Divine Tips About Cash Flow Statement Example For Small Business Balance Sheet Interest Expense

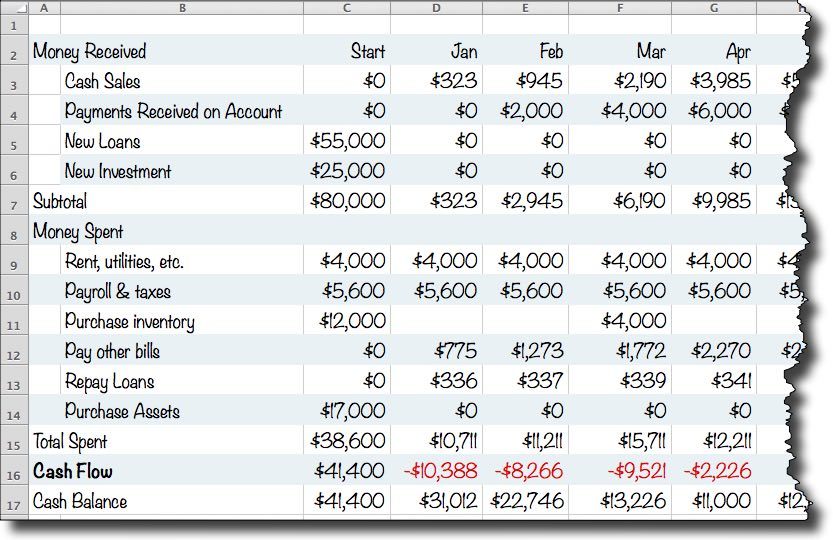

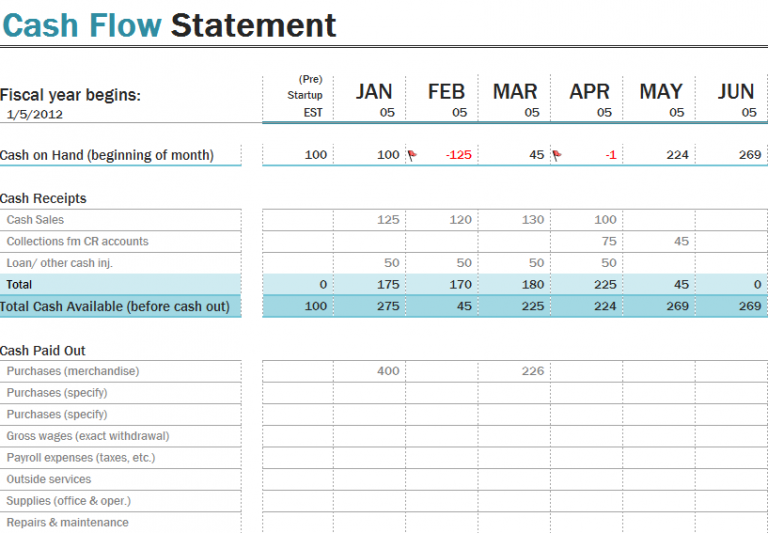

Enter your beginning balance for the first month, start your projection with the actual amount of cash your business will have in your bank account.

Cash flow statement example for small business. Why is a cash flow statement important? There are two different types of cash flow statements: Download this cash flow statement example to get started on yours.

Improving cash flow is a top priority for small business owners. Since the income statement and balance sheet are based on accrual accounting, those financials don’t directly measure what happens to cash over a period. 10 ways to improve small business cash flow;

First, let’s take a closer look at what cash flow statements do for your business, and why they’re so important. Indirect cash flow statements are the more common type of.

Opt for leasing instead of purchasing equipment or real estate to reduce upfront costs and enhance cash flow. If you don't want to separate the cash receipts from and the cash paid for then you can just delete the rows containing those labels. It also helps you to fully understand the impact that all your business processes have on your cash position.

