Fantastic Info About Ap Balance Sheet Bank Overdraft In

This $10,000 is recorded as your accounts payable (ap).

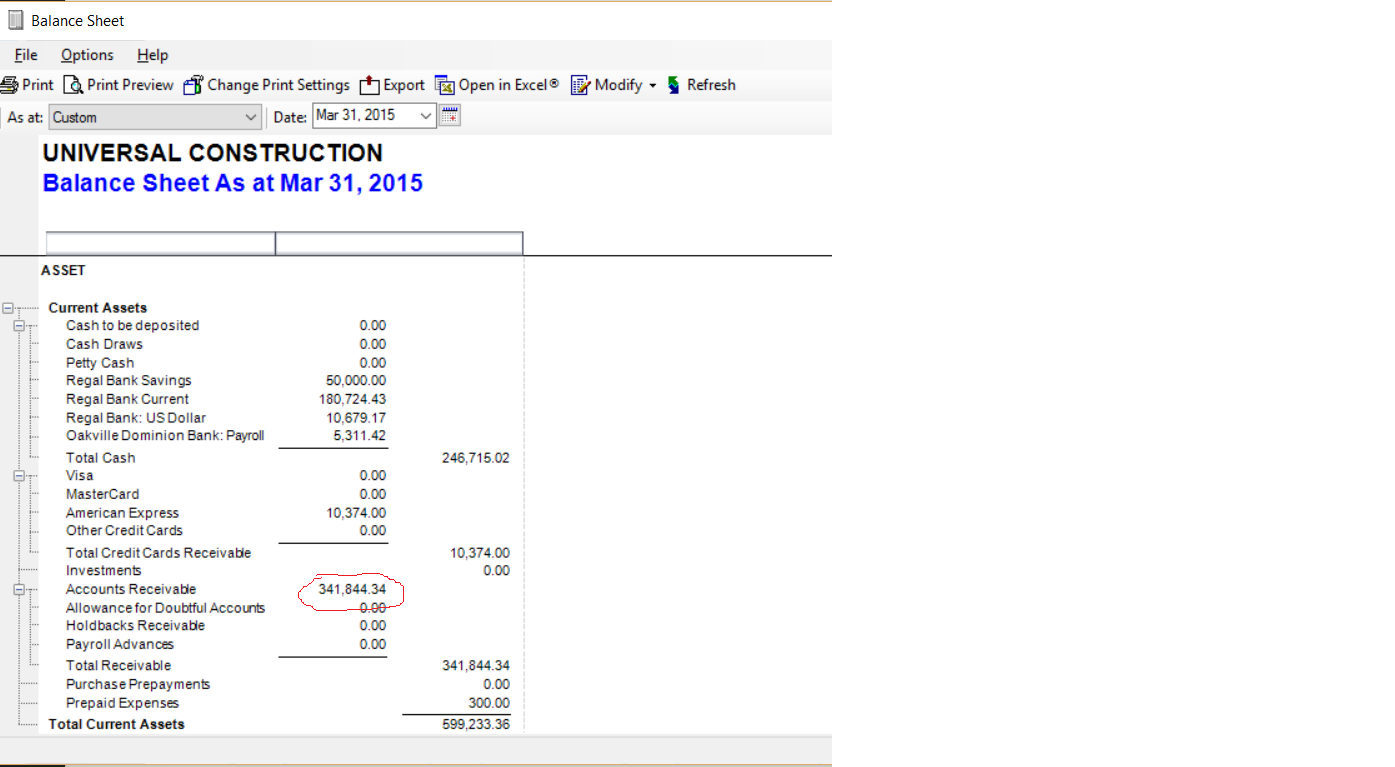

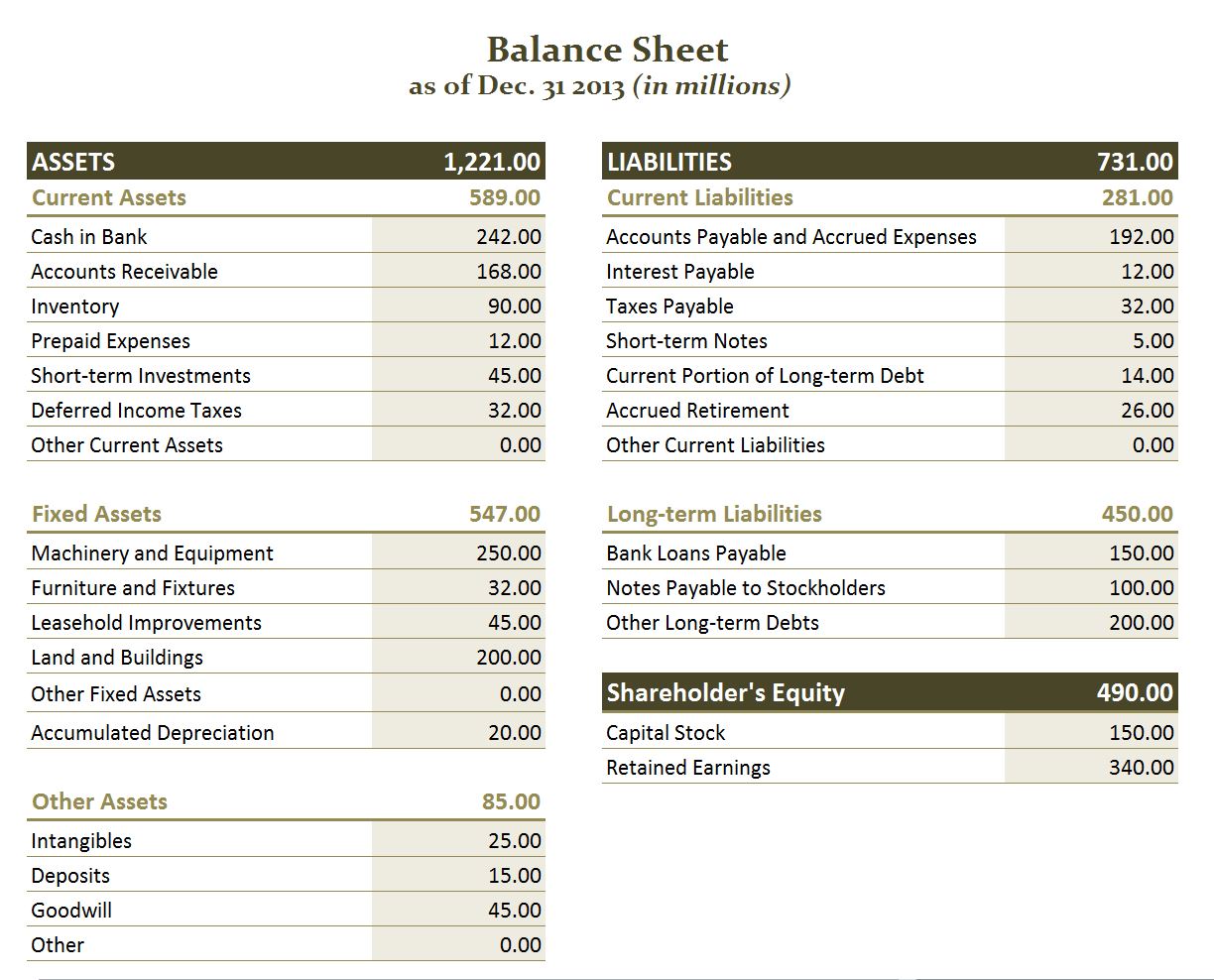

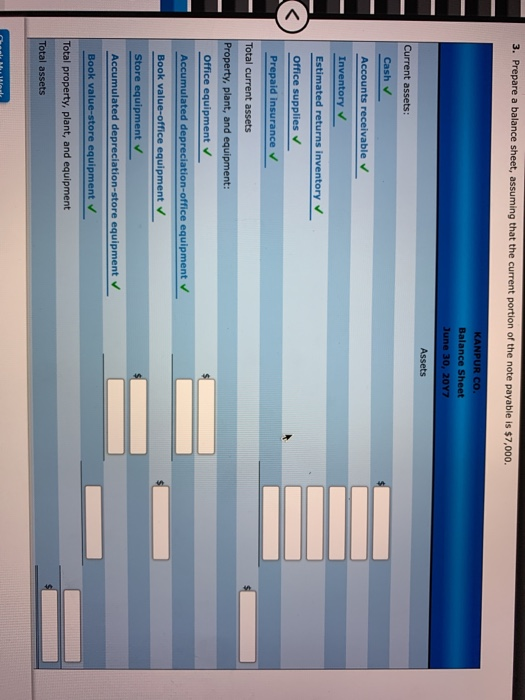

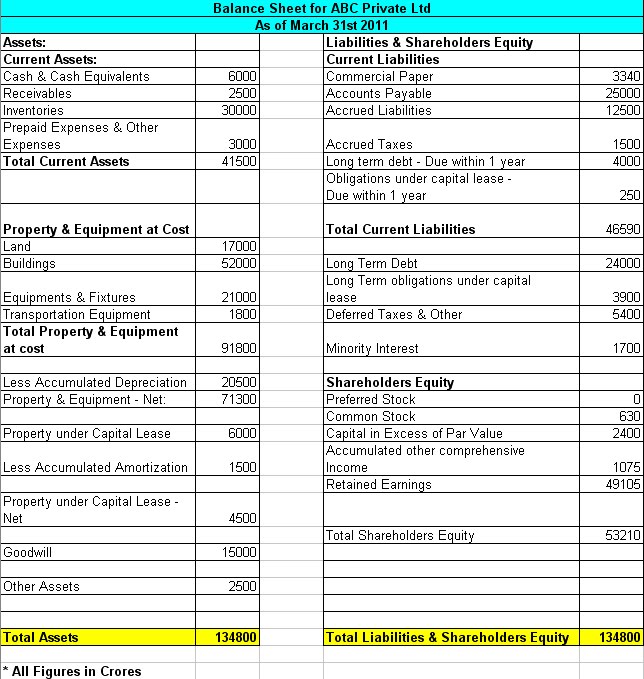

Ap balance sheet. Use this guide to see. Accounts payable (ap) are recorded under the current liabilities section on your balance