Awesome Info About Cash Flow Requirement For Private Limited Company Profit And Loss Account Format In Hindi

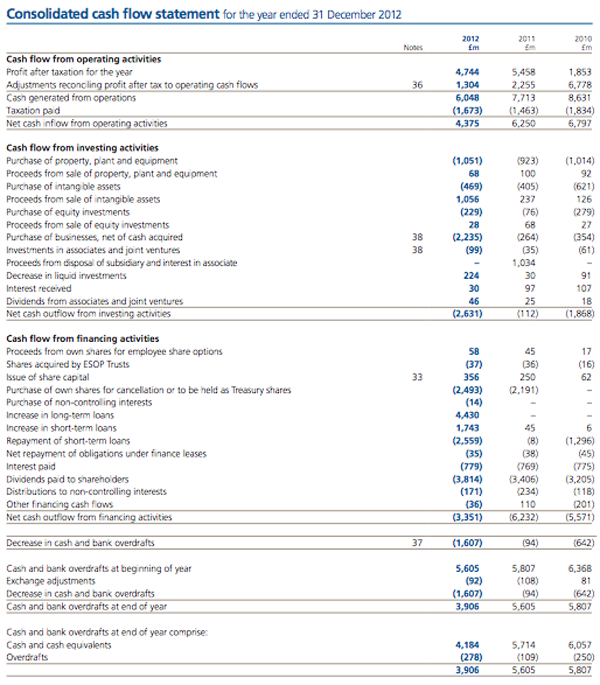

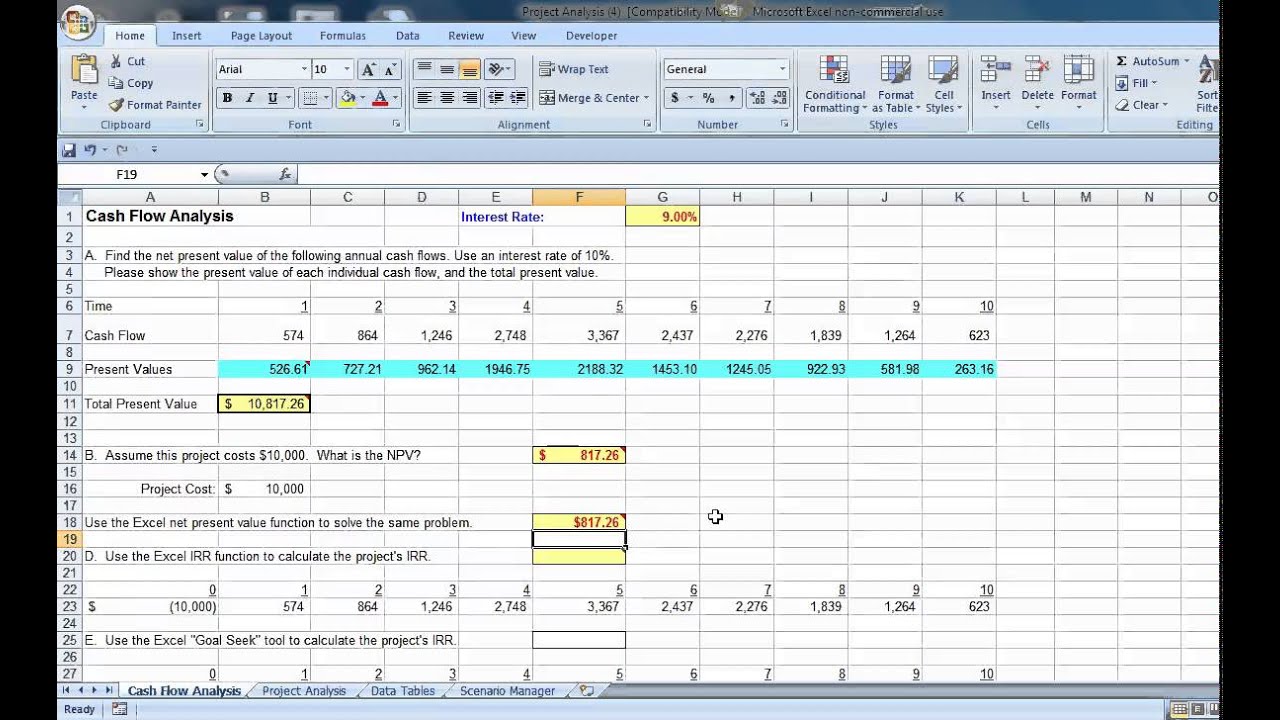

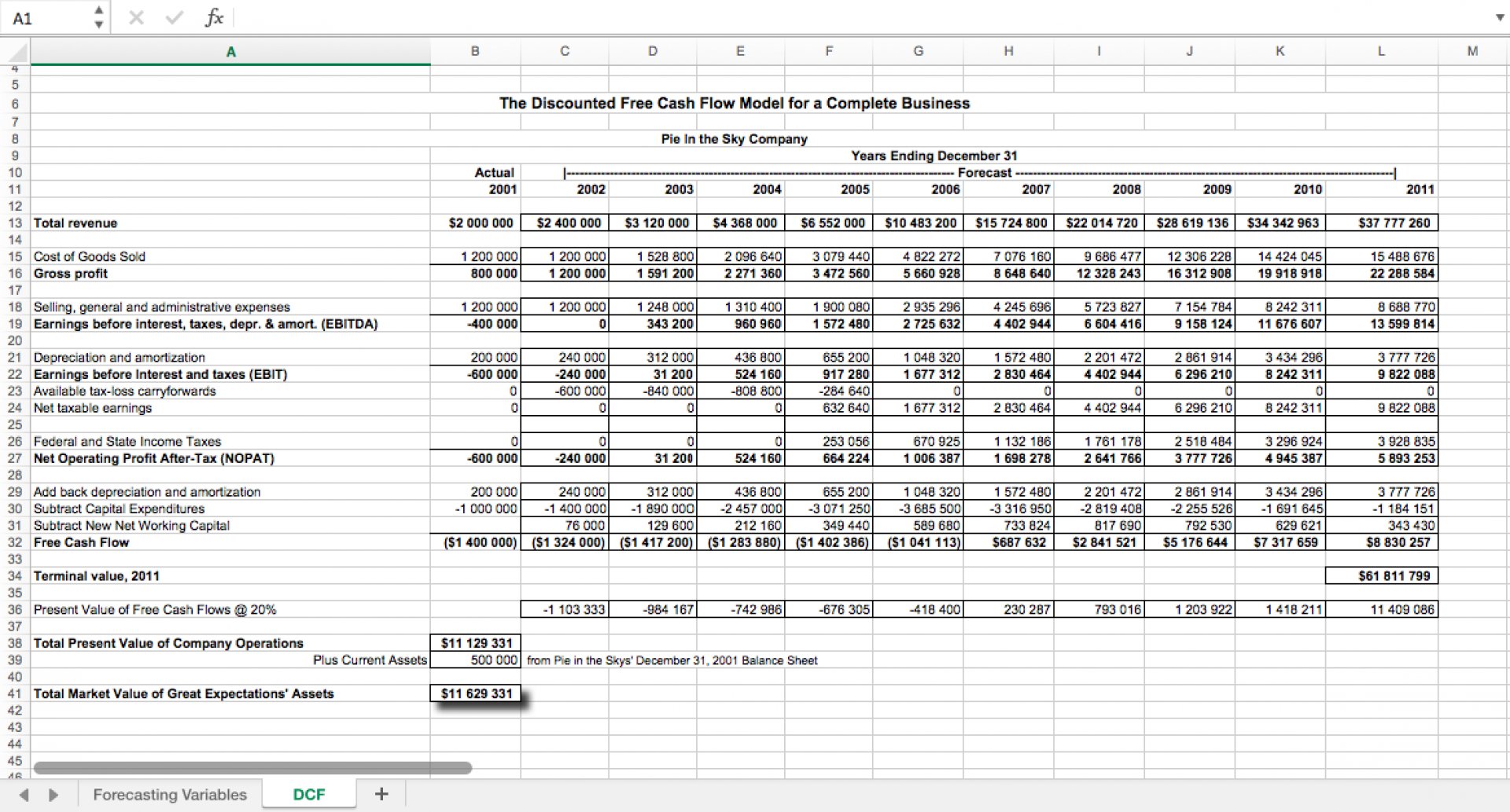

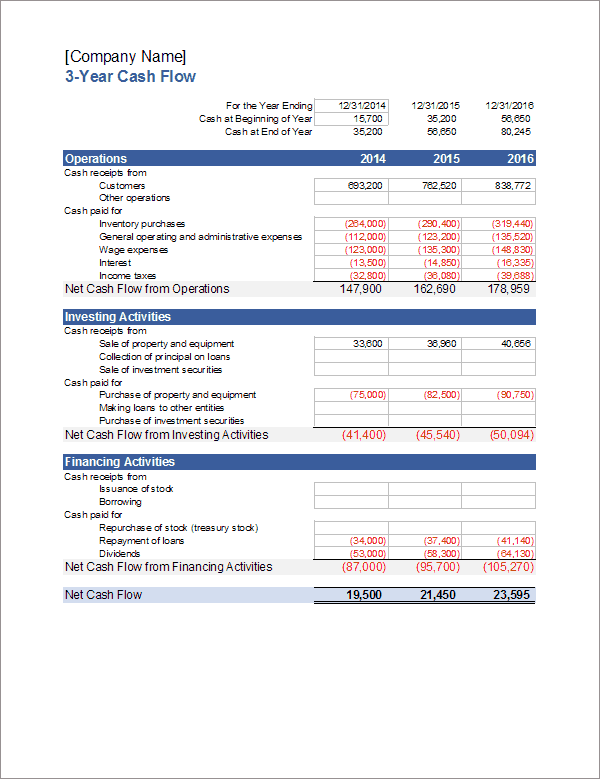

A cash flow statement must depict the cash flows within the period classifying them as:

Cash flow requirement for private limited company. With the introduction of the companies act, 2013 in the year 2014, the compliance burden of every company has increased substantially irrespective of the. As per the companies act, 2013, most companies are required to furnish a cash flow statement, ensuring transparency and accountability in financial reporting. Case of a company or of the composition of the correspondin g governing body in case of any other enterprise so as to obtai n economic benefits from its activities.

Particulars exemption to private limited companies thereunder 1. According to section 2(40) of companies act, 2013, the financial statements of a company must include cash flow statement. The cash flow statement must report cash flows during the period classified.

Private equity funds last year returned the lowest amount of cash to their investors since the financial crisis 15 years ago,. February 12, 2024 at 1:31 am pst. The exemption in preparing the cash flow statements to small companies has been intended to be maintained by companies act, 2013 as it states.

Follow up on overdue payments. 2(40) financial statement apart from one person companies (opcs), small companies, dormant. Where the entity voluntarily chooses to prepare a cash flow statement, it must apply the provisions in section 7.

Operating activities investing activities financing activities. 26 june 2022 cash flow statement is applicable to all private limited companies except: Cash flow statement along with the financial statement:

Charge interest on overdue payments if it’s in your payment terms. Time span and requirement:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

![46+ Cash Flow Management Techniques that induce ]](https://ctmfile.com/assets/ugc/images/CFM_FiREapps_1.png)