Top Notch Info About Financial Ratios For Different Industries Cash Flow Balance Sheet

Almanac of business and industrial financial ratios.

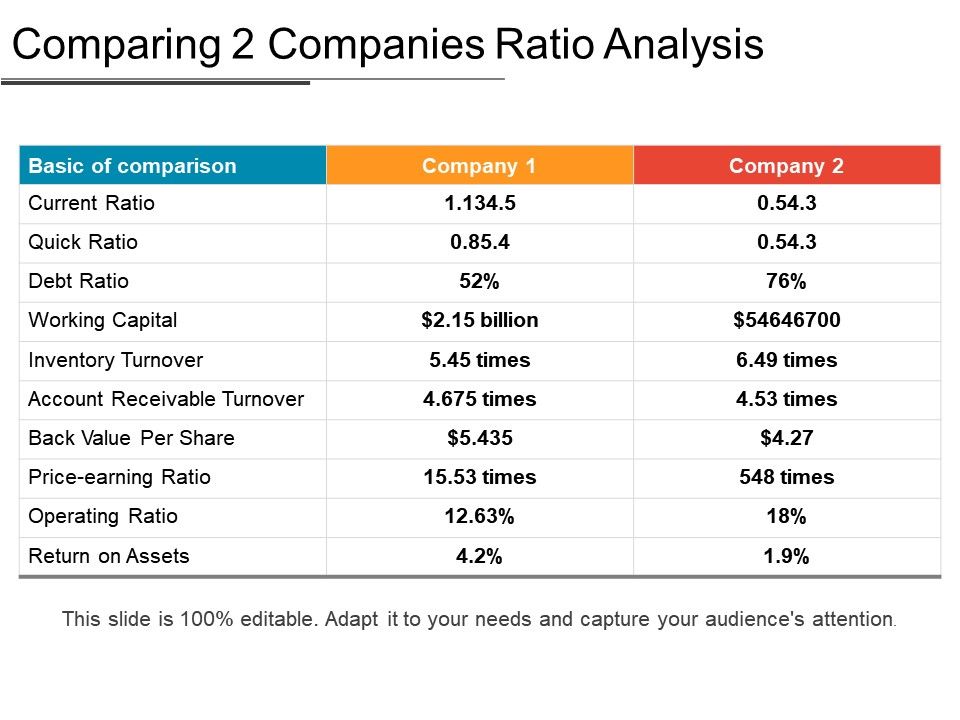

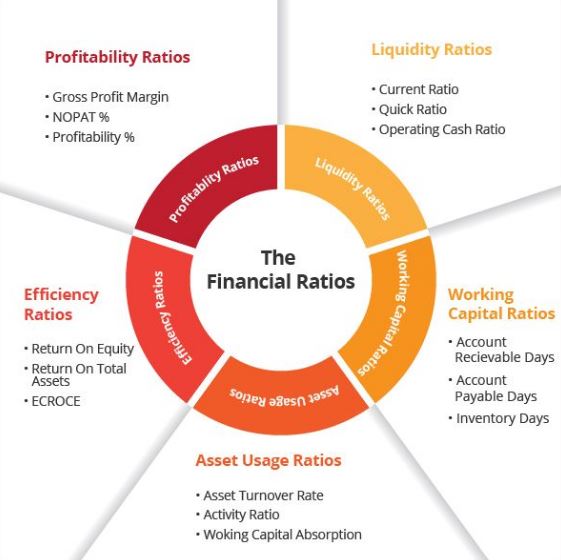

Financial ratios for different industries. By steve lander financial ratios are tools that companies use to understand their performance by comparing different aspects of their performance. These ratios are used by financial analysts, equity research analysts, investors, and. Includes over 70 financial ratios grouped into the following 7 categories:

Financial planning and analysis professionals calculate financial ratios for the following reasons for internal reasons. Financial ratios are primarily used by two categories of people: Corporate finance ratios are quantitative measures that are used to assess businesses.

D&b key business ratios (kbr), provided by mergent, provides immediate online access to recent competitive industry benchmarking data for public and private. These ratios look at the debt levels of an organization to its assets,. Features of industry financial ratios.

