Cool Tips About Treasury Share In Balance Sheet To Create A Common Size Income Statement

February 16, 2024 at 1:13 am pst.

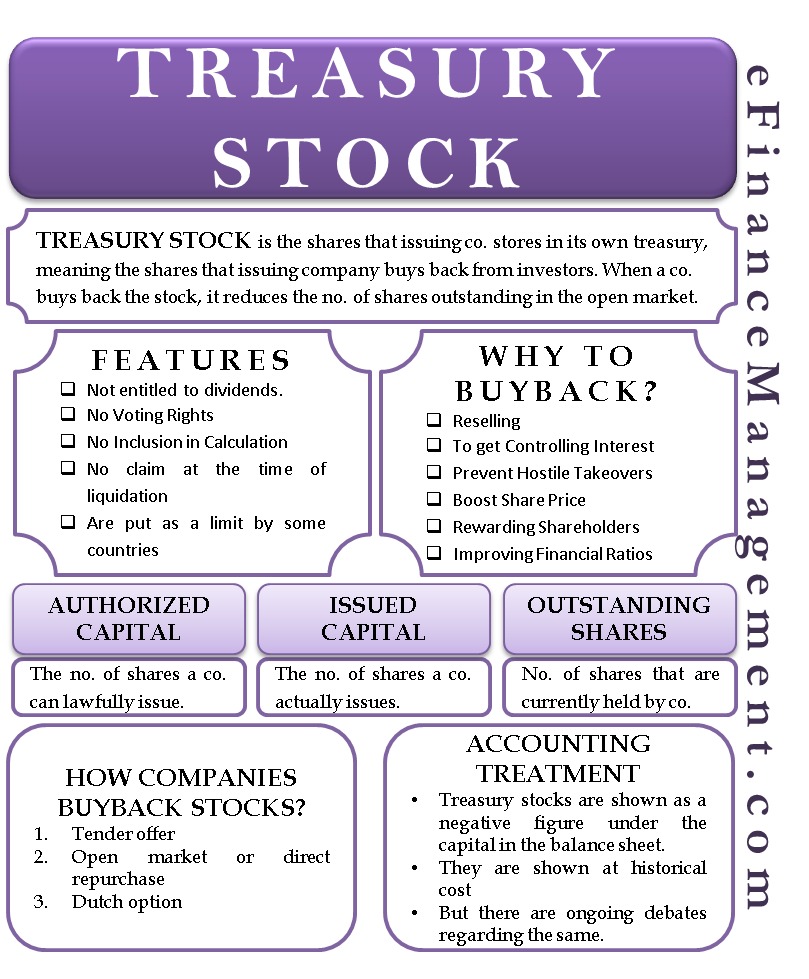

Treasury share in balance sheet. When a company buys back shares, the expenditure to repurchase the stock is recorded in a contra equity account. Treasury stock, also known as treasury shares or reacquired stock, plays a unique role in a company's balance sheet. Heidelberg materials will buy back more shares after its debt declined.

