Formidable Tips About Are Drawings Included In The Income Statement Financial Leverage Analysis Interpretation

Drawings are not seen as an expense when calculating business profit and are not tax.

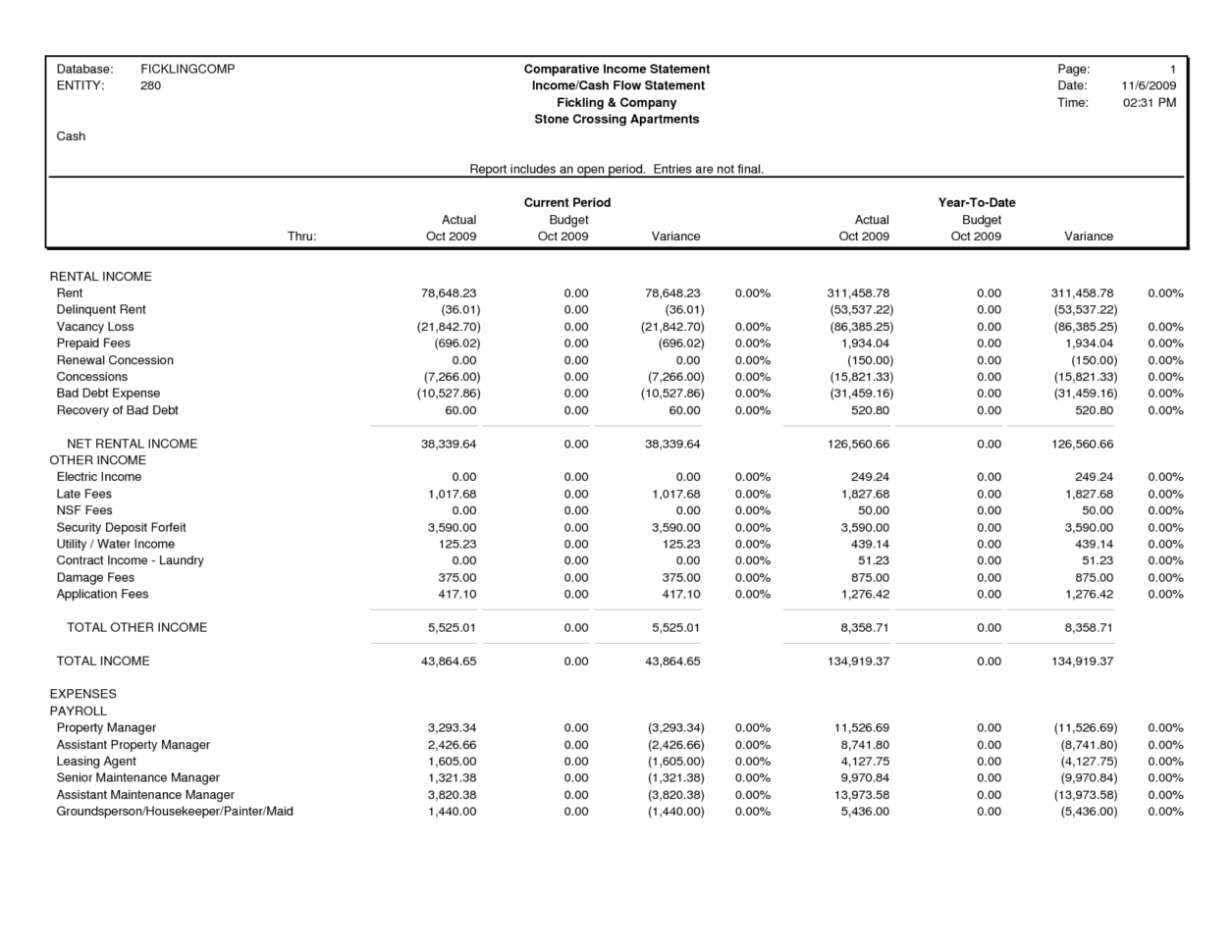

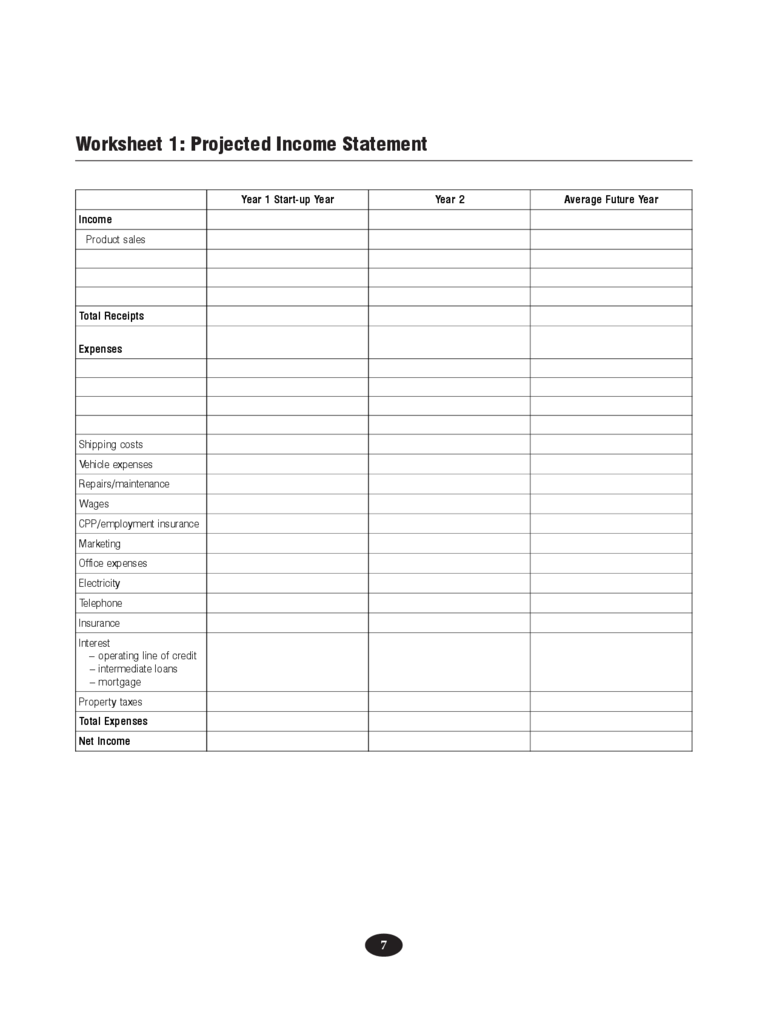

Are drawings included in the income statement. Revenue, expenses, gains, and losses. The profit and loss account or the income statement reports the business’s income by reducing expenses from revenue generated. Since the cash amount doesn’t fully tell us the details, the information relating to the drawings is included in the notes to the financial.

Under the accrual method of accounting, the amounts are reported in the accounting period in which the employees earn the salaries and wages. The statement of financial position also known as a balance sheet represents the assets, liabilities and equity of a business at a point in time. However, the following journal entries are passed to record drawings for the year:

Sales on credit) or cash vs. How do drawings affect your financial statements? Let’s take an example, mr x runs a trading business.

