Real Info About Cash Paid For Operating Expenses Direct Method Loss In Income Statement

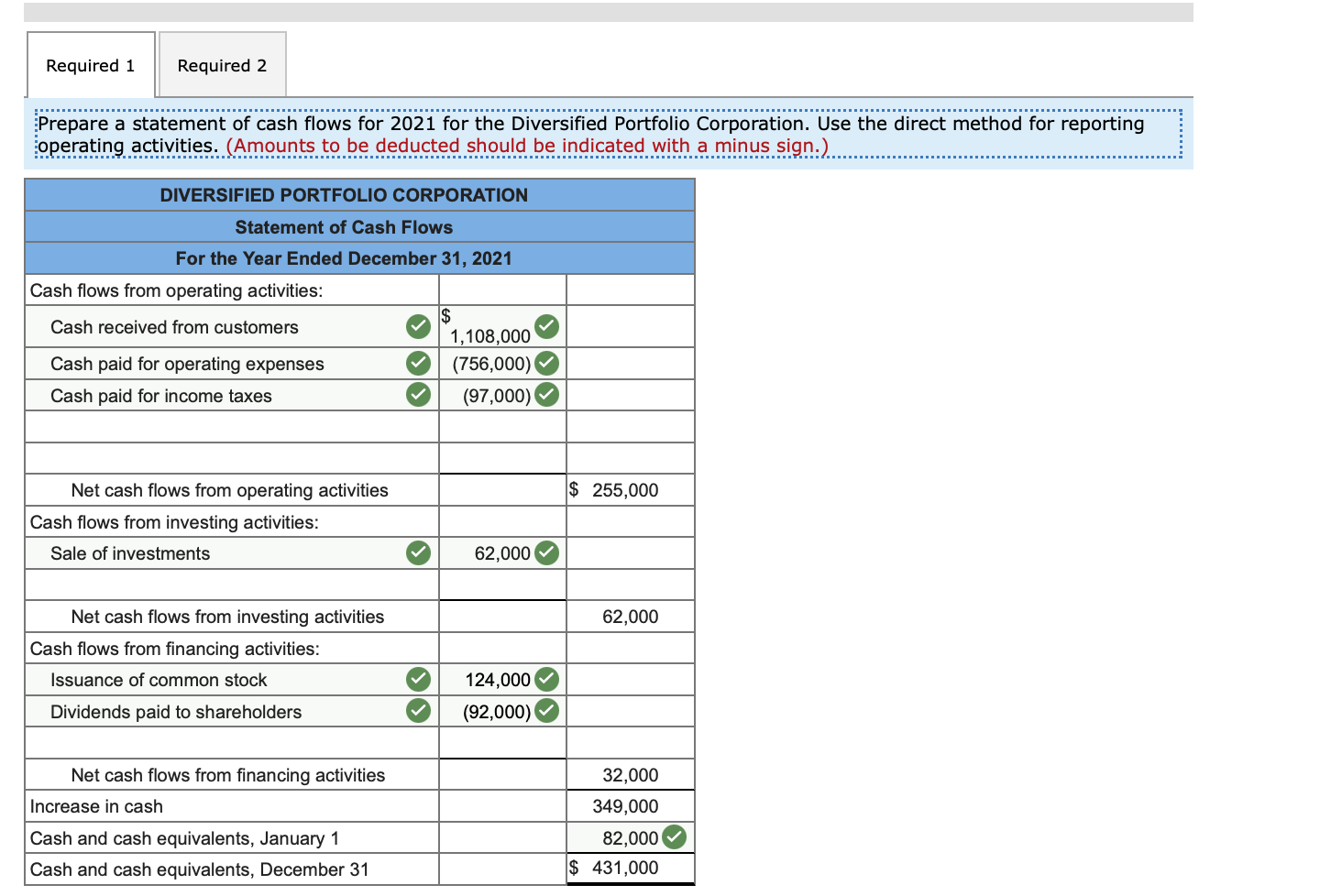

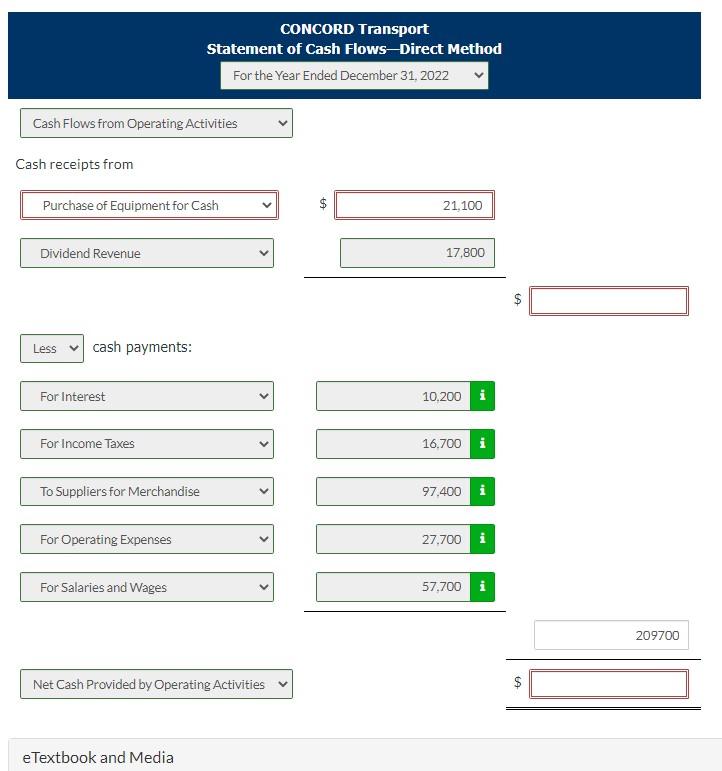

