Fun Info About Company Financial Statements Cash And Bank Balances

Prudent investors might also want to.

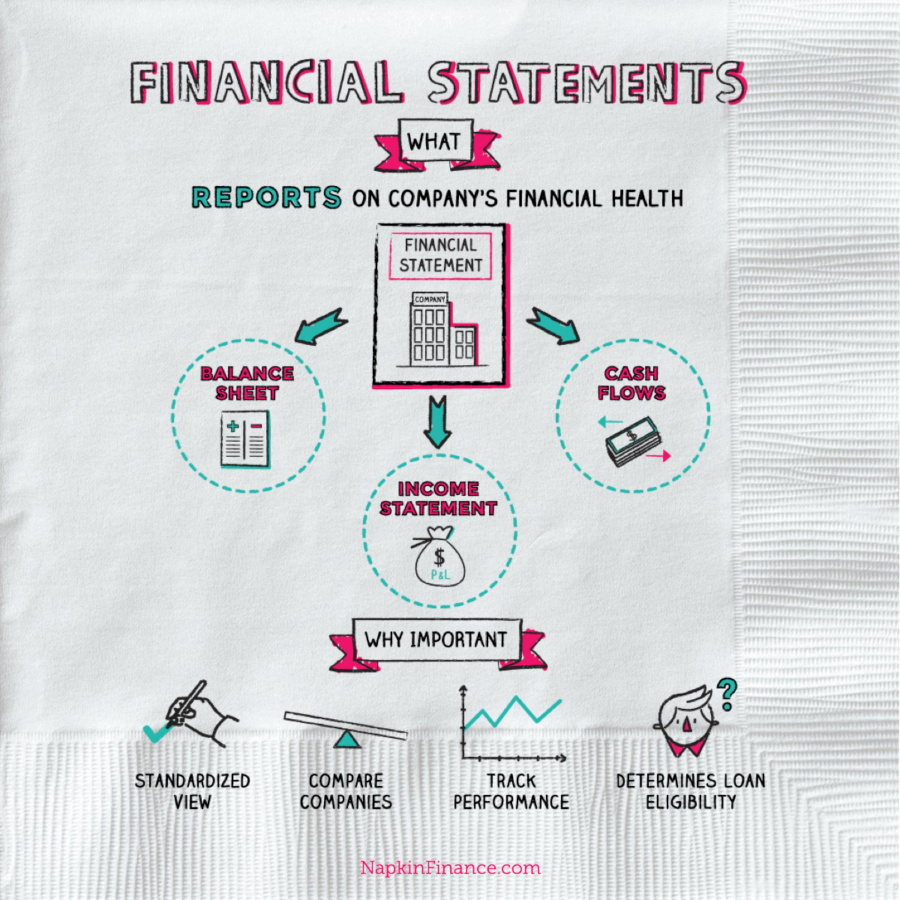

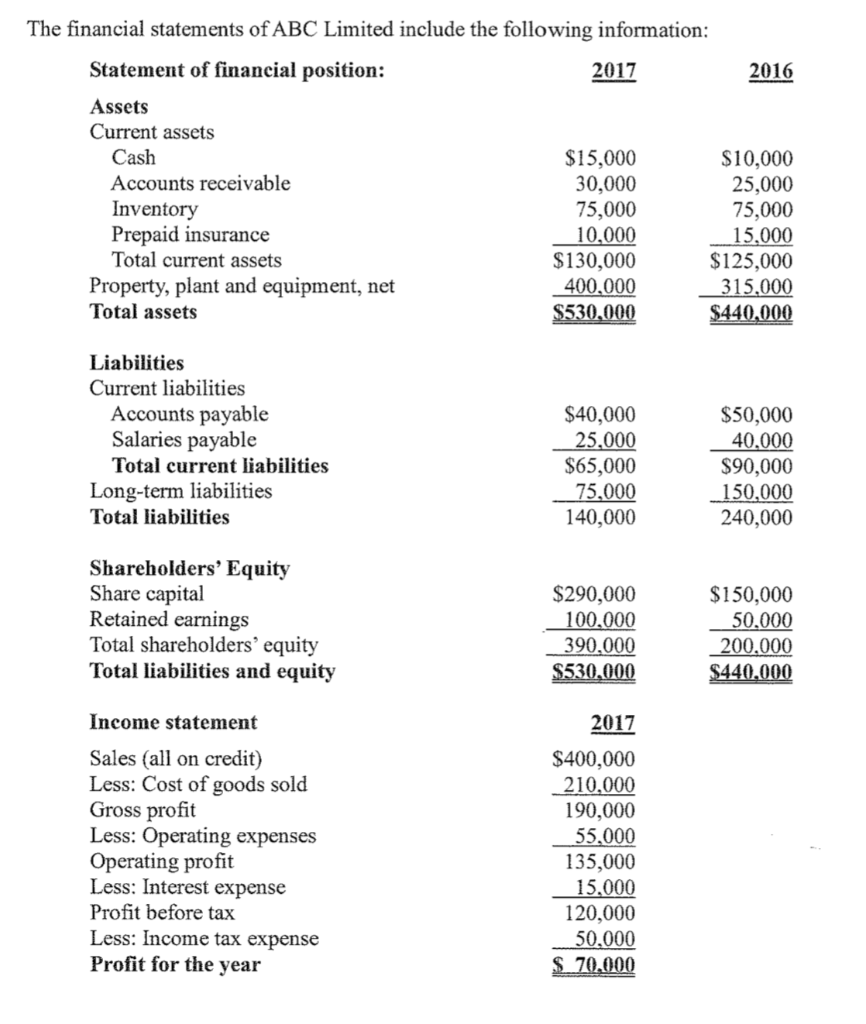

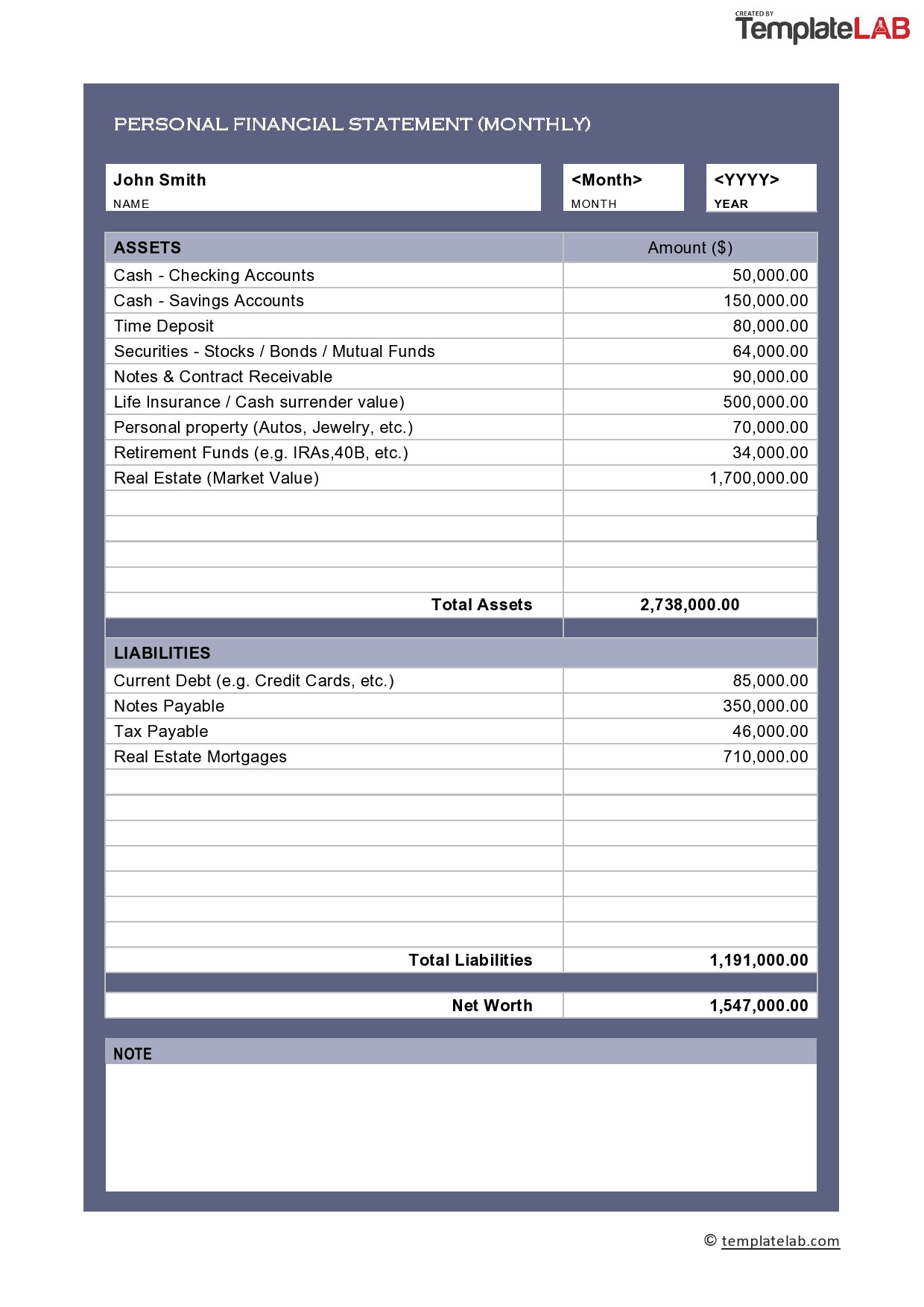

