Inspirating Tips About Prepaid On Balance Sheet Profit And Loss Statement Form Free Printable

What is prepaid accounting?

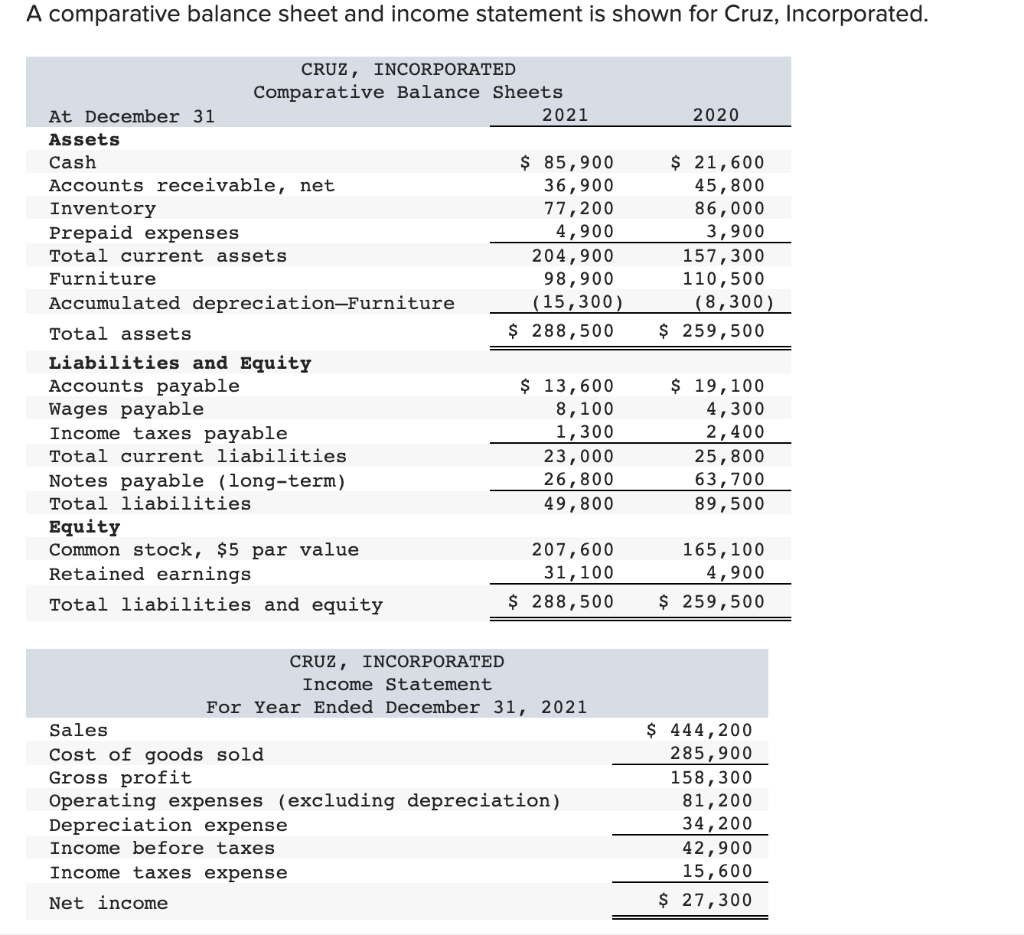

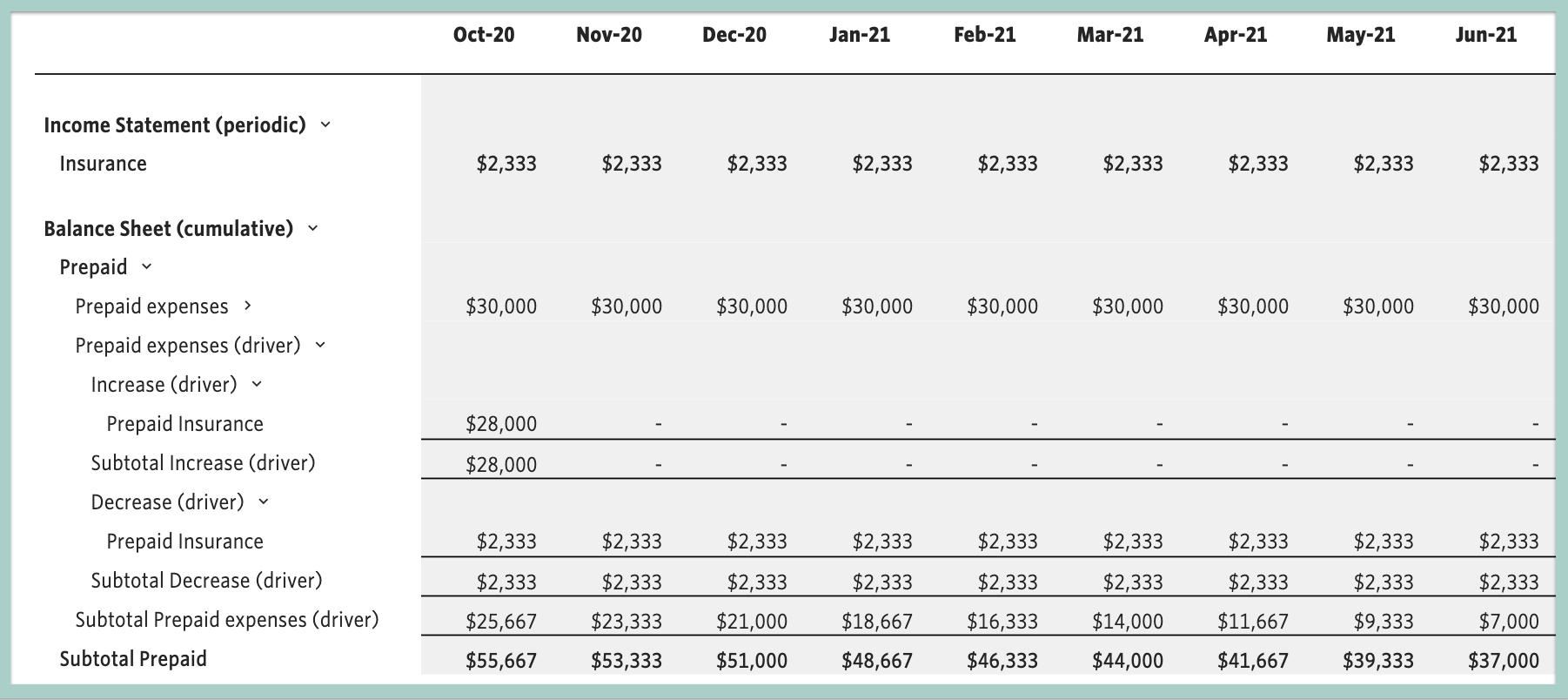

Prepaid on balance sheet. These payments are recorded as assets on the balance. Prepaid expenses are first recorded in the prepaid asset account on the balance sheet as a current asset (unless the prepaid expense will not be incurred within. Prepaid expenses are treated as assets on a company’s balance.

