Ace Tips About Profitability Ratios Types Chapter 5 Accounting For Merchandising Operations

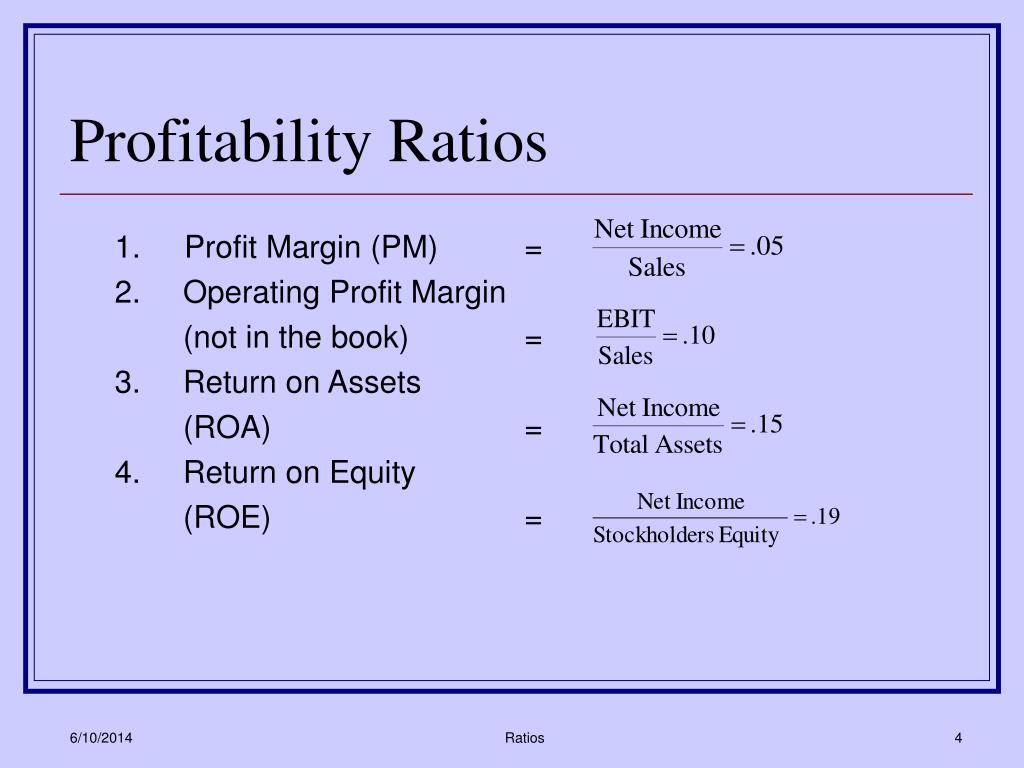

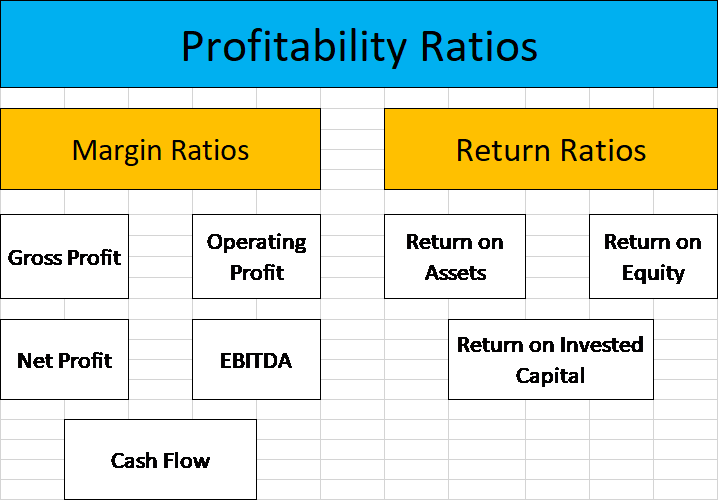

Margin ratios give insight, from several different angles, on a company's ability to turn total sales into profits.

