Wonderful Info About Difference Between Profit And Loss Gross Fixed Assets In Balance Sheet

That amounted to $1,468 apiece, no small matter in a country with a per capita gross domestic.

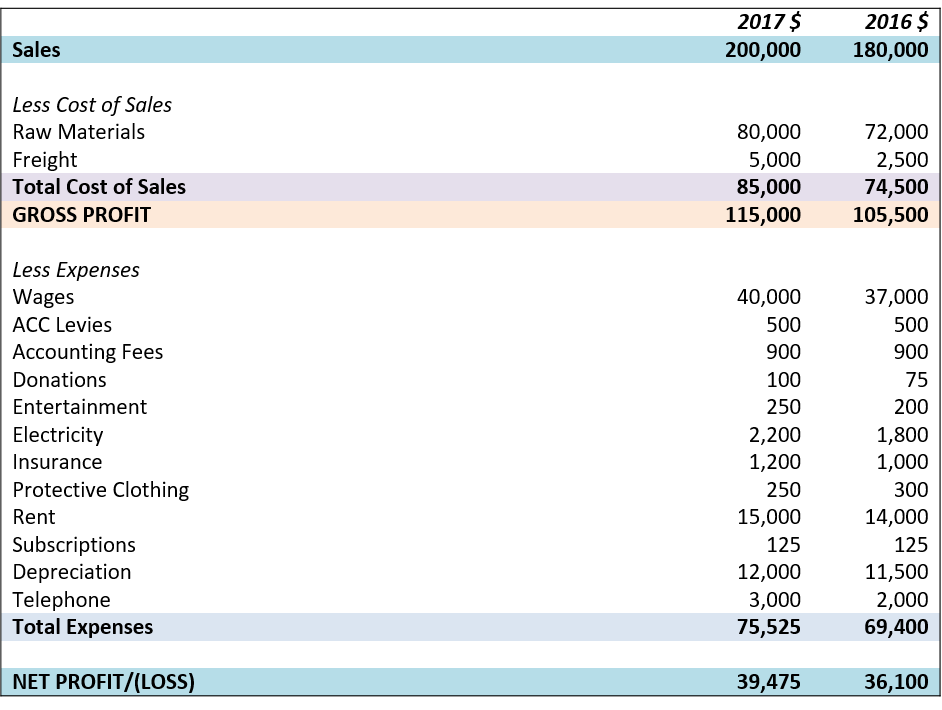

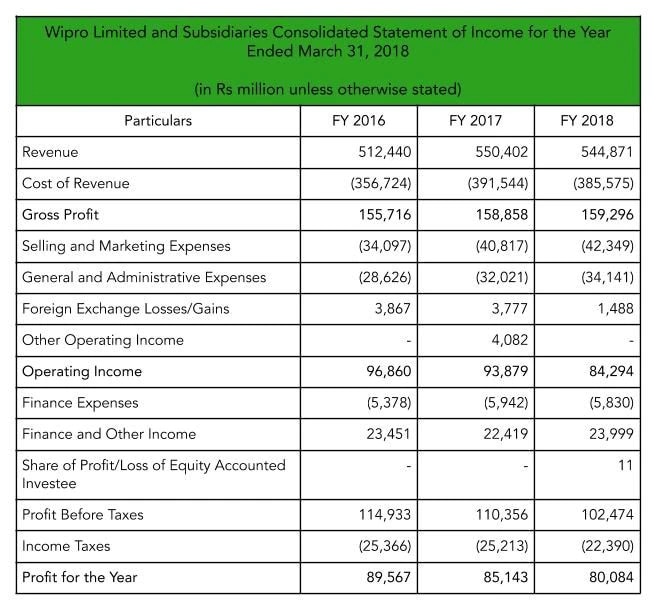

Difference between profit and loss. A profit and loss statement and a balance sheet are two core financial statements that businesses generate monthly, quarterly, and annually. Balance sheet discloses the valuation of these line items at a certain point of time, while a statement of profit or loss shows the revenues earned and expenses paid by a business for a specific period of time. Profit and loss account.

