Outrageous Info About Net Cash Inflow From Operating Activities Types Of Assets On Balance Sheet

We view the number of active.

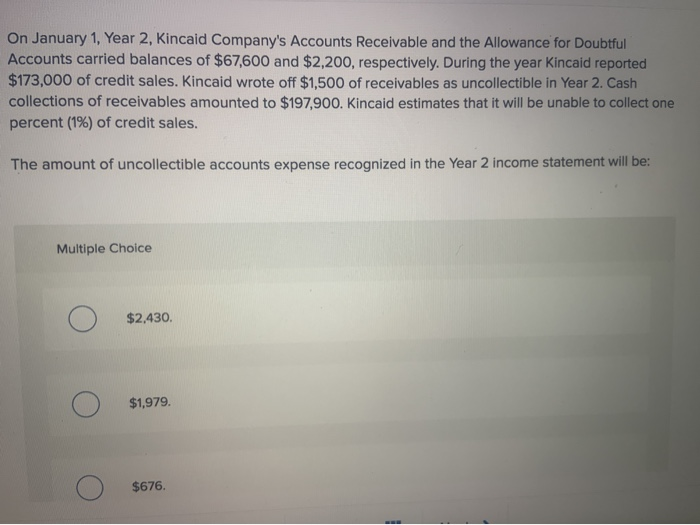

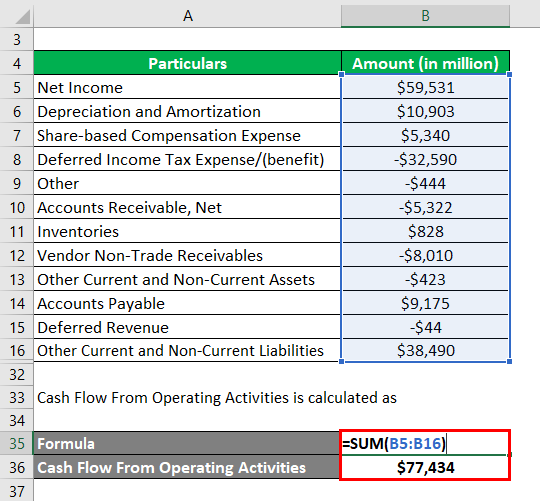

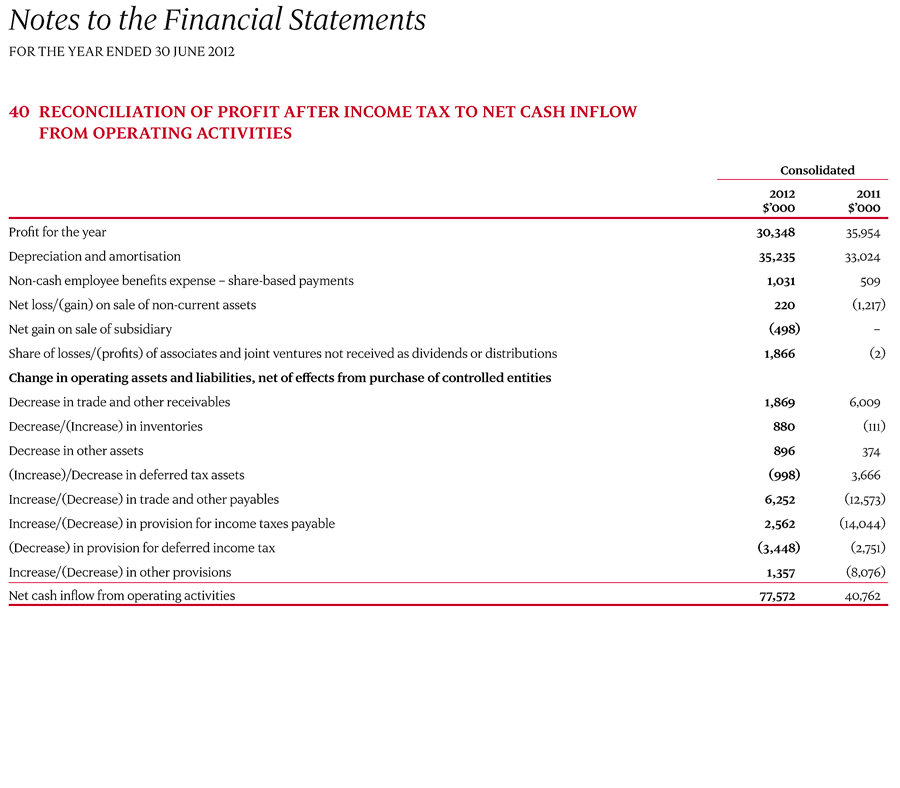

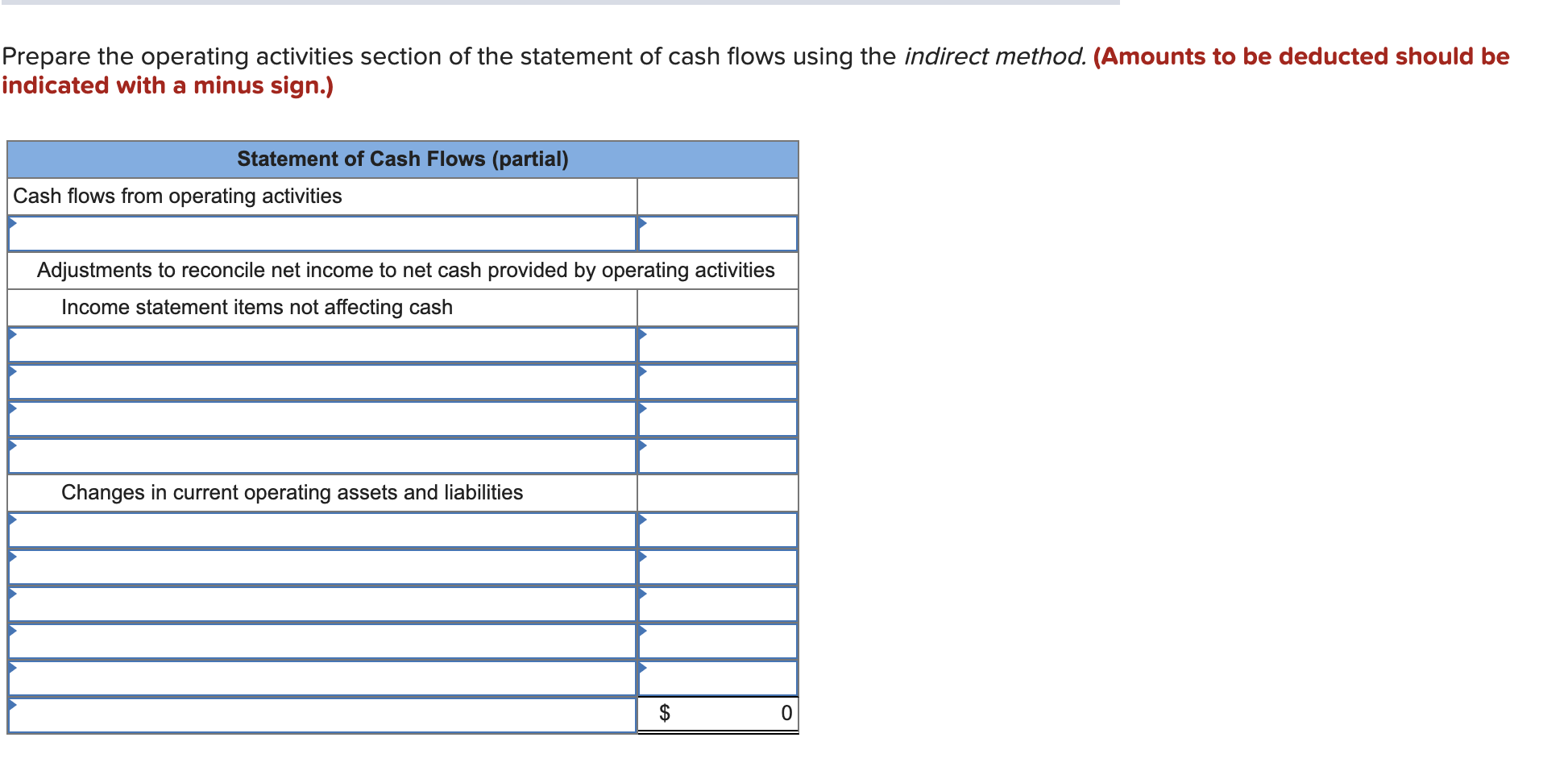

