Beautiful Work Tips About Provision For Bad Debts In Balance Sheet Pro Forma P&l

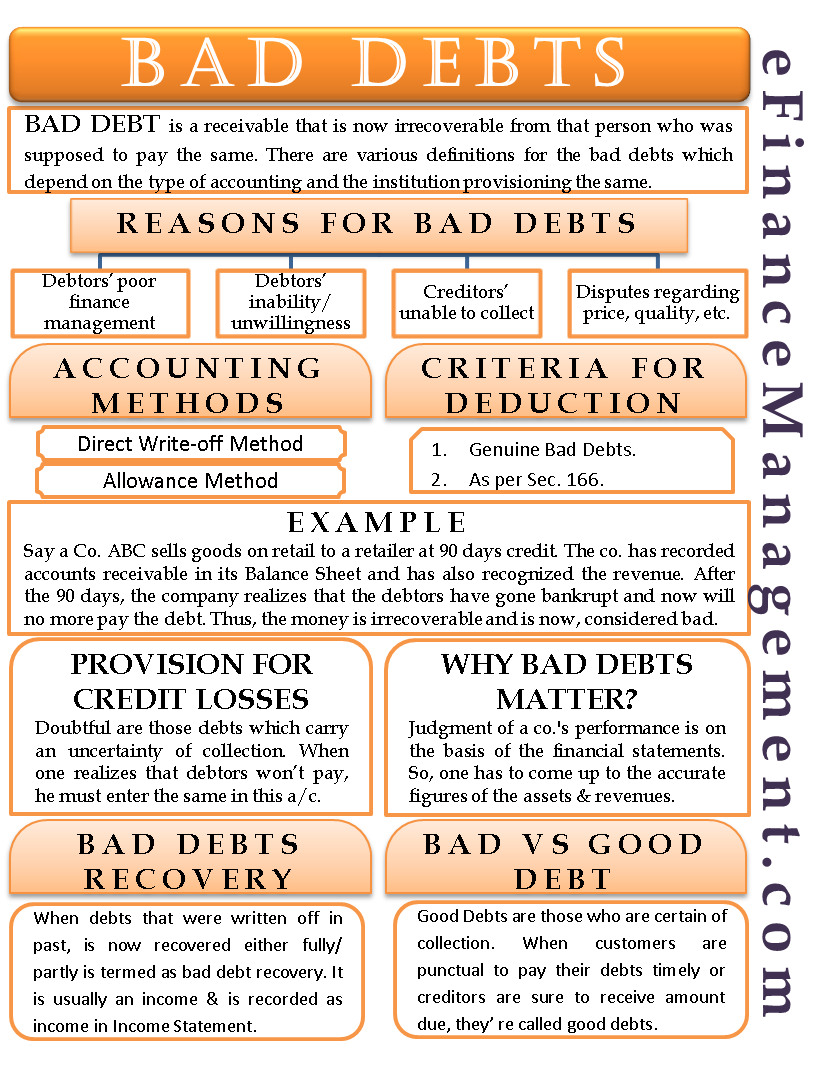

A provision for a bad debt account holds an amount, in addition to the actual written off bad debts during a year, that will be known to be due and payable in.

