Fun Tips About Free Cash Flow For The Firm Maxis Financial Statement

Option b describes free cash flow to equity (fcfe).

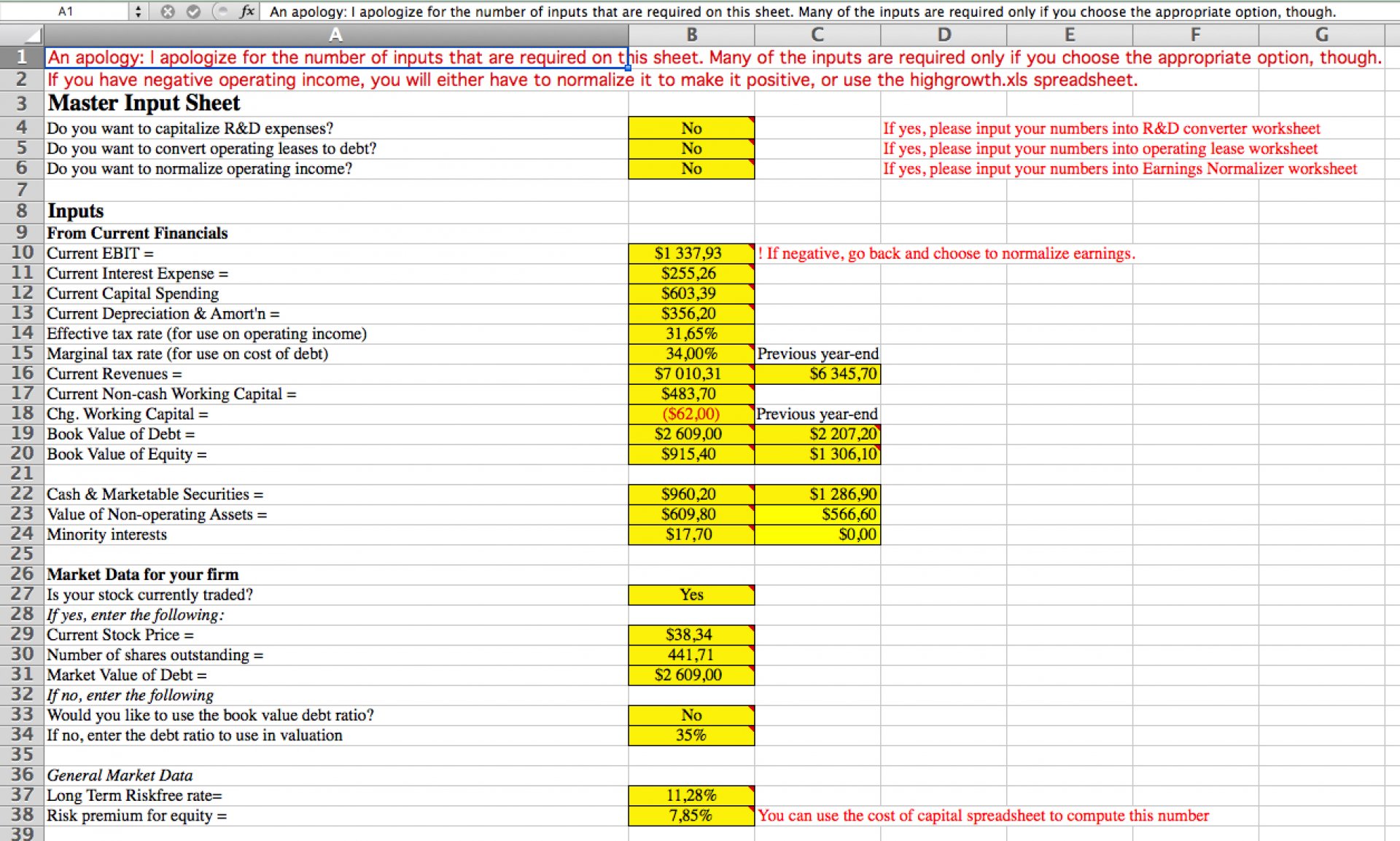

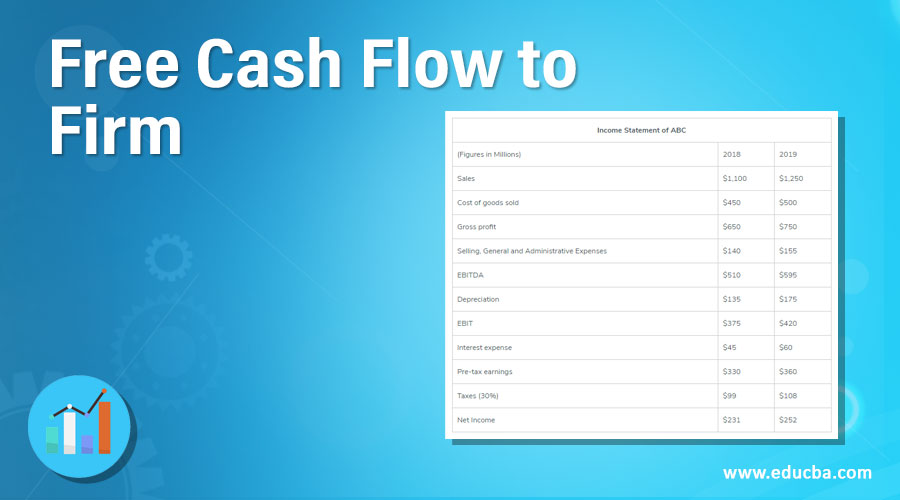

Free cash flow for the firm. A study of professional analysts substantiates the importance of free cash flow valuation (pinto, robinson, stowe 2019). Fcff, or free cash flow to firm, is the cash flow available to all funding providers (debt holders, preferred stockholders, common stockholders, convertible bond investors, etc.). When valuing individual equities, 92.8% of analysts use market multiples and 78.8% use a discounted cash flow approach.