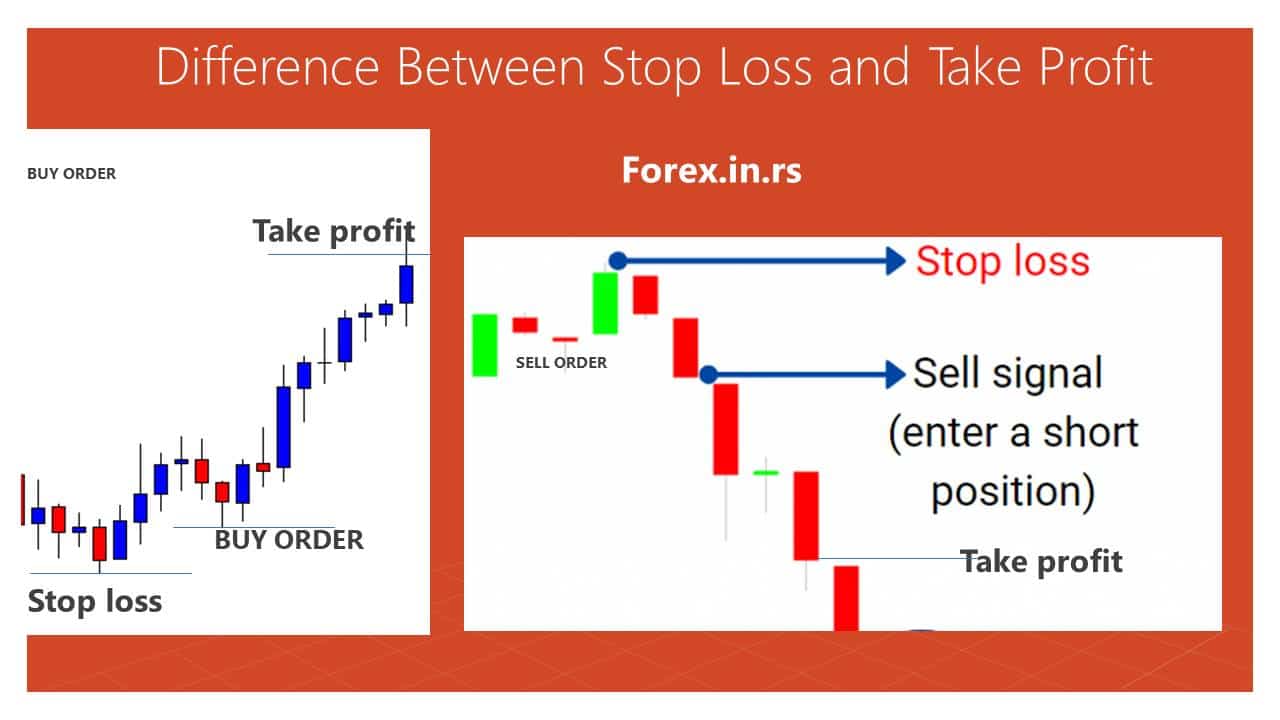

Realized pnl (rpnl)reflects the profits or losses for a closed trading position and is indicated by a number.if the position was fully. When experts prepare them a key difference between these two documents is that financial experts typically prepare them at different points in the business cycle. The main difference is that the balance sheet yields information regarding a company’s assets, liabilities, and shareholders’ equity, while the profit and loss statement summarizes information about revenues, and expenses.

Income statements are financial documents that convey the profit and expenses of a business during a given period, typically in months, quarters or years. In simple terms, a profit and loss account is a summary of an organisation’s expenses and revenues and ultimately calculates the net figure of the business in terms of profit or loss. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to new york attorney general.

Updated june 24, 2022 business leaders use financial statements to evaluate a company's financial health and performance. For example, if you sell 1,000 products for $200 each, your total revenue is $200,000. Profit and loss (p&l) statement.

A profit and loss account (p&l) reports the true financial position of the business, i.e. Key differences the profit and loss statement, commonly known as the income statement, plays a crucial role in illustrating a company's financial health by depicting its revenue, expenses, and net income or loss over a specific time frame. Profit and loss (p&l) statement refers to a financial statement that summarizes the revenues, costs, and expenses incurred during a specified period, usually a quarter or fiscal year.

Record annual profits from italy's two biggest banks last week showed both intesa sanpaolo and unicredit benefiting from a drop in loan losses, but also highlighted different policies towards. A balance sheet reports a company's assets, liabilities and shareholder equity at a specific point in. They reveal the net profit during that period, which is one of the most important indicators of an organisation's success.

Gross profit vs. The financial status of the firm is revealed by way of the total amount of resources raised from different sources in the form of equity and liabilities and applied in the form of assets.

Pnl, also known as profit and loss, is a crucial financial metric that helps determine the profitability of investments or trading activity by calculating the difference between expenses and earnings. It is also commonly known as the p&l statement or income statement. These can wipe out gross profit and lead to a net loss (or negative net income).

What is the profit and loss statement (p&l)? What is the difference between a profit and loss statement and a balance sheet? It’s the very first line on the profit and loss statement.

A balance sheet is a declaration that details a company's. Revenue is the money your business makes from selling goods or services. The financial statements that show a company's profits during a certain period are called income statements or profit and loss statements.

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)