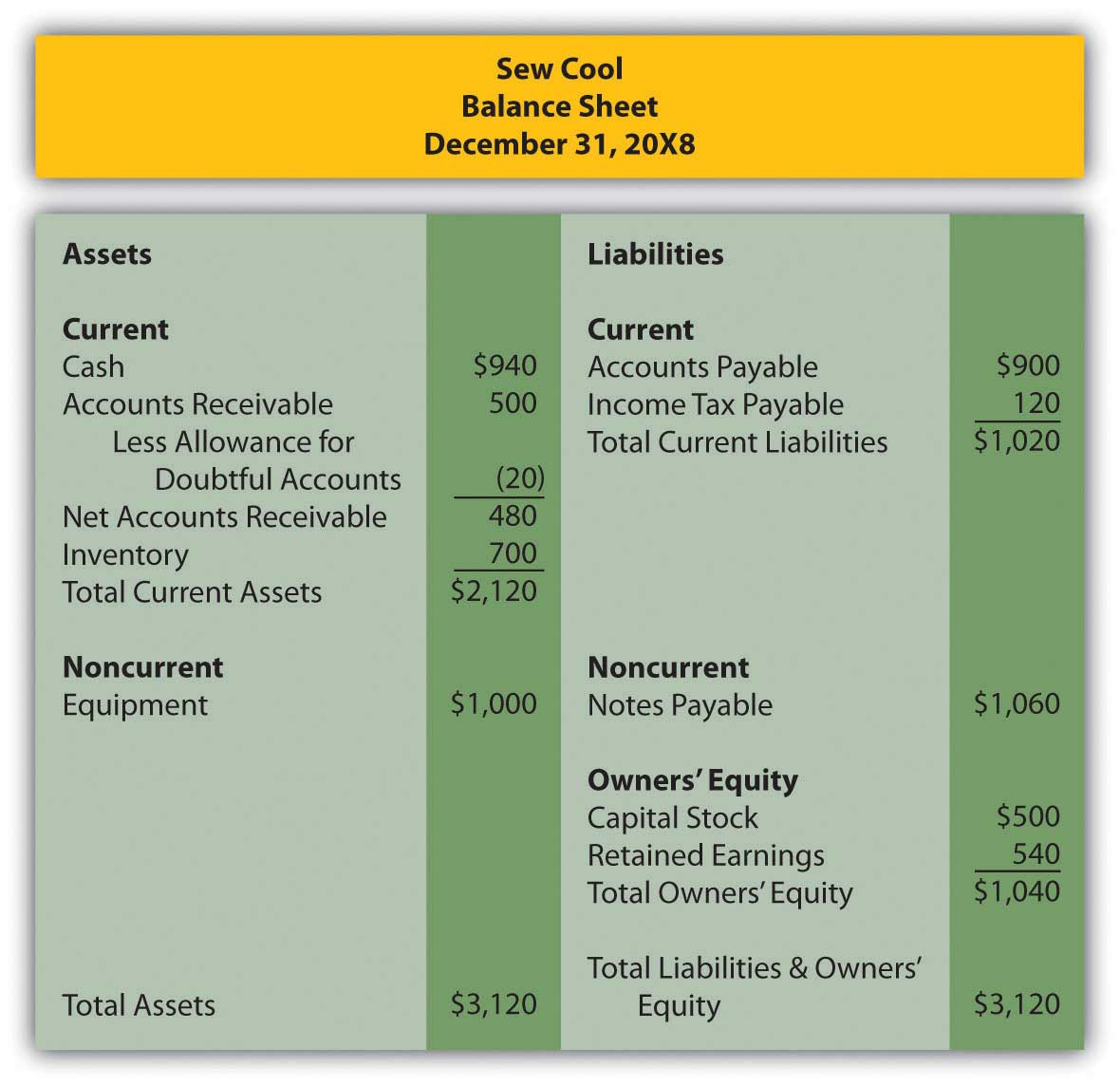

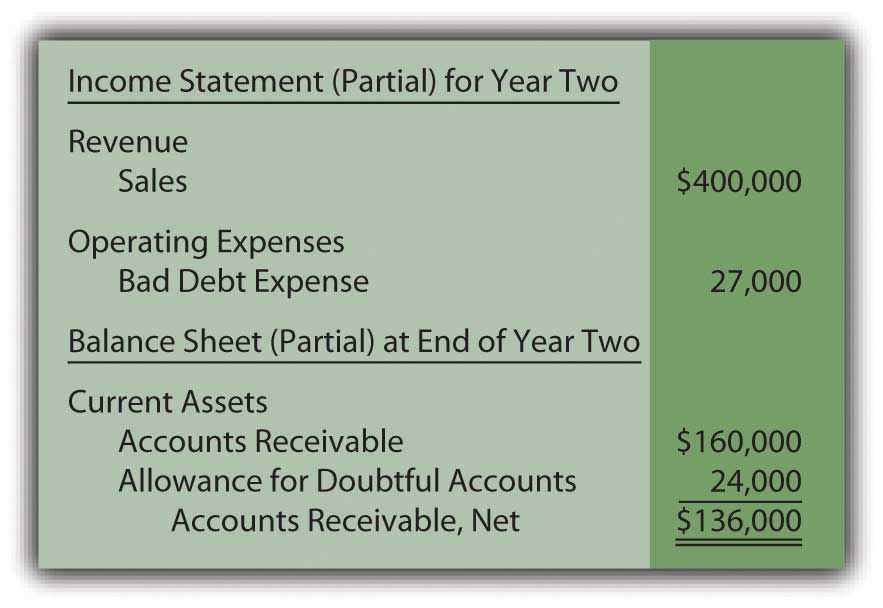

Provision for bad debts in balance sheet. This estimate is referred to as a provision because it is an expense that would occur in the future at an uncertain time. It is used along with the accounts receivable. Provision for doubtful debts is shown in the debit.

