First Class Info About Not For Profit Accounting Standards Financial Statement Of Nestle 2018

Certain portions may include material copyrighted by american institute of certified public accountants.

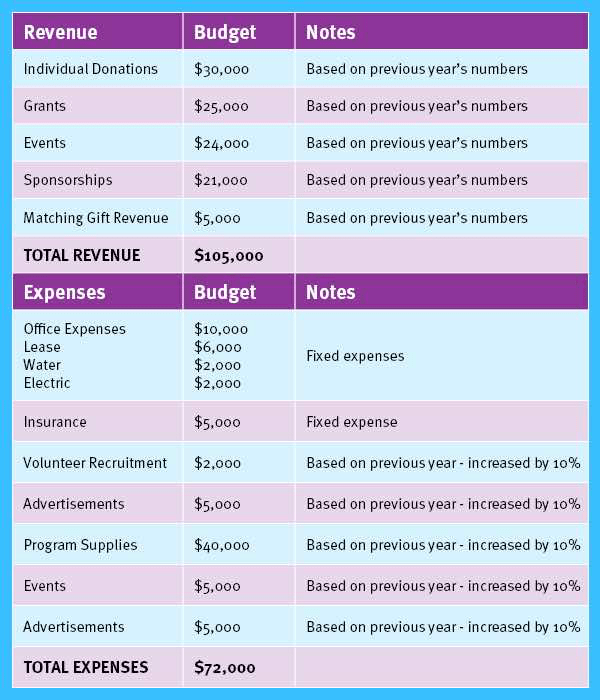

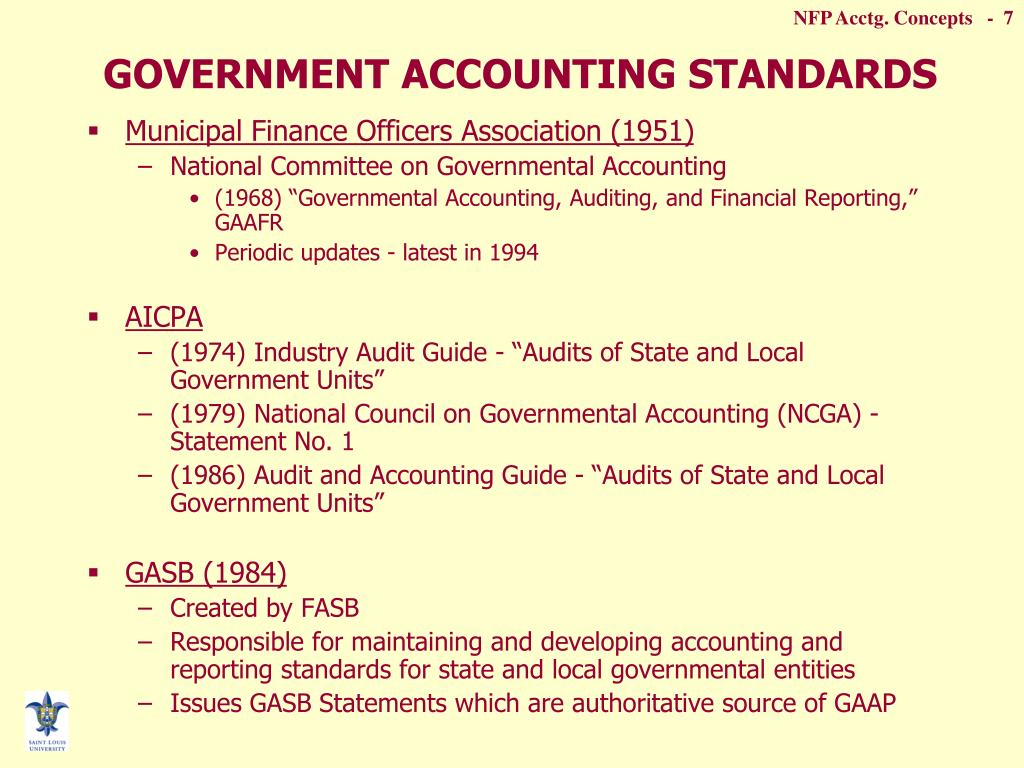

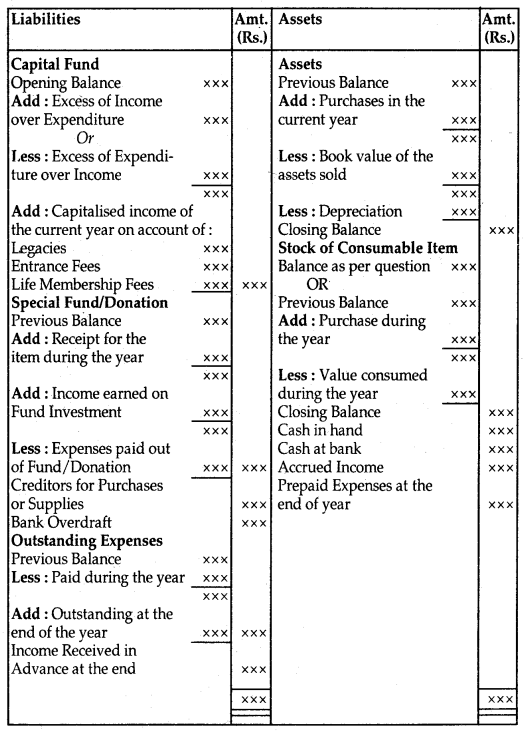

Not for profit accounting standards. In the u.s., nonprofit accounting guidance is established by the financial accounting standards board (fasb) and follows generally accepted accounting principles (gaap) — including a subset specific to fund accounting — to prepare financial statements required for reporting to board members and donors. Applies prospectively to annual financial statements relating to fiscal years beginning on or after january 1, 2022. A new york judge has ordered donald trump and his companies to pay $355 million.

There is also limited awareness on applicability of accounting standards formulated by the institute of chartered accountants of india to the npo sector. When it comes to asnpo, the search is over. Which entities apply fasb’s specialized guidance for nfps

Here’s a look inside donald trump’s $355 million civil fraud verdict. Sound accounting practices based on the generally accepted accounting principles, promulgated, inter alia, as accounting standards, in accounting for various npo transactions. This guide summarizes the applicable accounting literature, including relevant references to and excerpts from the fasb’s accounting.

This chapter provides an overview of the accounting and reporting framework applicable to nfps that apply fasb standards, including: The board received 25 comment letters on the proposed update. Axa fy23 underlying profit rises.

Generally accepted accounting principles (gaap). Copyright © 2024 by financial accounting foundation. Guidance for the valuation and depreciation of public sector assets in accordance with the requirements of the international financial reporting standards (ifrs), international public sector accounting standards (ipsas) or their jurisdictional equivalents, such as australian accounting standards (aasb).