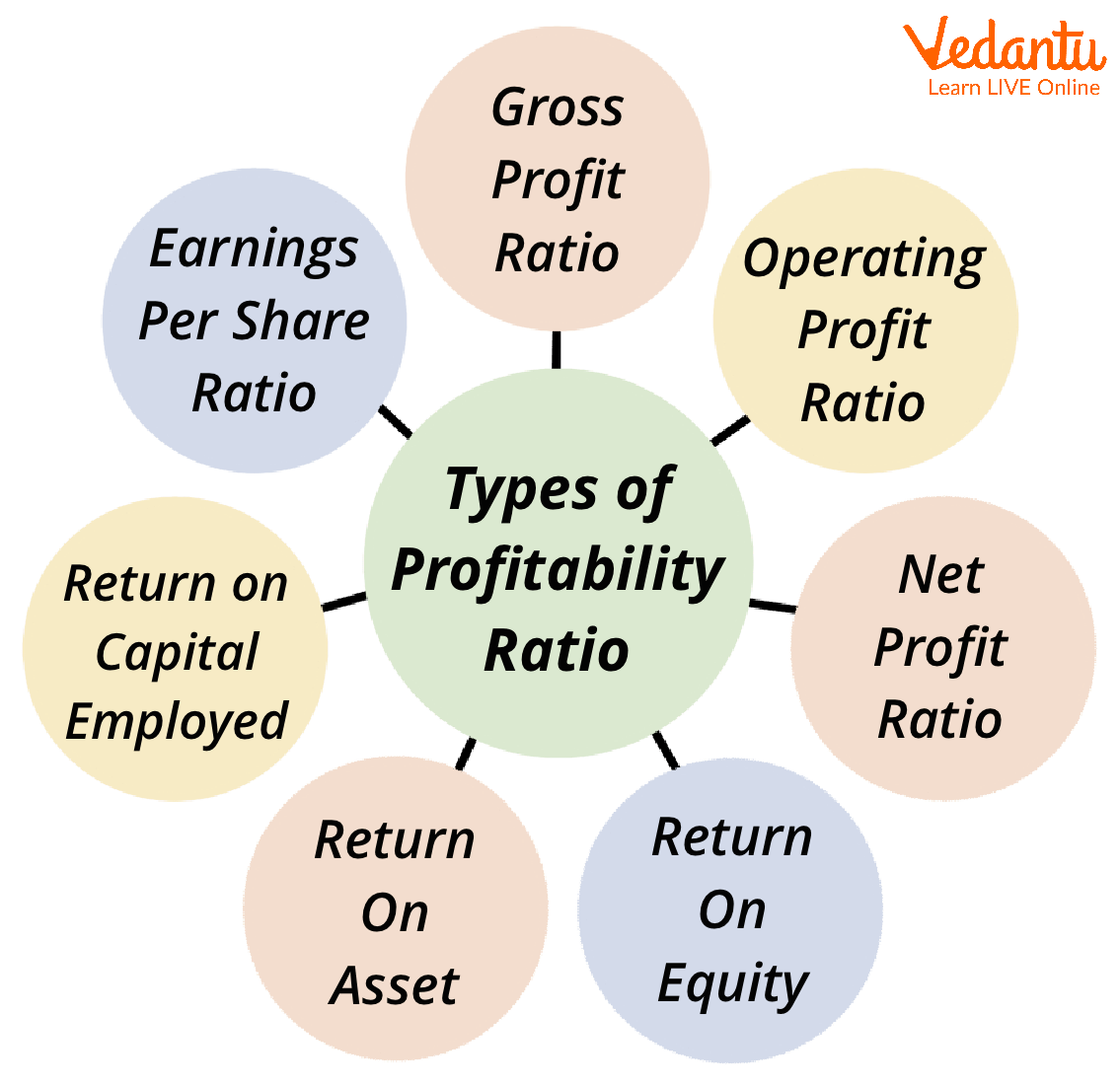

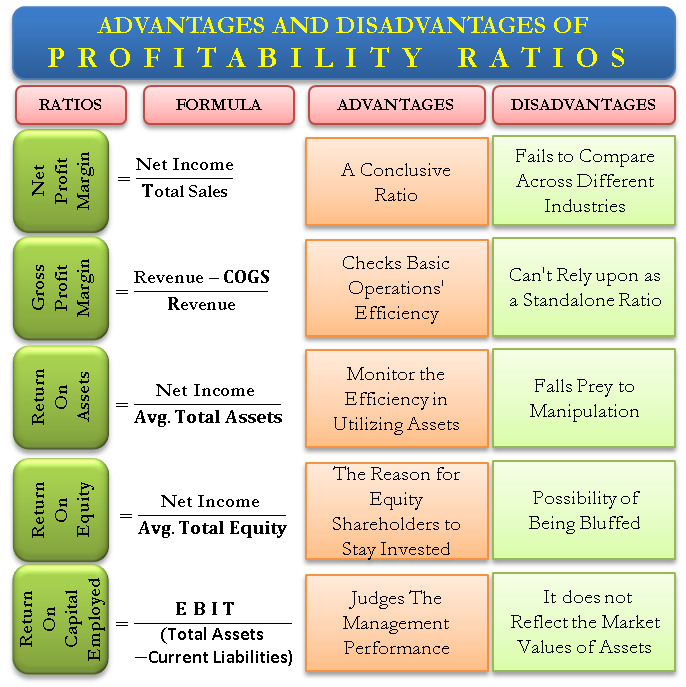

Profitability ratios types. Return on assets (roa) return on equity (roe) return on capital employed (roce) return on investment (roi) return on net worth (ronw) example of profitability ratios with calculation uses of profitability ratios act as evaluation criterion The five main types of profitability ratios include: Return ratios measure the overall ability of the firm to generate shareholder wealth.

Margin ratios give insight, from several different angles, into a company's ability to turn sales. Margin ratios represent the firm's ability to translate sales dollars into profits. Now that we know what a profitability ratio is and where to find the necessary information to calculate it, let’s examine the types of ratios.

