Lessons I Learned From Info About Indirect Method Operating Cash Flow Axa Insurance Financial Statements

Depreciation loss or gain on sale of fixed assets miscellaneous expenses written off investment income interest dividend operating.

Indirect method operating cash flow. The result is therefore exactly the cash flow that was generated within the period under consideration. Most reporting entities use the indirect method to report cash flows from operating activities. Cash flow indirect method:

Introduce basic concepts, such as assets, liabilities and net income; The following example shows the format of the cash flows from operating activities section of cash flows statement prepared using. Indirect method cash flow from operations:

$22,300.00 changes in current operating assets and liabilities: In the direct method, these two amounts were simply omitted in arriving at the individual cash flows from operating activities. Here's an example of the indirect method for a cash flow statement:

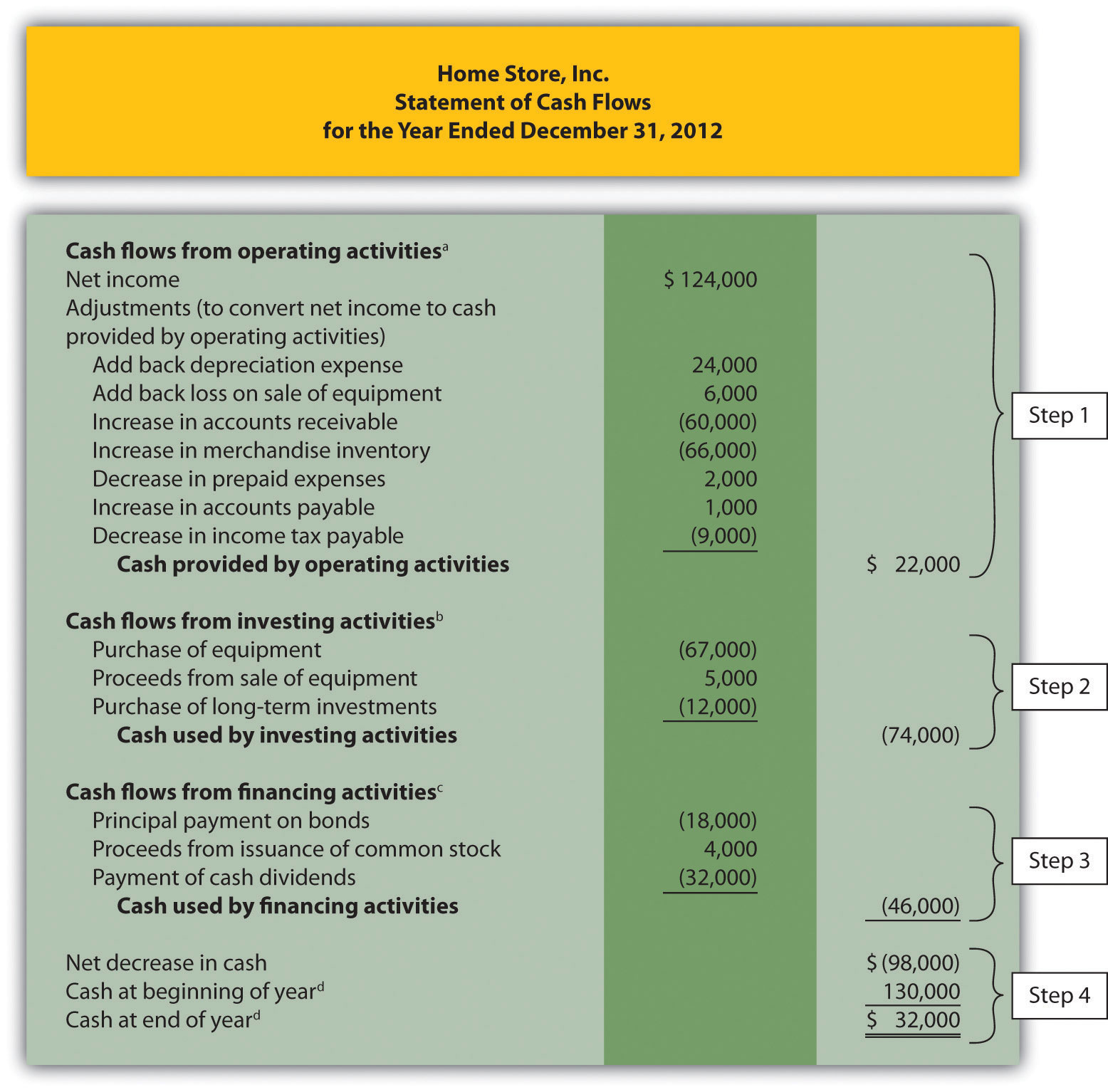

The statement of cash flows prepared using the indirect method adjusts net income for the changes in balance sheet accounts to calculate the cash from operating activities. You can gather this information from the company’s balance sheet and income statement. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of.

Adjustments to reconcile net income to net cash flows from (used for) operating activities: $4,710.00 net cash flows from operating activities $502,960.00 What is the cash flow statement indirect method?

The indirect method is one of the two treatments for creating cash flow statements. The direct method tracks all transactions in a period on a cash. Using the indirect method, operating net cash flow is calculated as follows:

Add back noncash expenses, such as depreciation, amortization, and depletion. When the indirect method of presenting the statement of cash flows is used, the net profit or loss for the period is adjusted for the following items: Profit on sale of land:

The indirect method reports cash flows from operating activities into categories such as: Cash flows are classified and presented into operating activities (either using the 'direct' or 'indirect' method), investing activities or financing activities, with the latter two categories. This presentation begins with net income and then eliminates any noncash items (such as depreciation expense) as well as nonoperating gains and losses.

Determine net cash flows from operating activities. Cash flows from operating activities. $81,750.00 loss on disposal of equipment:

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. It starts with a business’s net income and then lists cash flows, both received and paid, for various activities (i.e., the three cash flow categories: The cash flow statement indirect method is one way to present a company’s total cash flow.

:max_bytes(150000):strip_icc()/dotdash_Final_Cash_Flow_Statements_Reviewing_Cash_Flow_From_Operations_Oct_2020-01-5374391bf75040dfa769ad9661c90b89.jpg)