Smart Info About Calculation Of Cash Flow From Operating Activities Audit Rectification Report

Cash flow from operations formula.

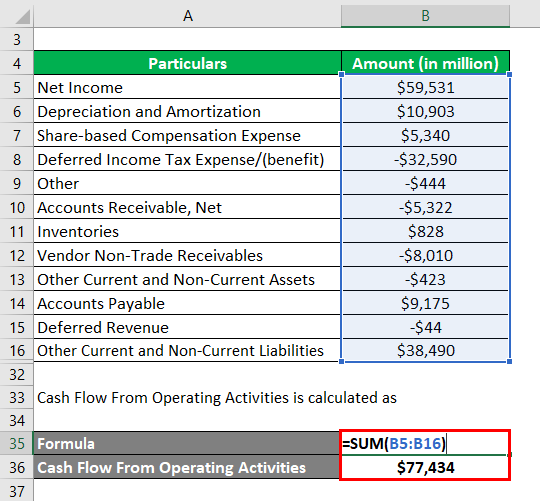

Calculation of cash flow from operating activities. Cash flows from (used for) operating activities: Operating cash flow (ocf) is how much cash a company generated (or consumed) from its operating activities during a period. $405,200.00 adjustments to reconcile net income to net cash flows from (used for) operating activities:

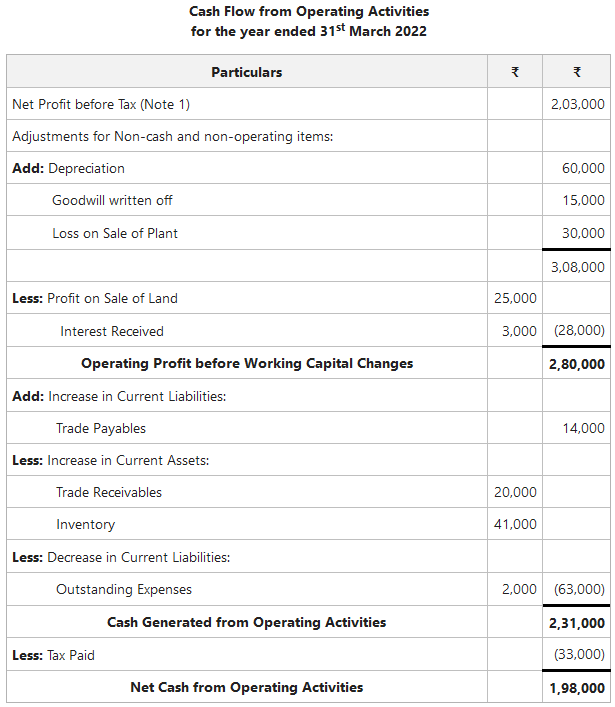

Although $238,000 of merchandise was acquired, only $229,000 in cash payments were made ($238,000 less $9,000). Cash flow from operating activities = funds from operations + changes in working capital where, funds from operations = (net income + depreciation, depletion, & amortization + deferred taxes. Figure 17.6 liberto company statement of cash flows for year one, operating activities reported by direct method.

Here we will study the indirect method to calculate cash flows from operating activities. The calculation for ocf using the indirect method uses the following formula: Net loss $ (738) $ (1,331) adjustments to reconcile net loss to net cash provided by (used in) operating activities:

Next, take a simple example of working capital calculation. In indirect method, the net income figure from the. Amortization of discount and issuance costs on convertible notes.

Cash payments or refunds on. $81,750.00 loss on disposal of equipment: Operating cash flow (ocf), often called cash flow from operations, is an efficiency calculation that measures the cash that a business produces from its principal operations and business activities by subtracting operating expenses from total revenues.

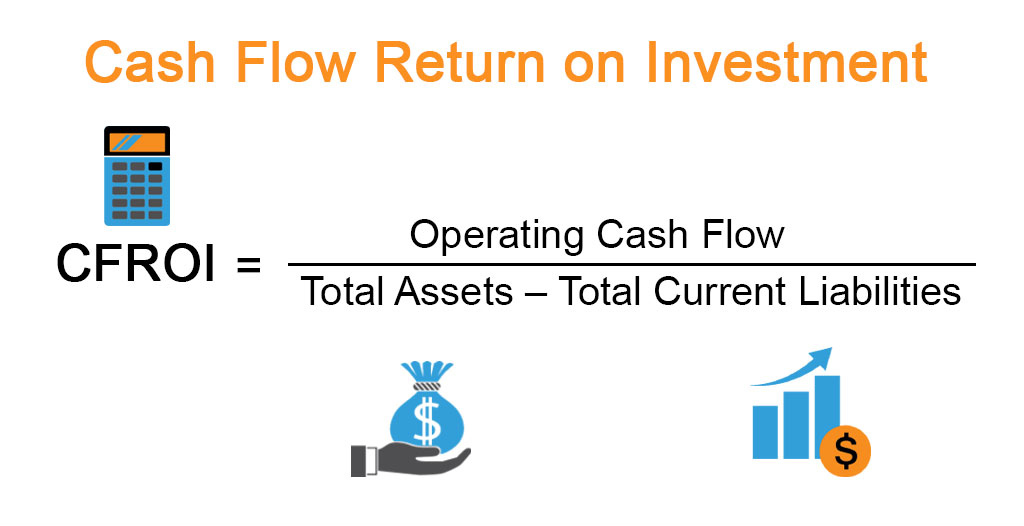

What is cash flow from operating activities? Because the ancillary business endeavours aren't visible in the numbers in the calculation, a company's operating profit margin can confuse its financial partners. Cash payments to and on behalf of employees.

$22,300.00 changes in current operating assets and liabilities: Using the indirect method, we first need the net income, so we will first prepare an income statement. Cash flows from (for) operating activities:

Cash flow from operations formula (indirect method) = $170,000 + $0 + 14,500 + $4000 = $188,500. Say, current assets and current liabilities consist only of trade receivables and trade payables. Liberto’s income statement reported net income of $100,000.

As such, you can calculate cash flow from operating activities using the following formula: While the exact formula will be different for every company (depending on the items they have on their income statement and balance sheet), there is a generic cash flow from operations formula that can be used: Cash flows from operating activities appear at the top of the cash flow statement.

Cash flow from operating activities is the amount of money a company earns by performing its daily activities over a certain period of time, like a month or a year. It's one of the three main types of cash flow that a company might experience. Knowing about the types of cash flow and the different ways to log them can help you understand a company's overall income and spending.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/terms_c_cash-flow-from-operating-activities_FINAL-e4025a9df8de40059fc1b585394c4b8b.jpg)