Top Notch Tips About Provision For Doubtful Debts In Income Tax Financial Analysis Summary Example

The provision for doubtful debts is the.

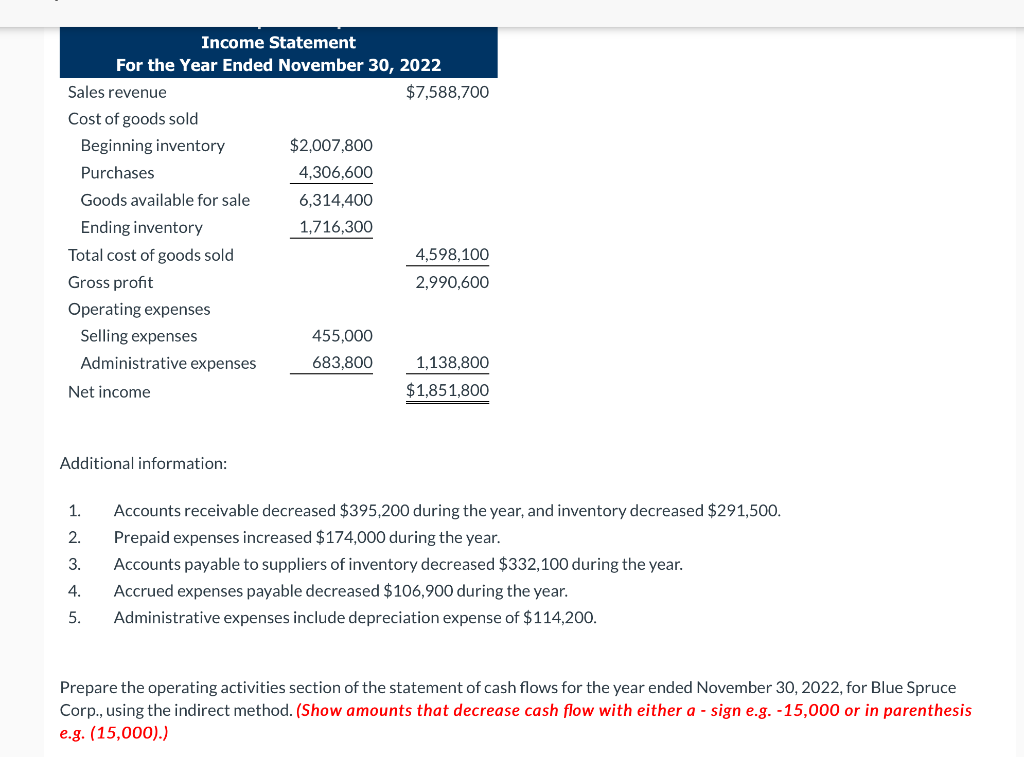

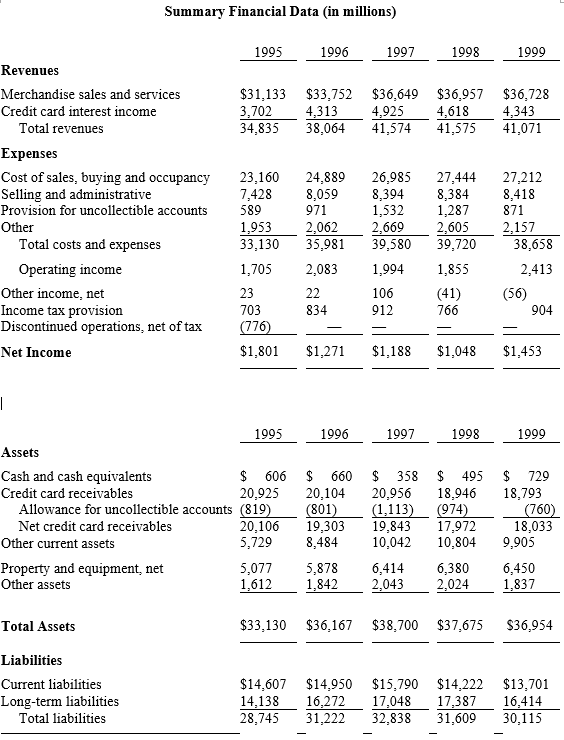

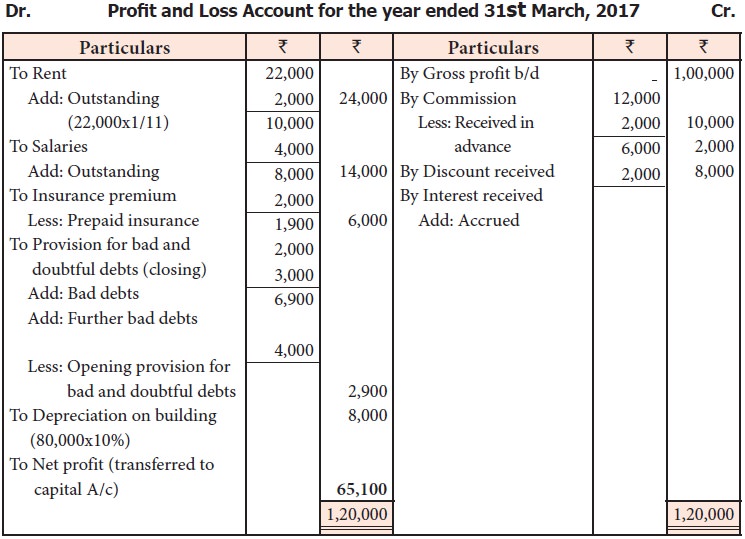

Provision for doubtful debts in income tax. Provision for bad and doubtful debts (general) (note impairment loss on trade debts) provision for obsolete stocks (general) reinstatement costs (expenses incurred to. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an.

As regards provision for doubtful debts, ld. The assessee claimed deduction towards provision for bad and doubtful advances u/s 36 (1) (viia) of the act at 7.5% of the gross total income amounting to rs. A deduction is not allowed for a debt owed to a trader except:

No other assessee is allowed to claim the deduction on the provision of bad debts. From 1 april 2019, the law dealing with electronic services supplied by foreign entities into south africa was amended. New doubtful debts regime the provisions of section 11(j) of the income tax act (“the act”) allow for taxpayers to claim tax relief in respect of doubtful debts.

Counsel submitted that provision for doubtful debts are a part of the operating activities of a business. The limits on which the deduction is allowed to the. To qualify for a deduction for tax purposes, there should be evidence to.

