Inspirating Tips About Unearned Rent Income In Balance Sheet Projected Financial Statements For Bank Loan

Key takeaways rental income includes any payment received for use or occupation of a rental property.

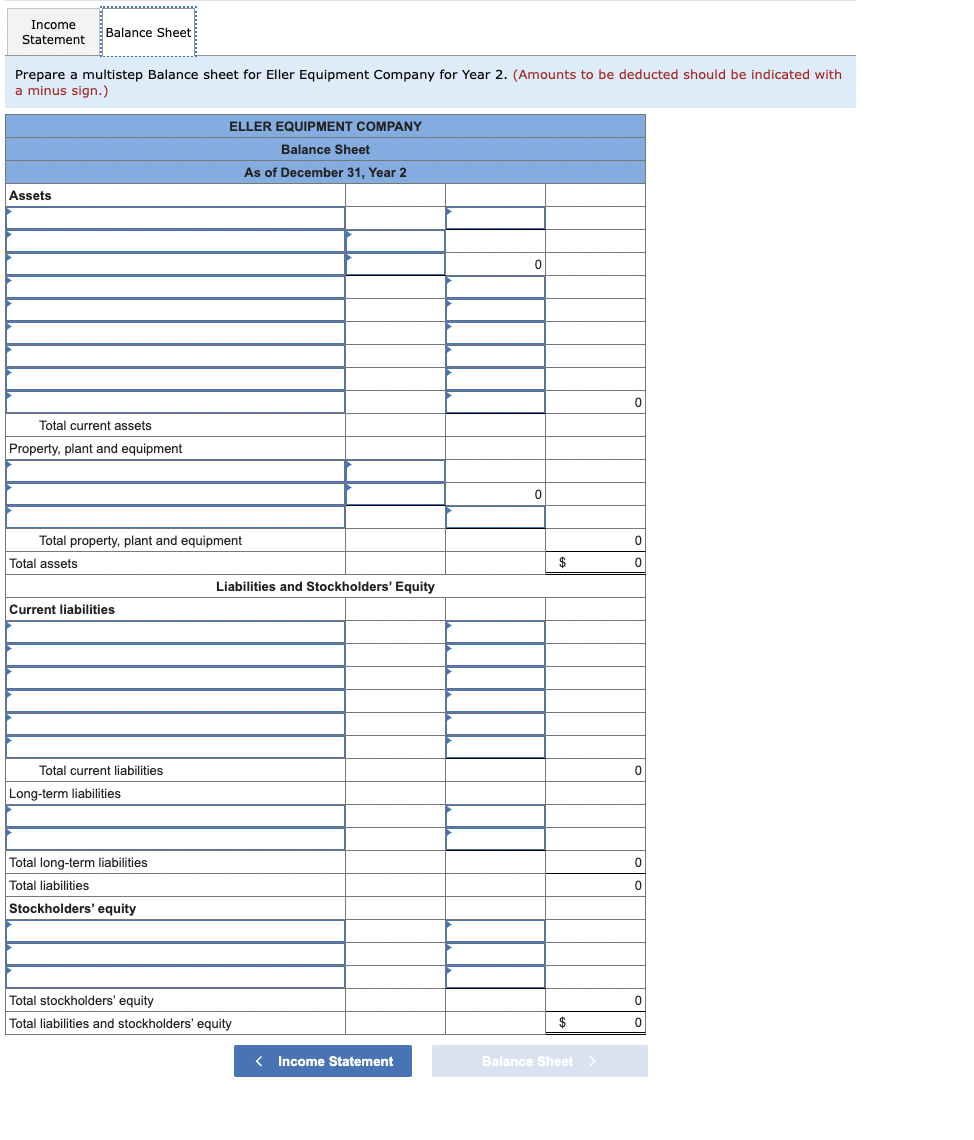

Unearned rent income in balance sheet. Rather, advances should be recorded as liabilities (under unearned rent income or advances. Unearned rent is presented as a current liability in the balance sheet since the rental period is less than one year. Unearned revenue is reported on a business’s balance sheet, an important financial statement usually generated with accounting software.

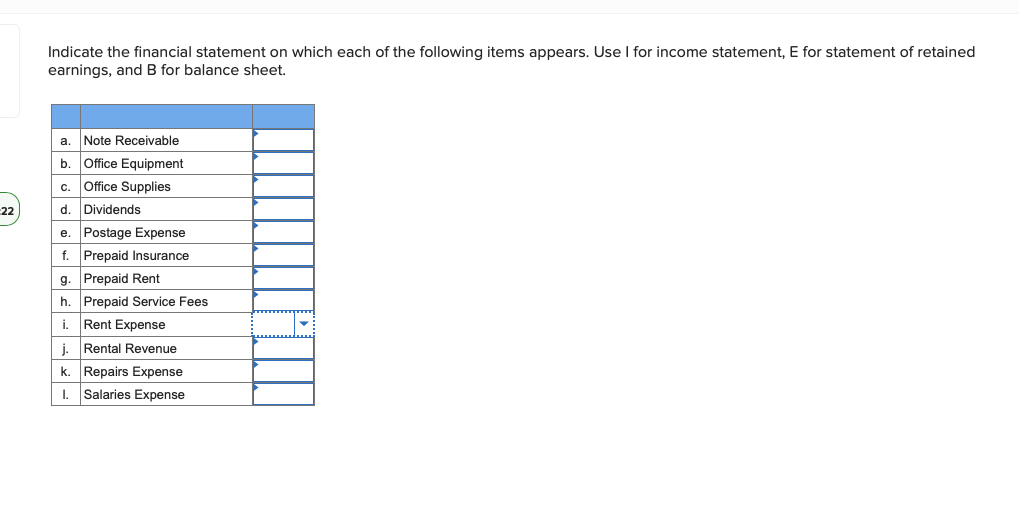

Rent received and landlord expenses paid by the tenant are two. This is also referred to as deferred revenues or customer deposits. As unearned revenues and expenses affect cash recognition, they are recorded in all three of the financial statements:

Unearned revenue is treated as a liability on the balance sheet because the transaction is incomplete. The journal entry for this transaction is as follows: Rent revenue is presented in the income.

