Looking Good Tips About Cash Flow Statement For Nonprofit Organization Dividends Received Income

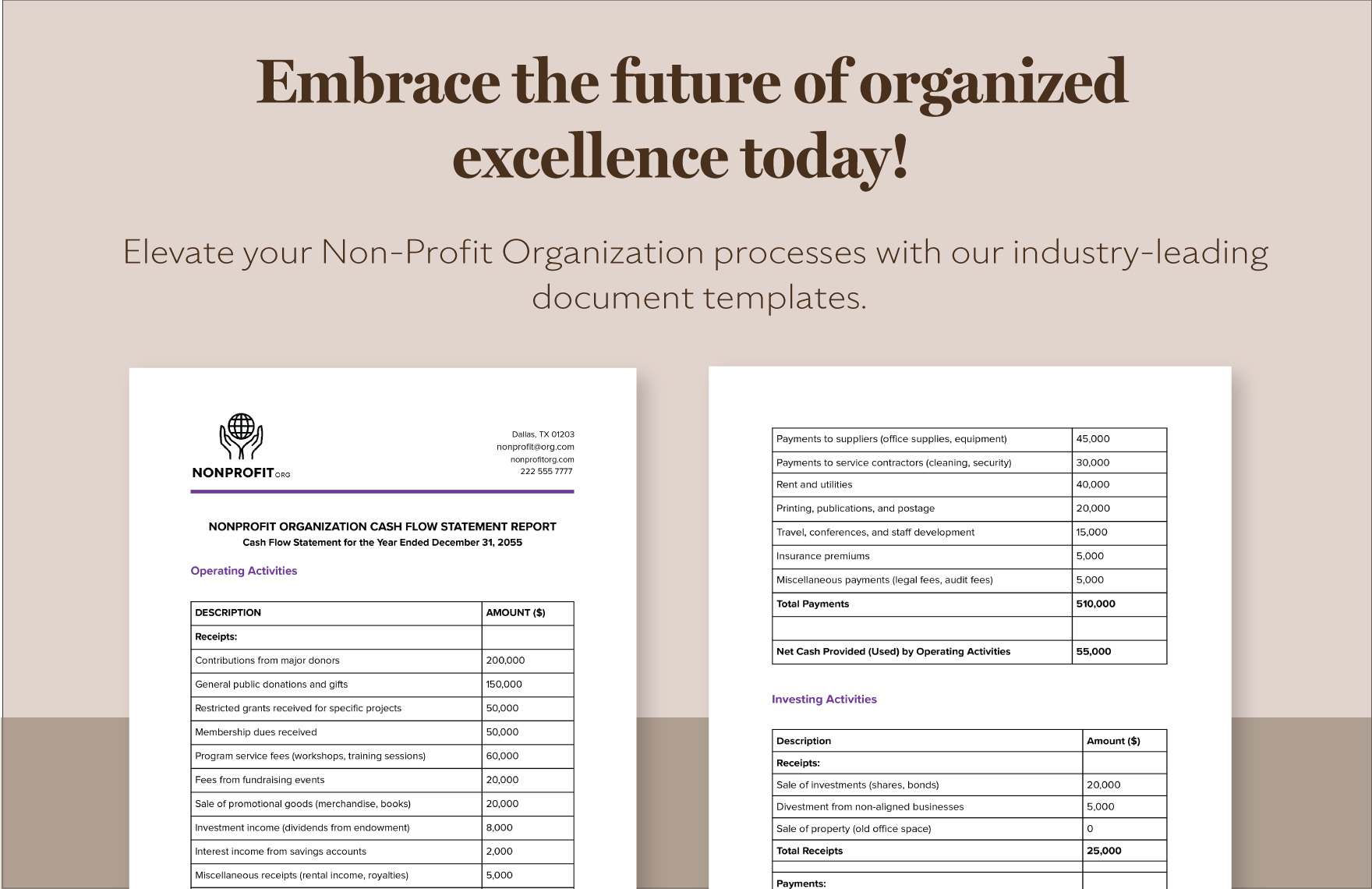

Understanding the ebbs and flows of your organization’s cash will help you make smart management decisions that protect your core programs and overall sustainability.

Cash flow statement for nonprofit organization. Putting your cash flow forecast to work. It gives insight into periods when the organization will have adequate cash to cover expenditures. Cash inflows for a nonprofit come from contirbutions of cash, checks, fundraising efforts, and grants.

