Matchless Info About Difference Between Adjusted And Unadjusted Trial Balance Travel Agency Sheet

Refresh the general ledger tab to ensure proper posting of jes.

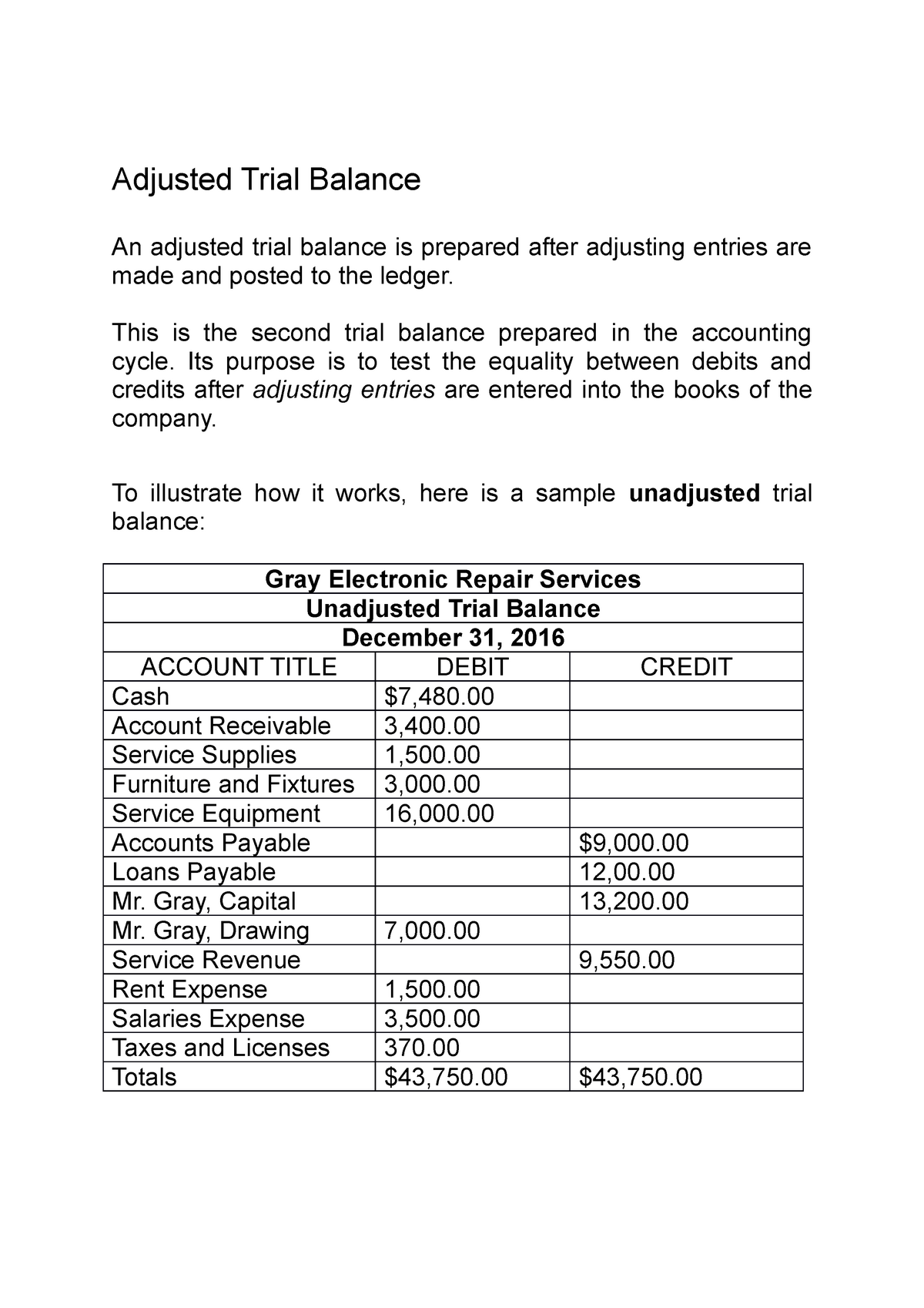

Difference between adjusted and unadjusted trial balance. A trial balance is an important step in the accounting process, because it helps identify any computational errors throughout the first three steps in the cycle. A trial balance is a list of all accounts in the general ledger that have nonzero balances. 1.adjusted trial balance is used after all the adjustments have been made to the journal while an unadjusted trial balance is used when the entries are not yet considered final in a certain period.

Each serves a distinct function in the process of ensuring accurate and compliant financial reporting. Benjamin foster july 19, 2023 aspiring accountants or business owners, it’s time to dive into the world of trial balances. The adjusted trial balance is a list of accounts and their balances after adjusting entries have been posted.

