Brilliant Info About Profit And Loss Income Statement Difference Wages Payable In Balance Sheet

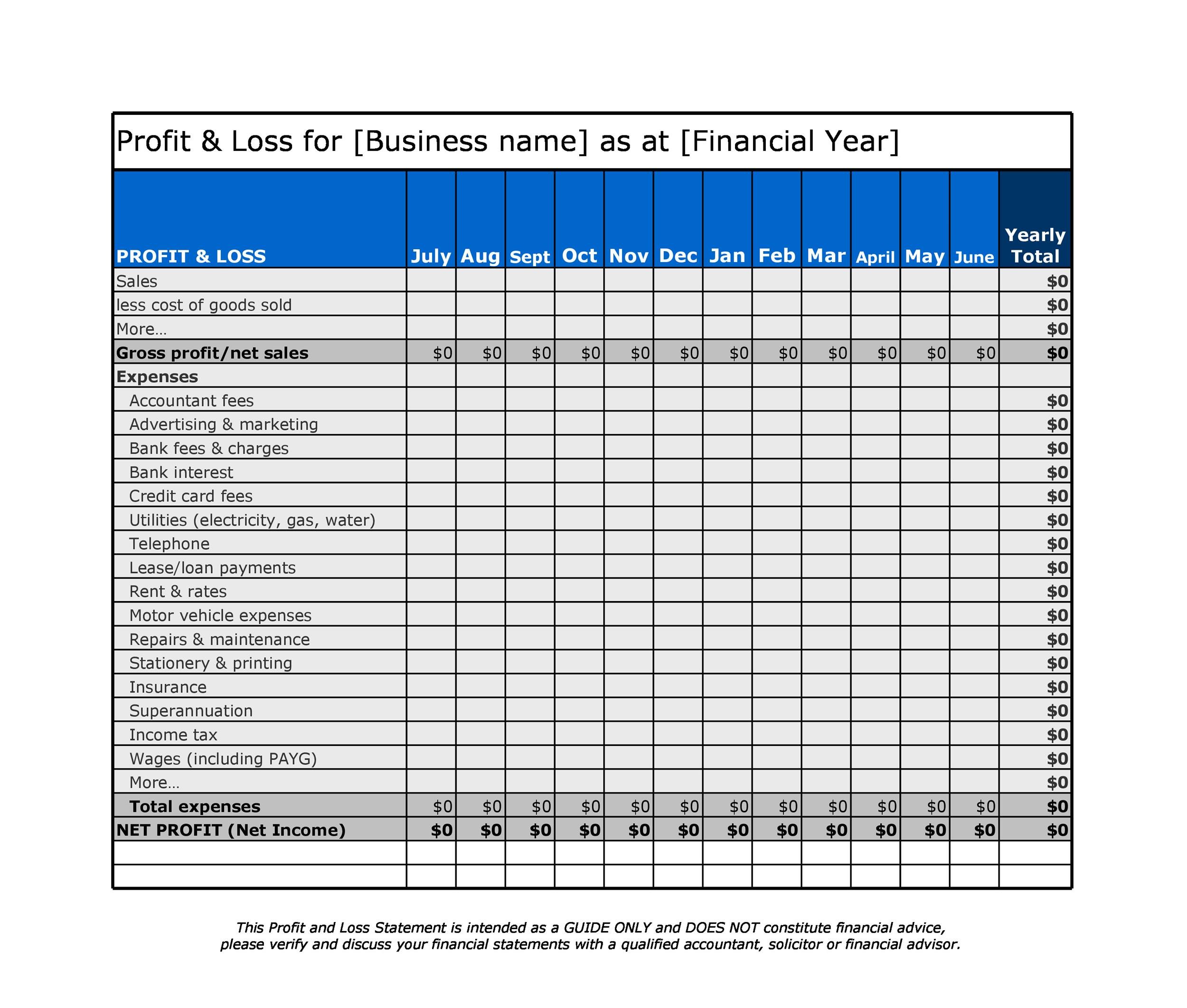

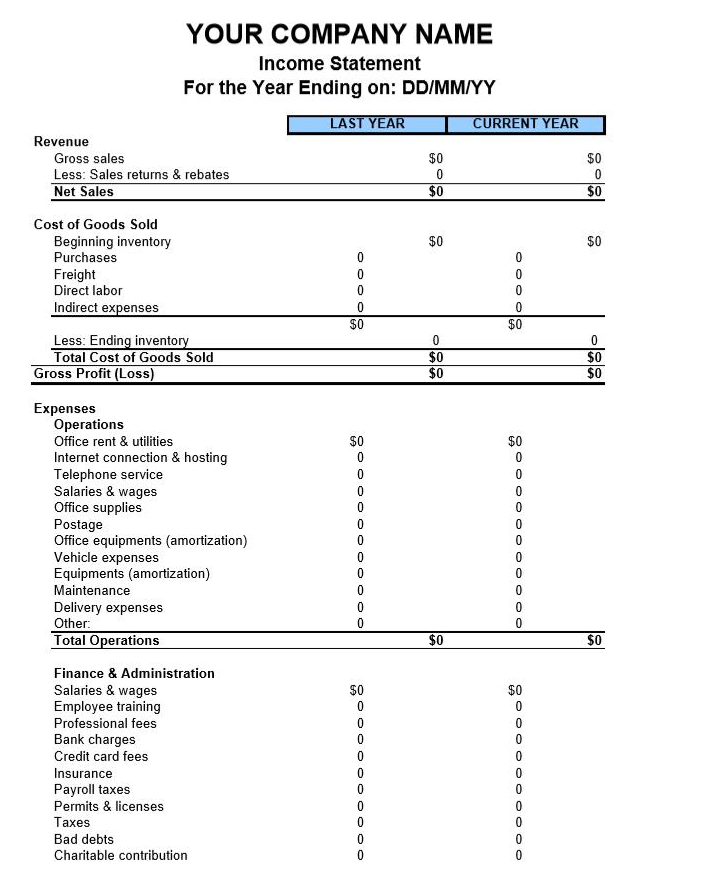

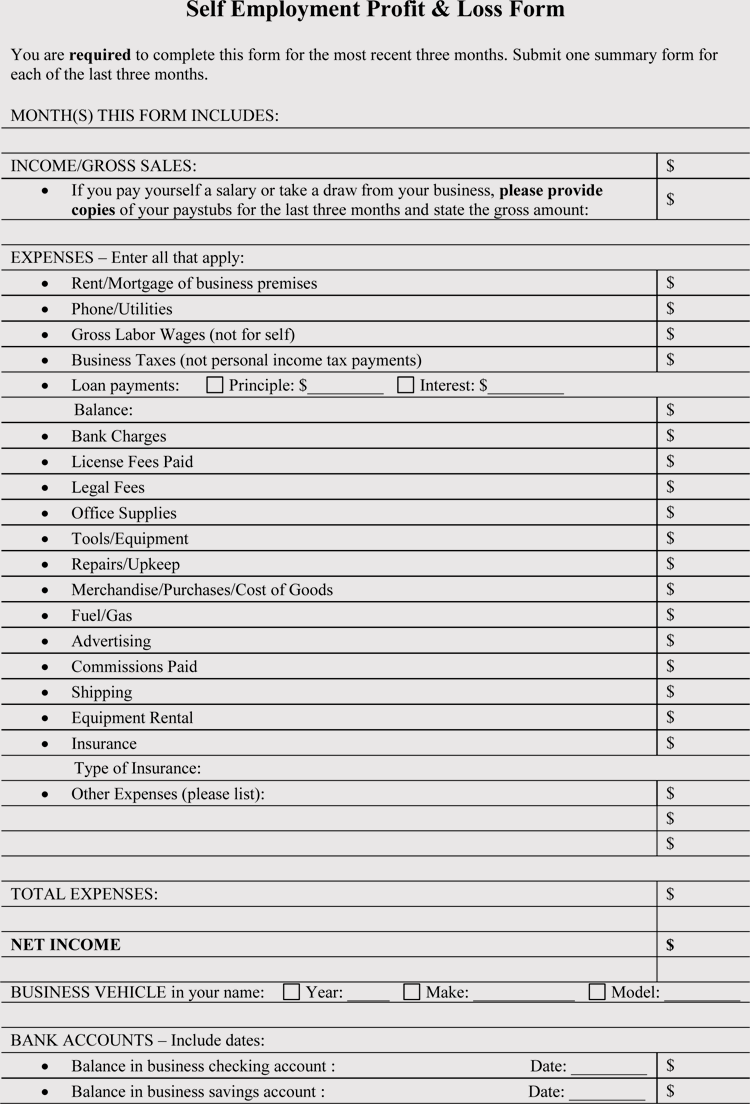

The profit and loss (p&l) statement (also known as an income statement) is one of the four basic financial statements that presents the revenues, expenses, and.

Profit and loss and income statement difference. The profit and loss statement, or “p&l statement”, is interchangeable with the income statement, one of the three. In this article, we explain the meanings of income statement vs profit and loss, compare them to one another. On the contrary, a profit and loss account displays the income realized and costs incurred by the firm throughout the course of operations in a fiscal year.