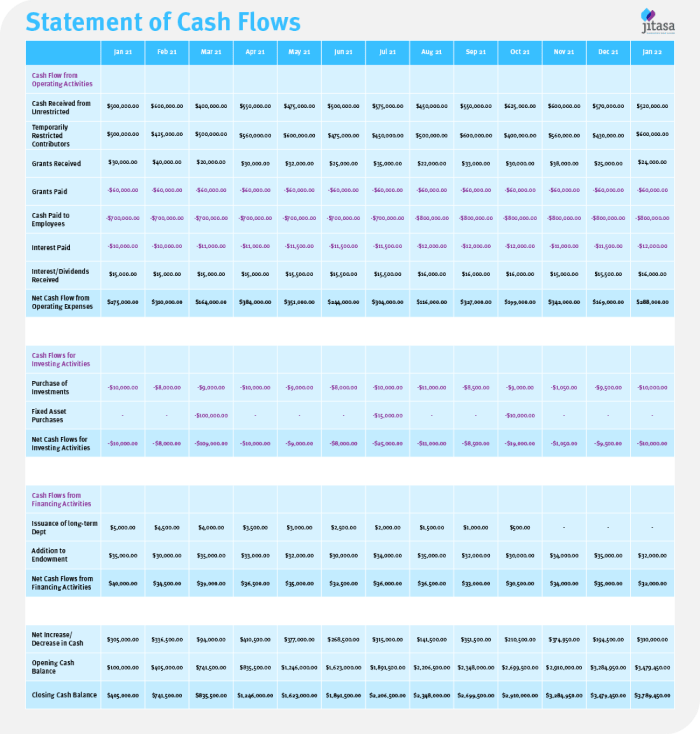

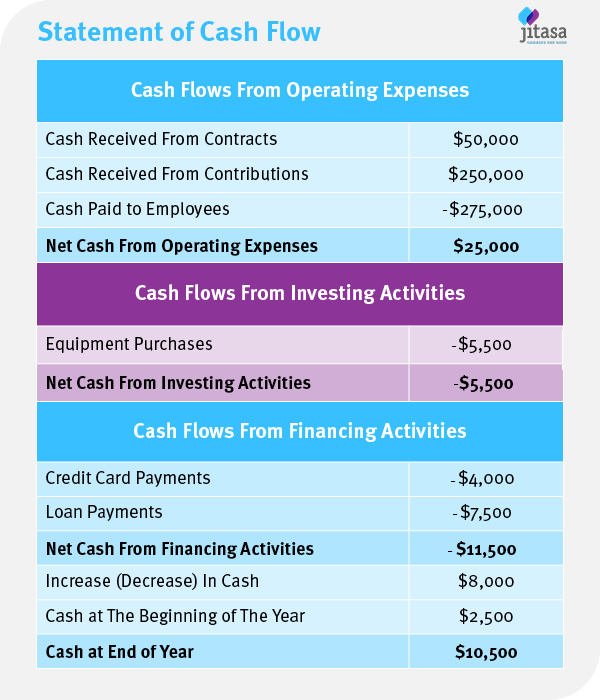

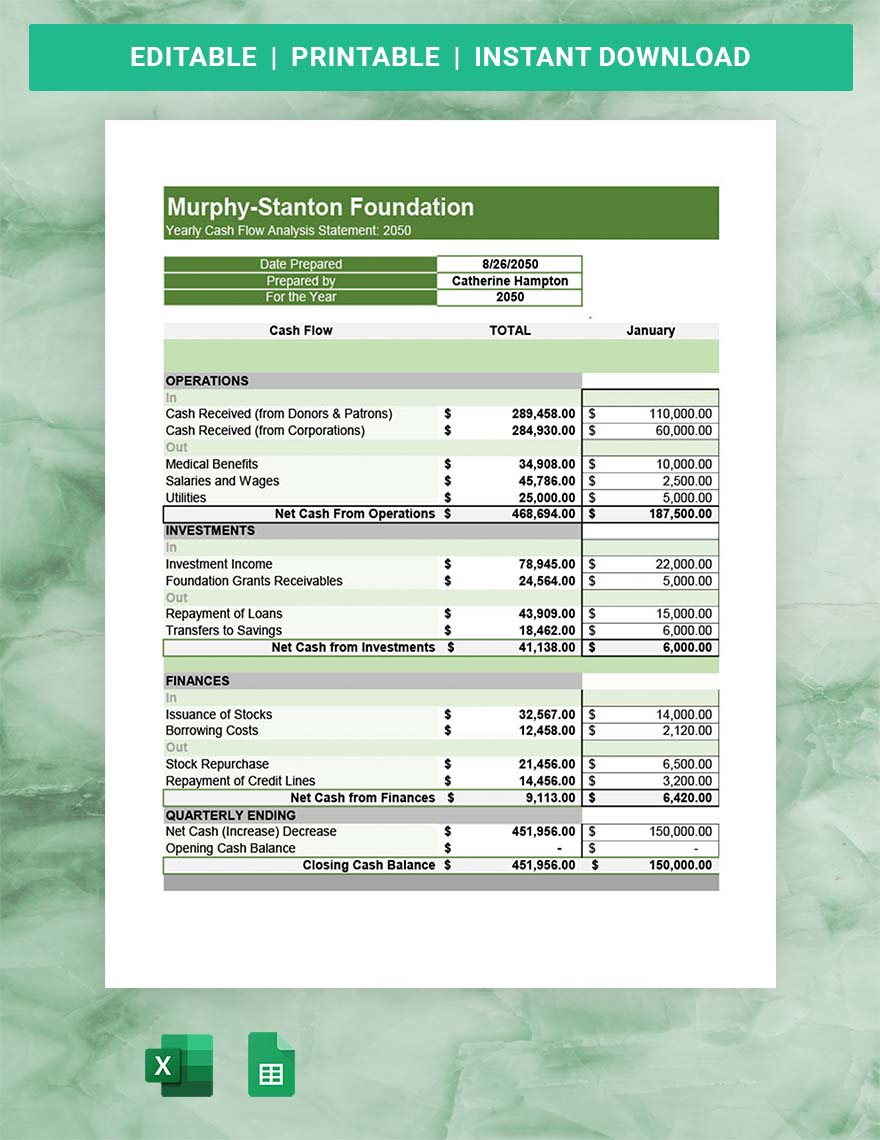

This statement tracks the monthly cash flow in and out of your organization. Cash flow is simply the mix—and timing—of cash receipts into and cash payments out of an organization’s accounts. Cash flows from operating activities cash flows from investing activities

The statement of cash flow breaks down. Cash flow projection template. This resource