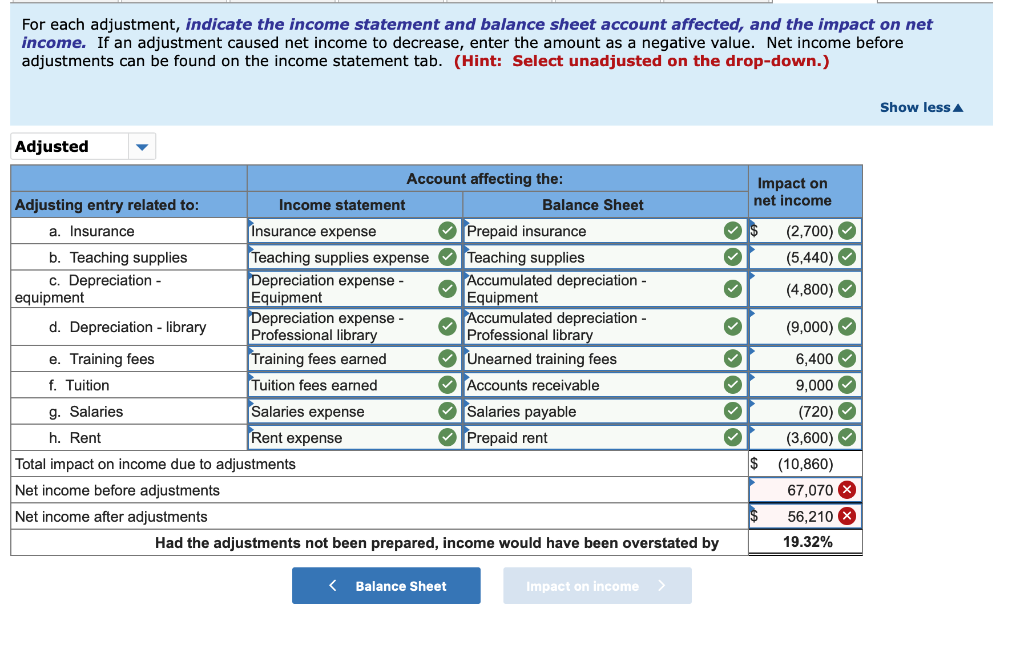

In the following month, the landlord earns the rent, and now. Unearned income or deferred income is a receipt of money before it has been earned. Likewise, recording the unearned rent as revenue will result of the.

Funds in an unearned revenue account are classified. The financial statement on which unearned rent revenue would appear is: As a company earns the revenue, it reduces the balance in the unearned revenue account (with a debit) and increases the balance in the revenue account (with a.

Balance sheet, income statement, and cash flow statement. In the month of cash receipt, the transaction does not appear on the landlord's income statement at all, but rather in the balance sheet (as a cash asset and an unearned income liability). Unearned revenue is amount of money that is received by the business for goods and services that is yet to be delivered or rendered.

The balance sheet is going to. Here’s an example of a. The nature of unearned rent is a liability which the company owes to its client or customer in providing the rent.

The company) is the party with. Advanced payments made by the lessee should not be part of rent income. More specifically, the seller (i.e.

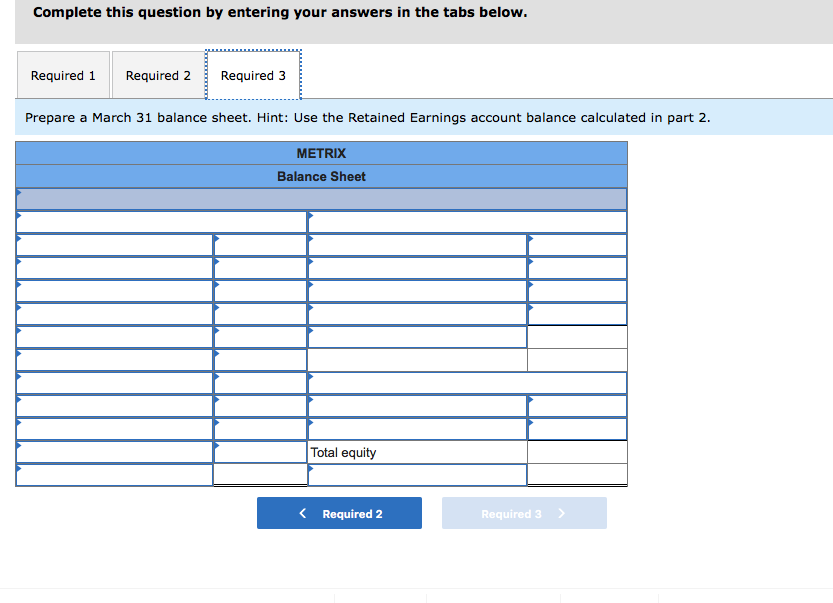

The statement of retained earnings will include beginning retained earnings, any net income (loss) (found on the income statement), and dividends. Notice that the resulting balances of the accounts under the two methods are the same (cash: In short, it is income that hasn’t been earned yet, such as rent paid for the upcoming month or payments for products that will be shipped later.

Unearned rent, or deferred rent or rent received in advance, is a liability account in accounting that represents rent payments that a tenant has made in advance.

:max_bytes(150000):strip_icc()/ScreenShot2020-10-27at3.34.43PM-253260b7e64f402aa5b3951a5d781292.png)