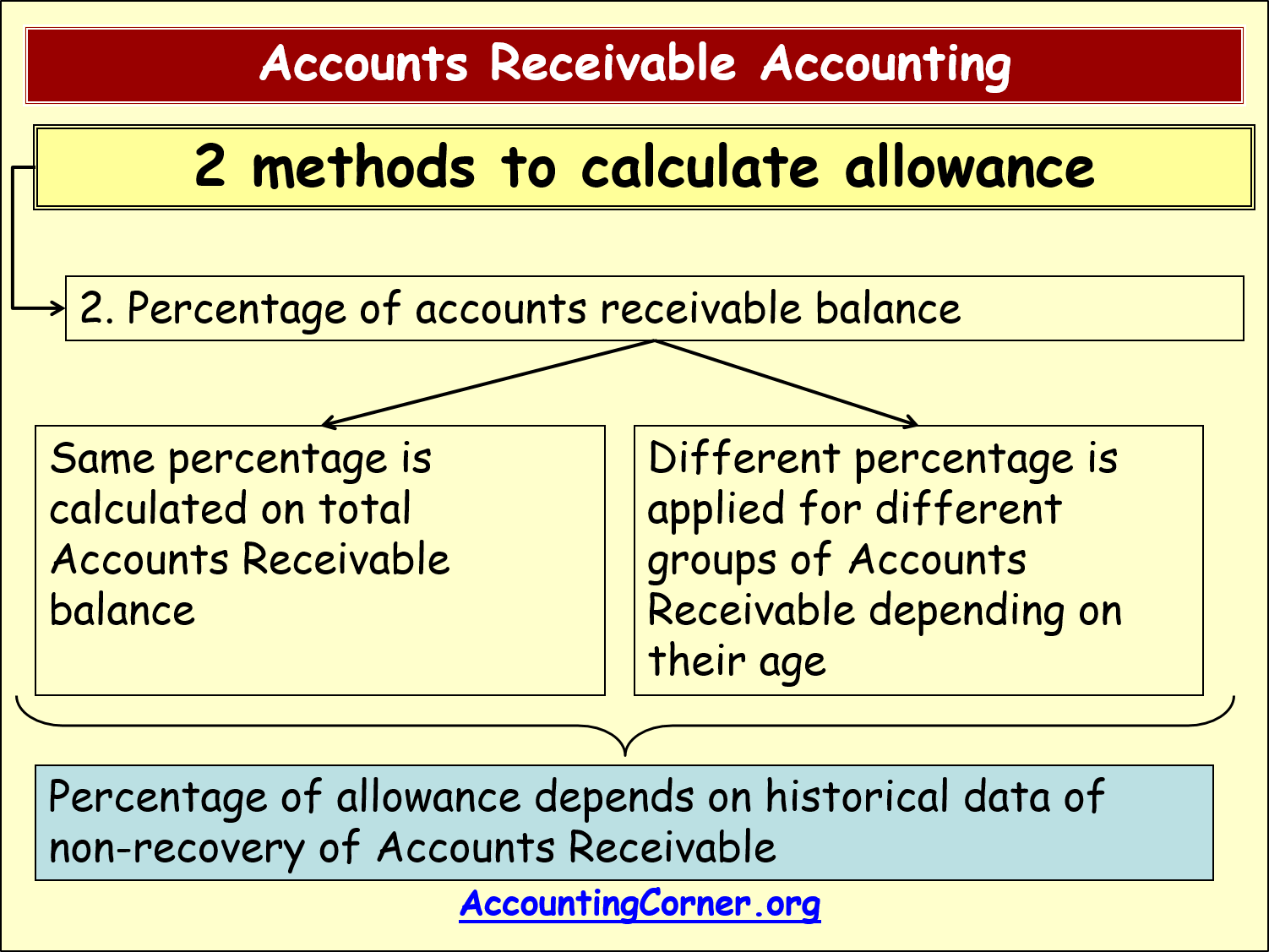

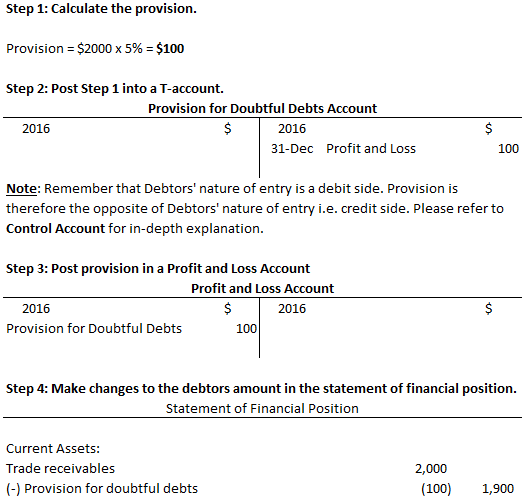

Creating a provision for doubtful debts for the first time dr income statement cr provision for doubtful debts for example: Specific provision for doubtful debts is tax deductible whereby each debt is evaluated separately. Trade receivables $10 000 a provision for.

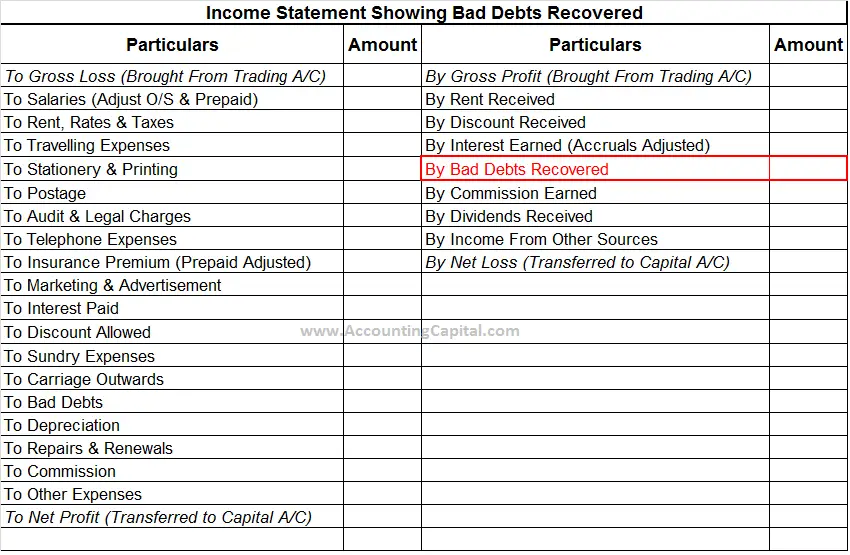

Section 11(j) of the income tax act 58 of 1962 (the act), as amended, provides for an allowance of doubtful debts in respect of trade debts of the taxpayer. Bad debts and provision for bad and doubtful debts. Until 2017, only specified categories of banks were permitted to claim deduction qua provision for bad and doubtful debts.

Provision for bad and doubtful debts our taxing statute shows discrimination between the banking sector and the business/industrial sector, as regards provision for. As per section 36(1)(viia) of the income tax act, 1961 only banks and financial institutions are allowed deduction in respect of the provisions made for bad and doubtful debts. The provision to permit claim of deduction for.

In the case of the bankruptcy or. With effect from 1 january 2019, the doubtful. A doubtful debt to the extent estimated to be bad.

The assessee in the year under consideration has claimed the deduction on account of provision for doubtful debts and doubtful advances amounting to rs.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)