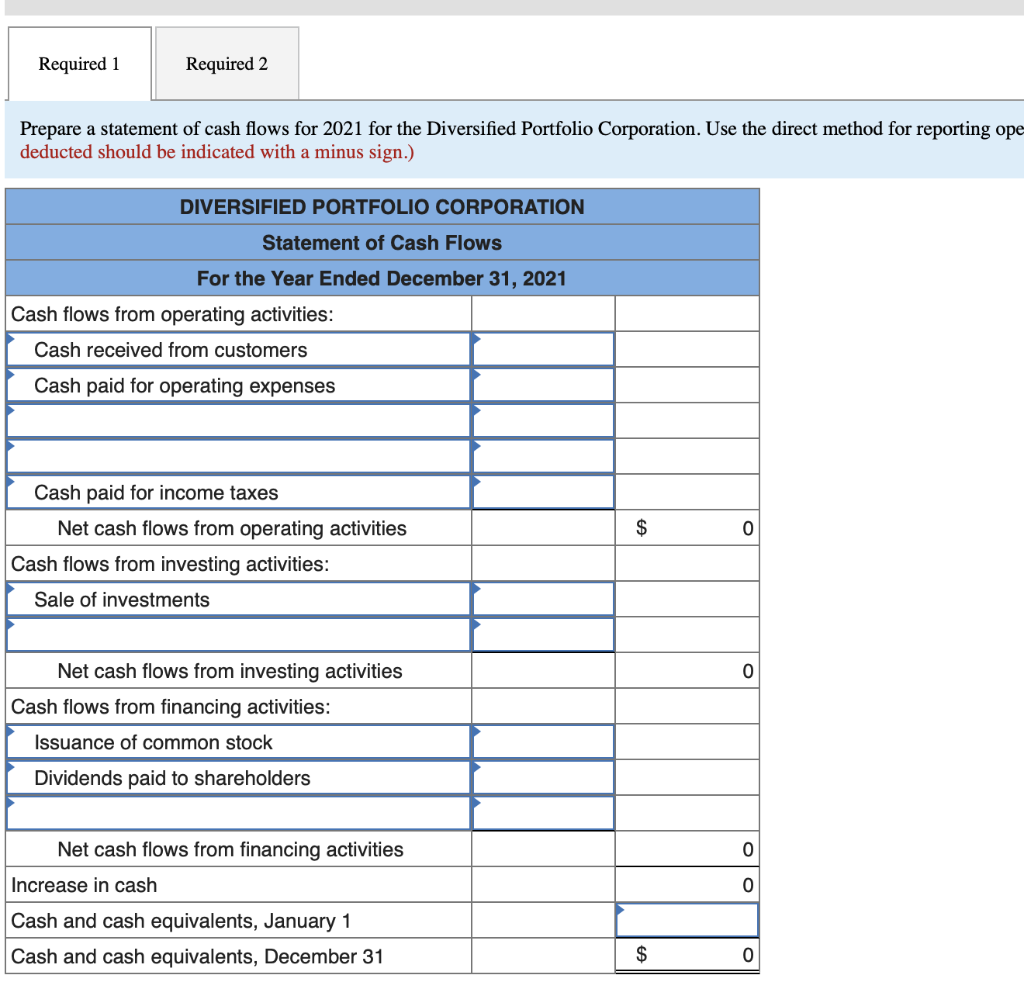

The cash flow statement direct method involves a detailed breakdown of operating expenses and income.

