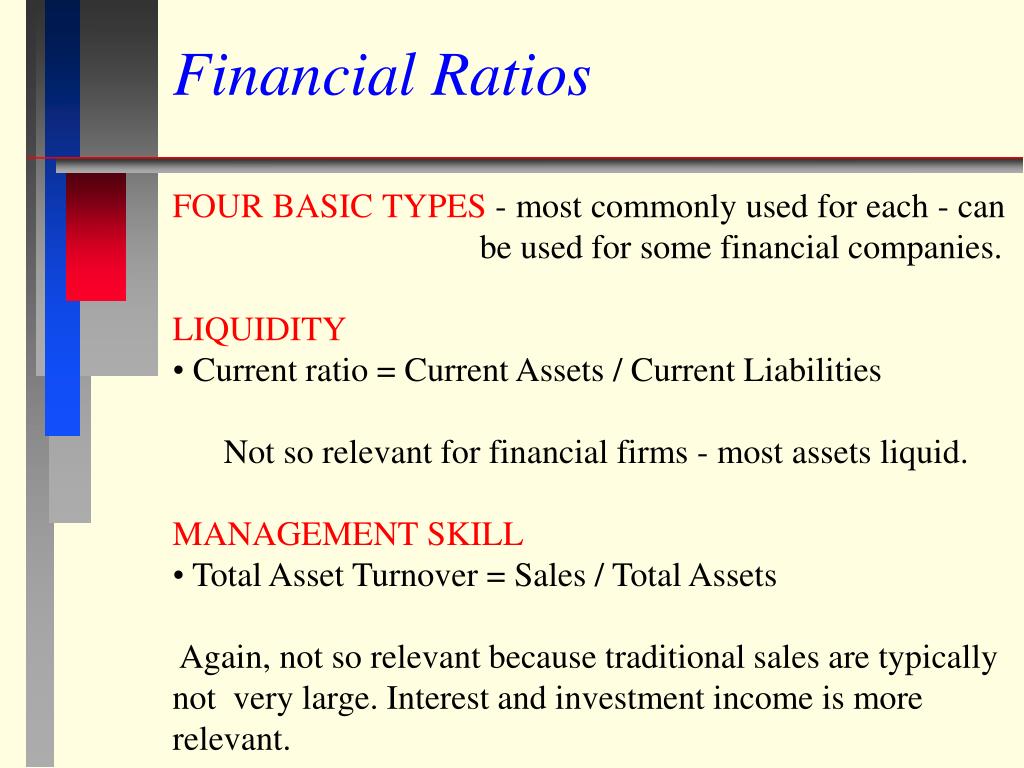

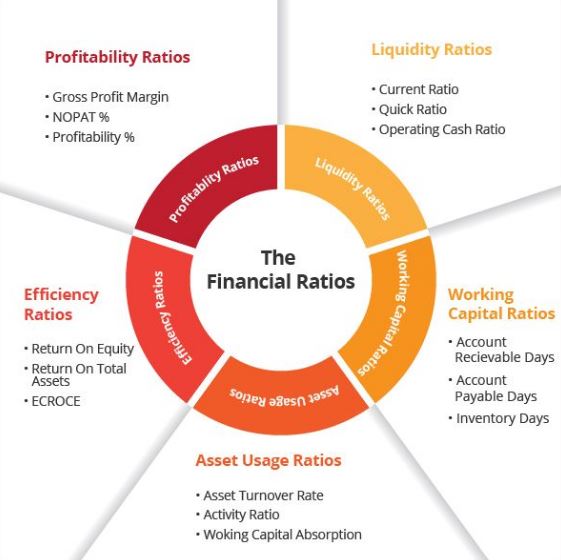

Different types of financial ratios. The current ratio is an indicator of your company's ability to pay its short term liabilities (debts). There are two methods in which ratios are categorised. Profitability, solvency, liquidity, turnover, coverage, and market prospects ratios.

Border patrol had nearly 250,000 encounters with migrants crossing into the united states from mexico in december 2023, according to government statistics. Financial ratio analysis is often broken into six different types: Learn how to compute and interpret financial ratios through this lesson.

Financial ratios can be classified into ratios that measure: Most ratios are best used in. Common ratios used to measure financial health

The current ratio is current assets divided by current liabilities. How well a company will be able to meet their financial obligations. The monthly number of encounters has soared.

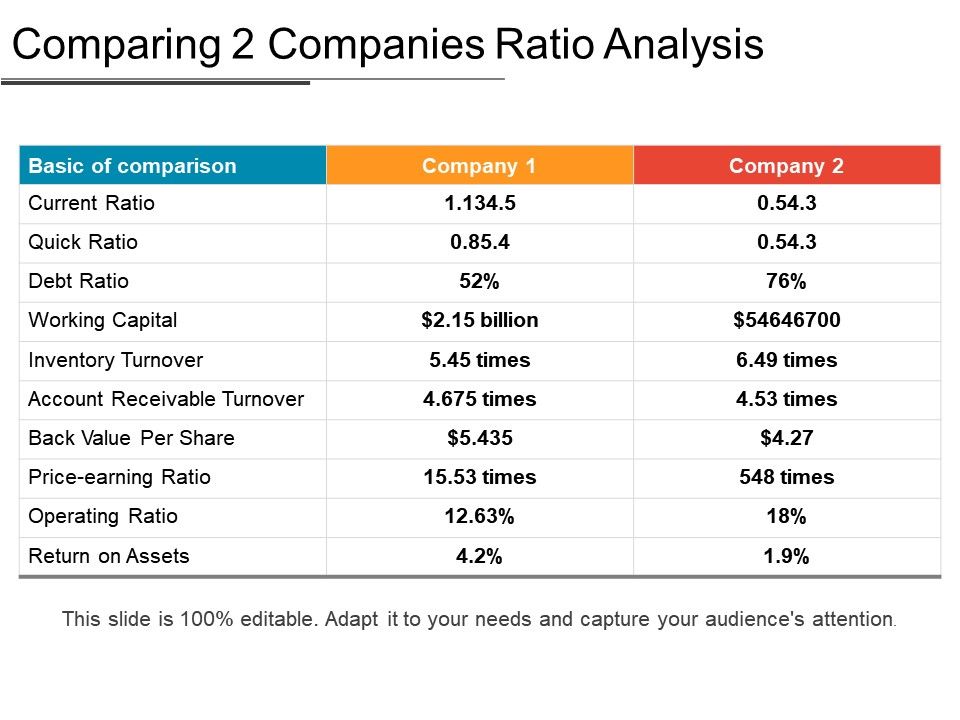

Also, monitoring financial ratios over time can help investors adjust their investment strategies accordingly. While profitability helps understand how profitable a. This metric can tell you.

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios, business risk ratios, financial risk ratios, stability ratios, etc. There are numerous financial ratios that are used for ratio analysis, and they are grouped into the following categories: What are the four types of financial ratios?

Analysis of financial ratios serves two main purposes: How to calculate and interpret financial ratios? What are the four types of financial ratios?

Financial ratios are classified into several groups, including, 1. Key financial ratios. Here are some of the most important financial ratios to know.

Common liquidity ratios are the current ratio, the quick ratio, and the cash ratio. This article breaks down the ratios by classifying them into four groups, including: What are the main uses of financial ratios?

Although there are many financial ratios businesses can use to measure their performance, they can be divided into four basic categories. This key financial ratio shows whether a company has enough income to cover its debts and is often used to evaluate a company’s credit risk and debt capacity. The sum of its debt obligations, including lease payments).