Brilliant Strategies Of Tips About Treatment Of Provision For Bad Debts In Cash Flow Statement Financial Restatement Disclosure Example

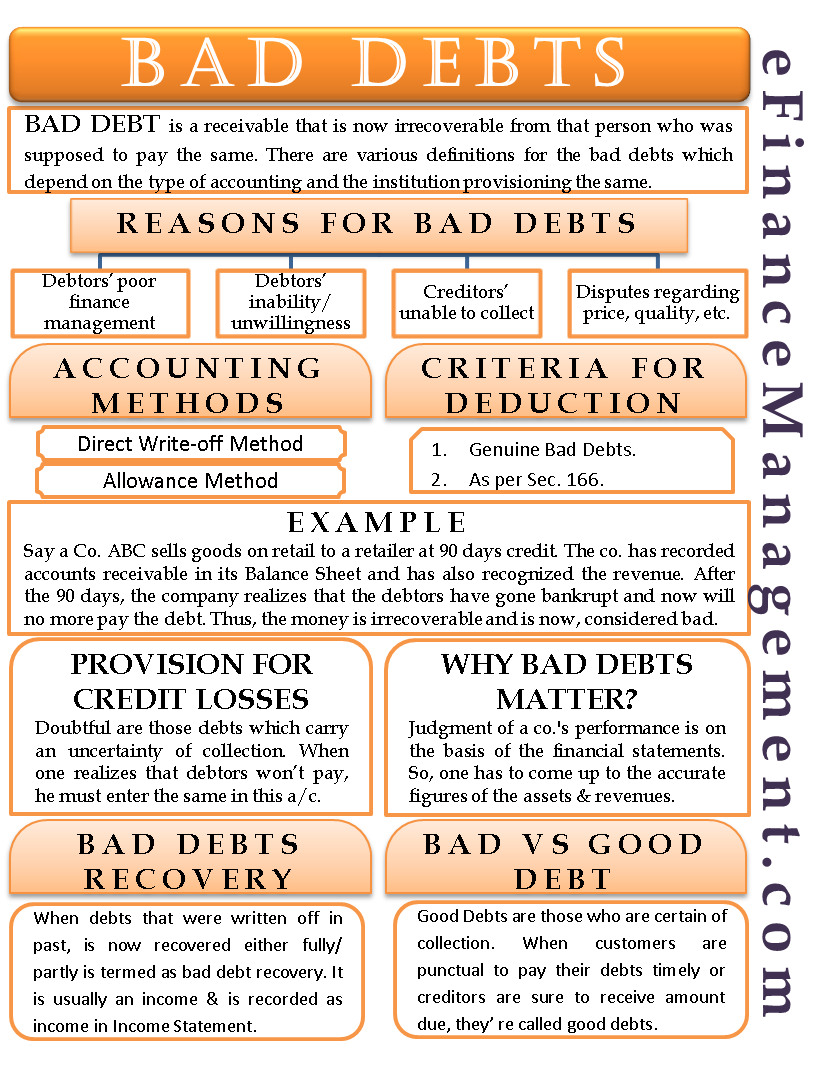

Bad debt and cash flow the only way that bad debts can affect cash flow is if the business receives some sort of payment on the debt.