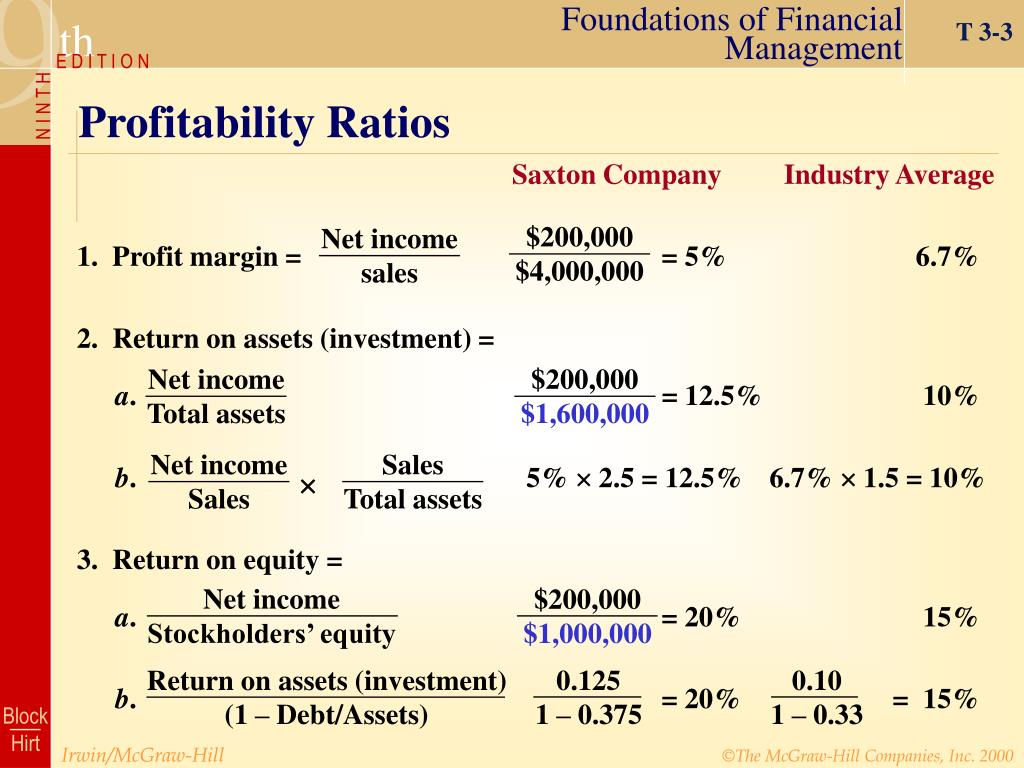

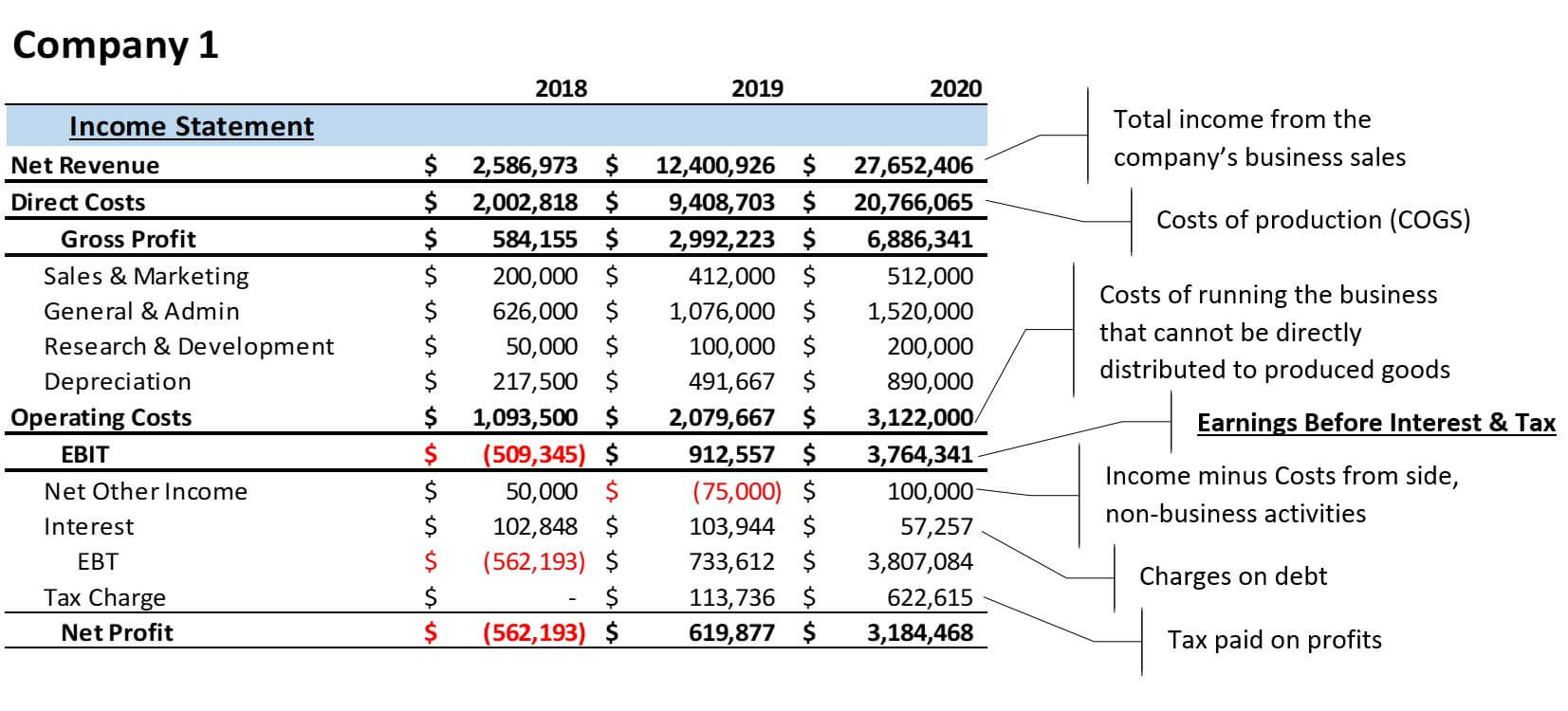

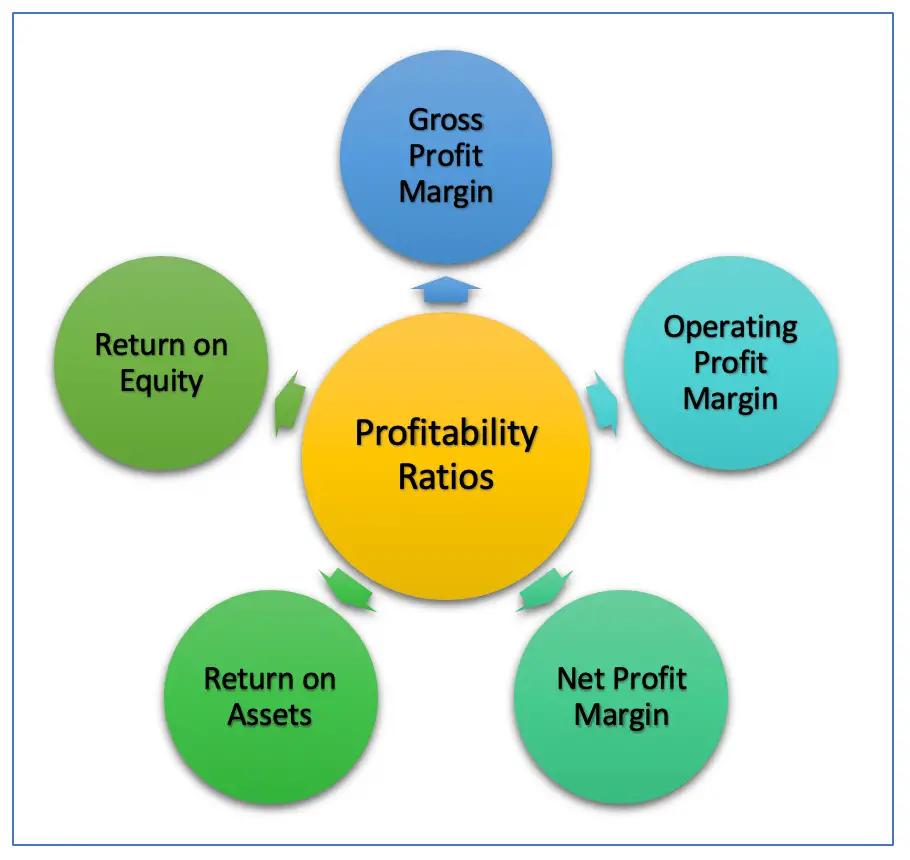

The most commonly analyzed profitability ratios include margins such as gross profit margin, operating margin and net profit margin, which reveal how efficiently revenue is converted into profits at different stages. 5 types of profitability ratio. It measures the relationship between revenues and costs.

Expressed as a percentage of revenue, allowing for comparisons between companies. Accounting ratios measuring profitability are known as profitability ratio. The usage and significance of these profitability ratio types are discussed below:

These ratios are also compared to the industry average and to its closest peers or competitors in the industry to ascertain the entity’s relative position as compared. A profitability ratio is a financial measurement. The ratio quantifies the cost levels required to achieve these revenues.

They are representative of a company’s true potential in terms of profitability and sustenance in the market. Profitability ratios are one of the key metrics that help to monitor the overall financial efficiency and health of the business. The gross profit ratio calculates the amount of income that is left after deducting the cost of goods sold.

It measures the relationship between revenues and costs. Profitability ratios show how well a company is able to make profits from its operations. These are critical markers for both the owners and the investors.

A large gross margin is essential since it will enable a company to generate a higher net profit. Hub project management september 26, 2022 a profitability ratio is a financial measurement. Profitability ratios are standardized against revenue—i.e.

These ratios can help you answer several important business questions. The two categories of profitability ratios are margin ratios and return ratios. Accounting ratios are of four types (a) liquidity ratios (b) solvency ratios (c) turnover ratios (d) profitability ratios.

Higher gross profit margins indicate. Profitability ratios generally fall into two categories—margin ratios and return ratios. There are two types of profitability ratios — margin ratios and return ratios.

:max_bytes(150000):strip_icc()/profitabilityratios2-36c31a87daca4fa9ae3fda8946f1e55a.png)