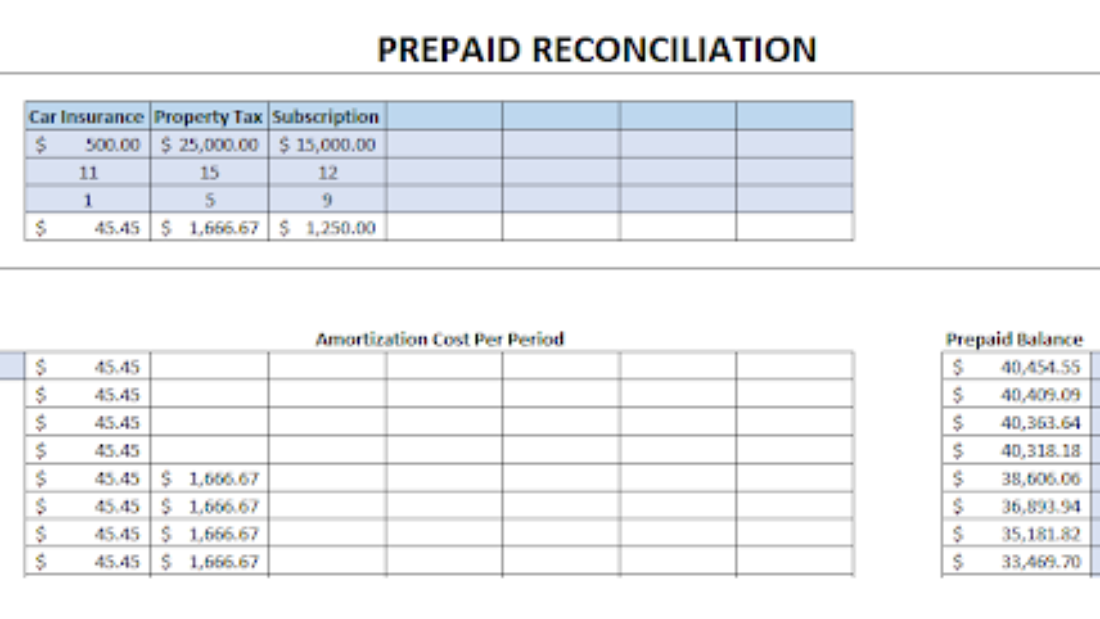

A prepaid expense is an expense that has been paid for in advance but not yet incurred. If the prepaid expense extends beyond one. Then, enter the total amount you paid for the expense.