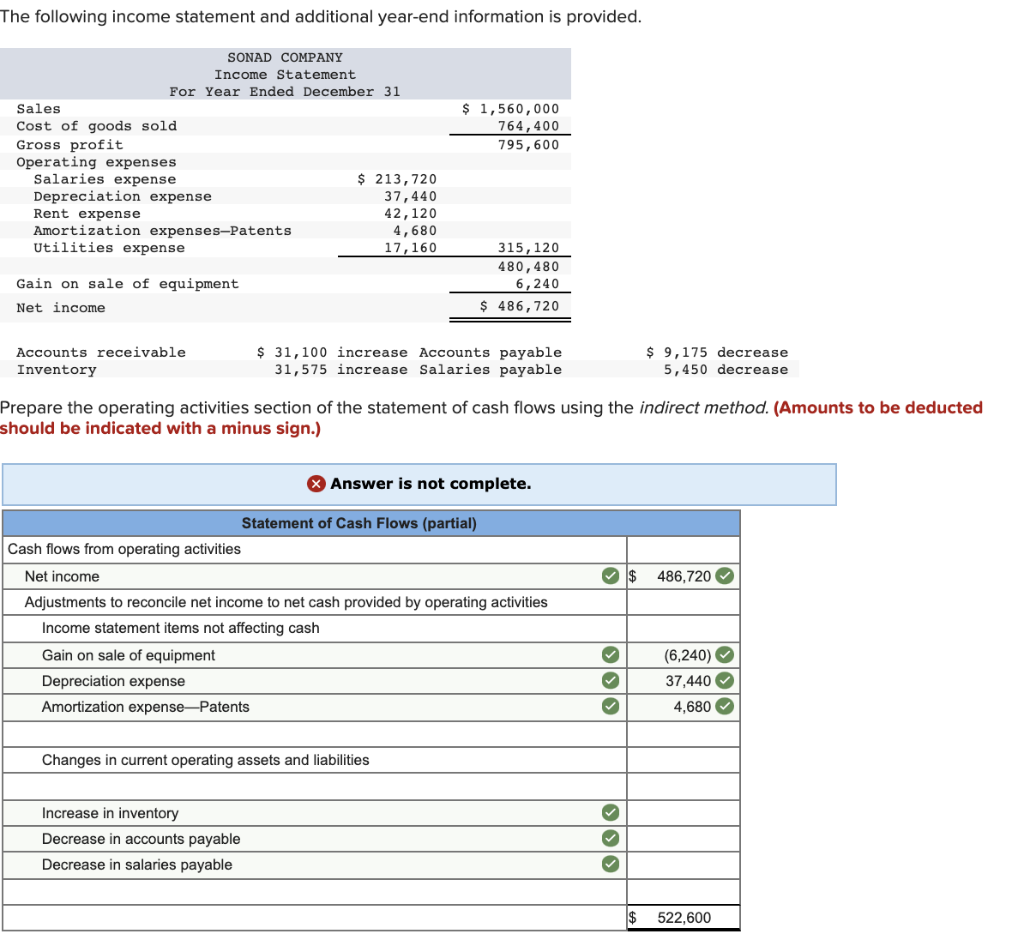

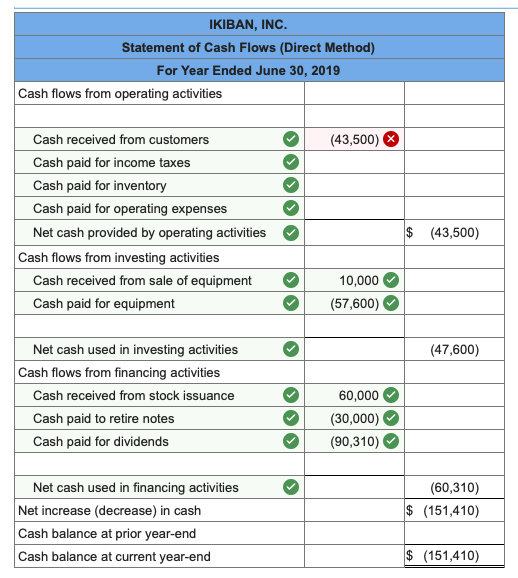

Cash paid for operating expenses direct method. List the steps to be followed in determining cash flows from operating activities. Net income $$ cash received from sales $$ adjust for. Liberto has one revenue and three expenses left on its income statement after removal.