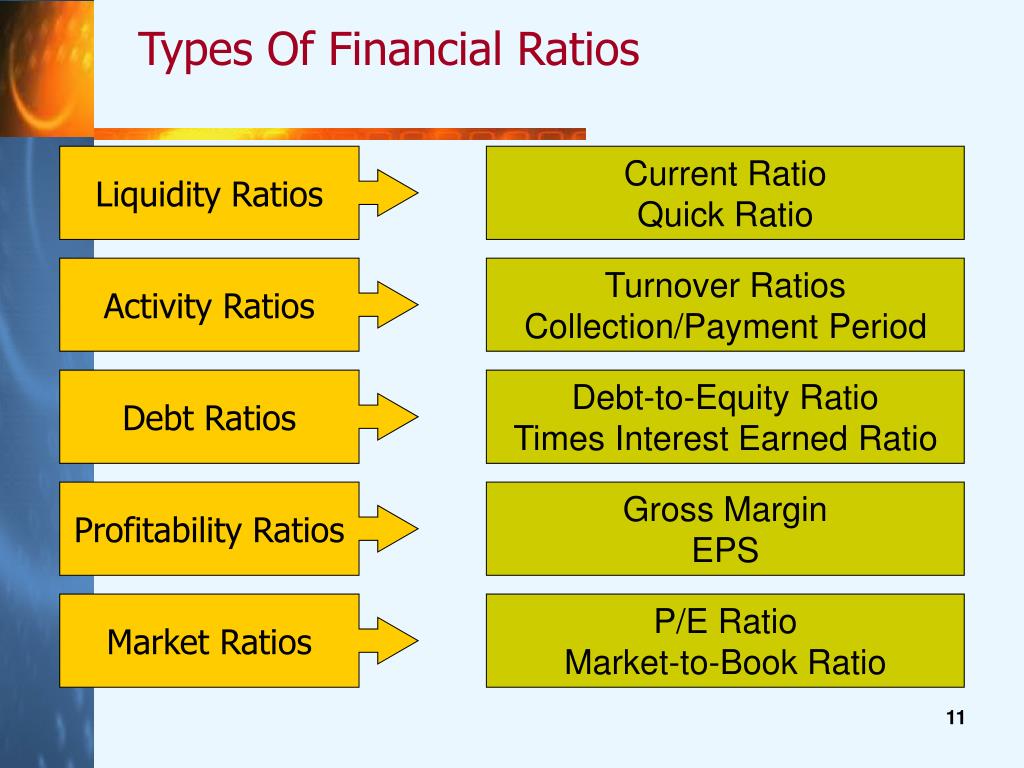

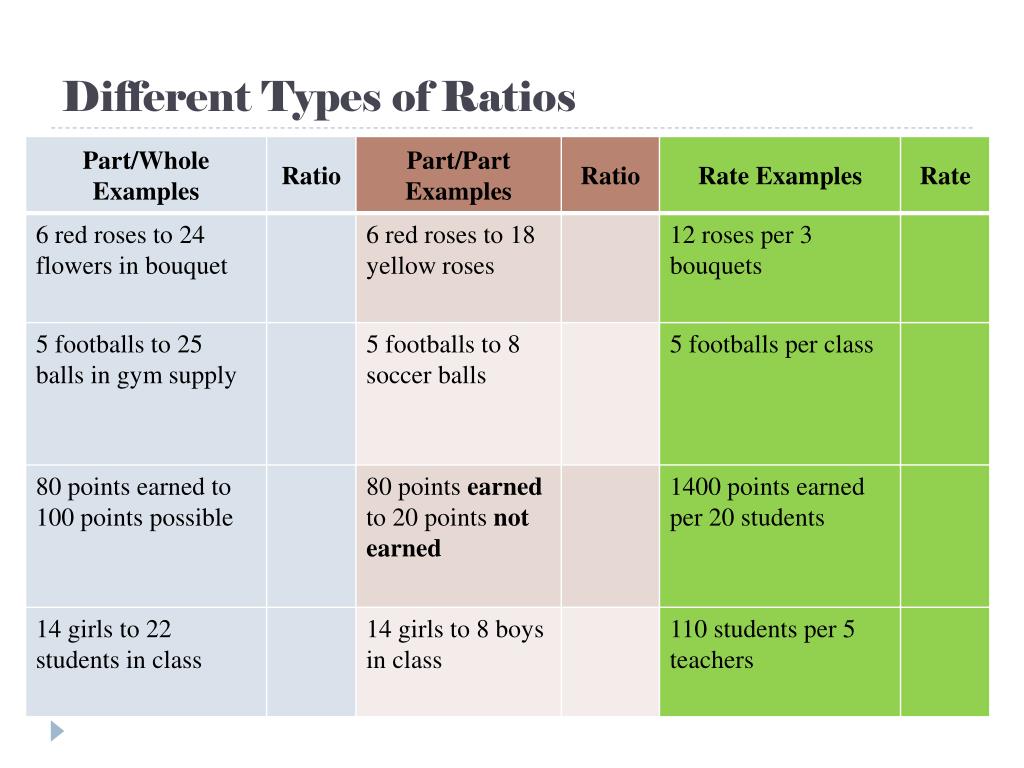

Compiled from tax returns submitted to the irs. Some of the most common are: There are five basic types of financial ratios :

