Awesome Info About Three Main Financial Statements Cash Drawer Balance Sheet Under Armour Ratios

We’re going to explain each and show you how these three types of financial.

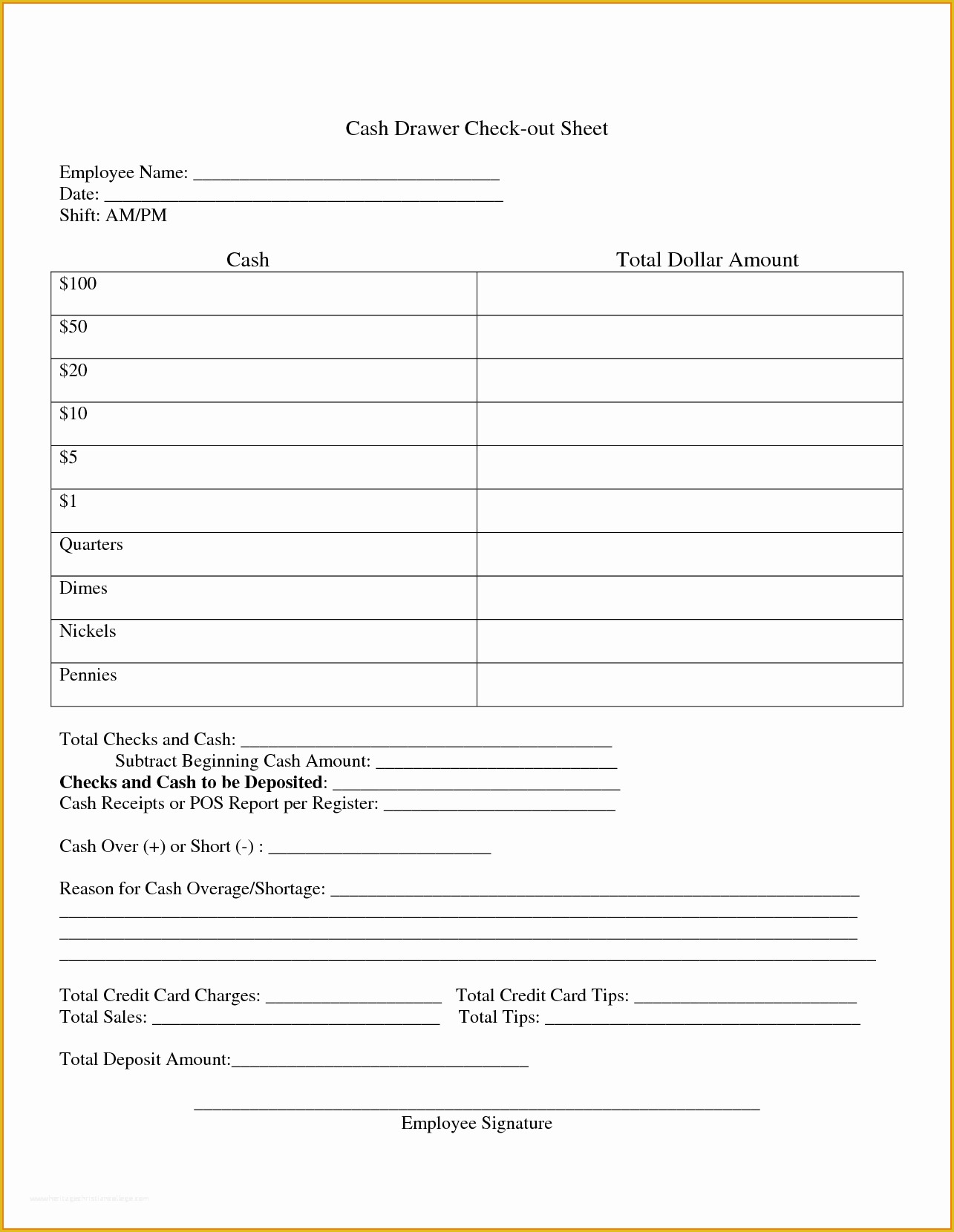

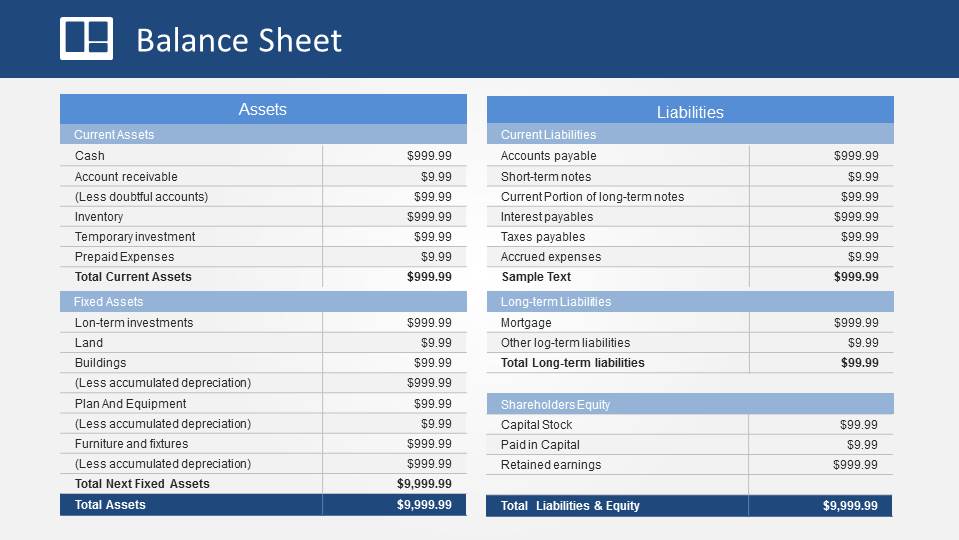

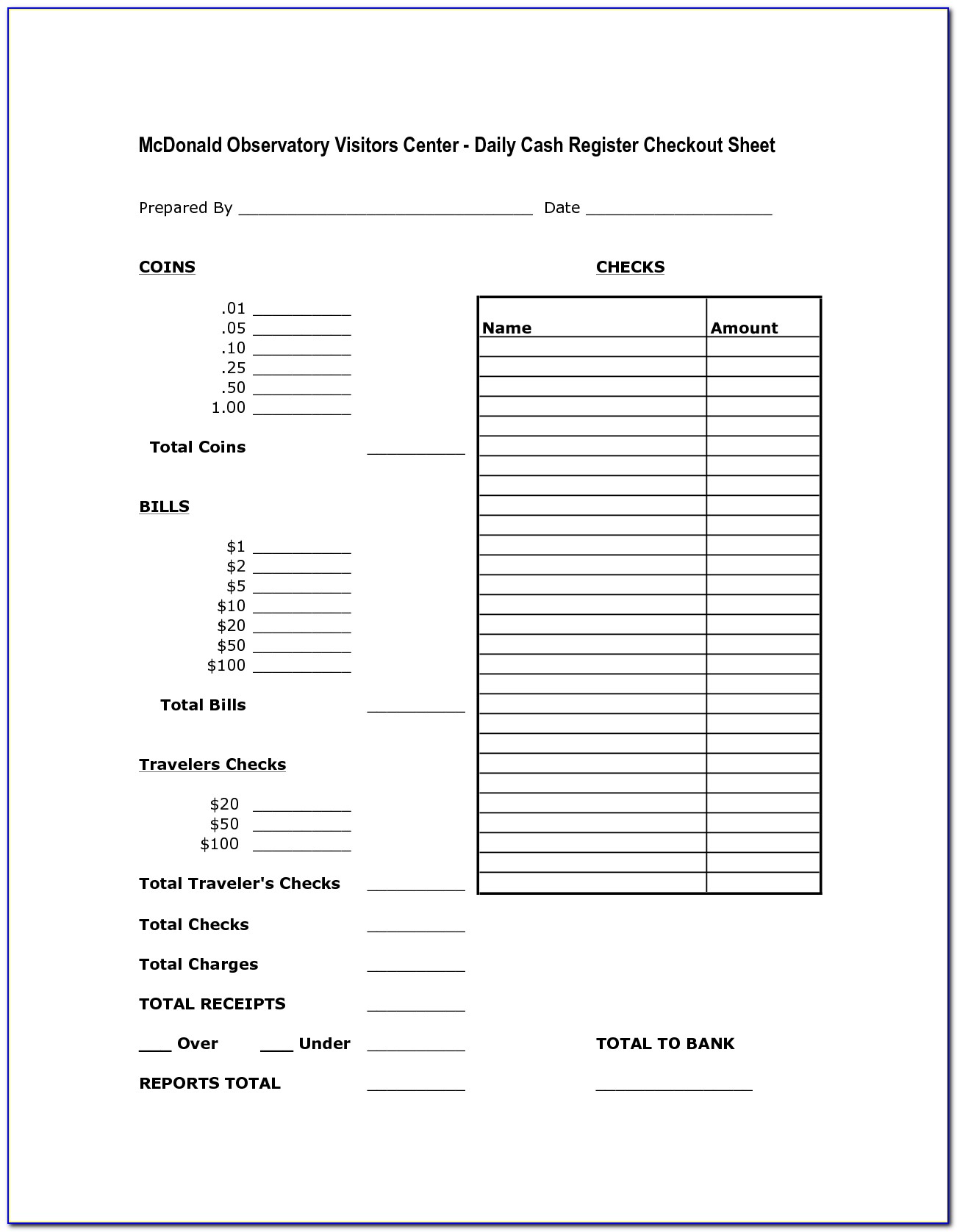

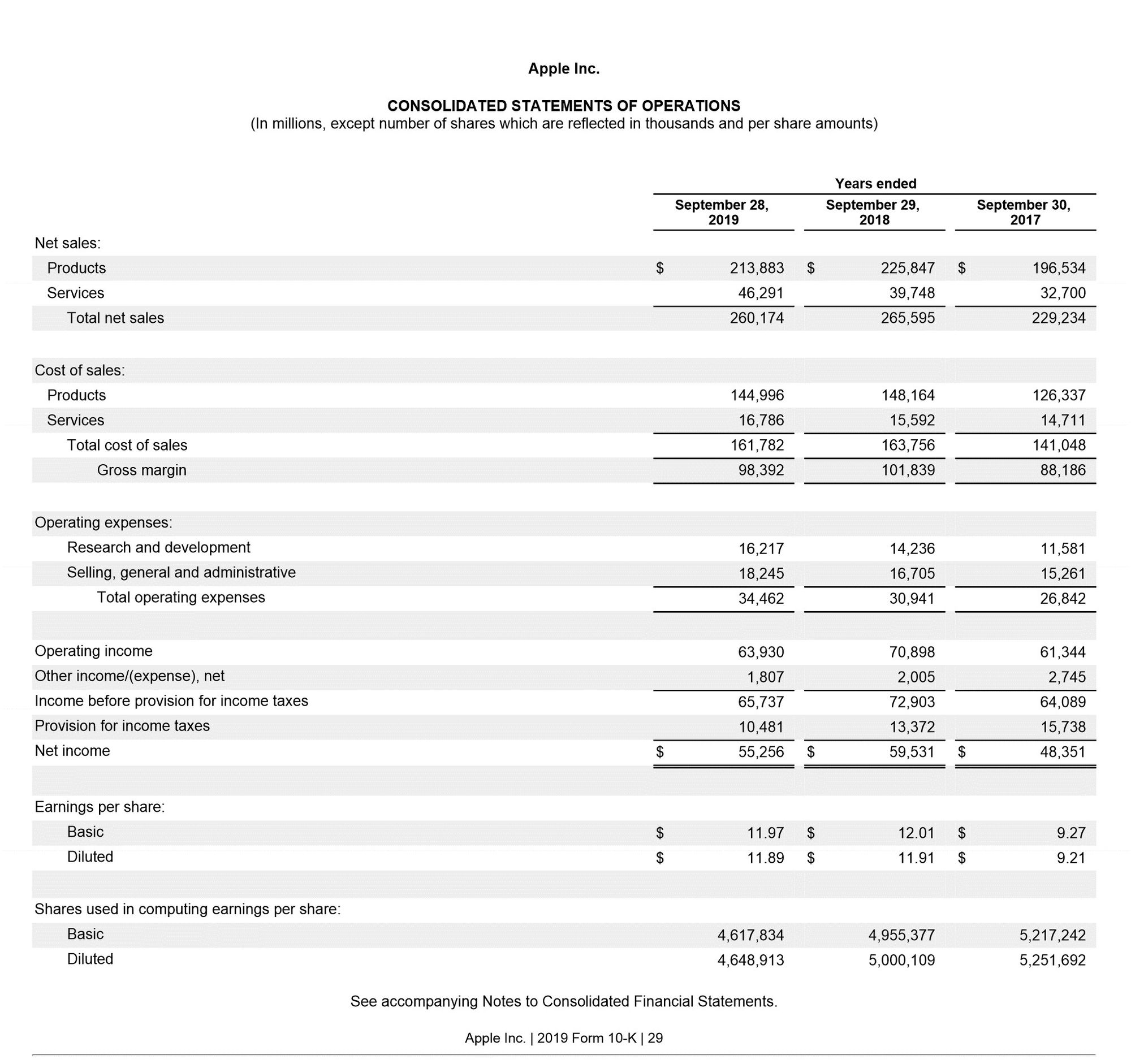

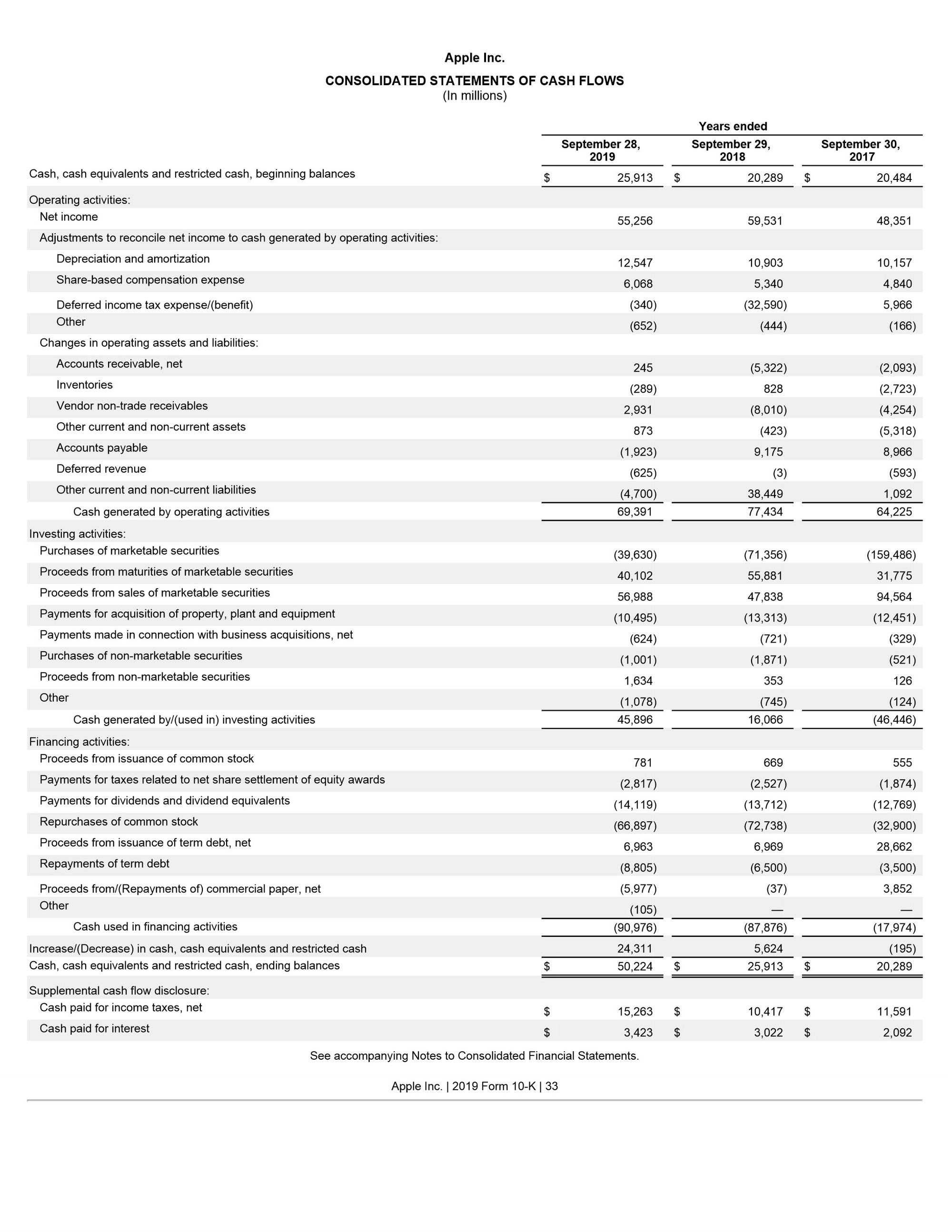

Three main financial statements cash drawer balance sheet. The primary three types of financial statements are the balance sheet, the income statement, and the cash flow statement. In this article, we will explain how to connect the three main financial statements and provide tips for successful financial statement analysis. The balance sheet, the income statement, and the cash flow statement.