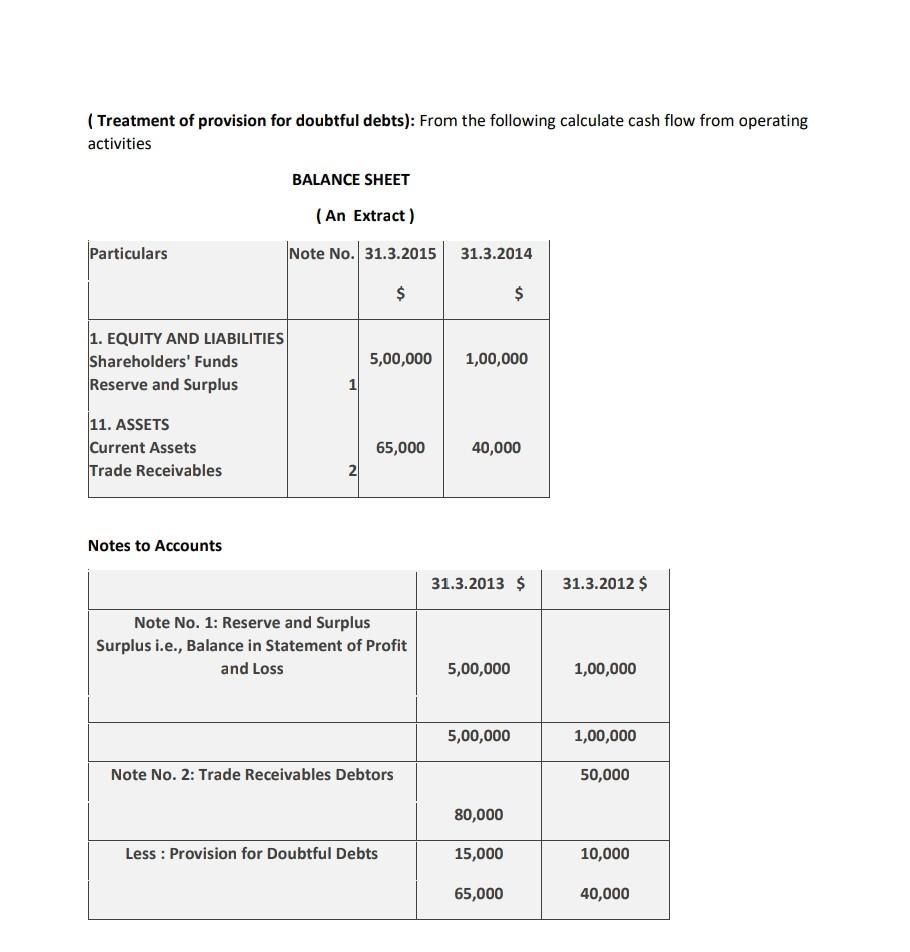

Treatment of provision for bad debts in cash flow statement. The provision for doubtful debts is the estimated amount of bad debt that will arise from accounts receivable that have been issued but not yet collected. For example, warranties may warrant companies to estimate future costs and record them. Accounts receivable can be one the largest.