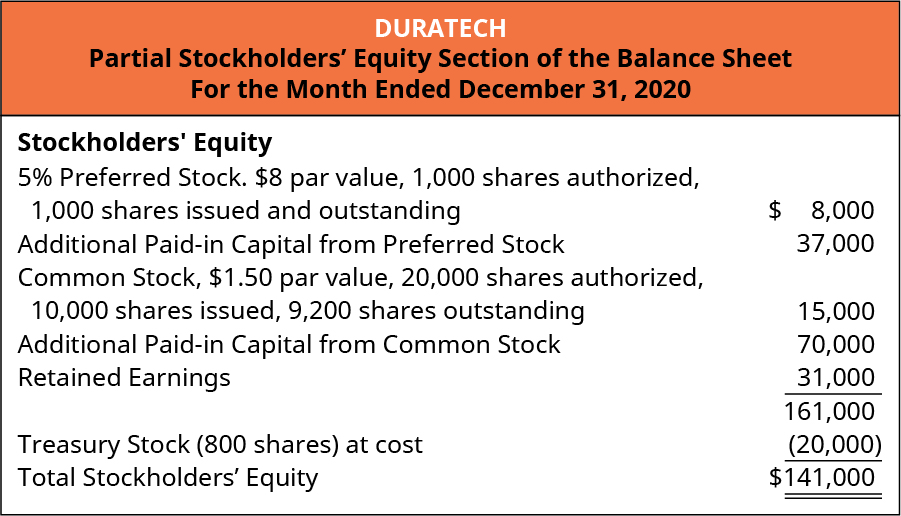

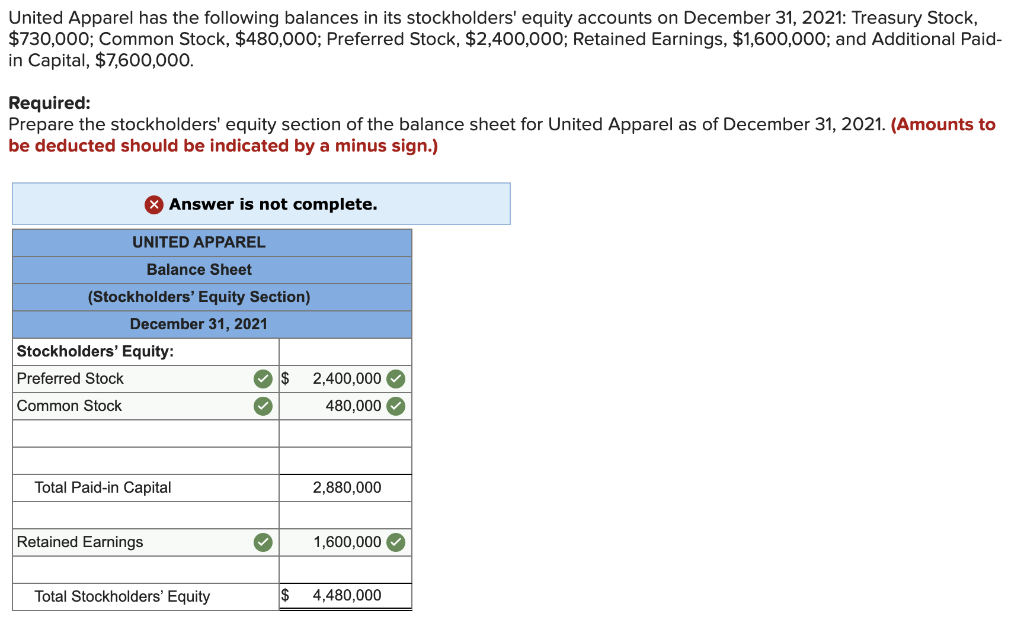

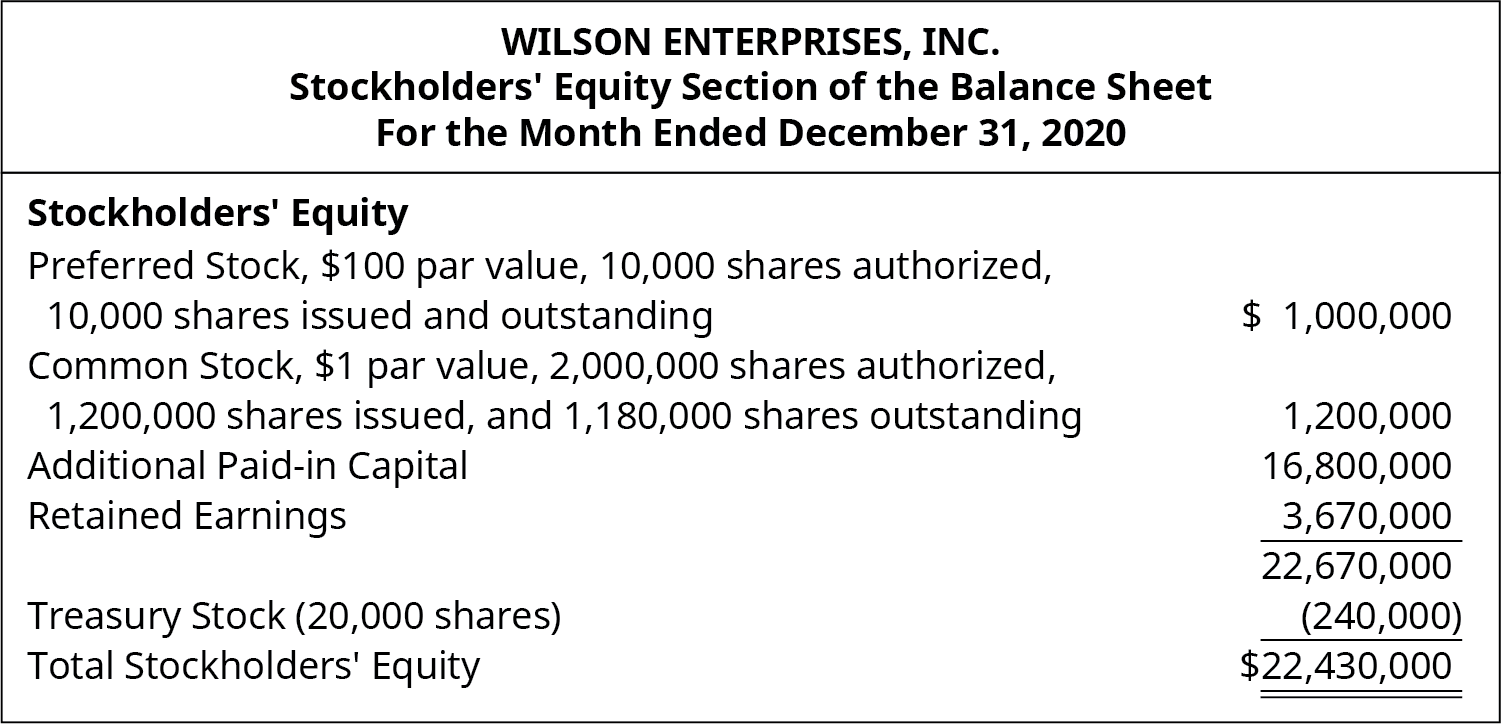

It's a contra equity account so it offsets the common. The money collected from the stock sale is shown in the asset section of the balance sheet. Treasury stock is reported on a company’s balance sheet under the shareholders’ equity section.