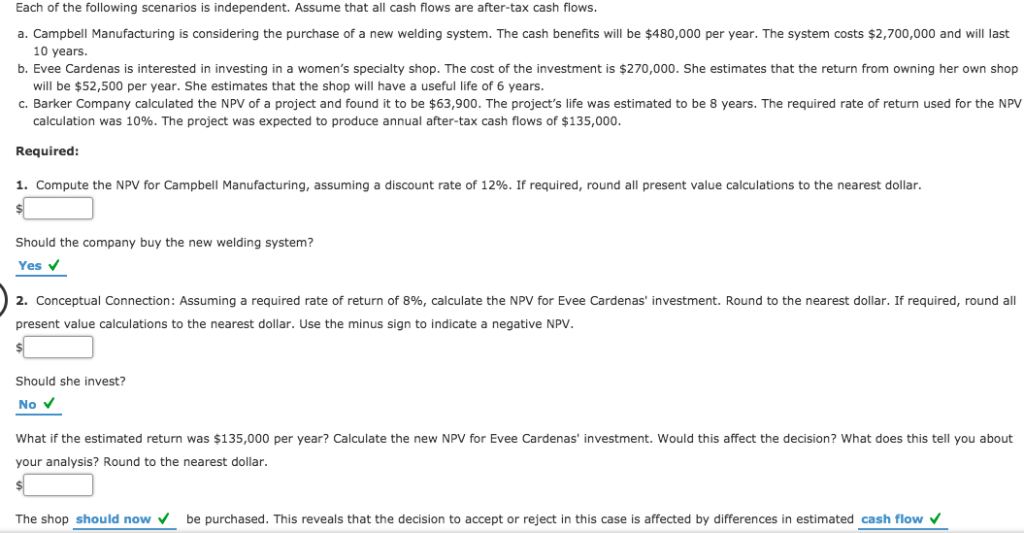

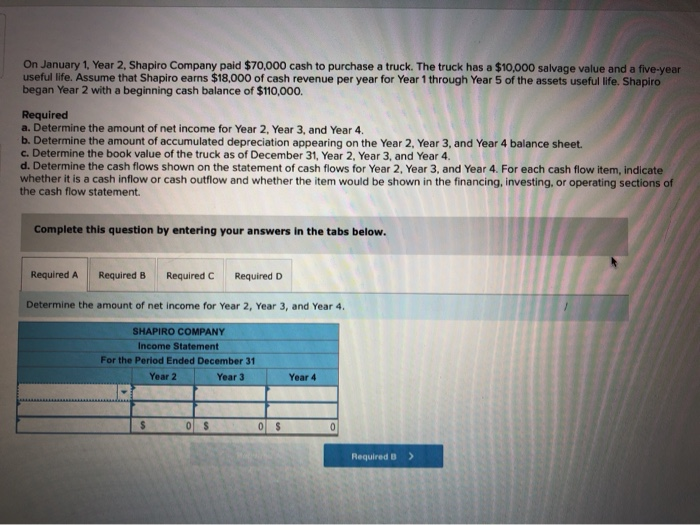

Net cash inflow from operating activities. The statement of cash flows reports cash inflows and/or cash outflows in each of three sections: Begin with net income from the income statement. While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used:

These operating activities may include: Cash flow from operating activities is the first of the three parts of a company's cash flow statement. Net cash flow can be calculated in 3 simple steps.