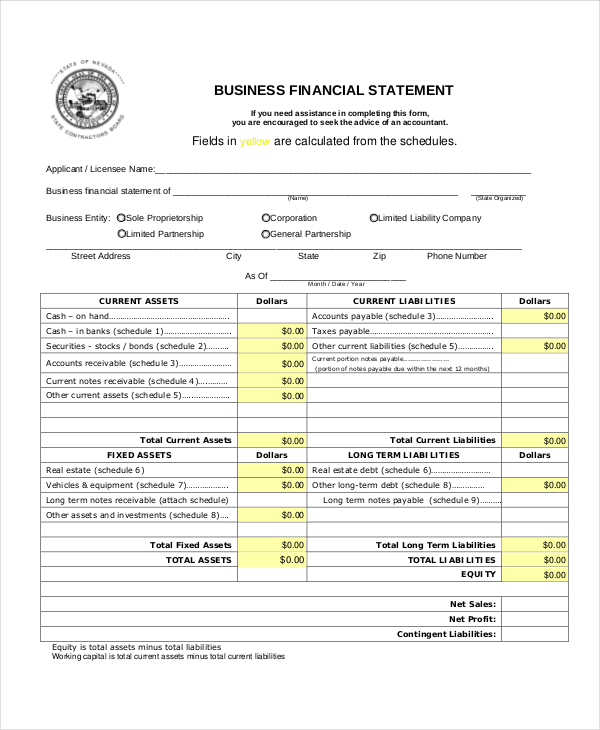

Company financial statements. There are four main financial statements. The value of these documents lies in the story they tell when reviewed together. Corporate finance financial statements financial statements financial statements are essentially the report cards for businesses.

They tell the story, in numbers, about the financial. These are prepared monthly, quarterly, and annually based on the purposes they are used for. And (4) statements of shareholders’ equity.