sheet. Ap appears in the statement of financial position (also known as the balance sheet) under ' current liabilities.' it represents the total amount due to.

It is disclosed as a sum of all the. Accounts payable is disclosed on the balance sheet as a current liability, which needs to be settled by companies over the course of one year. On a company’s balance sheet, the accounts payable turnover ratio is a key indicator of its liquidity and how it is managing cash flow.

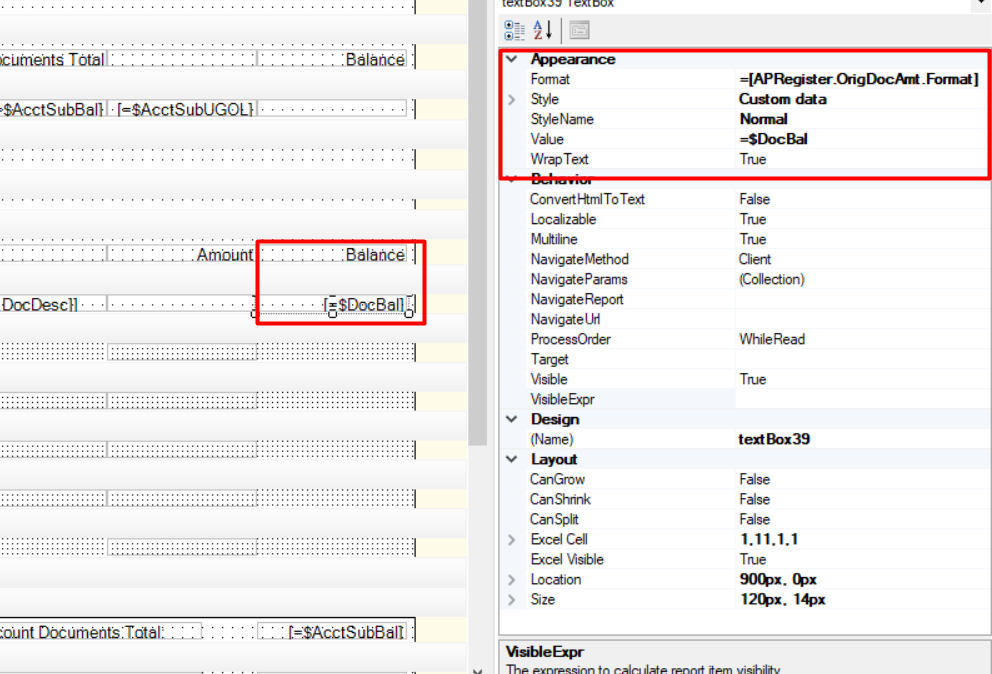

The ap trial balance report summarizes expenditures by date, and may also group them by vendor or other category. Learn about accounts payable (ap) and accounts receivable (ar), including how they relate — and differ — and how to record them on your balance sheet. It ensures that it can pay its debts on time.