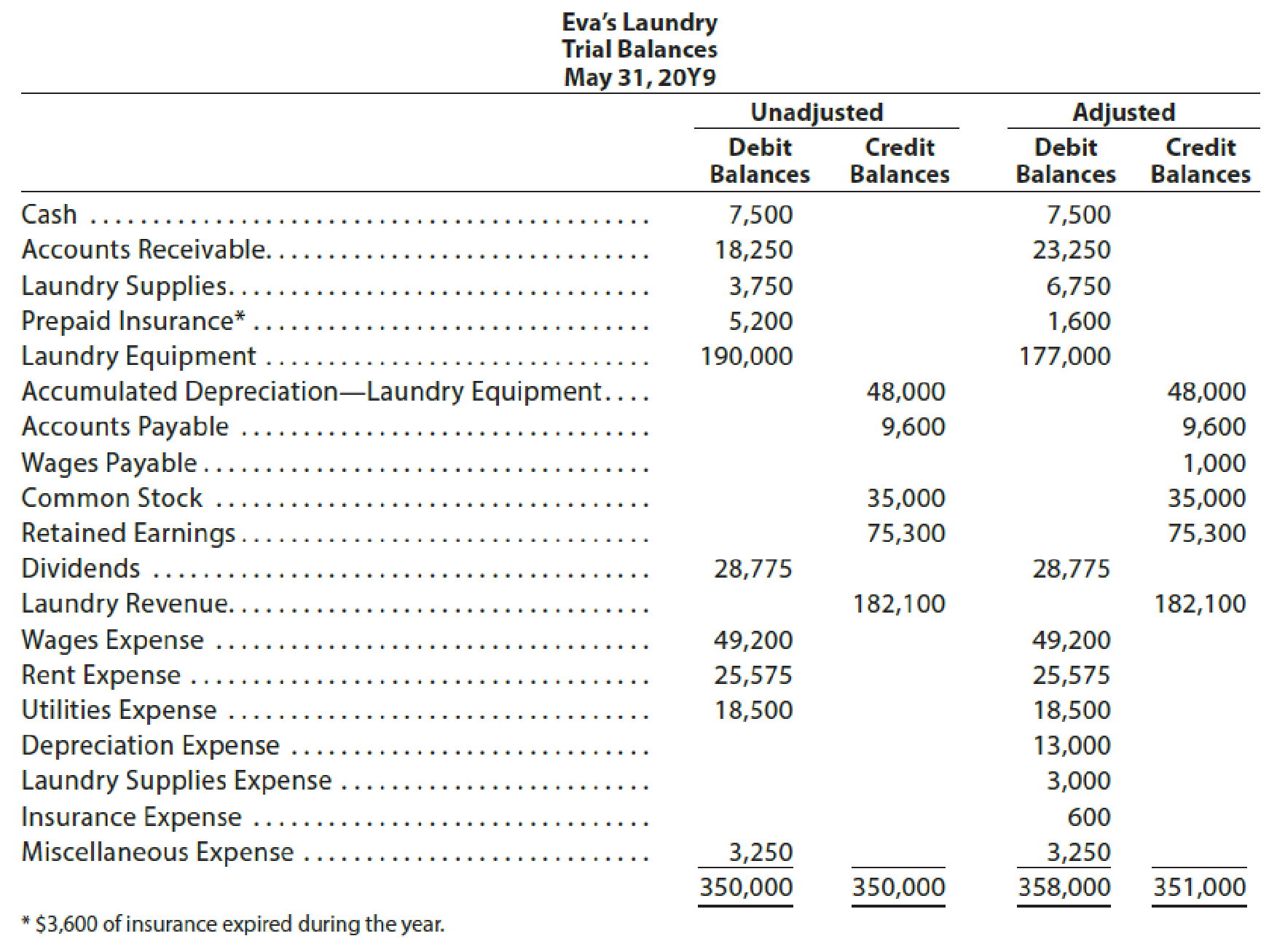

An unadjusted trial balance doesn’t ensure the accuracy of financial statements, whereas an. The adjusted trial balance is what you get when you take all of the adjusting entries from the previous step and apply them to the unadjusted trial balance. An unadjusted trial balance is based on the company’s original accounting records, before any adjustments have been made.

