Fantastic Info About Deferred Income Tax On Balance Sheet Statement Of Profit And Loss Other Comprehensive Format

Deferred tax assets and deferred tax liabilities can be calculated using the following formulae:

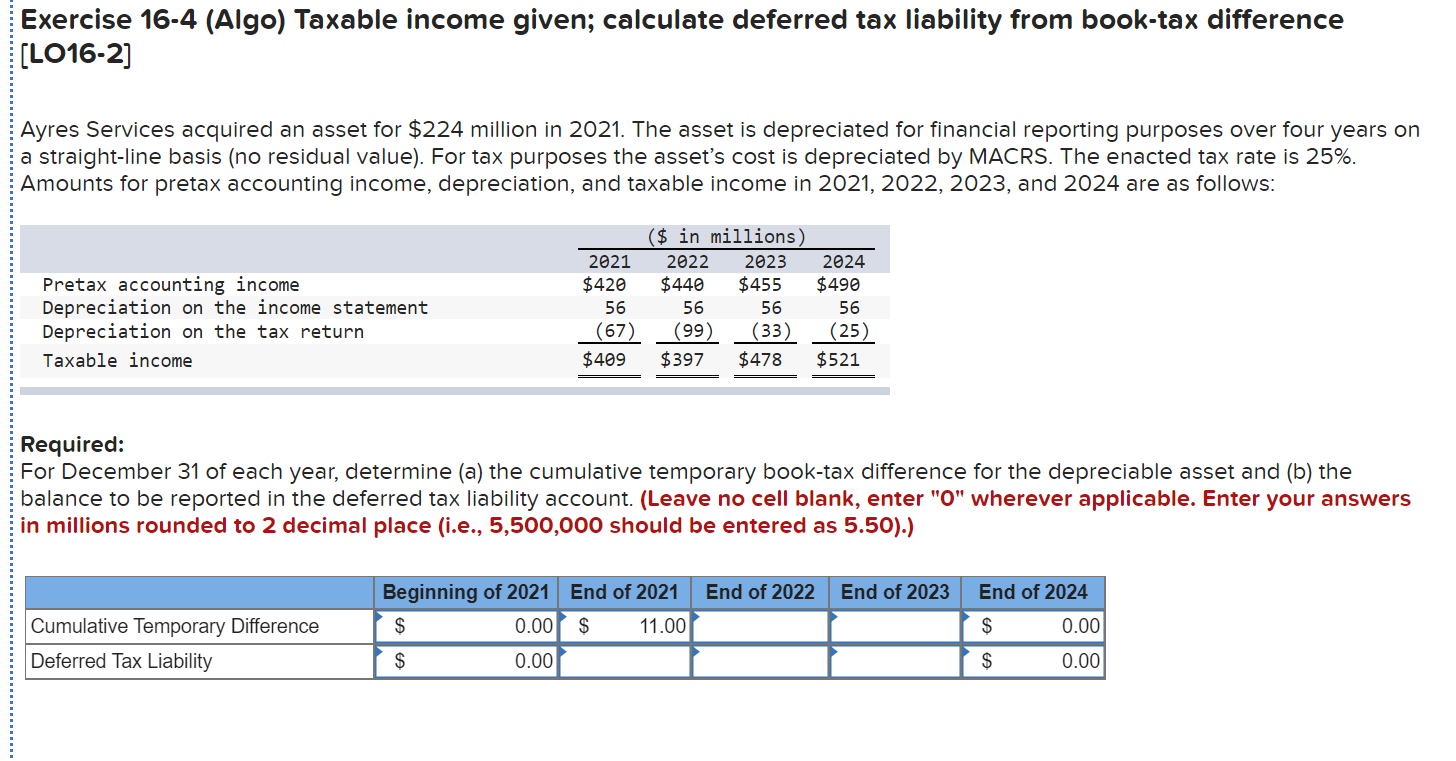

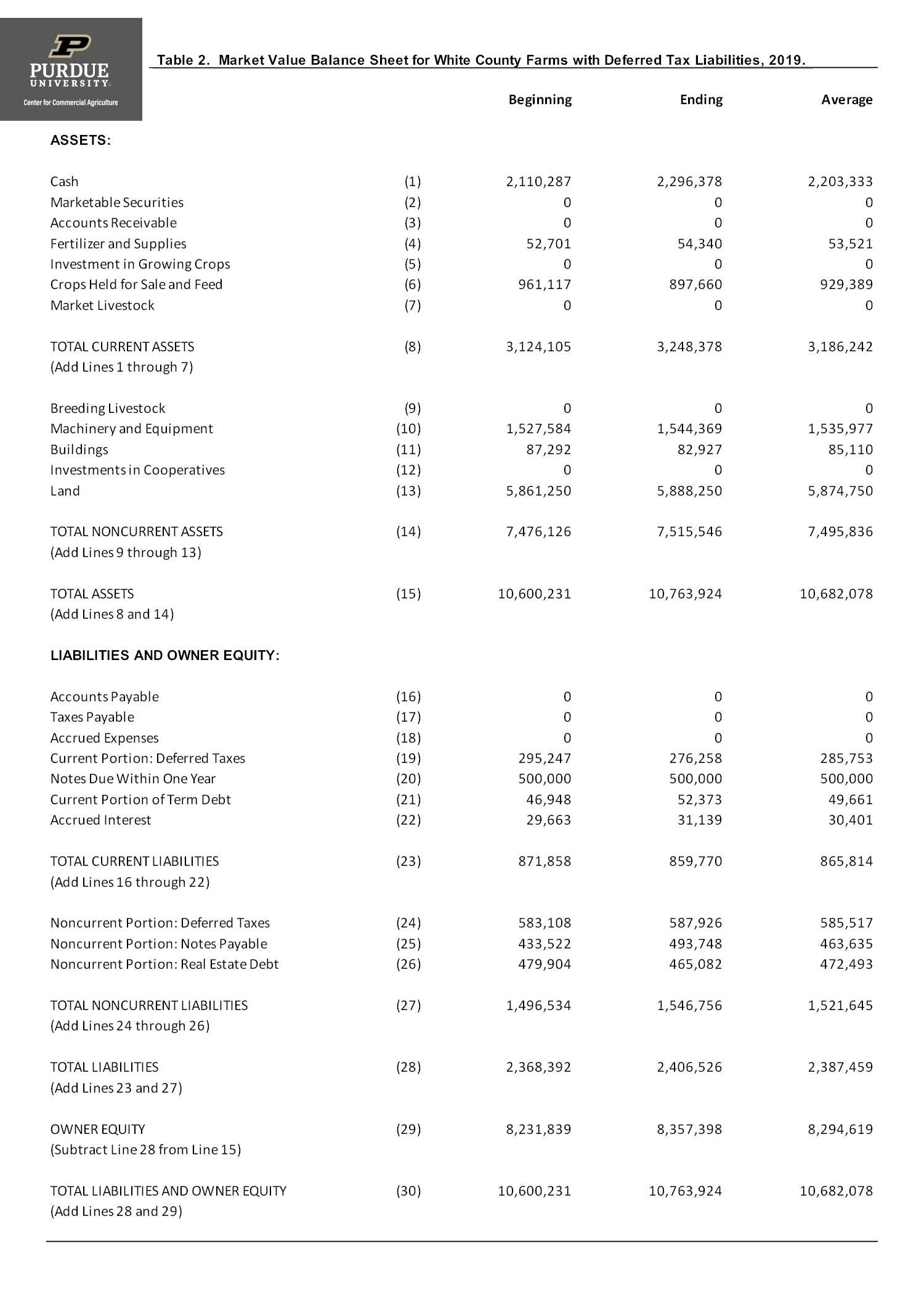

Deferred income tax on balance sheet. Explore the two approaches used by companies to calculate. Definition definition items on the balance sheet that are created when the tax paid is less than the tax considered on the income statement. Deferred tax liability (dtl) or deferred tax asset (dta) forms an important part of financial statements.

Deferred income tax is essentially a liability recorded on a company’s balance sheet. Fundamentally, deferred tax balances represent the future tax impacts of recovering or otherwise consuming assets (e.g., by depreciating the asset) and. Read running payroll for details of.