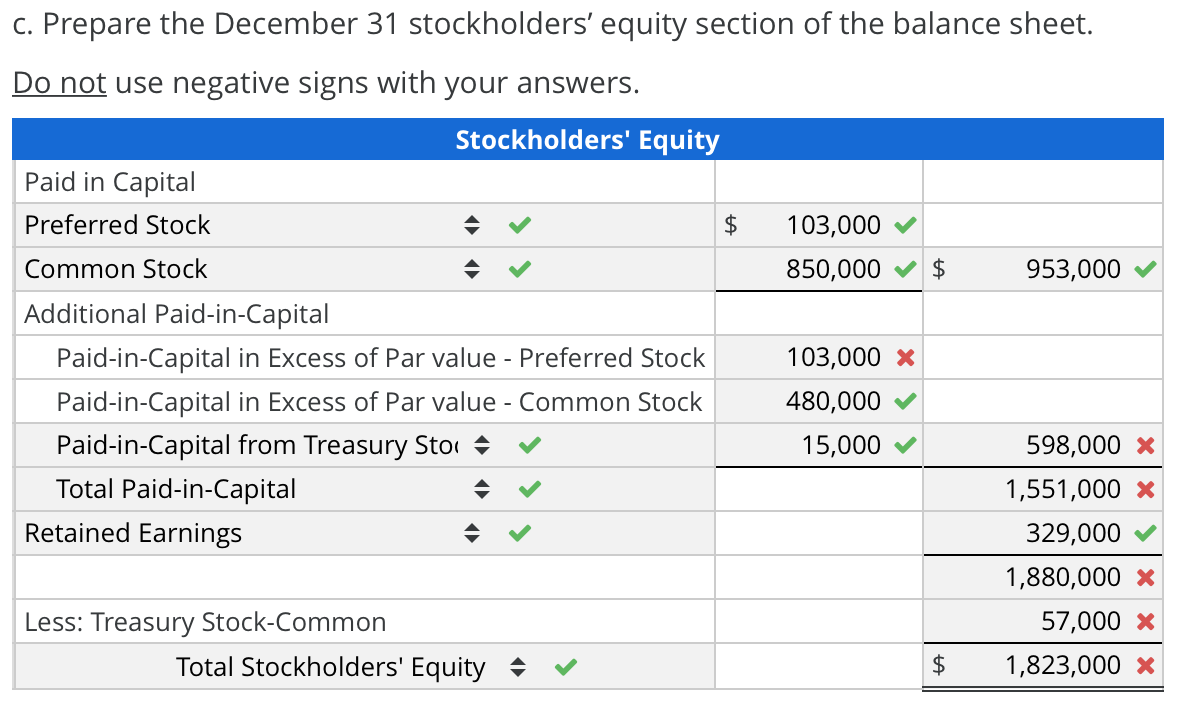

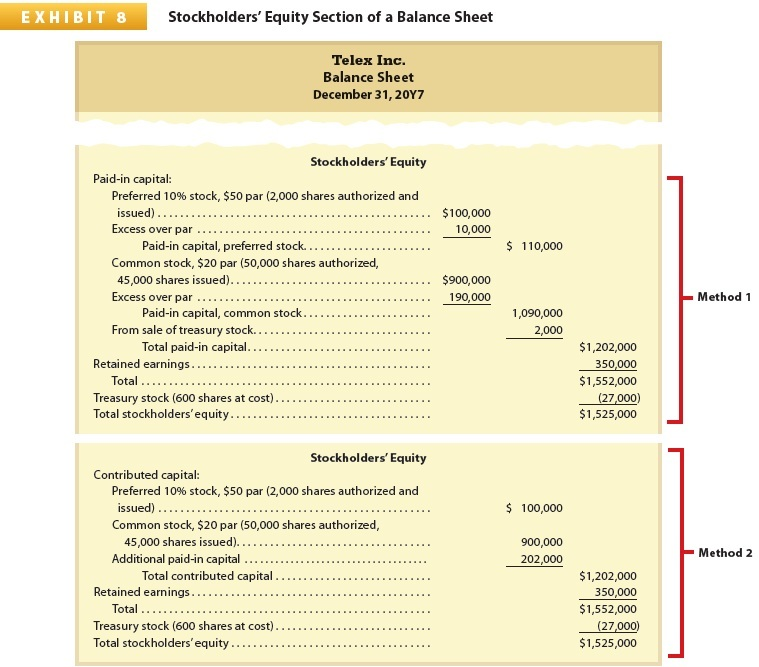

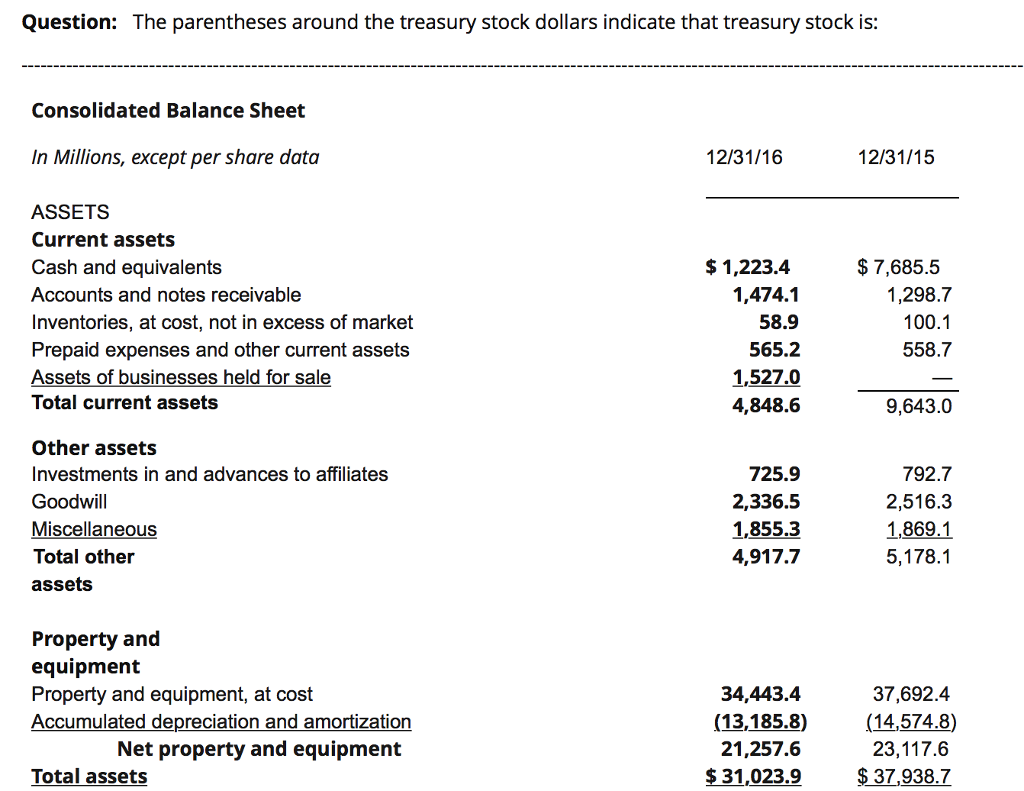

You can find information on treasury stock in the consolidated balance sheet of a company. It represents shares of the company's stock that have been. There are two methods of accounting for treasury stocks:

