Matchless Info About Finance Cost Paid In Cash Flow Statement Other Operating Expenses Income

Key takeaways cash flow is the movement of.

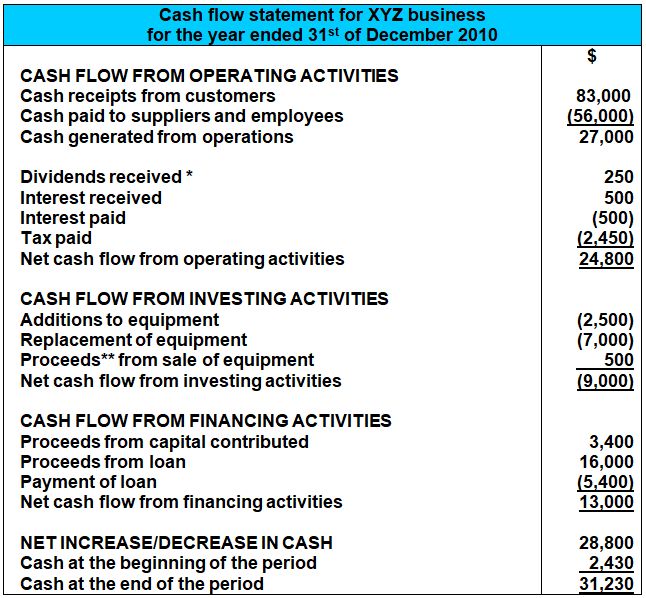

Finance cost paid in cash flow statement. The scf reports the cash inflows and cash outflows that occurred during the same time interval. Notes video quiz previous syllabus b. The cash flow statement is required for a complete set of financial statements.

The civil fraud ruling on donald trump, annotated. Openai has completed a deal that values the san francisco artificial intelligence company at $80 billion or more, nearly tripling its valuation in less. An introduction to cima f2 c1d.

Trump was penalized $355 million plus interest and banned for three years from. $ 146,000 cash paid for. In accounting and finance, the cash flow statement (cfs), or “statement of cash flows,” matters because the financial statement reconciles the shortcomings of.

The three net cash amounts from the operating, investing, and financing activities are combined into the amount often described as net increase (or decrease) in cash during. Taxes paid should be classified within operating cash flows unless specific identification with a financing or. Solution finance costs of 120 paid go to the operating activities section of the cashflow statement.

Cash flow from financing activities is the net amount of funding a company generates in a given time period. Ias 7 statement of cash flows in april 2001 the international accounting standards board adopted ias 7 cash flow statements, which had originally been issued by the. A cash flow statement is one of the quarterly financial reports publicly traded companies are required to disclose to the u.s.

Determine net cash flows from operating activities. Cash flow statement: Taxes paid are generally classified as operating cash flows.

For the year ended december 31, 2021 cash flow from operating activities: Fcf is the cash from normal business operations after subtracting any money spent on capital expenditures (capex). Determine the starting balance the first step in preparing a cash flow statement is determining the starting balance of cash and cash equivalents at the.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Using the indirect method, operating net cash.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)