will help your nonprofit manage your cash flow by explaining why, when, and how.

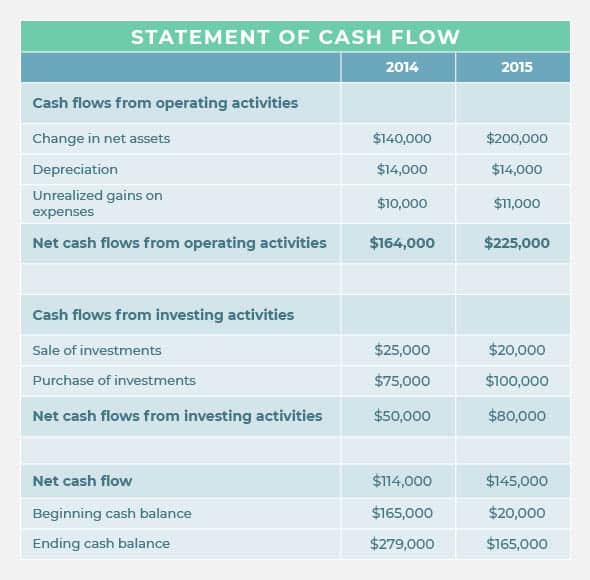

Calculate cash flows from financing activities; To get a better feel for your current cash flow status and to detect any seasonal trends in your nonprofit's cash flow, we recommend… The biggest benefit of building cash flow forecasts for nonprofits is that they can be used to identify and respond to cash deficits and cash surpluses in advance.