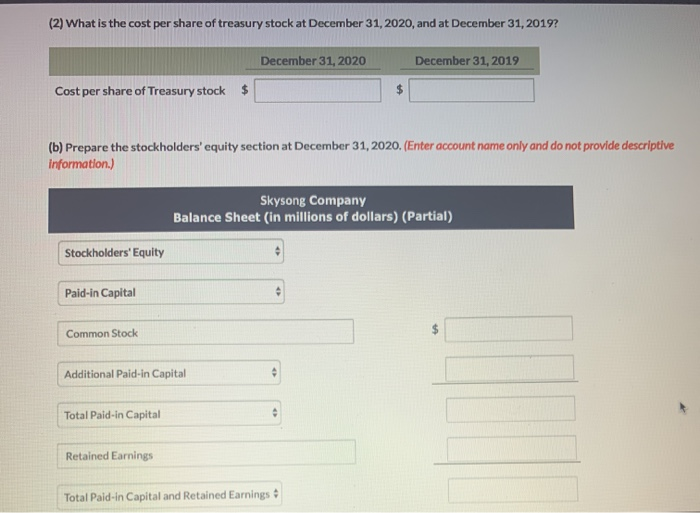

The company reports treasury shares accounting at the. By the investopedia team updated august 18, 2021 reviewed by gordon scott fact. Treasury stock on a balance sheet represents money the company has spent to buy back its own shares.