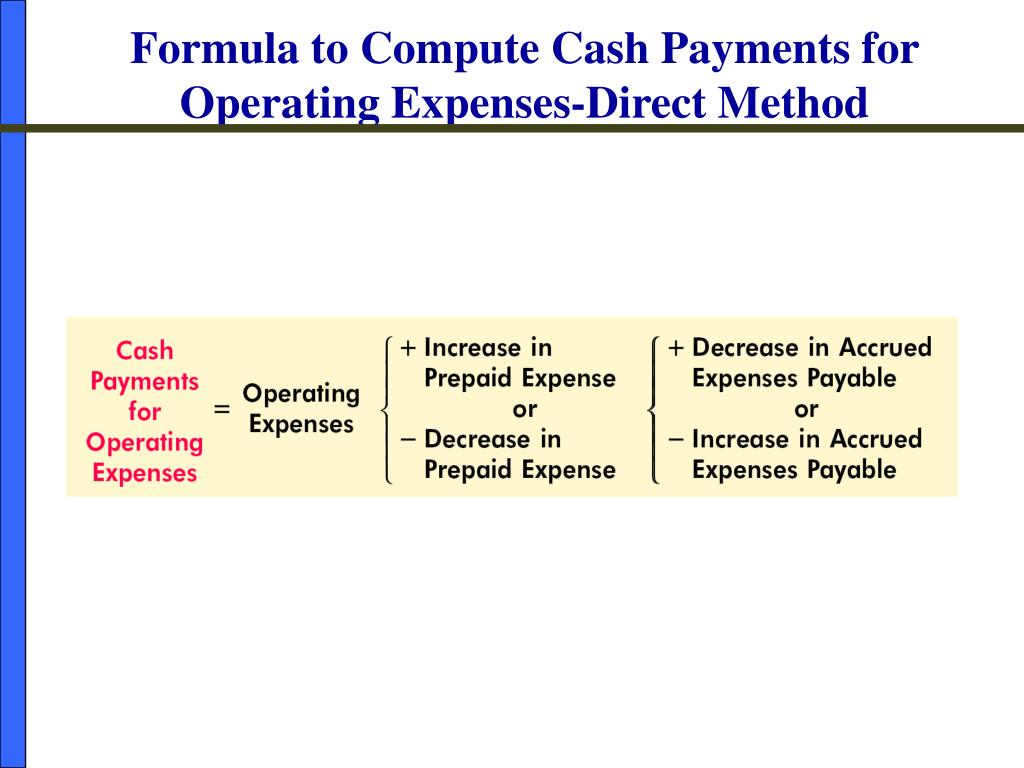

Compared to the indirect method, the direct method is simpler, as the formula comprises subtracting cash operating expenses from cash revenue. Cash paid for operating expenses totaled $64,000. Cash flows from operating activities :