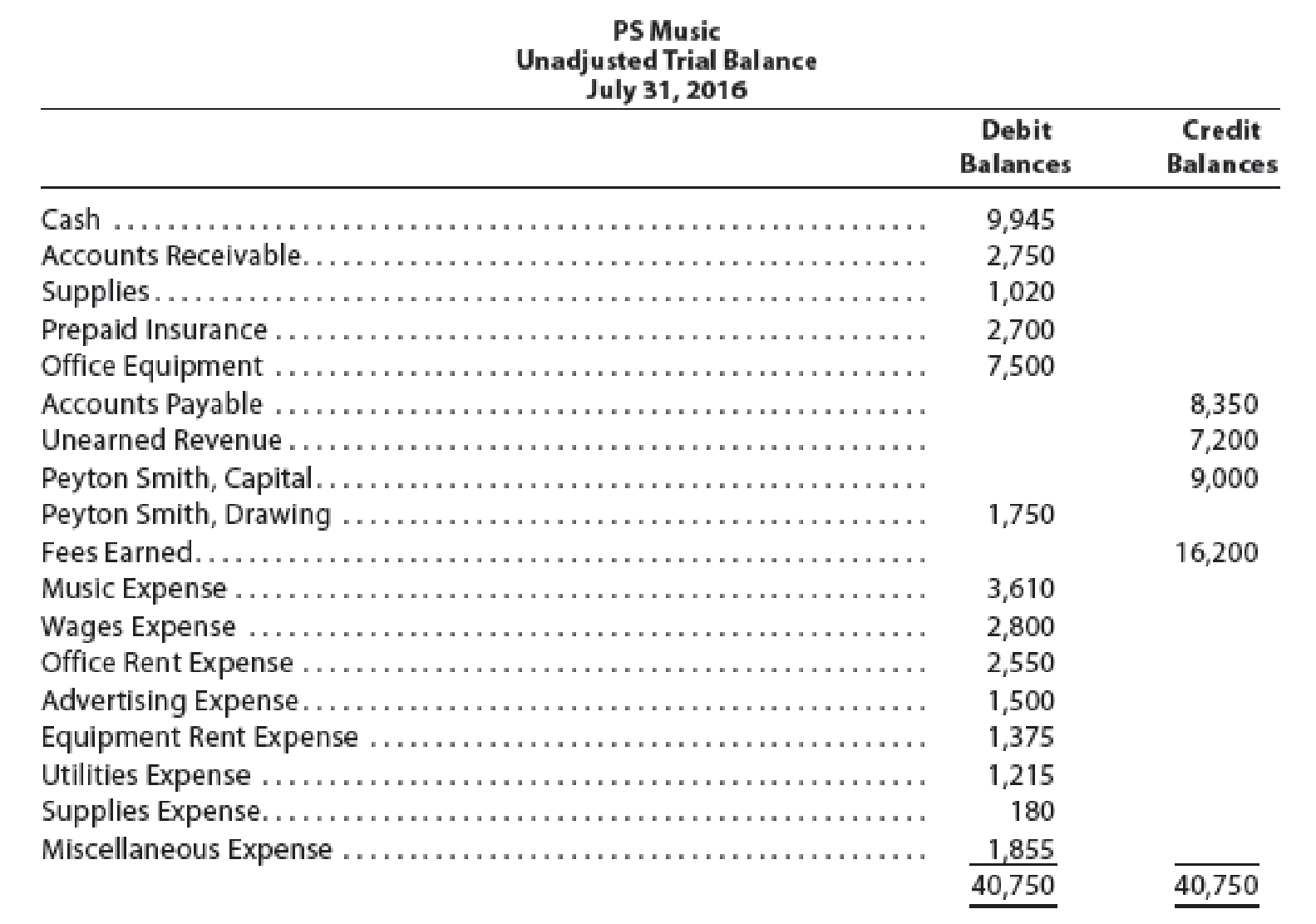

It is a starting point for analyzing account balances and adjusting entries. Review the unadjusted trial balance in the april reports tab for accuracy and completeness of jes. Meaning unadjusted trial balance is the first list of ledger account balances, compiled without making any period end adjustments.

Adjusted trial balance is an advanced form of the commonly used trial balance statement. Comparing an unadjusted and adjusted trial balance. Adjusted trial balance is a list that shows all general ledger accounts and their.

While an unadjusted trial balance provides a snapshot of a company’s financial position at a specific point in time, it lacks the necessary adjustments for accuracy. Adjusted trial balance is a list of ledger account balances after adjusting entries are made. Almost every trial balance statement requires adjusting entries.

Adjusted trial balance is an internal business document that presents the closing balances of all ledged accounts after reconciliation or adjustments. Just like in an unadjusted trial balance, the. The differences between unadjusted and adjusted trial balances are significant.

The adjusted trial balance generally has more accounts listed. There are two types of trial balance: The adjusted trial balance (atb) is the same as utb except that it also includes any adjusting entries made during an accounting period.

It includes temporary accounts that are not closed at the end of the accounting period. 1 concept unadjusted vs adjusted trial balance 6m 0 comments mark as. ² in accrual accounting, revenue and expenses are recorded when they are earned or incurred irrespective of whether the cash is exchanged or not.

Adjusting entries that will result in a difference between the unadjusted trial balance and the adjusted trial balance include the following: Preparing an unadjusted trial balance is the fourth step in the accounting cycle. Unadjusted trial balance is used to identify the necessary adjusting entries to be made at the end of the year.² adjusting entries are made mainly due to the usage of accrual system of accounting.