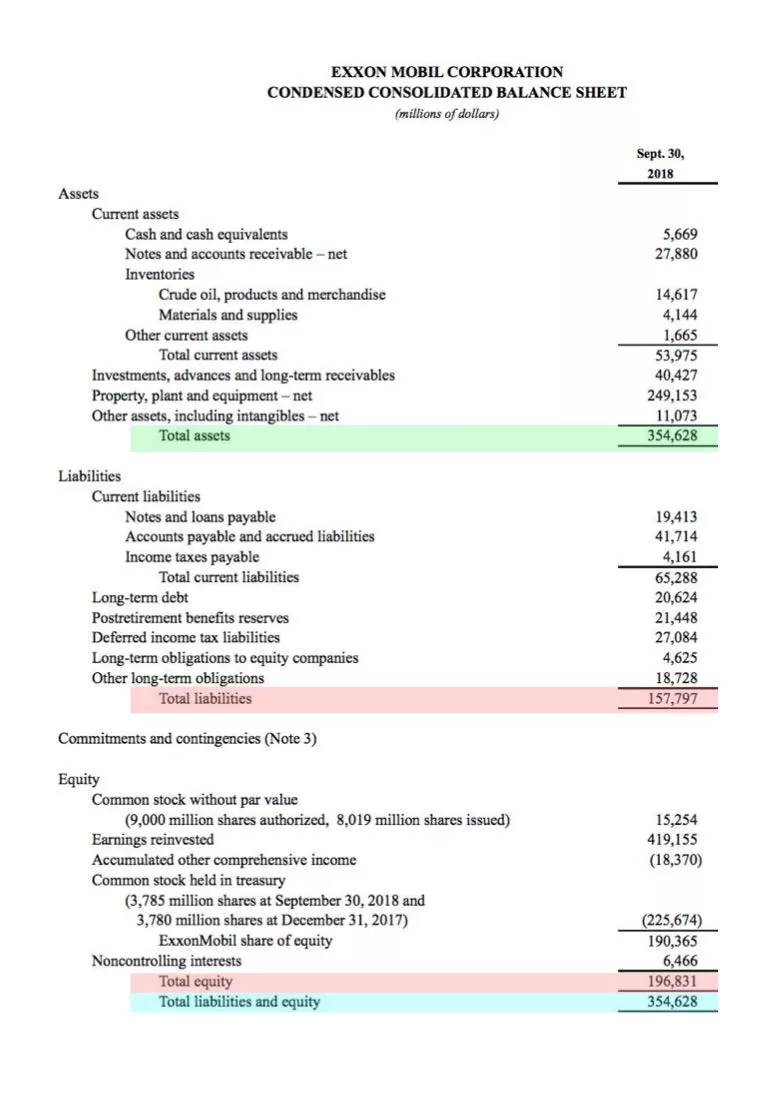

Treasury stock is the cost of shares a company has bought back. How does a share premium account appear on the balance sheet? As of september 30, 2023:

If the treasury stock is not. When a firm buys back stock, it may resell them later to raise cash, use them in an acquisition, or. Presentation of treasury stock.

Prescribing the accounting for treasury shares (an entity's own repurchased shares) prescribing strict conditions under which assets and liabilities may be offset in. Under the cost method of recording treasury stock, the cost of treasury stock is reported at the end of the stockholders' equity section of the balance sheet. When a company buys back its own.

Treasury stock is a contra equity account recorded in the shareholders' equity section of the balance sheet. because treasury stock represents the number of shares repurchasedfrom the open market, it reduces shareholders' equity by the amount paid for the stock. Treasury stock can be found in the liabilities and equity section as. It is presented as a negative value deducted from the total.

On the shareholders’ equity section of the balance sheet, the “treasury stock” line item refers to shares that were issued in the past but were later repurchased. European markets heidelberg materials balance sheet improves as building sector recovers. In addition to not issuing dividends and not.

Treasury stock = number of repurchased shares x average cost per share. Chart 4 summarizes the assets and liabilities that the government reports on its balance sheet. Treasury stock accounting is the technique of recording treasury shares in the balance sheet.