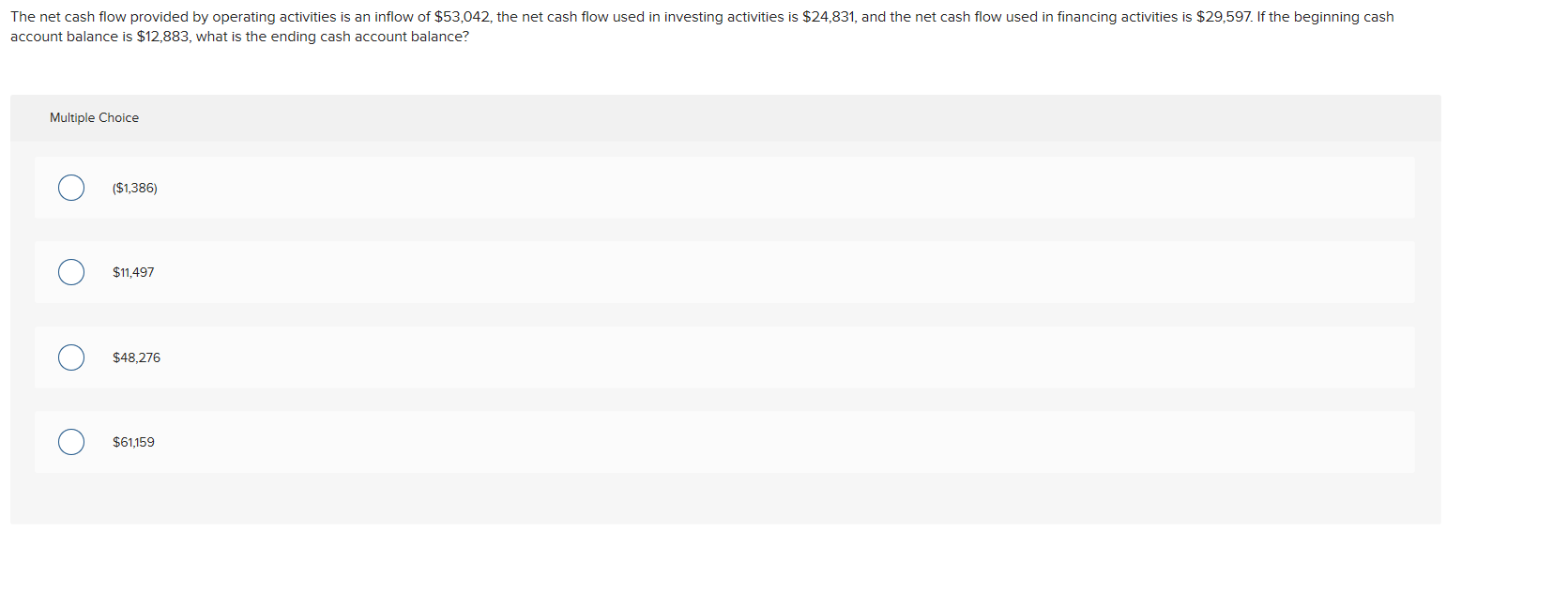

Net cash flow comes from three business activities: Updated april 13, 2021 what is net cash flow? Net cash flows from operating activities:

As such, you can calculate cash flow from operating activities using the following formula: Cash flow from operations formula. The change in active customers in a reported period captures both the inflow of new customers as well as the outflow of existing customers who have not made a purchase in the last twelve months.

Some examples of cash inflows from investing activities include the sale of investment properties or securities. Net cash flow can be broken down into three components: Net outflow from investing activities:

First and foremost, calculate the cash flow from operating activities. Finance document from metropolitan community college, omaha, 1 page, norbert company reports the following net cash flows in its statement of cash flows: Net cash flow from operating activities, as we have defined, primarily deals with the production.

Net cash flow is the difference between a company’s cash inflows and outflows within a given time period. To transform a company’s income statement into its cash flows from operating activities, three distinct steps must be taken. Net cash flow from operating activities vs investing and financing activities operating activities.

A company has a positive cash flow when it has excess cash after paying for all operating costs and debt payments. Cash flow from operations is the first of the three parts of the cash flow statement that shows the cash inflows and outflows from core operating the business in an accounting year; Determine net cash flows from operating activities using the indirect method, operating net cash flow is calculated as follows:

7.2.2 cash inflows and outflows. Record cash inflow for the year from operating activities includes a $270 million working capital inflow more than offsetting a prior year $202 million outflow, predominantly from destocking. Cash generated and spent by a company to be able to run standard business operations.

Cash flow from operating activities may also be referred to as operating cash flow (ocf) or net cash provided from operating activities. Add back noncash expenses, such as depreciation, amortization, and depletion. Net inflow from financing activities:

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)