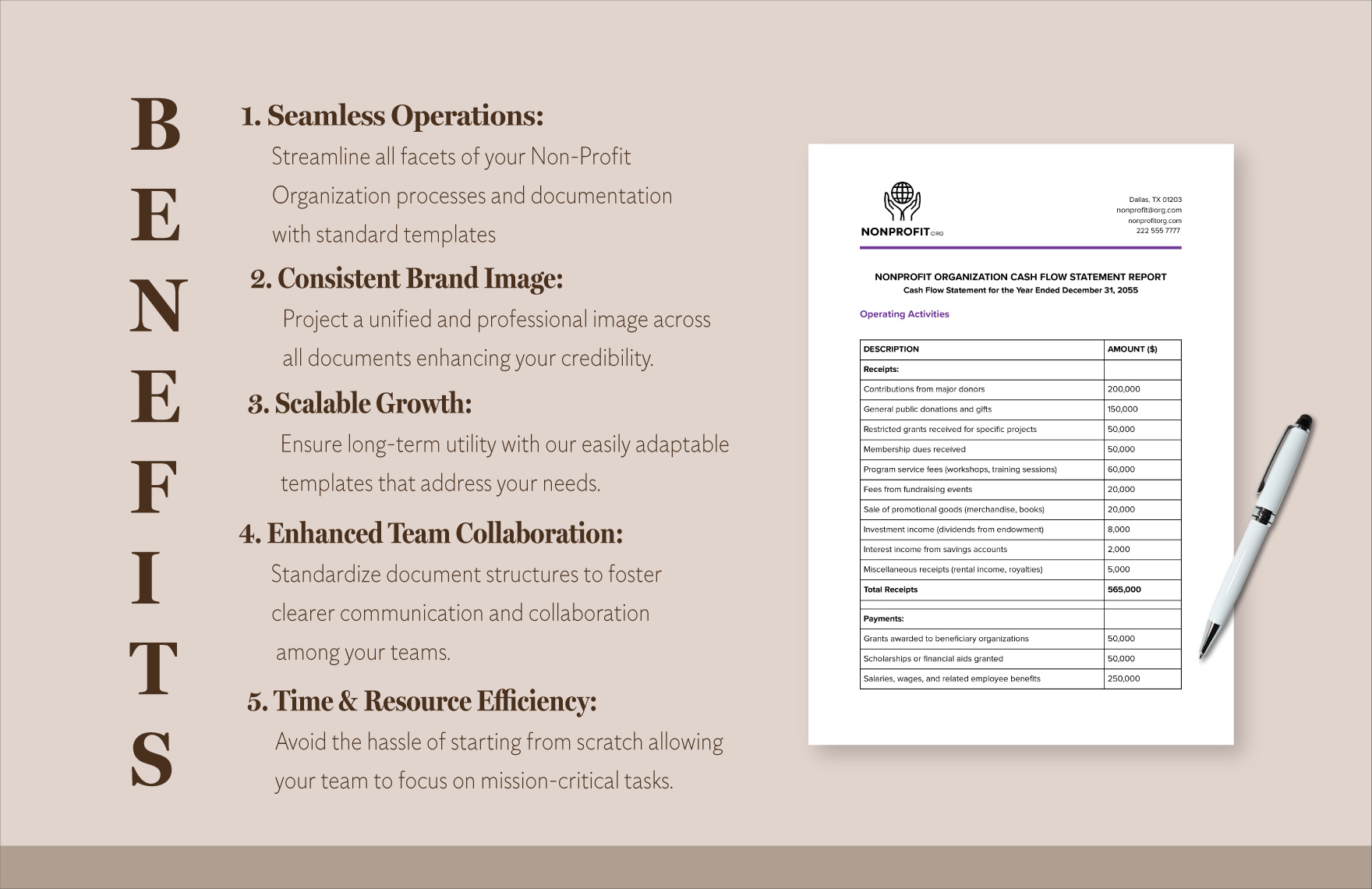

Your nonprofit’s free cash flow describes the amount of liquidity your organization has to fund growth. Your nonprofit cash flow statement is an important financial document that can give you insights into your organization’s financial health. A nonprofit statement of cash flows is a financial report that shows how cash moves in and out of an organization on a regular basis.

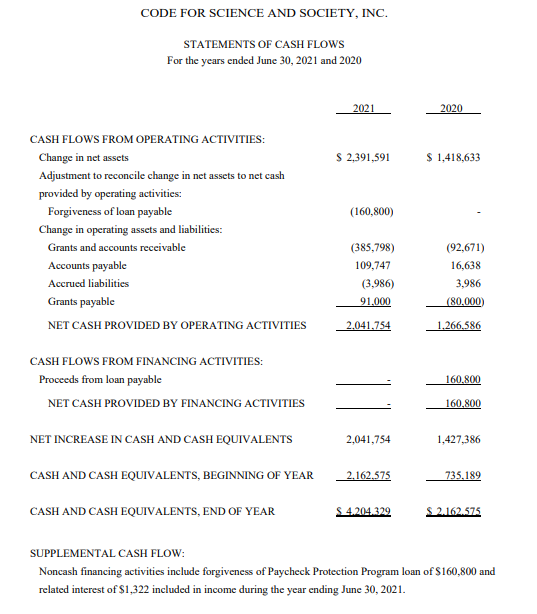

Statement of financial position, statement of activities, statement of cash flows, and statement of functional expenses. Here’s what it looks like on code for science & society’s financial report. Cash flow statements for nonprofits:

Cash flow statements are generally required under gaap principles. This report is pulled on a monthly bases additionally will generally composed of three primary sections. Forecasting your cash flow, for example, can help your organization respond and adapt to immediate financial challenges.

This report is pulled on a monthly basis and is. Two of the metrics that your nonprofit accountant might highlight within your statement of cash flow include: A nonprofit organization, organized under section 501(c) of the tax.

Effectively managing your nonprofit’s finances is always important, but even more so when times are uncertain. Let’s dive in to see how. Here are the main steps in preparing the statement of cash flows:

The purpose of the cash flow statement is to provide information about the sources and uses of cash in the organization. Use this template to manage cash flow at. It is where the numbers on budget spreadsheets and financial reports translate into the reality of money changing hands.