Best Info About Positive Investing Cash Flow Heb Financial Statements

And profitability comes as investments are paid down.

Positive investing cash flow. A cash flow statement summarizes the amount of cash and cash equivalents entering and leaving a company. However, companies can have negative cash flow, even profitable companies. Now you must be eager to know how to use cash flow scan and implement it to generate good investment stocks.

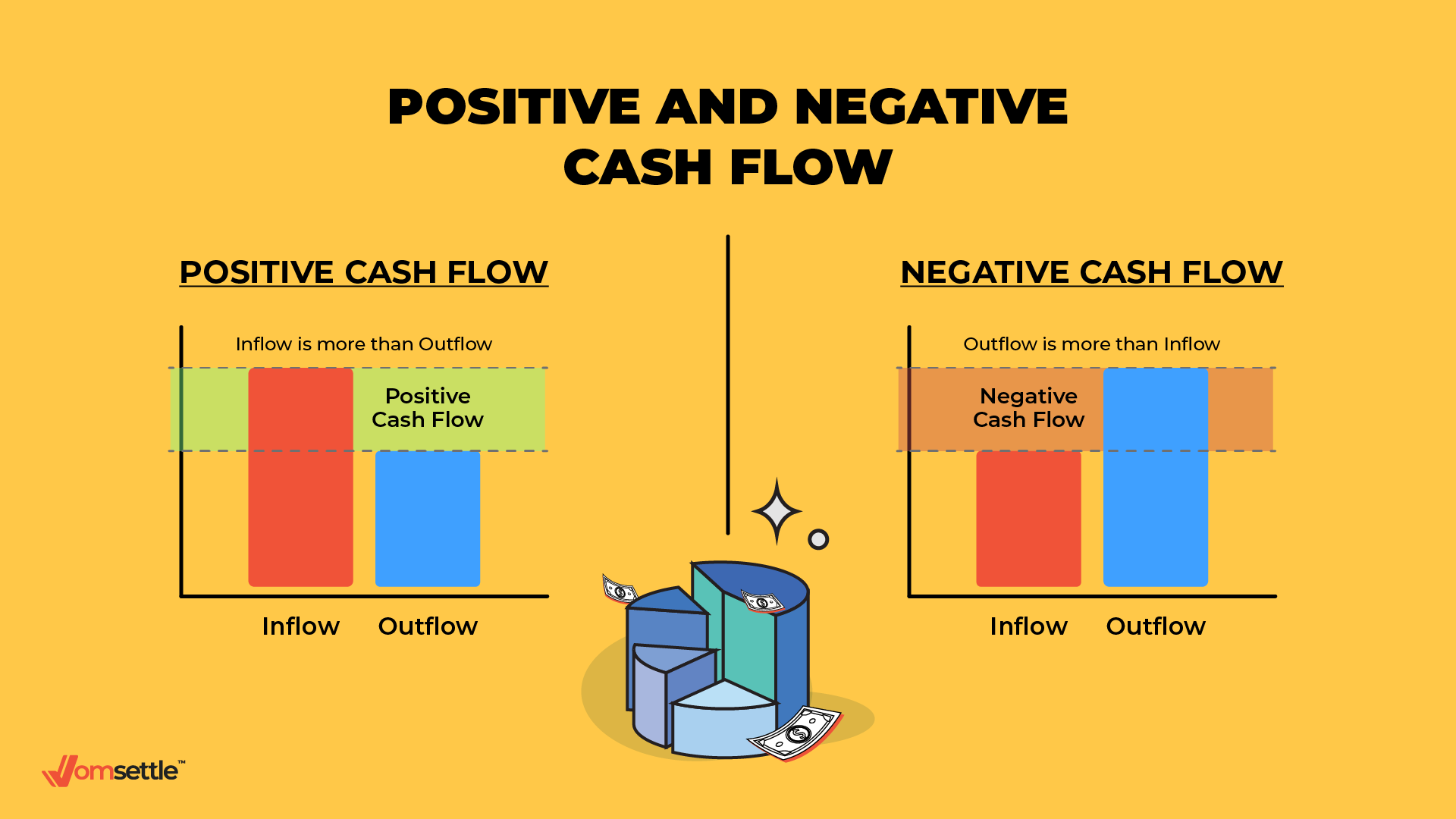

Cash flow positive simply means more cash coming in than going out. Additionally, a consistently positive cash flow infers that the business can add to its assets and create value for its shareholders. Cash flow from financing (cff)

Before we delve deeper into this type of cash flow, it would be wise to understand exactly where investments fall in any company’s. For example, a company might be investing heavily in plant and. By contrast, if cfi is negative, the company is likely investing heavily into its fixed asset base to generate revenue growth in the coming years.

Proceeds from maturities of marketable securities for $26.7 billion proceeds from the sale of. Even though the cash flow from investing activities offers a clear picture of a company’s investments, it's necessary to consider both the income statement and balance sheet to. Cash flow from investing activities is the section of a company’s cash flow statement that displays how much money has been used in (or generated from) making investments during a specific time period.

Companies look to generate positive cash flow. Often, major conglomerates rely almost entirely on this data before a staggered process of investing activities begins. The fundamental way to build wealth is to have a different approach to money.

The business brought in $53.66 billion through its regular operating activities. Investing activities that were cash flow positive are highlighted in green and include: This metric indicates that a business has enough working capital to cover all its bills and will not need additional funding.

Class a shares of lyft ( nasdaq: A positive investing cash flow means that a company generates more cash from its investments than it is spending. This can be good or bad, based on how the company uses the extra cash.

For many companies, positive cash flow from operations is used to offset the negative cash flow from investing. In a note released monday, t.d. Now let us have a look at a few more sophisticated cash flow statements for companies that are listed entities on nyse.

T o generate positive cash flow and avoid negative cash flows that can harm an investor’s financial position, various strategies can be employed, such as:. The cfs highlights a company's cash management, including how well it generates. Cfi is an outflow of $20,000.

Cash flow is broken out into cash flow from operating activities, investing activities, and financing activities. Thus we will discuss all this here to help you filter out companies with good cash flow. There are a couple ways you can prioritize which balances to target first, and both have advantages for improving your cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statement_Analyzing_Cash_Flow_From_Investing_Activities_Jul_2020-01-5297a0ec347e4dd8996f307b3d9d61ad.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Corporate_Cash_Flow_Understanding_the_Essentials_Oct_2020-01-3c5fb3c82fb240c0bad19e14f04ce874.jpg)