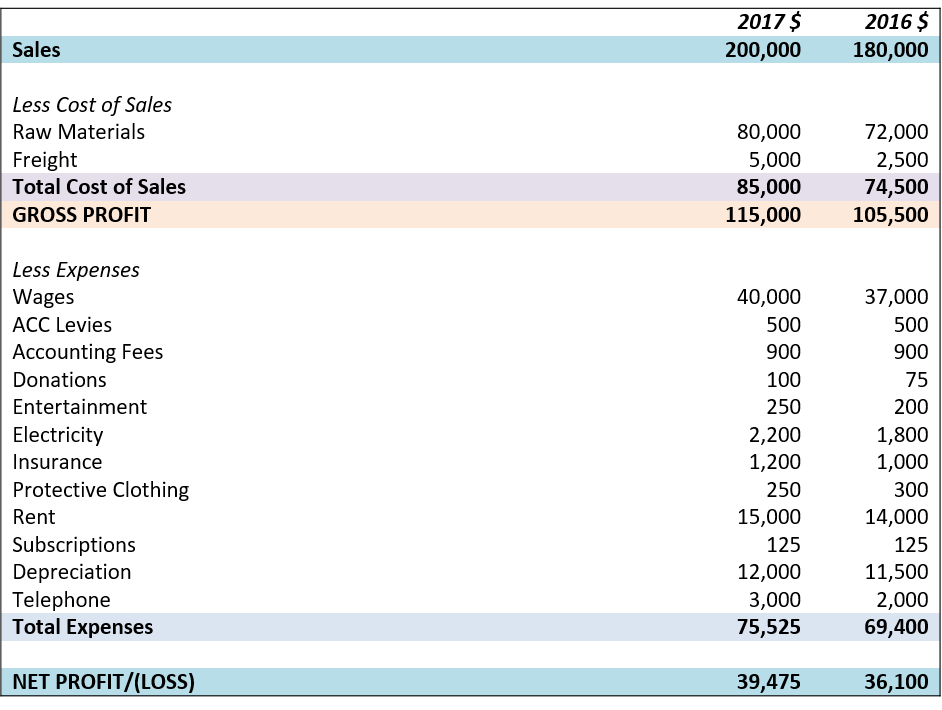

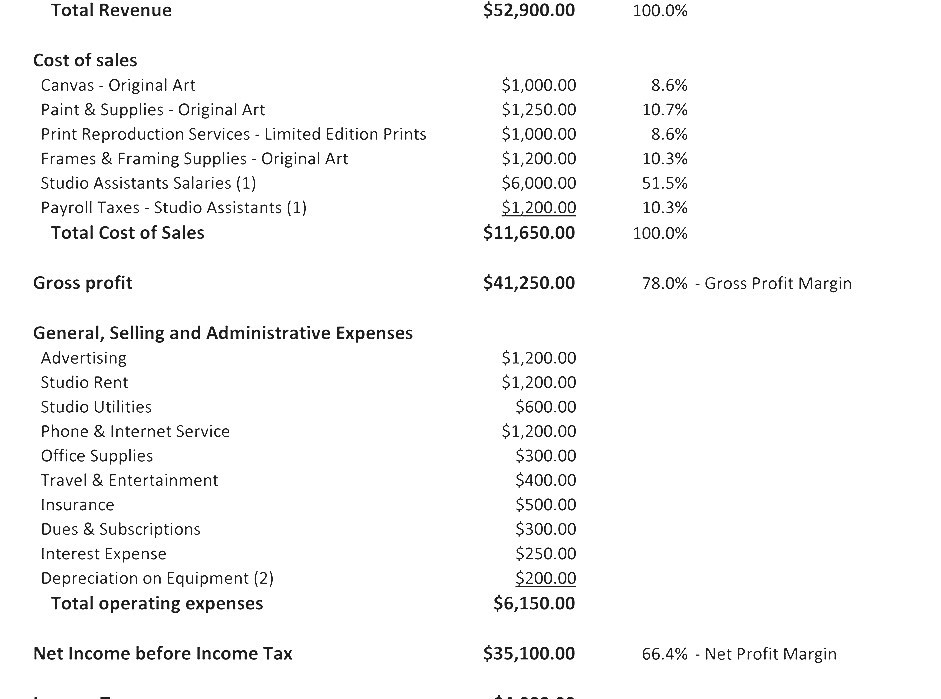

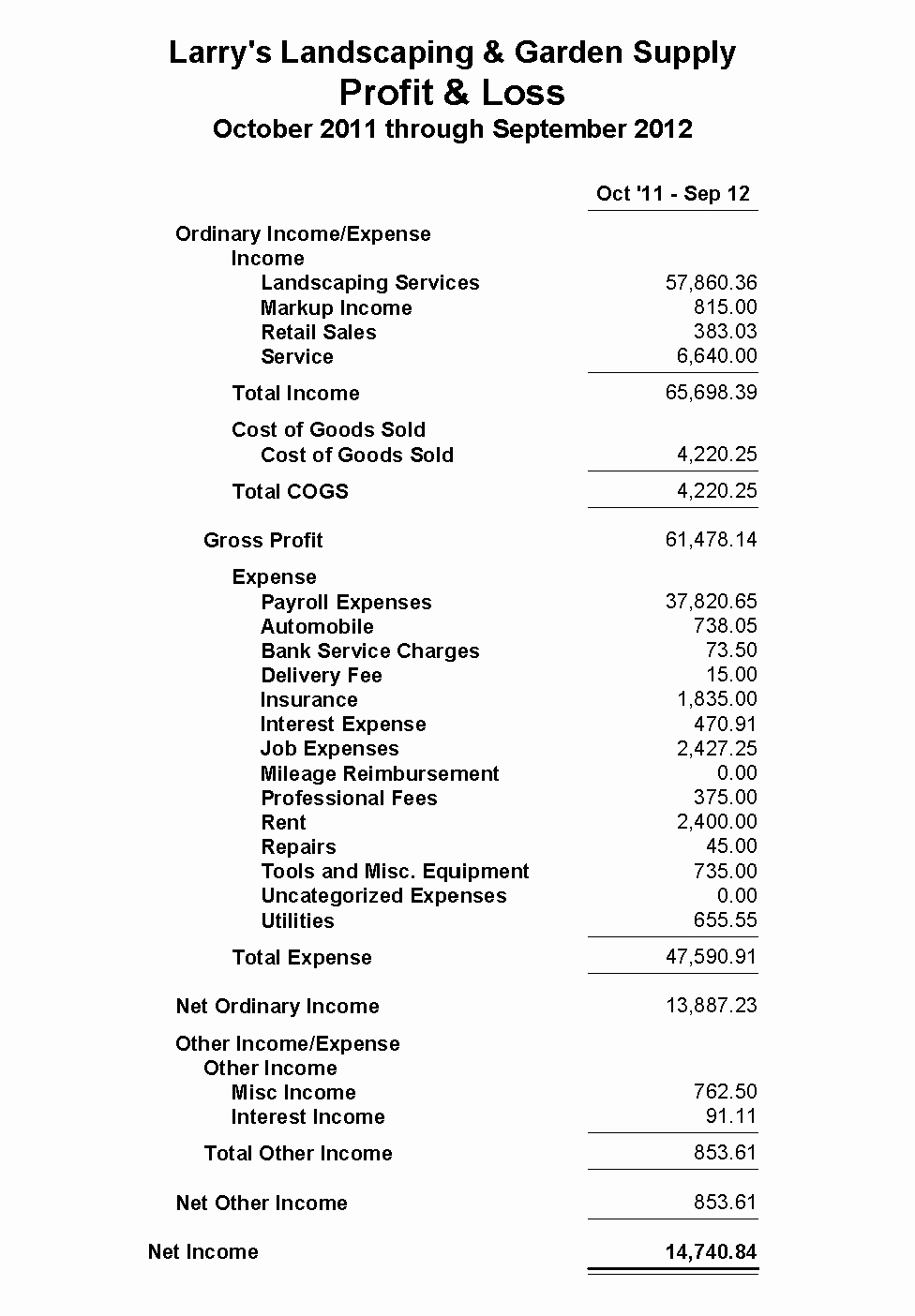

Revenue, expenses, and net income. By quickbooks july 13, 2022 when looking at your financial statements,. A profit and loss statement includes a business’s total revenue, expenses, gains, and losses, arriving at net income for a specific accounting period.

More advanced profit and loss statements also include. The other two are the. How to read a profit and loss statement.

The profit & loss statement, also known as an income statement or p&l statement, is a financial document that shows the revenues and expenses of a business over a specific. The income statement shows the profit/loss for any date/day of the year while a profit & loss statement reports profit/loss for the whole accounting period. A new york judge has ordered former president donald trump and executives at the trump organization to pay over $364 million in a civil fraud case, handing a win to.

A p&l statement (sometimes called a statement of operations) is a type of financial report that tells you how profitable your business was over a given period. The main difference between the two is that an income statement is more comprehensive than a profit and loss statement. An income statement shows all of a.

The difference between gross profit and operating expenses; Let’s look at each of the profit & loss/income statement types one by one. Understanding the differences between gross profit and net income can help investors determine whether a company is earning a profit and, if not, where the.

The income statement is a financial document that shows how much money a company has earned over a specific period of time, while the profit and loss statement is focused. The p&l statement is one of three primary financial statements that businesses use to record and report their financial performance; Accounting balance sheet vs.

Understanding an income statement vs profit and loss can help you determine a business's performance and how you can improve it. A profit and loss statement is a snapshot of a company's sales and expenses over a period of time, such as one year.

![[Free Template] What Is a Profit and Loss Statement? Gusto](https://gusto.com/wp-content/uploads/2019/05/Profit-and-Loss-Statement-Overview.jpg)

![53 Profit and Loss Statement Templates & Forms [Excel, PDF]](https://templatelab.com/wp-content/uploads/2015/11/Profit-and-Loss-27-790x1231.jpg)