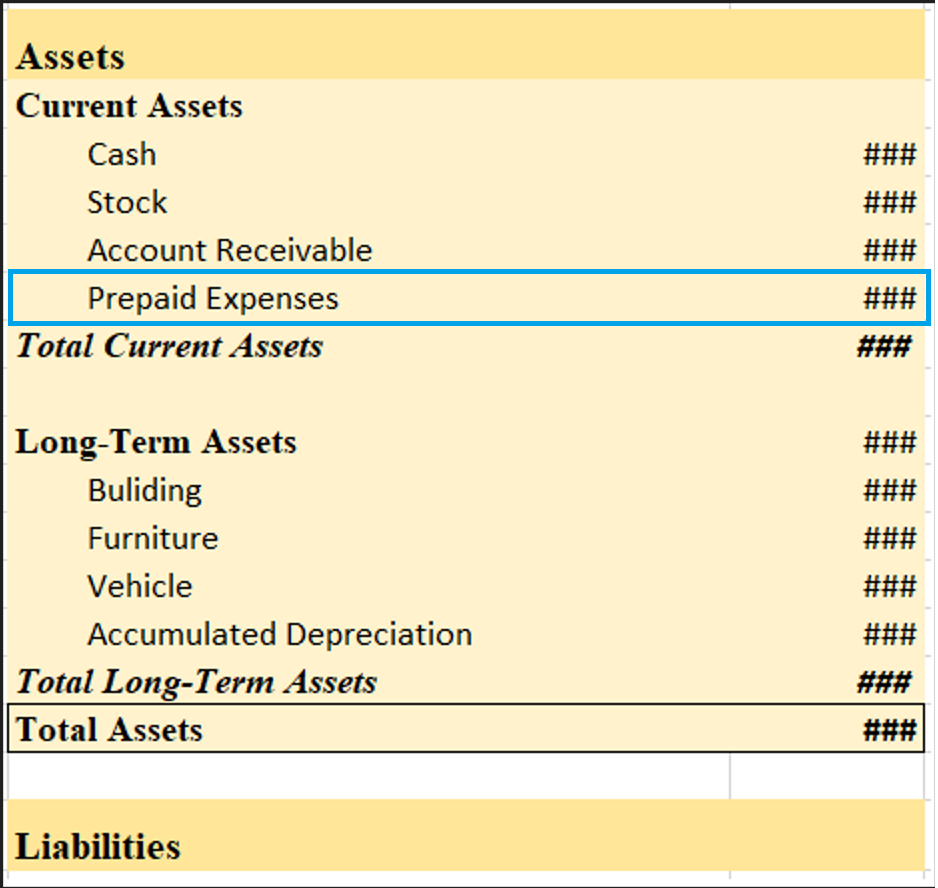

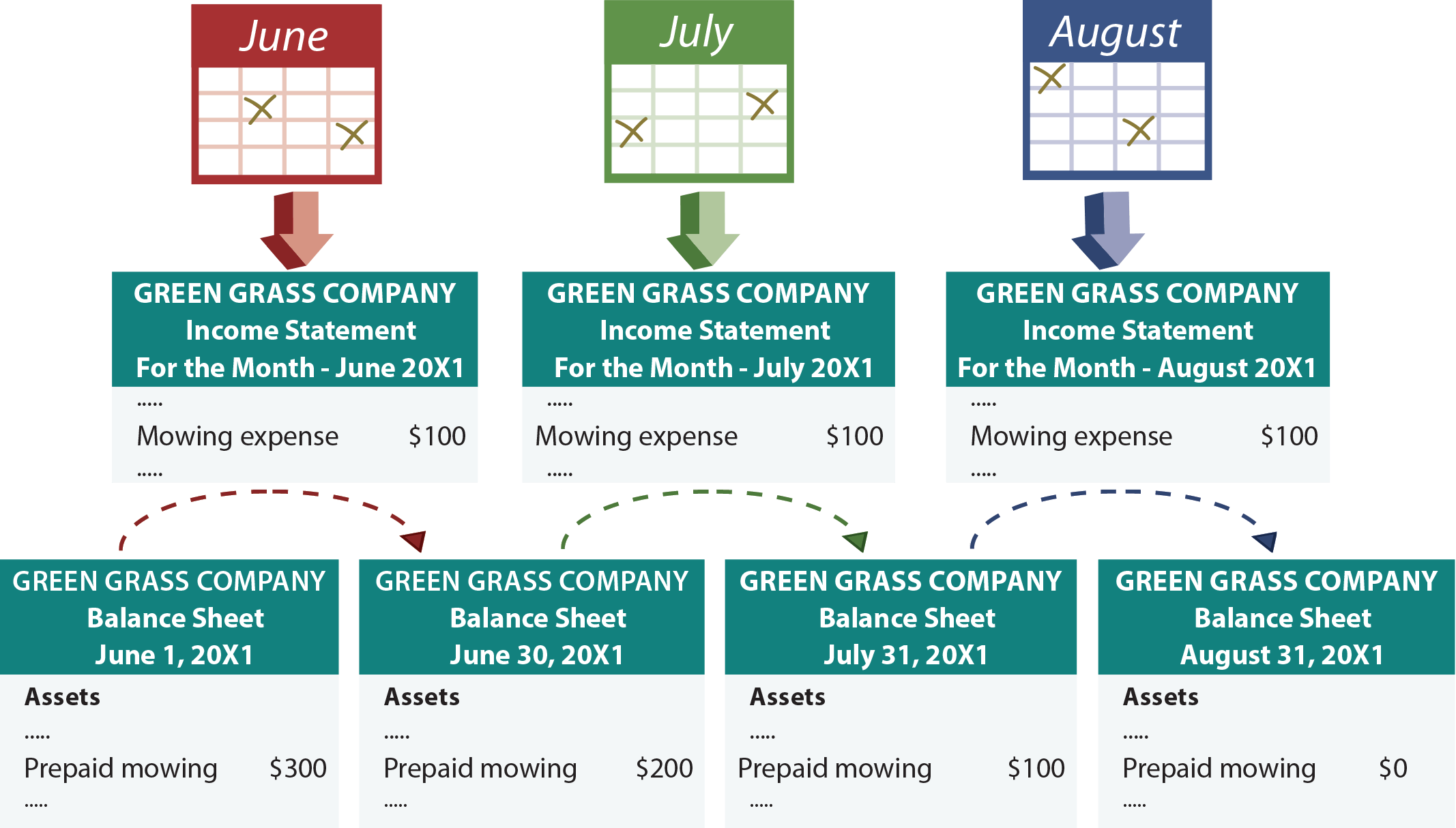

The “prepaid expenses” line item is recorded in the current assets section of the balance sheet. Each month, you reduce the asset account by the portion you use. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset.

A prepaid expense is an expense for which a company makes advance payments for goods or services to be used at a future date. When you prepay rent, you record the entire $6,000 as an asset on the balance sheet. To record a prepaid expense, create a new asset account with an appropriate title to distinguish it from other assets.