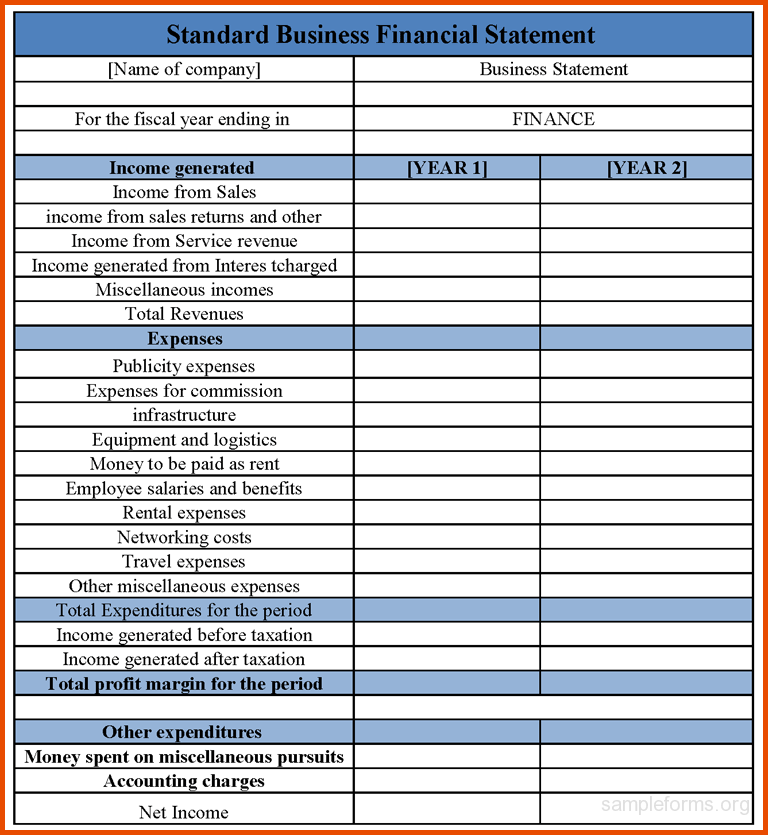

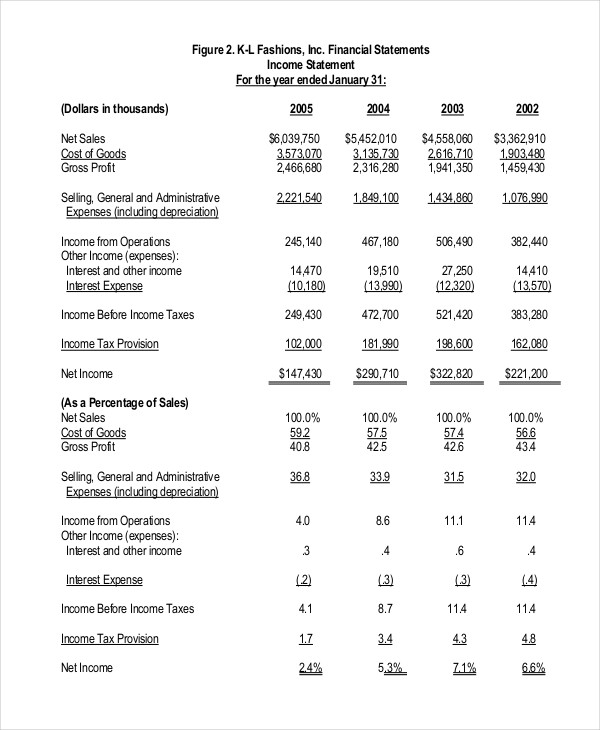

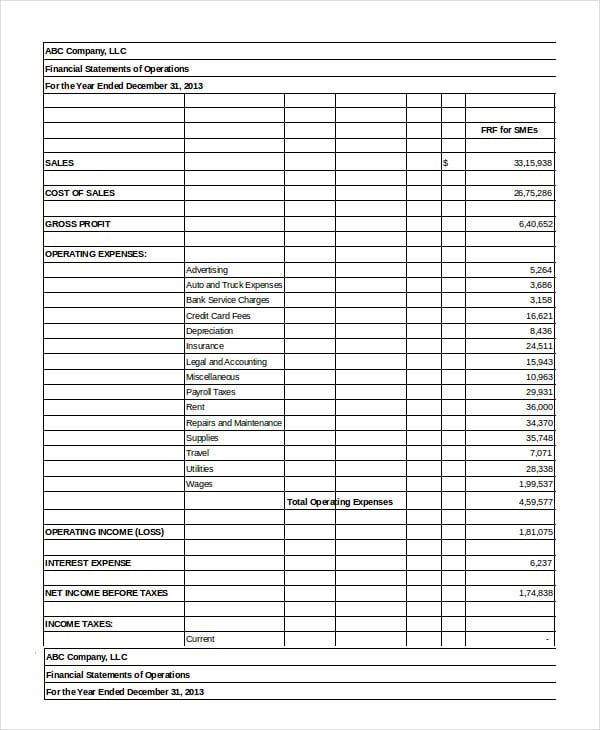

Balance sheets, income statements, cash flow statements, and annual reports. Income statement analysis most analysts start their financial statement analysis with the income statement. Here are all of the financial statements prepared by companies:

June 8, 2022 this article is tax professional approved there are three main types of financial statements: These three statements together show the assets and liabilities of a. How to read a balance.

What are the three financial statements? Intuitively, this is usually the first thing we think about with a business… we often ask questions such as, “how much revenue does it have?” “is it profitable?” and “what are the margins like?” Each of the financial statements provides important financial information for both internal and external stakeholders of a company.