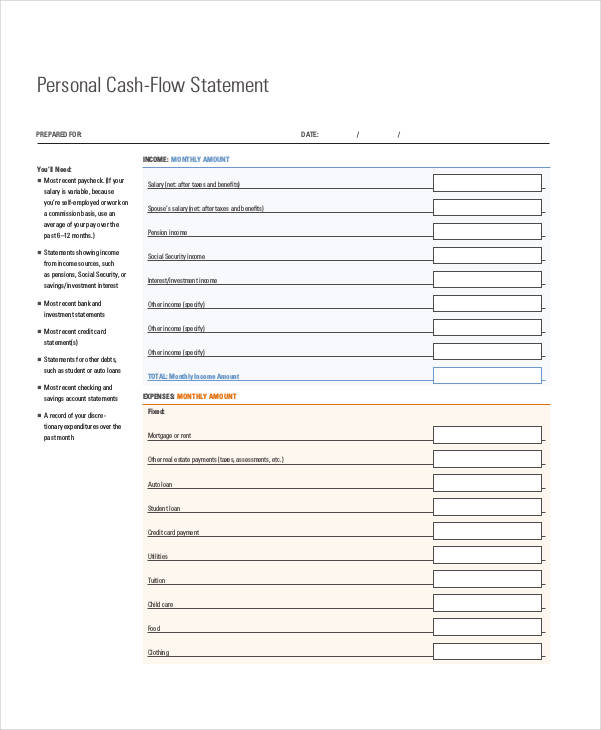

A cash flow statement tracks all the money flowing in and out of your business. Your cash flow statement is one of the most important financial statements you’ll prepare as a small business owner.

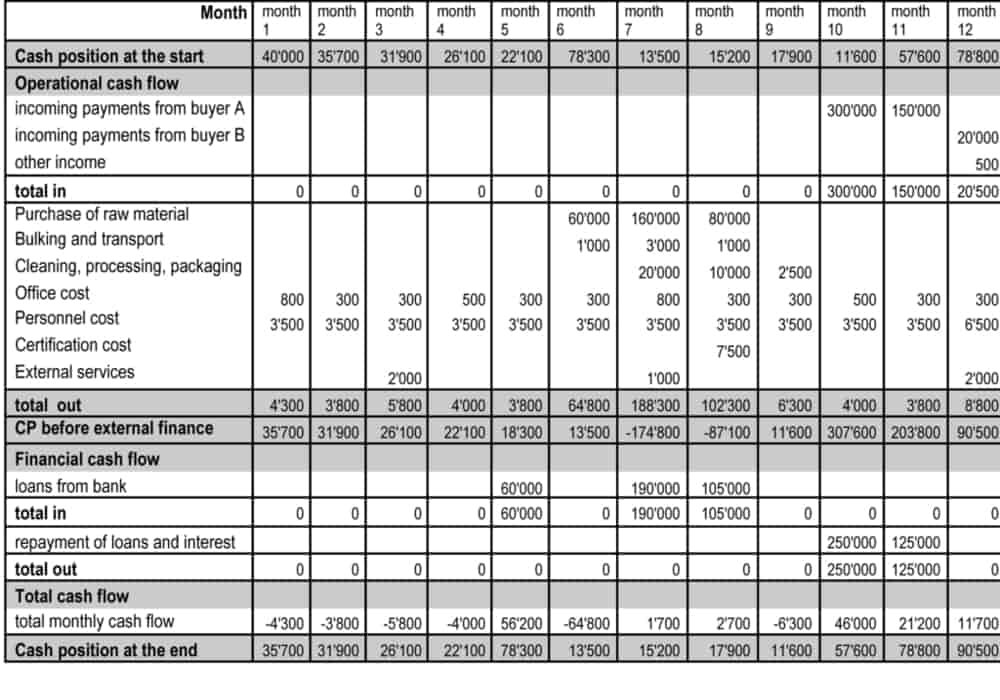

Plan ahead to make sure you always have money to cover payments. Using it, you, the business owner, can easily track your income, payments, and your business’s ending cash position. A basic cash flow statement for a small business provides a picture of where a company’s cash has come from and where it is being spent over a set period of time.