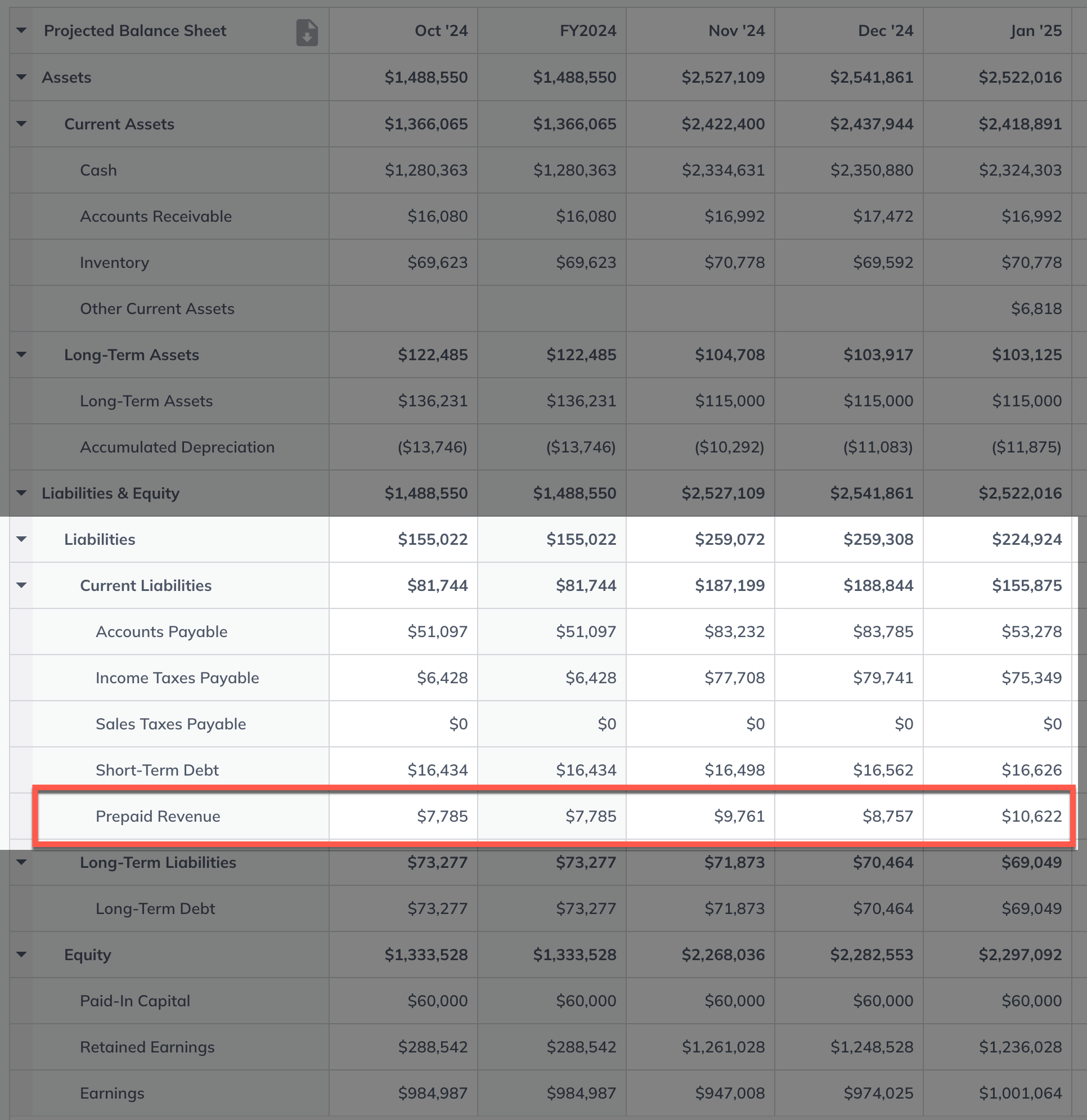

Prepaid expenses on the balance sheet the balance sheet is an equal sign with company assets on one side, liabilities plus owners' equity on the other. Prepaid accounting is the process of paying for expenses in advance before they are incurred or consumed. The reason for the current asset designation is that.

A prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed. Examples of prepaid expenses include insurance premiums, rent, or subscription services. Initial journal entry for prepaid insurance:

Therefore, there will be no changes in the totals. Prepaid expenses are initially recorded as. Prepaid expenses, or prepaid assets as they are commonly referred to in general accounting, are recognized on the balance sheet as an asset.

In business, a prepaid expense is recorded as an asseton the balance sheet that results from a business making advance payments for goods or services to be received in the future. Prepaid expenses are payments made in advance for goods or services that will be received in the future. Some of these examples are given below:

It appears as a current asset in the balance. Initially, they are recorded as assets on the balance sheet. There can be several different examples of prepaid expenses commonly found on the company’s balance sheet.

A prepaid expense is a payment made in advance for goods or services that will be received in the future. Prepaid rent will increase, while cash will decrease. In short, store a prepaid rent payment on the balance sheet as an asset until the month when the company is actually using the facility to which the rent relates, and.