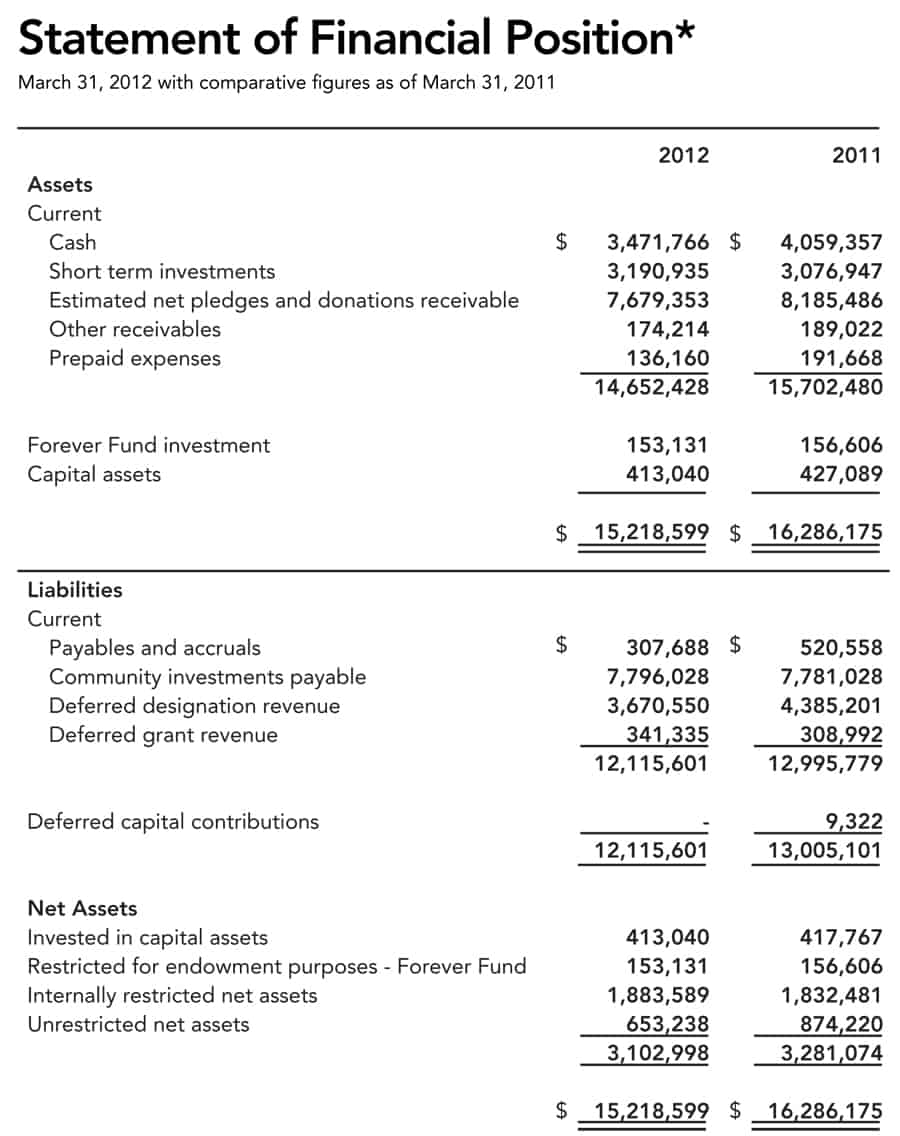

Income statements show how much money a company made and spent over a period. To understand a company’s financial position—both on its own and within its industry—you need to review and analyze several financial statements: (1) the income statement, (2) the balance sheet, and (3) the cash flow statement.

There are four sections to a company's financial statements: The balance sheet, the income statement, the cash flow statement, and the explanatory notes. The balance sheet, the income statement, and the cash flow statement.

Financial statements are records that reflect how a company has performed financially in a fiscal year. Balance sheets show what a company owns and what it owes at a fixed point in time.

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.45.59AM-aab9d8741c8f4ee1aff95f057ca2ab3a.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-01-3998c75d45bb4811ad235ef4eaf17593.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-03-aac8341b98da4fd3a4f13ed3ee7fa053.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Financial_Statements_Aug_2020-02-6a82acc4cf2d4434a77899c09d49e737.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2022-04-26at10.48.43AM-b060c24322b74084aa691c24b753b3fc.png)