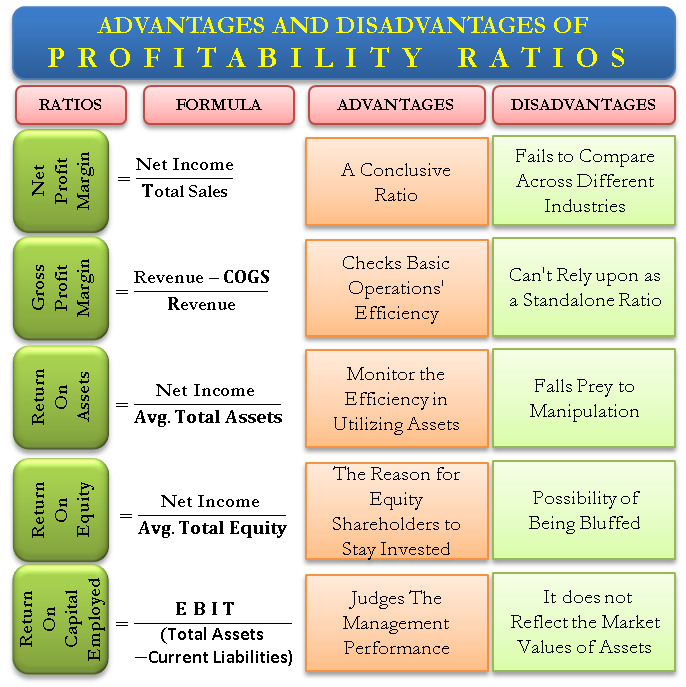

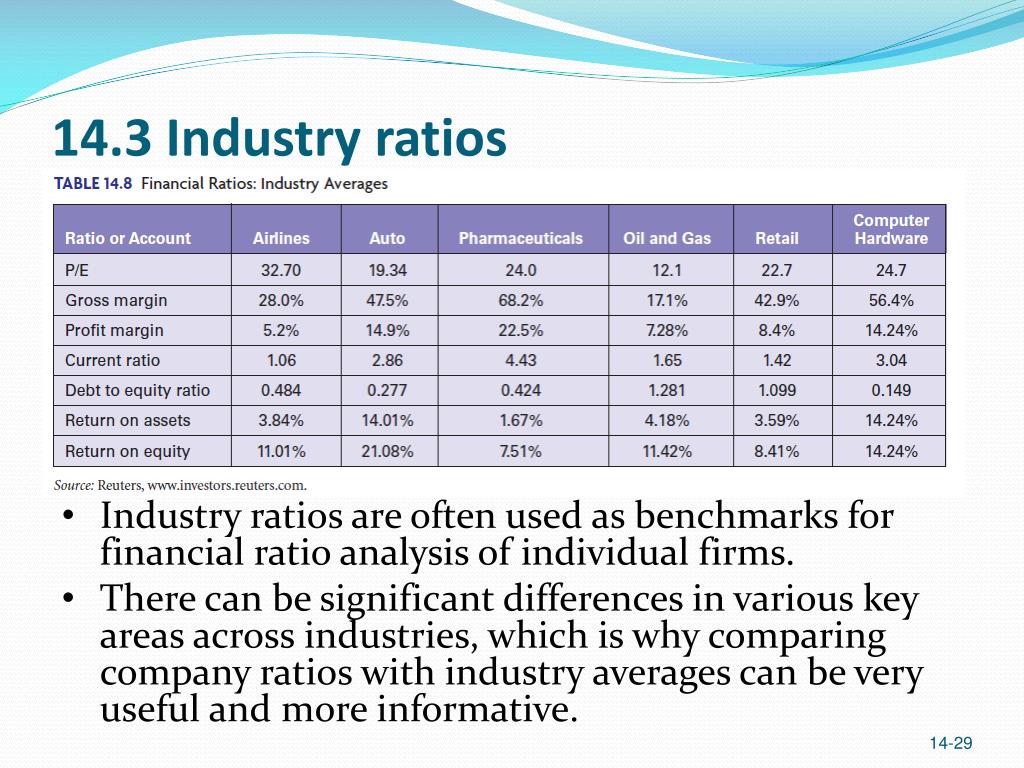

There are various types of financial ratios that focus on different aspects of a company’s finances, including liquidity ratios, profitability ratios, solvency ratios,. Financial ratios and industry averages are useful for comparing a company with its industry for benchmarking purposes. Profitability ratios (e.g., net profit margin and return on shareholders' equity) liquidity ratios (e.g., working capital).

Different financial ratios indicate the company’s results, financial risks, and working efficiency, like the liquidity ratio, asset turnover ratio, operating profitability ratios,. Industries with the highest pe ratio are shown in the following chart and table. There are many types of financial ratios.

A beginner’s guide contents hide 1 introduction to financial ratios 1.1 definition of financial ratios 1.2 importance of. You can further filter the industries by sector in the chart. Provides access to competitive benchmarking data, featuring 14 key business and financial ratios for public and private companies in 800 lines of business.

Features the most widely used financial ratios, including liquidity,. Financial ratios industry level via wrds. Financial ratios inside a business.

Financial analysts, security analysts, competitors, investors, creditors, tax and regulatory authorities. Industries with highest pe ratio. 190 lines of business covered and 50 performance.

Included within key statistic chapter of every us naics report.