The first income tax month is 6 april to 5 may inclusive, the second income tax month is 6 may to 5 june inclusive, and so on. Discover the concept of deferred tax and its impact on balance sheets and profit and loss accounts. Deferred tax liability is a liability that is due in the future.

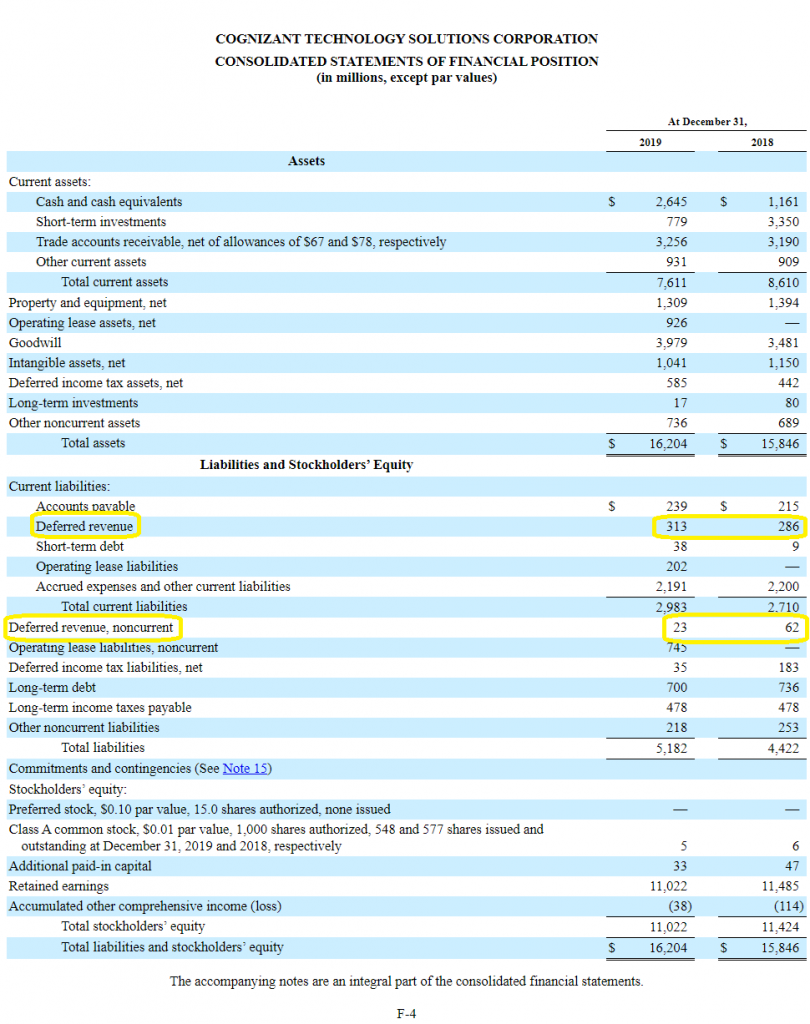

For this reason, the company’s payable income taxmay not equate to the total tax expense reported. Proper classification and measurement of deferred taxes are essential for accurate financial reporting on the balance sheet and income statement. The following formula can be used in the calculation of deferred.

Going off the prior depreciation example, the deferred tax liability (dtl) recorded on the. A deferred income tax is a liability recorded on a balance sheet resulting from a difference in income recognition between tax laws and the company’s accounting methods. The next step is the actual calculation of deferred taxes!

A deferred tax asset is a business tax credit for future taxes, and a deferred tax liability means the business has a tax debt that will need to be paid in the future. This liability emerges because of the disparity between how income is. There are additional required balance sheet disclosures for deferred tax accounts:

Calculate and record deferred tax assets and liabilities. Deferred revenue is a liability on a company's balance sheet that represents a prepayment by its customers for goods or services that have yet to be. A deferred tax liability is recorded on.

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)

:max_bytes(150000):strip_icc()/Terms-d-deferred-revenue-Final-a8fb680c51014901a4b8f88ac7fb7f77.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)