Underrated Ideas Of Tips About Section 199a Information Stmt Marriott Financial Statements

Future developments for the latest information about developments related to.

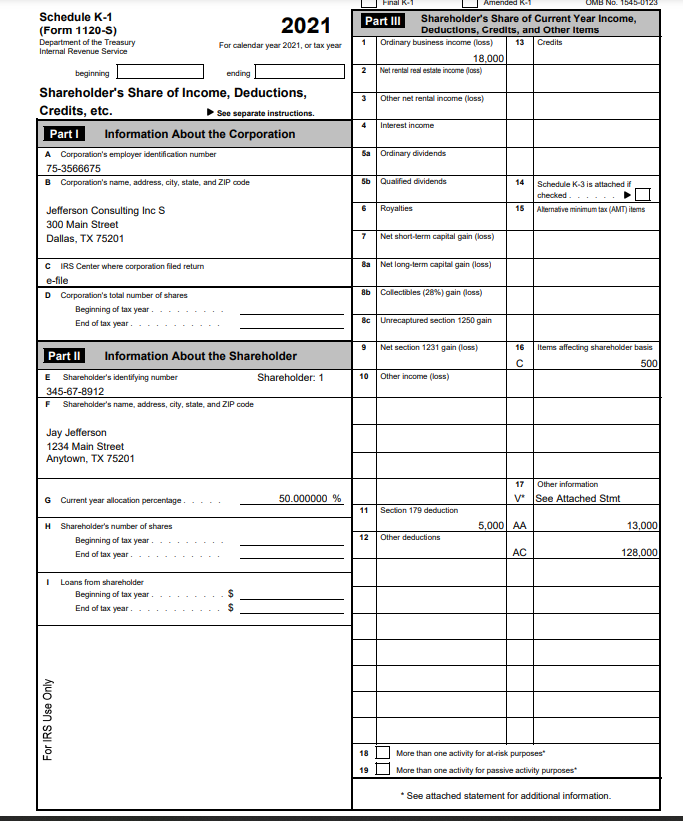

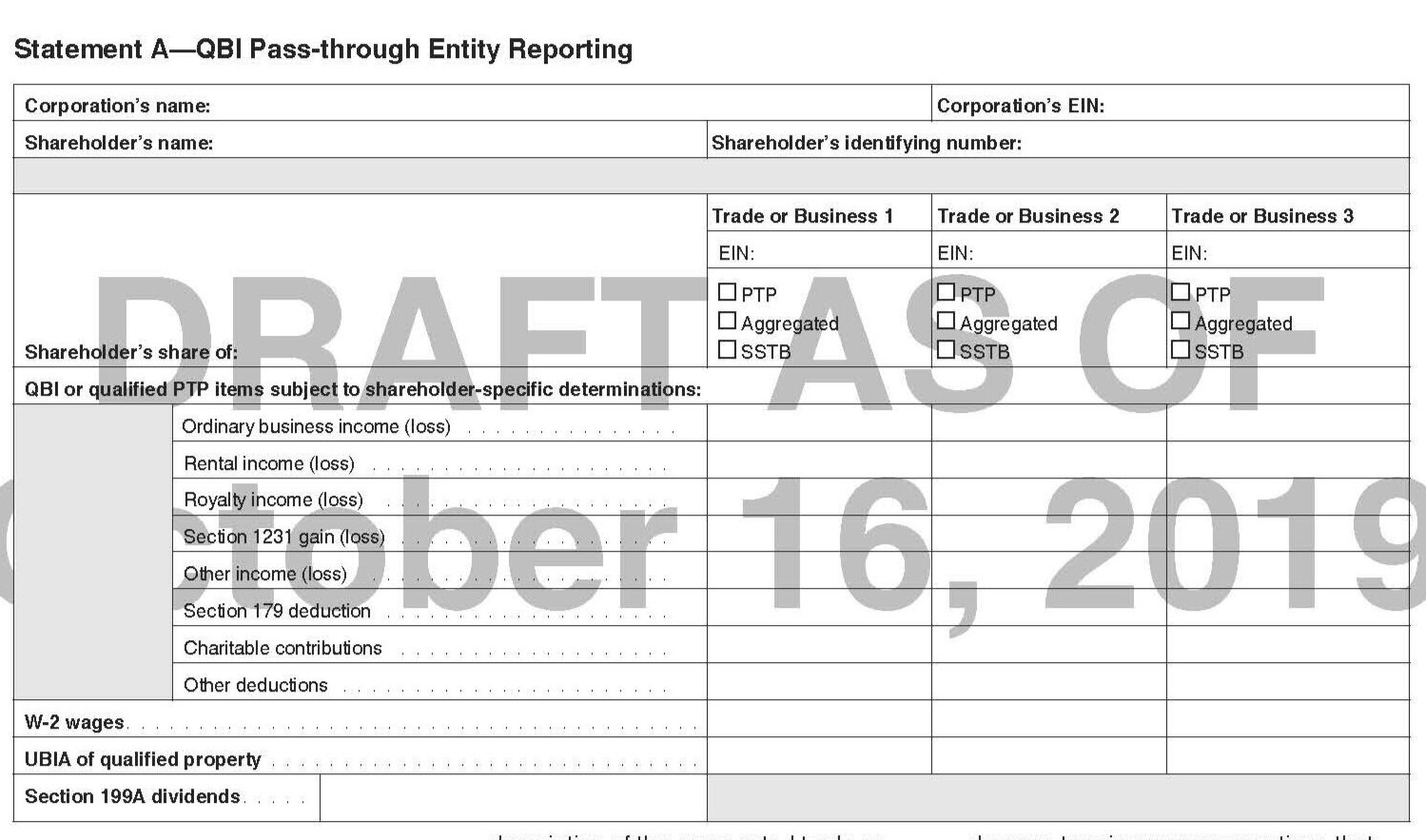

Section 199a information stmt. Making the 199a entries from a partnership in the individual (form 1040) tax program. Section references are to the internal revenue code unless otherwise noted. This document contains proposed regulations concerning the deduction for qualified business income under section 199a of the internal revenue.

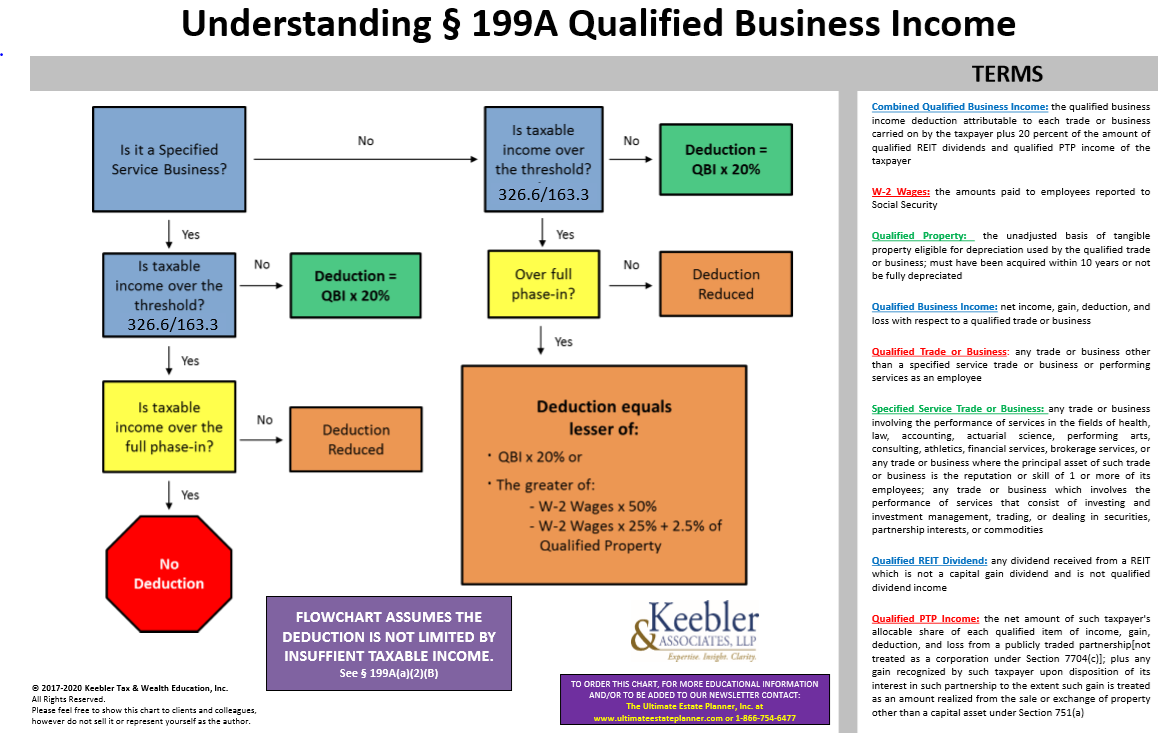

Like most of the changes in the individual income tax in p.l. We use the partner's section 199a information worksheet in lieu of reporting in the partner statements because so much detail is needed. Generally, you may be allowed a deduction of up to 20% of your net qualified business income (qbi) plus 20% of your qualified reit.

Section 199a of the internal revenue code provides many owners of sole proprietorships, partnerships, s. Review and planning to maximize the benefits of qbi on the form 1040 larry l gray, cpa, cgma what we will cover. We use the worksheet to indicate.

Section 199a in general. Return of partnership income was prepared in the business. What is the qualified business income deduction (qbid)?

Unadjusted basis immediately after acquisition (ubia) of. 1 199a qualified business income (qbi): However, if you scoot further.