By correctly accounting for bad debts, businesses can ensure that their accounts are. The journal entry to create provision is shown below: In this lesson, you will learn how to calculate and record bad debts, provision for bad debts, and how to adjust the provision for bad debts using the balanc.

500+ accounting questions (with answers) provision for doubtful debts are deducted from accounts receivables/sundry debtors and shown. A business typically estimates the amount of bad debt based on historical experience, and charges this amount to expense with a debit to the bad debt expense. A provision for bad debts is the probable loss or expenses of the immediate future.

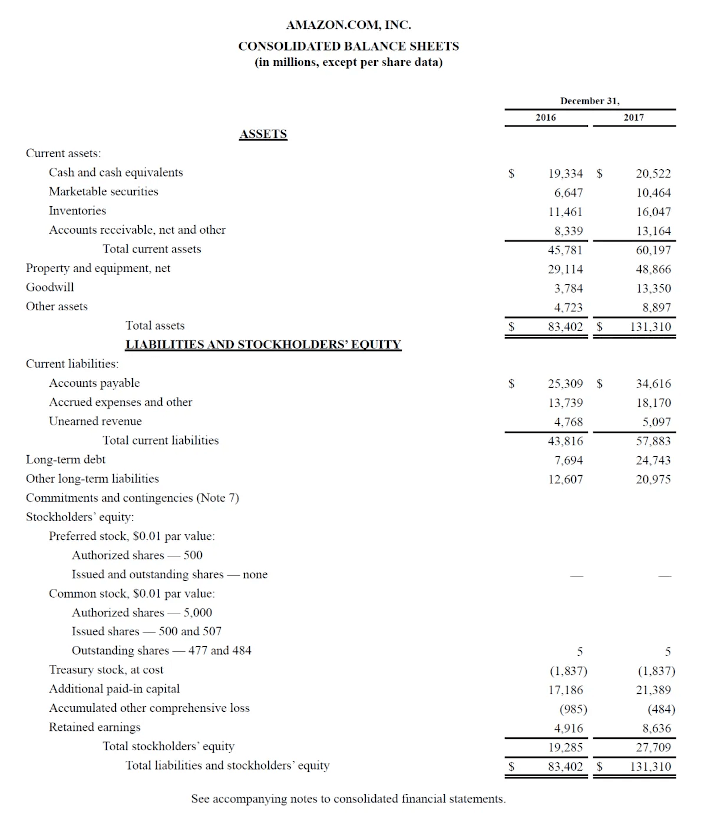

The allowance for doubtful accounts (or the “bad debt” reserve) appears on the balance sheet to. The bad debt expense is a company’s outstanding receivables that were determined to be. The provision for bad debts is a contra asset account that shows the net realizable value of the company's accounts receivable.

Last updated january 23, 2024 learn online now what is bad debt? The amount of bad debts is not debited to the profit and loss account since it was already debited in earlier years. Bad debt is an amount of money that a creditor must write off if a borrower.

The provision for bad debts creates a contra account (an asset account with a credit balance), which is then listed in the balance sheet and placed just below the. Such an estimate is called a bad debt allowance,. A bad debt provision is a reserve against the future recognition of accounts receivable as being uncollectible.

It is required under the matching principle. Bad debt provision to record bad debts in the account books, firms must initially estimate their potential losses. But the accountant is unsure when or how much the loss/expenses.

Reviewed by somer anderson fact checked by kirsten rohrs schmitt what is bad debt? A contra account has an opposite normal balance to its paired account, thus reducing or increasing the balance in the paired account at the end of a period;

:max_bytes(150000):strip_icc()/Allowance_For_Doubtful_Accounts_Final-d347926353c547f29516ab599b06a6d5.png)

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)