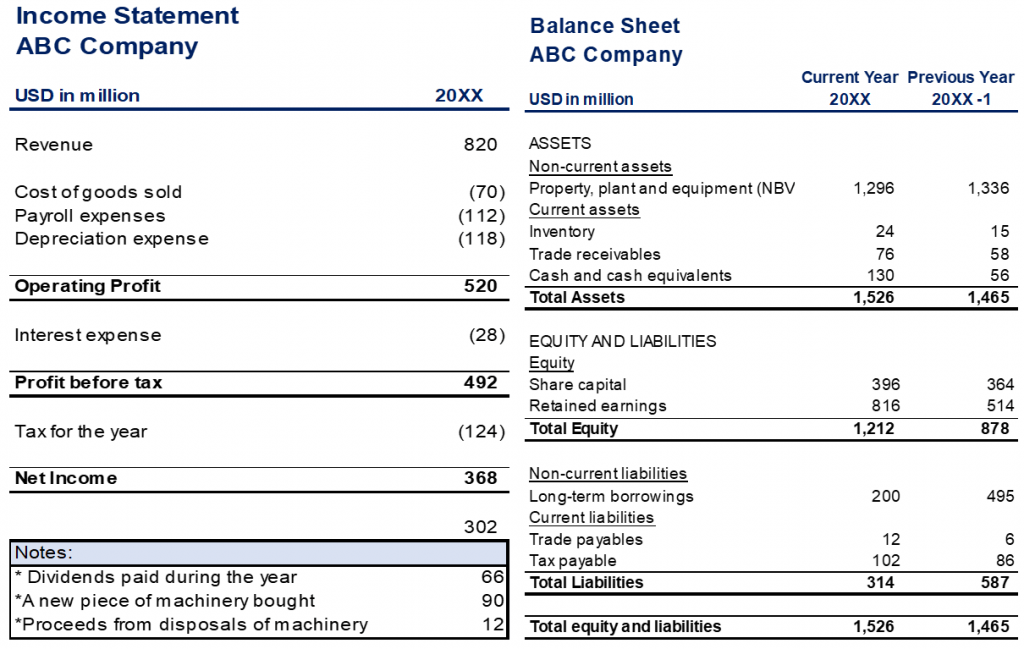

Free cash flow to firm (fcff) (also referred to as unlevered free cash flow) and free cash flow to equity (fcfe), commonly referred to as levered free cash flow. Free cash flow to the firm (fcff) is the amount of cash a company has left over after accounting for all its expenses, reinvestment needs, and debt payments. After deducting depreciation, taxes, and working capital, the amount of cash flow from operations available to the firm is known as free cash flow to the firm.

Free cash flow to firm or simply fcffcan be described as the cash that is available with the firm owners to pay off their investors. It’s often considered the best measure of a company’s ability to generate value for its shareholders. In other words, free cash.

Lyft beat estimates for quarterly profit on tuesday and said it would generate positive free cash flow for the first time in 2024, as it cut costs and became more competitive with larger rideshare. Out of that number, the firm did repurchase $2.252b worth of common stock. After accounting for capital expenditures, free cash flows for the quarter printed at $46m and for the year at $3.837b.

Free cash flow (fcf) is a company's available cash repaid to creditors and as dividends and interest to investors. Management and investors use free cash flow as a measure of a company's. Free cash flow is, in essence, cash that is free to be disbursed to the owners of the firm or used for any kind of investment the firm deems worthwhile.

Free cash flows provide an economically sound basis for valuation. Free cash flow to the firm (fcff) is the amount of cash available to holders of a company’s equity and debt after accounting for expenses, taxes, and investments. Fcff is distinct from free cash flow to equity, which does not account for bond creditors and preferred shareholders.

Company alpha reports the following information: A positive fcff value indicates that the firm has cash remaining after. It is equal to a company’s cash flow from operations (cfo) minus any capital expenditures (capex).

Analysts can also calculate certain cash flow metrics that will get them even more insight. Change in firm value for valuation approach. Free cash flow (fcf) is the cash a company generates after taking into consideration cash outflows that support its operations and maintain its capital assets.

Free cash flow to the firm (fcff); While free cash flow represents a company’s ability to grow its business, pay dividends, or pay down debt, some firms may use different methods to assess free cash flow. There are two types of free cash flows:

Boeing’s free cash flow to the. This is the ultimate cash flow guide to understanding the differences between ebitda, cash flow from operations (cf), free cash flow (fcf), unlevered free cash flow, and free cash flow to firm (fcff). Free cash flow is arguably the most important financial indicator of a company's stock value.

:max_bytes(150000):strip_icc()/Freecashflowfirm_final-687ff00a77b04ae6b47c4de5529e5ff2.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_to_the_Firm_FCFF_Sep_2020-01-f5a6d0cd933447618490bce0f60b57d1.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-02-3c51e1263e6f488daa2d923e2a43a33d.jpg)