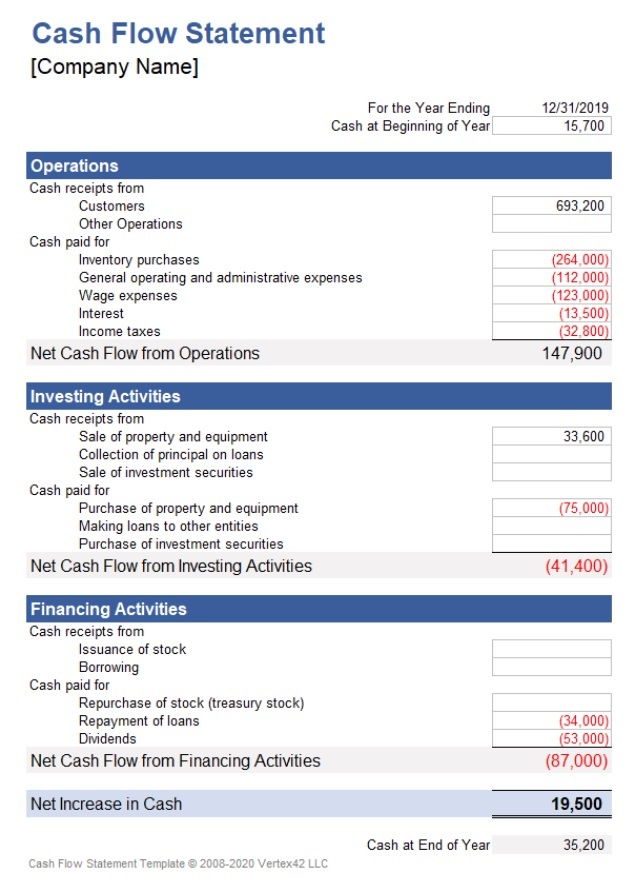

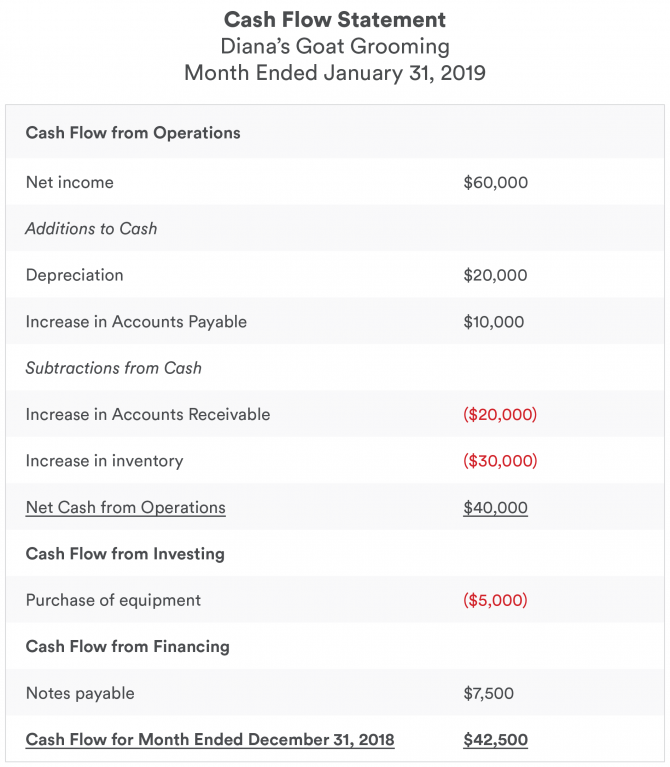

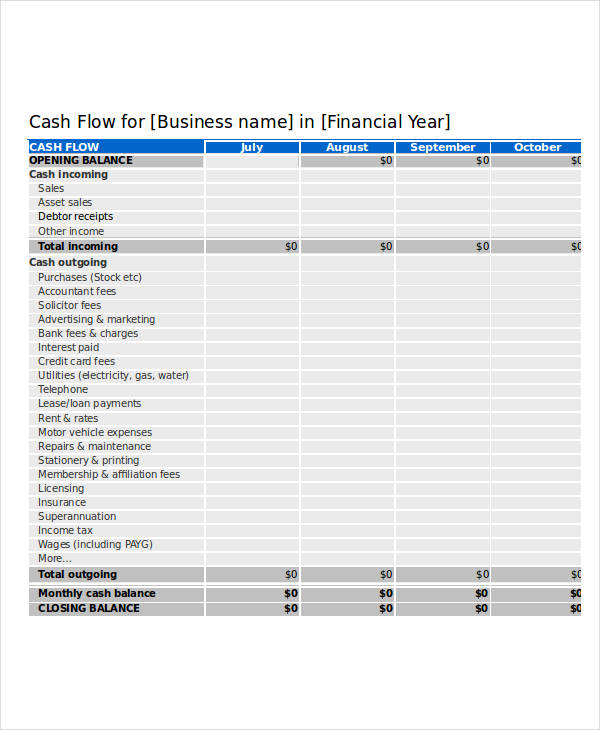

Here is a standard cash flow statement template for small businesses. Let’s use the information from infinity stones inc., a fictitious company selling jewelry, in making a statement of cash flows. The categories can be customized to suit your company's needs.

Example of a cash flow statement for a. Conduct credit checks on customers seeking credit to minimize. The purpose of a cash flow statement is to record how much cash (or cash equivalents) is entering and leaving the company.

It helps to reconcile the numbers in your bank account with your actual income and spending, so you can better understand how cash moves through your business and if you’re managing your money effectively. Let’s look at what each section is showing. Accounting & taxes the cash flow statement is one of the most important financial statements for small business owners.

Forecast your future business finances; This value can be found on the income statement of the same accounting period. A cash flow statement is a financial statement that summarizes the inflows and outflows of cash transactions during a given period of business operations.

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Cash_Flow_Statement_Jul_2020-01-013298d8e8ac425cb2ccd753e04bf8b6.jpg)