Each offers unique details about a business’ activities and together provide a comprehensive view of a company’s operating activities. An overview the balance sheet and cash flow statement are two of the three financial statements that companies issue to report their financial performance. The three main types of financial statements are the balance sheet, the income statement, and the cash flow statement.

The balance sheet is one of the three main financial statements, along with the income statement and cash flow statement. Learn about how the income statement, balance sheet, and cash flow statement are interconnected and used to analyze company performance. Net income from the bottom of the income statement links to the balance sheet and cash flow statement.

The model is built by first entering and analyzing historical results. The income statement is a statement that illustrates the profitability of the company. The information in each of these statements is linked to the information in the other two statements.

As fixed assets age, they begin to lose their value. Net income & retained earnings. The income statement, balance sheet, and statement of cash flows are required financial statements.

Balance sheet vs. Balance sheet as the term balance sheet suggests, it is a tabular sheet of balances of assets, liabilities, and equity. For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it.

There are three main types of financial statements: These three statements are informative tools that traders can use to analyze a company's financial strength and provide a quick picture of a company's financial health and underlying value. So on a balance sheet, accumulated depreciation is subtracted from the value of the fixed asset.

Assets are normally classified as current assets and property plant and equipment. A financial statement segments into three divisions; These three statements together show the assets and liabilities of a business.

Considerable information is included on the balance sheet presented in figure 3.5 “balance sheet”.assets such as cash, inventory, and land provide future economic benefits for a company.liabilities for salaries, insurance, and the like reflect debts that are owed at the end of year.the $179,000 capital stock figure indicates the. These three financial statements are intricately linked to one another. The balance sheet, income statement, and cash flow statement:

There are three financial statements that work together to create a complete picture of your business’s finances: The three main financial statements are the balance sheet, income statement, and cash flow statement. The three financial statements—income sheet, balance sheet, and statement of cash flows—provide granular financial forecasts that explain the future of your company's financial performance.