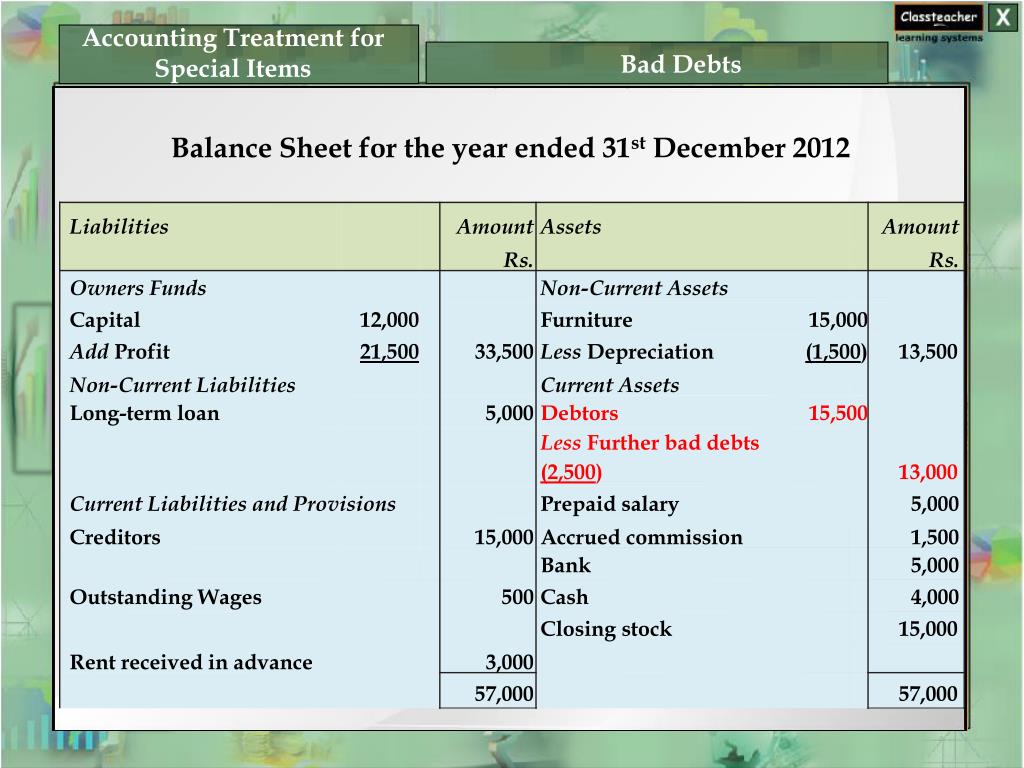

(provision for bad debts created) accounting for bad debts. At the end of each financial year,. If provision for doubtful debts is the name of the account used for recording the current period's expense associated with the losses from normal credit sales, it will appear as an.