At minimum, this report should be run at the. Key takeaways a higher accounts payable. It also provides valuable information.

Payables appear on a company's balance sheet as a current liability. The ap balance sheet is a crucial tool for managing a company’s financial health. Accounts payable (ap) is a liability that appears on a company’s balance sheet.

It is distinct from notes payable liabilities, which are debts. Accounts payable (ap) is a current liability representing money owed to customers. Analysing the ap turnover (how long does the organisation take to pay the.

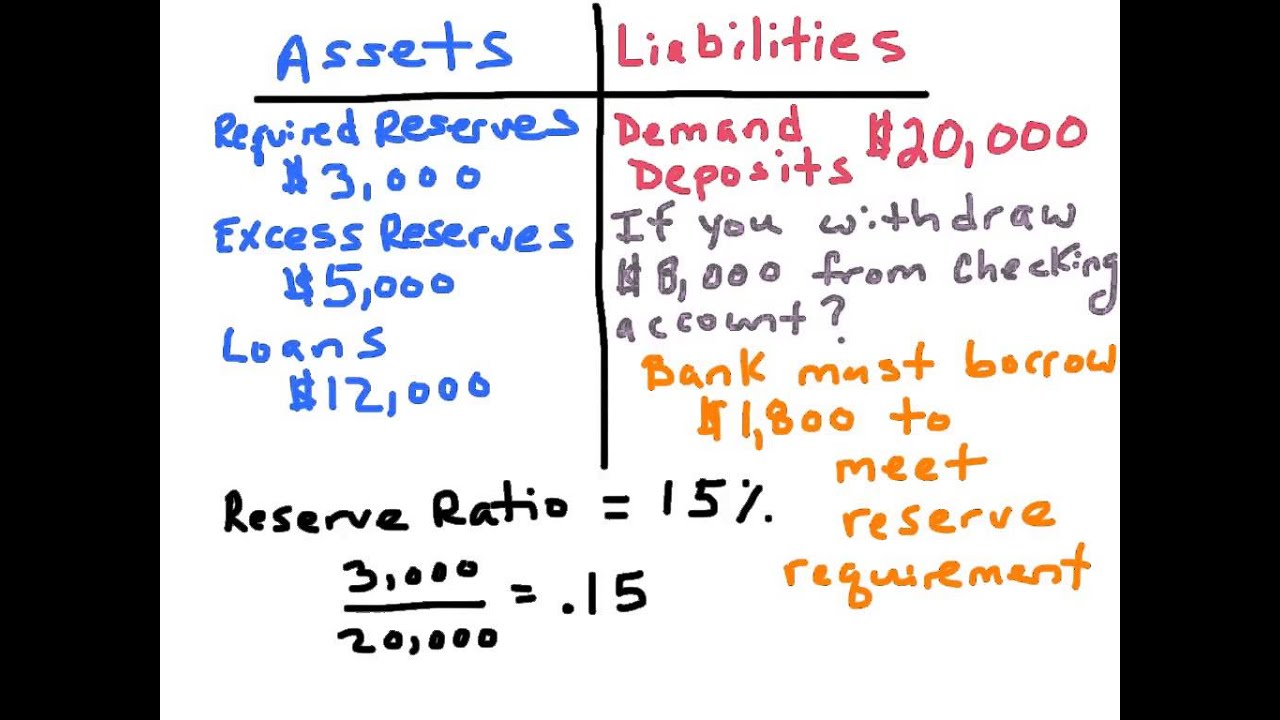

The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. Ap is considered one of the most current forms of the current liabilities on the balance sheet. Accounts payable (ap) is money owed by a business to its suppliers shown as a liability on a company's balance sheet.

What is the definition of accounts payable? The sum of any and all outstanding payments owed by one organization to its suppliers is recorded as the balance of accounts payable on the company’s balance sheet,. Assets are items of value that your business owns and are further divided into.

Accounts payable is the sum of money you owe to a vendor or a seller for purchasing their product or service, for which. It represents the amount of money owed by the business to its vendors for goods. Accounts payable, commonly referred to as “ap,” is categorized as a liability and should be recorded accurately as a “current liability” in the balance sheet.

Accounts payable (ap) is a crucial factor in the financial health and cash flow of a business. Your company’s balance sheet is divided into three categories. Find out how to create a reliable balance sheet forecast for accounts payable and.