The Secret Of Info About Calculate Leverage Ratio From Balance Sheet Ifrs Indian Accounting Standards

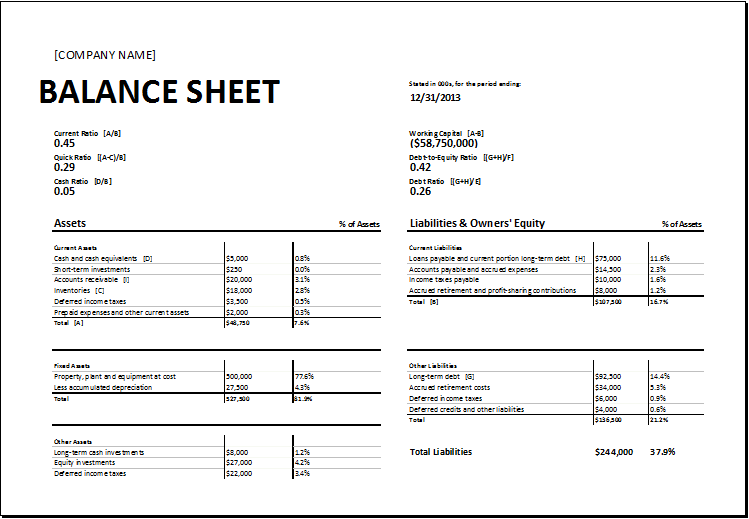

Leverage ratios efficiency ratios profitability ratios market value ratios uses and users of financial ratio analysis analysis of financial ratios serves two main purposes:

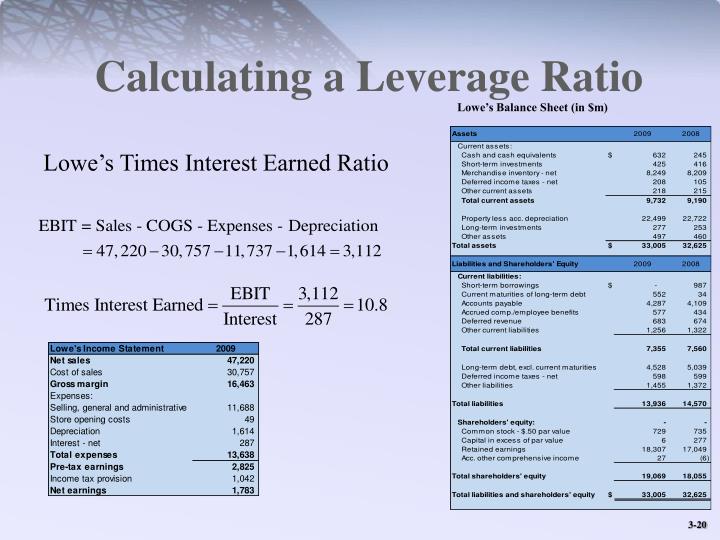

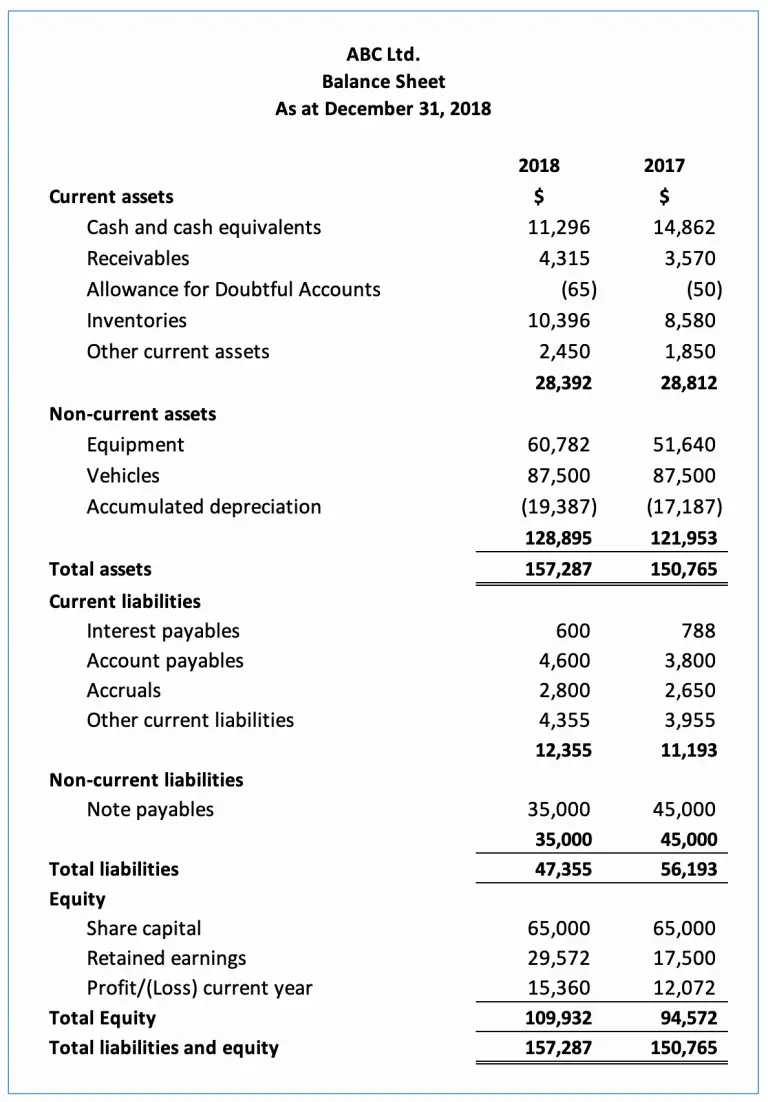

Calculate leverage ratio from balance sheet. A leverage ratio is any one of several financial measurements that look at how much capital comes in the form of debt (loans) or assesses the ability of a company to meet its financial obligations. Debt to equity ratio in practice. A leverage ratio is any kind of financial ratio that indicates the level of debt incurred by a business entity against several other accounts in its balance sheet , income statement,.

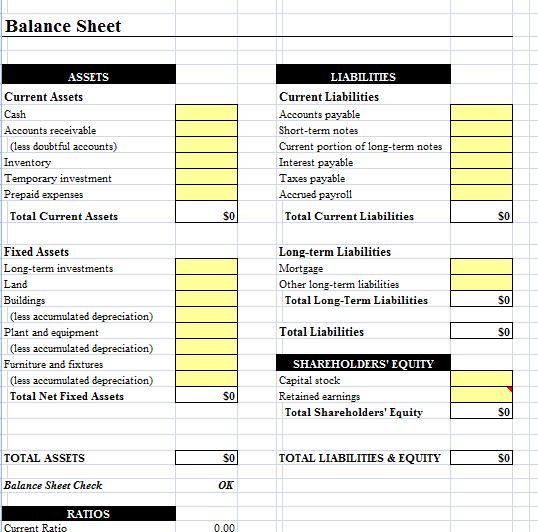

Assets = liabilities + equity to summarize, we can state that your balance sheet provides a glimpse into the future and the current financial. Hence now will find out the leverage ratio. Some accounts that are considered to have significant comparability to debt are total assets, total equity, operating expenses, and incomes.

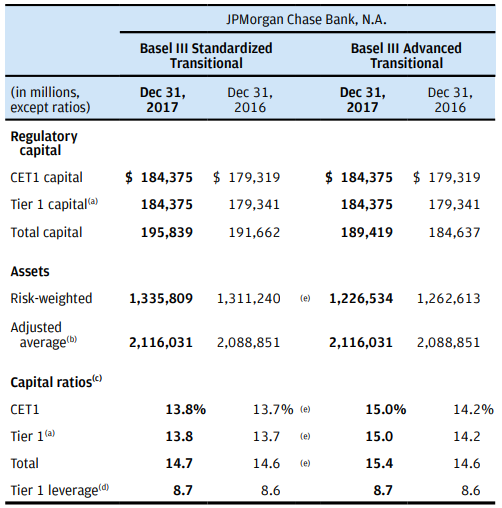

The bank balance sheet ratio calculator is a tool that you can use to determine a bank’s financial stability and liquidity using items found on a balance sheet. The following equation can be helpful: The leverage ratio category is important because companies rely on a mixture of equityand debt to finance.

The formula for leverage ratios is used to measure the debt level relative to the size of the balance sheet. Leverage ratio = total debt / total equity Below are 5 of the most commonly used.

Debt to equity ratio = (short term debt + long term debt + fixed payment obligations) / shareholders’ equity. The formula to calculate financial leverage is as follows: Leverage ratios tell us how much debt a bond issuer has relative to its cash flow, or ebitda, which is a company’s earnings before interest, taxes, depreciation, and.

Which company has a higher financial leverage ratio? Calculate the common balance sheet leverage ratios. These cover all aspects of the company’s.

The balance sheet of companies xyx inc. We can calculate the leverage ratio by using the below formula. Multiply the result by 100 to convert the number to a percentage.

Table of contents there are many financial metrics commonly used to evaluate a company’s financial performance. If, as per the balance sheet, the. The calculation of leverage ratios is primarily by comparing the total.