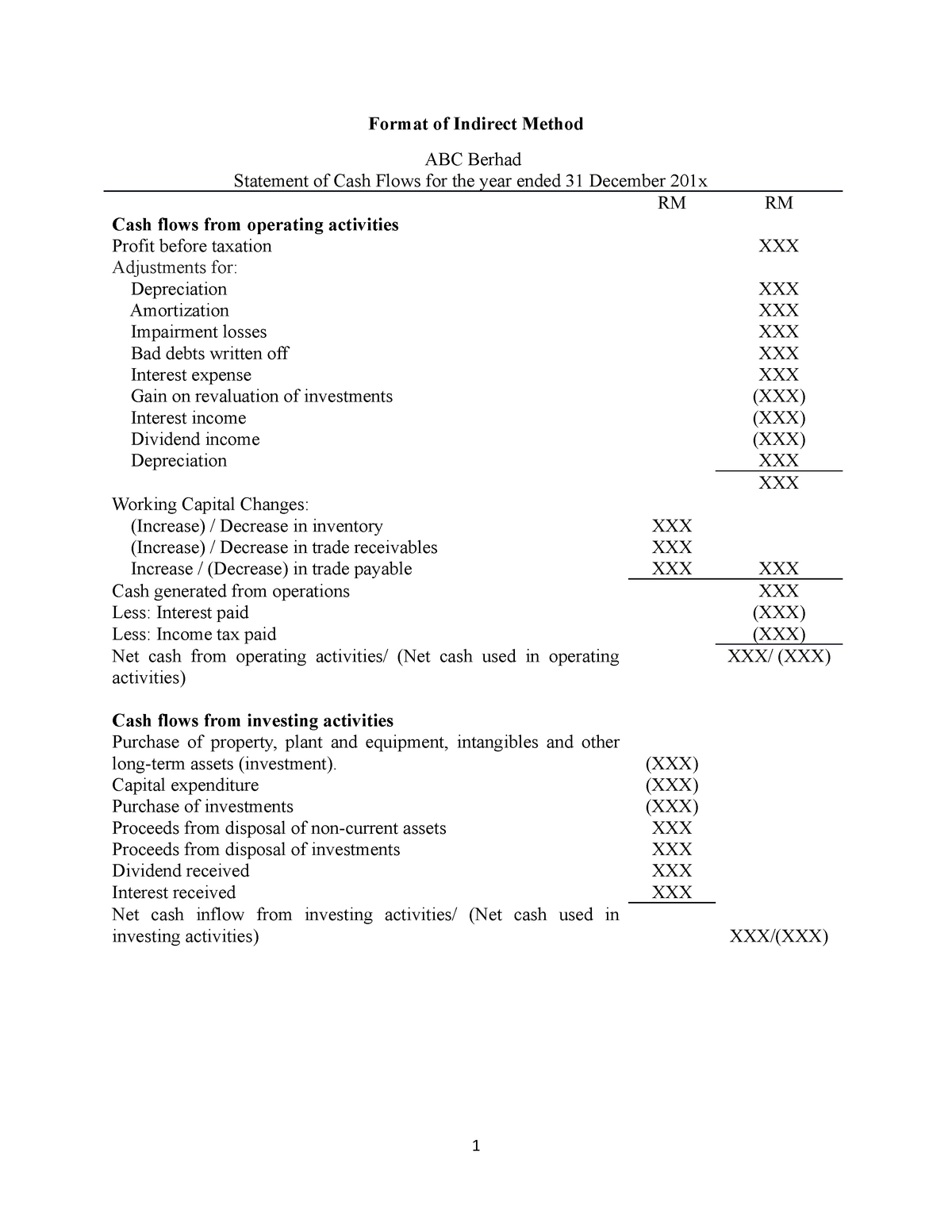

If the actual bad debt was greater than the provision, the bad debt expense must be tracked on the income statement for the same accounting period during which. Because, you know, cash is king. The treatment of the bad debts provision in the reconciliation of net income and cash flows from operations under the indirect method is particularly troublesome and worthy.

If, subsequently the bad debts amounts recovered, the journal entry in this case: It is relevant to the fa (financial accounting) and fr (financial reporting) exams. We will take the example of company alpha.

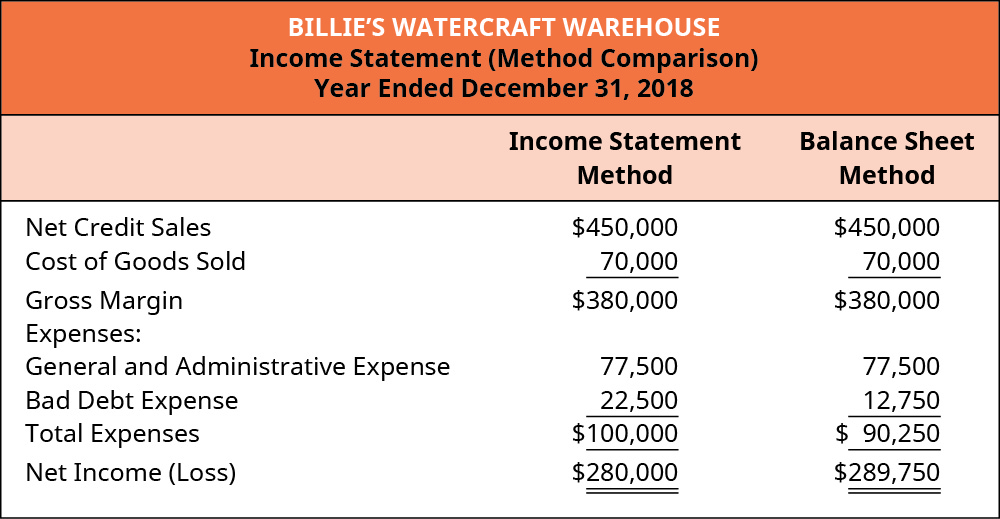

The operating section of your cash flow statement records adjustments for bad debt. This can happen if a debtor makes. Implicitly, the bad debts provision is viewed as a revenue deduction like sales discounts, returns, and allowances, rather than as a noncash expense;

This article considers the statement of cash flows of which it assumes no prior knowledge. Provisions for bad debts faqs what is bad debt? The problem i have is, if we incorporate bad and doubtful debts into the receivables balance, then compare receivables with the prior year, we will be misled into.

What is the provision for bad debts? You don't care about accounts receivable, only about money actually received. The sharp deterioration took place in the last year after delinquent commercial property debt for the six big banks nearly tripled to $9.3bn.

The bad debt provision isn't an issue with the direct method. The provision for bad debts could refer to the balance sheet account also known as the. How bad debt arises although some companies make loans to employees or.

Hi katrien, that's kind of a trick question. What is the treatment for bad debts written off against provision for bad debts in cash flow statement? Consequently, companies must increase their expenses in the income statement.

Let’s have a look at the accounting treatment for bad debts. Definition of provision for bad debts. However, bad debts and/or changes in the allowance for doubtful accounts are an example of accounts receivable reducing in a.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)