Recommendation Tips About Cash Flow Statement Consists Of Amazon Audit Report 2019

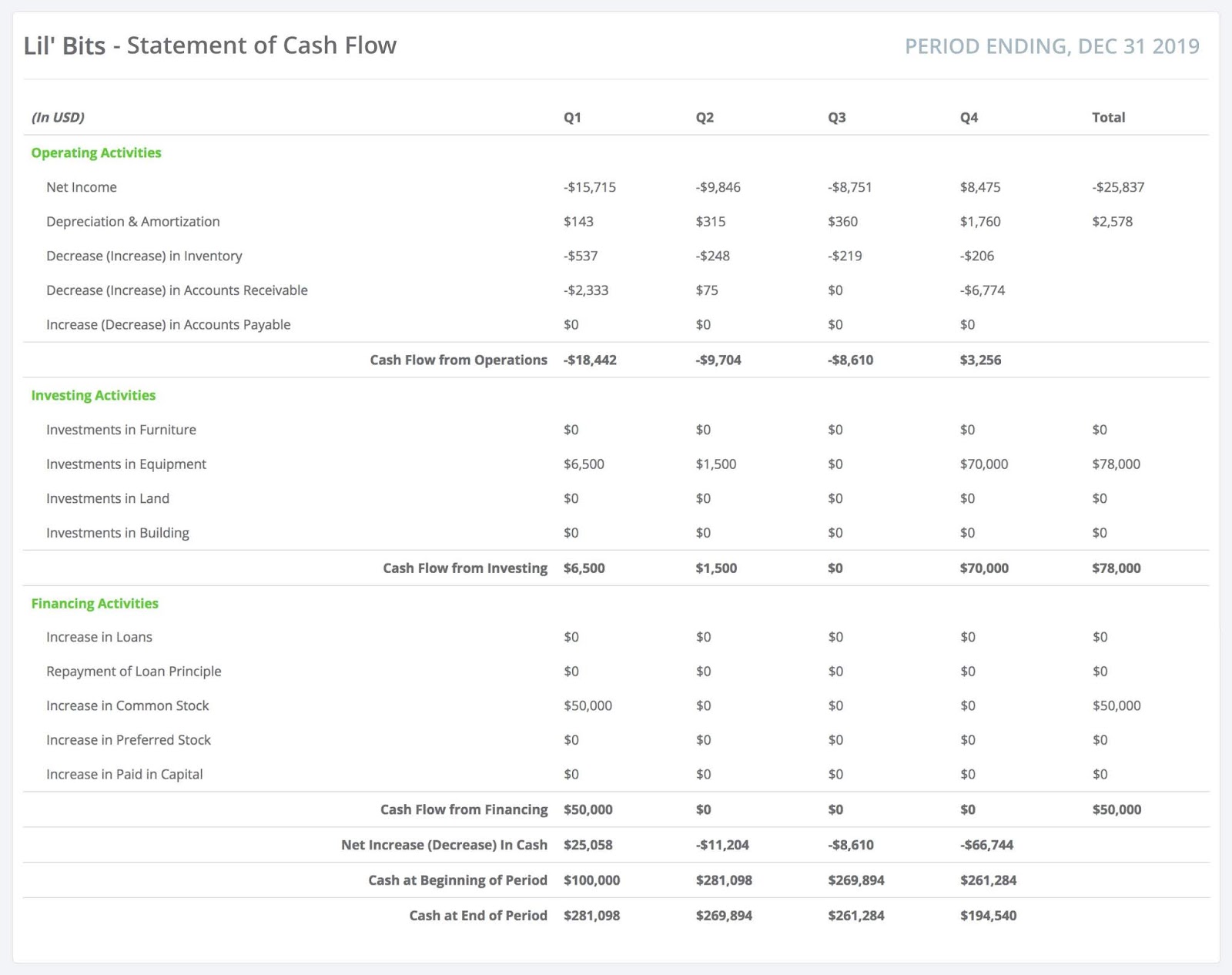

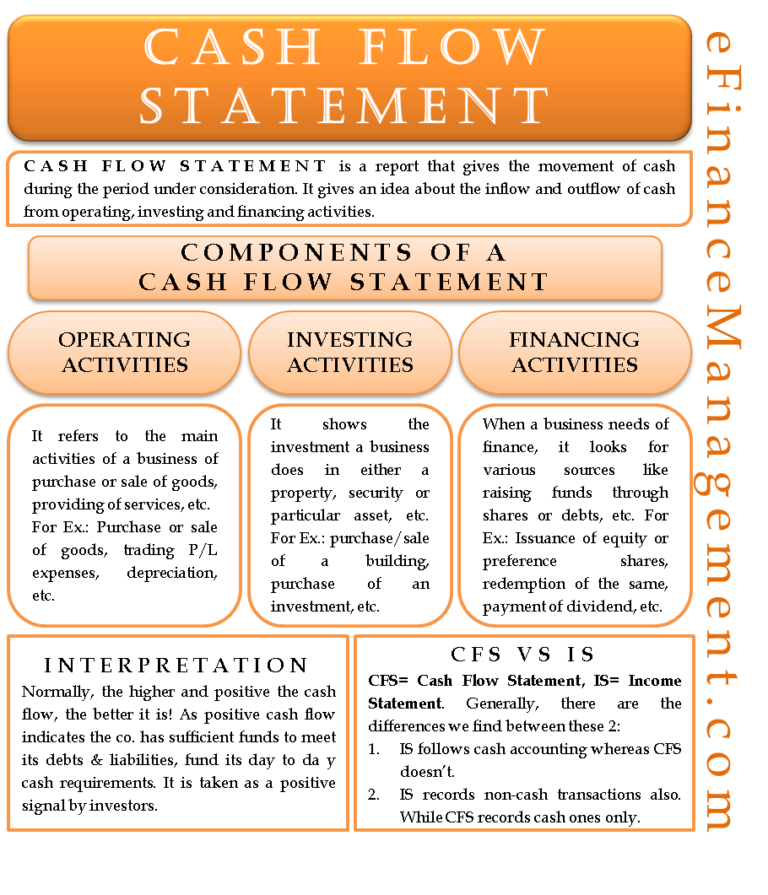

The cash flow statement reports the cash generated and spent during a specific period of time (e.g., a month, quarter, or year).

Cash flow statement consists of. There are two methods for cash flow statement preparation: It helps identify the availability of liquid funds with the organization in a particular accounting period. A cash flow statement is a financial statement that presents total data.

Cash flow from investing activities is an item on the cash flow statement that reports the aggregate change in a company's cash position resulting from any gains (or losses) from investments in. The cash flow statement includes the bottom line, recorded as the net increase/decrease in cash and cash equivalents (cce). A statement of cash flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

Along with balance sheets and income statements, it’s one of the three most important financial statements for managing your small business accounting and making sure you have enough cash to keep operating. It reports the cash receipts (cash inflows) and the cash disbursements (cash outflows) to explain the changes taking place during the year in the cash balance. There are two methods for cash flow statement preparation:

The direct method determines changes in cash receipts and payments. The objective of ias 7 is to require the presentation of information about the historical changes in cash and cash equivalents of an entity by means of a statement of cash flows, which classifies cash flows during the period according to operating, investing, and financing activities. Statement of cash flows presents the inflows and outflows of cash in the different activities of the business, the net increase or decrease in cash, and the resulting cash balance at the end of the period.

The statement of cash flows (also referred to as the cash flow statement) is one of the three key financial statements. Cash from operating activities, cash from investing activities and cash from financing activities. Purpose of the cash flow statement.

Each statement of cash flow consists of three major components: Cash flows from operating activities (cfo) this is a vital part of each cash flow statement. Essentially, a cash flow statement is a financial statement that provides a comprehensive overview of a company’s cash inflows and outflows during a specified period.

Including cash inflows a business gains from its continuing progress and external financing sources, as well as all cash outflows that pay for trading activities and finances during a delivered time. A cash flow statement consists of three sections: A cash flow statement consists of three sections:

Operating, investing and financing activities. Cash from operating activities, cash from investing activities and cash from financing activities. A cash flow statement tells you how much cash is entering and leaving your business in a given period.

There are two methods for cash flow statement preparation: Cash from operating activities, cash from investing activities and cash from financing activities. A cash flow statement consists of three sections:

The bottom line reports the overall change in the company's. The cash flow statement is a financial statement that provides information about the cash inflows and outflows of a company during a specific period. These are the components that make up a cash flow statement:

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)