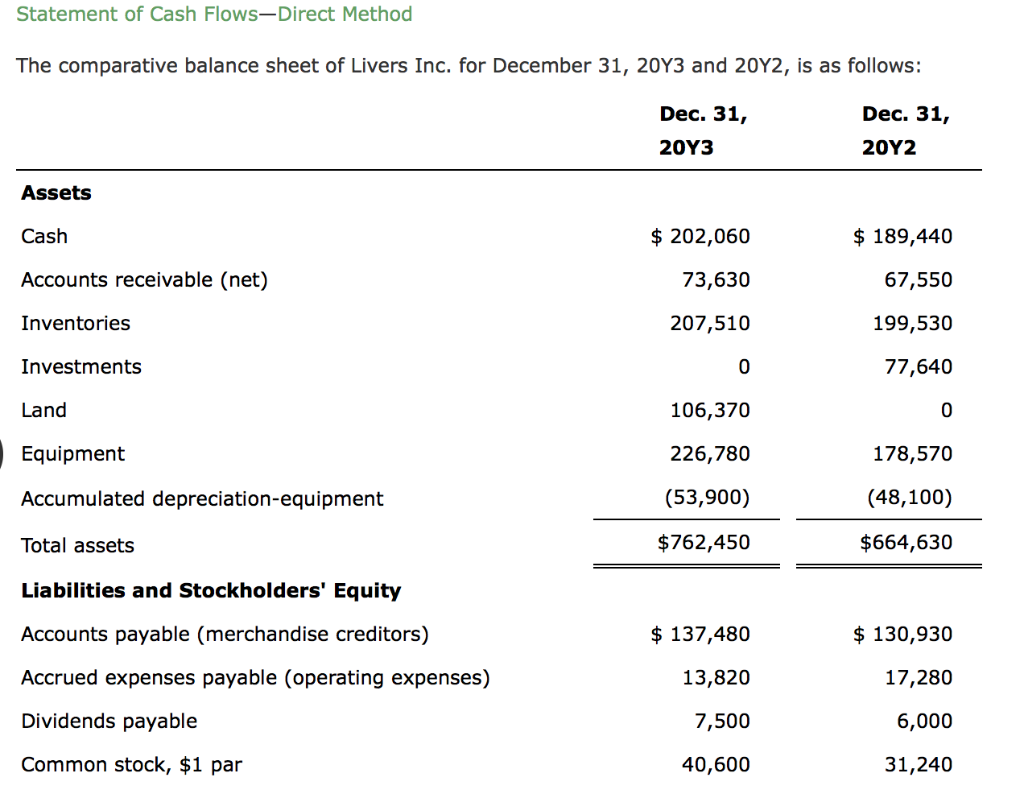

Under the direct method, the major classes of operating cash receipts and disbursements are reported separately in the operating activities section. We can work out the cash flow from operations using two methods: During the year, cash paid to suppliers was $340,000.

Cash paid to suppliers (29,800,000) cash paid to employees. Cash received from customers was $580,000. This method converts each item on the income statement directly to a.

Cash flows from operating activities: Businesses can calculate the net cash flow from operating activities (cfo) using: Applying the direct method to determine cash revenues and expenses.

Cash flows from operating activities: Cash flows are classified and. The direct method deducts from cash sales only those operating expenses that consumed cash.

This method shows a company’s total operating, financing, and. Cash flows from operating activities: It is one of two methods a company can apply when.

Ias 7 statement of cash flows requires an entity to present a statement of cash flows as an integral part of its primary financial statements. Cash paid for goods and services. In the direct method, we find out actual.

If the total of all. The direct method works by directly calculating each of the components of operating cash flows, such as cash receipts from customers, cash paid to suppliers,. (a) the direct method and (b) the indirect method.

Typical reporting categories in the operating section for the direct method include: Cash flows from operating activities: The total of operating cash disbursements is deducted from the total of operating cash receipts to arrive at net cash flows from operating activities.