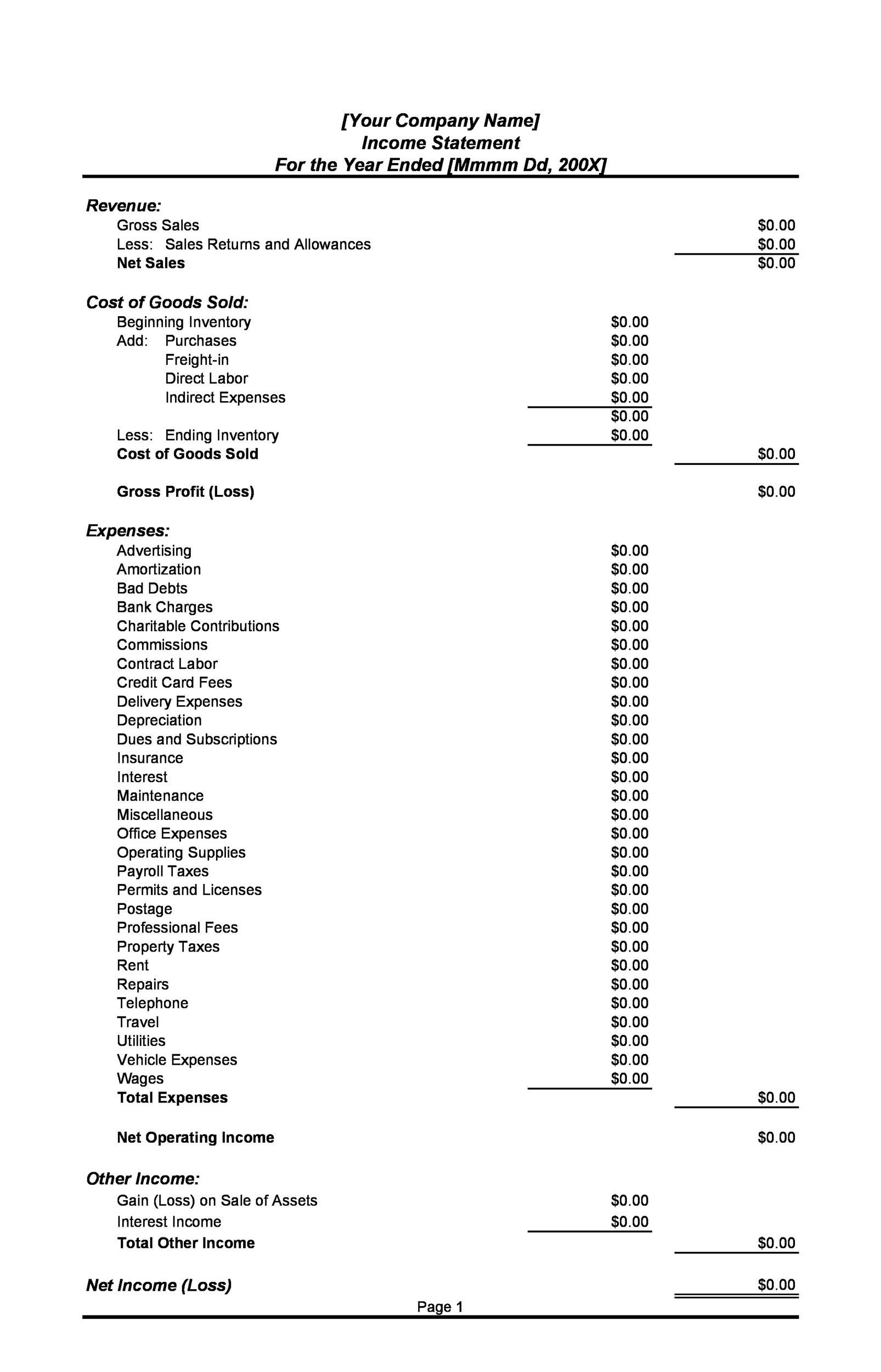

In the income statement, expenses are costs incurred by a business to generate revenue. Some of the common expenses recorded in the income statement include equipment depreciation, employee wages, and supplier payments. No, drawings are not shown in the statement of profit or loss.

He will show a balance of $1,200 ($100*12) in the trial balance in the debit column. They are recorded in a drawing account within the. Instead, drawing balances are reported on the company’s balance sheet as an equity account.

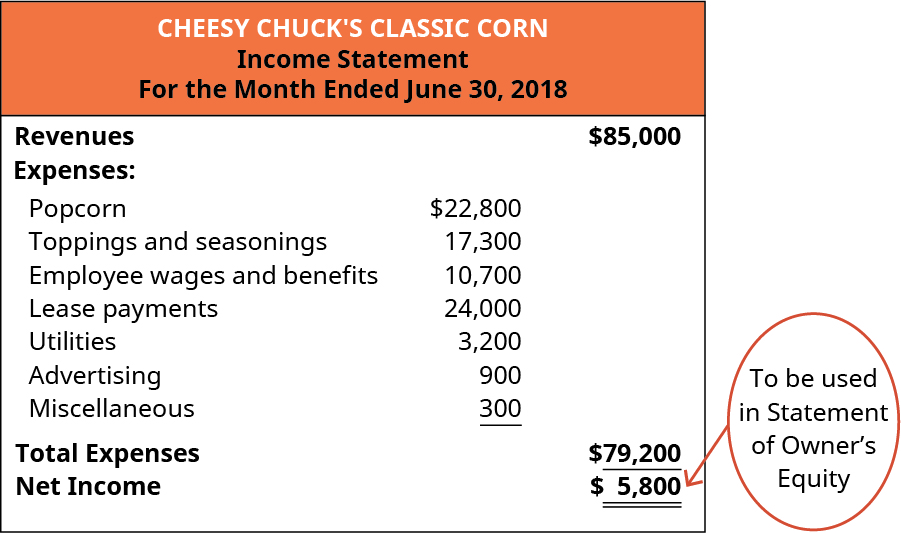

Let’s prepare the income statement so we can inform how cheesy chuck’s performed for the month of june (remember, an income statement is for a period of time). They do not affect the business expenses on the profit and loss account (income statement). The financial statements show the effects of business.

Our first step is to determine the value of goods and services that the organization sold or provided for a given period of time. As such, it will impact the company’s financial statement by showing a decrease in the assets equivalent to the amount that is withdrawn. Salaries and wages of a company's employees working in nonmanufacturing functions (e.g.

An income statement shows you the company's income & expenses. Effect of drawings on the financial statements. In the financial statement, the balance of drawings a/c will be deducted from the owner’s capital because.

The owner's drawings will affect the company's balance sheet by decreasing the asset that is withdrawn and by the decrease in owner's equity. From the income statement, apply your withdrawal to the equity line to balance your ledgers. It can also be referred to as a profit and loss (p&l) statement and is typically prepared quarterly or annually.

Drawings in accounting terms represent withdrawals taken by the owner. Drawing balances are not considered part of the company’s regular income and expenses, so it is not included in the income statement. Most israelis, both jewish and arab, do not believe absolute victory is possible in the war against hamas, a survey has found.

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-021-eb8d8819386649a898bb94fd7ca3abf8.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Balance_Sheet_Aug_2020-01-4cad5e9866c247f2b165c4d9d4f7afb7.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Income_Statement_Aug_2020-01-6b926d415b674b13b56bede987b7a2fb.jpg)